Doubt is not a pleasant condition, but certainty is absurd. – Voltaire.

I try my best to not only identify conditions that favor an accident in the stock market, but also to be consistent in mindset and approach for how a longer-term sequence for investors could play out.

To that end, I maintain my view I mentioned last year – despite melt-up dynamics favoring equities because of it’s a pre-election year, we are on the verge of an incredible deflationary bust, which would happen if I’m right that we are still in a bear market, and that a credit event is out there.

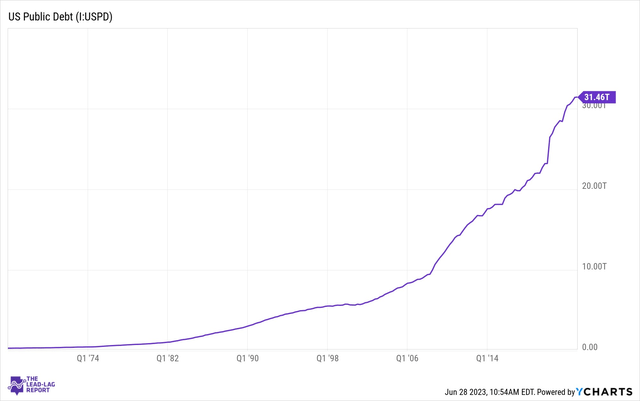

Pre-election year melt-up or not, the fundamental problem is that debt becomes deflationary when you can’t issue more of it.

Twitter

Understanding Deflation: A Primer

Deflation is a macroeconomic phenomenon characterized by a generalized decline in prices of goods and services. While it may seem beneficial for consumers due to lower prices, deflation can lead to severe economic consequences. The primary threat in a deflationary environment is the reduction in aggregate demand, which can trigger a vicious cycle of falling prices, shrinking profits, and declining economic activity. And when your starting point is this much leverage, it becomes exceedingly problematic.

YCharts

Impact on Small and Medium-Sized Businesses

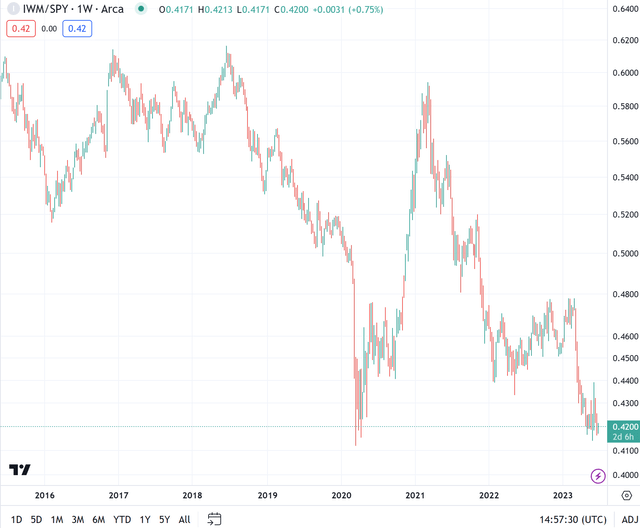

Deflation can be particularly damaging to small and medium-sized businesses (IWM). These enterprises often operate on limited cash reserves and rely heavily on consistent demand to meet their financial obligations. In a deflationary environment, demand for their products or services could plummet, leaving them unable to meet their financial obligations and potentially leading to insolvency.

This could explain some of the weakness in small-cap stocks which have been utterly left out of the pre-election year melt-up relative to the S&P 500 (SPY).

TradingView

Preparation and Mitigation Strategies

I am far from a perma-bear, but to deny the very real possibility that the long and variable lags of monetary policy couldn’t result in a nasty default and deflation cycle I believe is foolish. I recognize it’s not a high probability scenario, but it’s also not a zero probability. In the face of these risks, it is essential for businesses to prepare for a potential deflationary environment. This might involve ensuring they have enough cash reserves, considering ways to pivot their business model, and taking measures to remain competitive.

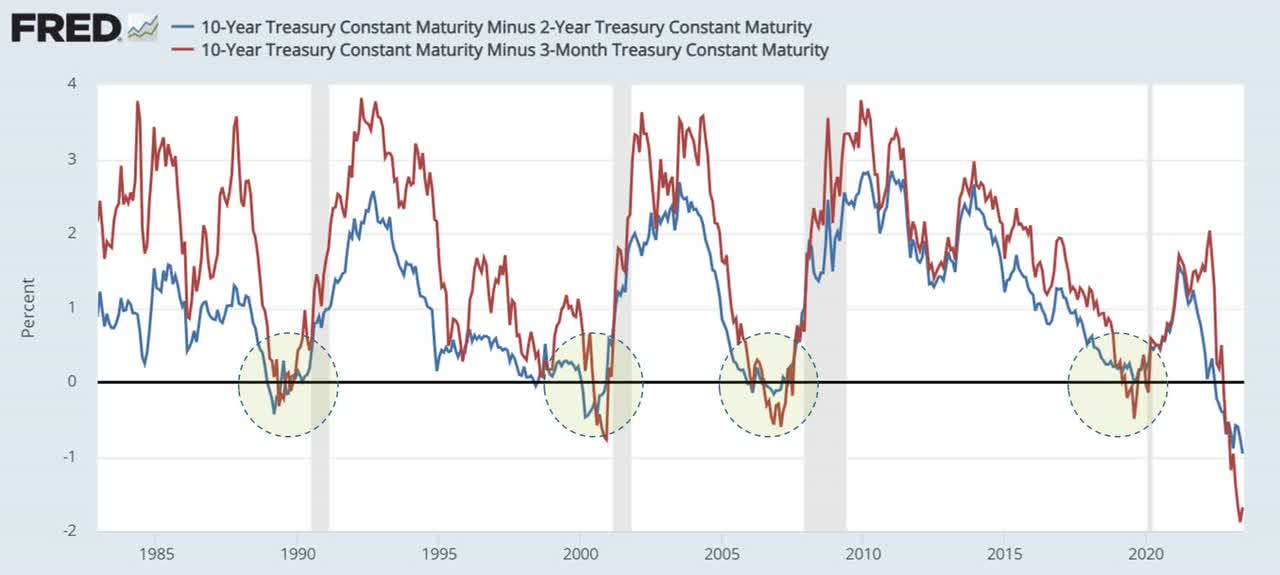

Risks from Treasury Bond Yields and the “10-2 Spread”

One of the markers indicating a potential deflationary bust is the behavior of treasury bond yields and the “10-2 spread.” The “10-2 spread,” which measures the difference between a long-term bond yield (the 10-year treasury yield, US10Y) and a shorter-term bond yield (the two-year treasury yield, US2Y), has historically been viewed as a precursor to a recession. If this spread becomes negative, it could signal an impending deflationary bust and a potential recession.

We are clearly there now. This remains a major warning signal.

FRED

Conclusion – From Duration Crisis to Credit Crisis

As I always emphasize, I could be unequivocally wrong here and maybe we will be just fine. But I do believe investors should consider the possibility that the inflation narrative is transitory after all, and factor in the reality that no one knows what tomorrow brings. With yields much higher than they were last year, I’d argue that one of the possible ways to play a recession/deflationary bust is with long duration Treasuries (NASDAQ:TLT). If indeed risks are far more elevated than headline averages would have you believe, it’s seems plausible that opportunities in the “pristine” asset of Treasuries could be the surprise winner going forward as the flight to safety sequence returns.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here