Investment Thesis

I make the case that the auction site eBay Inc. (NASDAQ:EBAY) is unlikely to reignite its growth prospects anytime soon.

Even though I recognize that its shares are not expensive, I still believe that the stock does not provide investors with a compelling risk reward.

For one, I believe for the remainder of 2023 we will see eBay comparing against slightly more challenging quarters than the relatively easy upcoming Q2 results (expected around August 2).

And then, to further compound matters, I make the case eBay’s share repurchase program in 2023 will be roughly half of what it was in 2022.

All in all, I find myself very much on the fence about eBay shares.

Why eBay’s Near-Term Prospects Are Not Enticing

In my previous analysis, as we headed into eBay’s Q1 results, I stated the following,

Competition for consumers is always brutal. But particularly when customers become increasingly price-conscious. Then, consumers shop around more and go with the brands that they believe they can trust to deliver the most value for the price.

The operative word here is value for the price. Along this theme, consider what Walgreens Boots Alliance (WBA) remarked yesterday,

We have seen changing market trends that have consumers prioritizing value in response to a more uncertain and challenging economic environment.

[…] similar to other retailers, we’ve been impacted by the rapid softening of the macro environment and a more cautious and value-driven consumer. Our customer is feeling the strain of higher inflation and interest rates, lower SNAP benefits [Supplemental Nutrition Assistance Program aka Food Stamps], and tax refunds, and an uncertain economic outlook.

Why am I bringing this up? Because there’s a misguided belief that consumer appetite for shopping has not been impacted by a weakening economy. For my part, I believe that investors are being lulled into a false sense of security.

eBay’s Growth Days Are Done

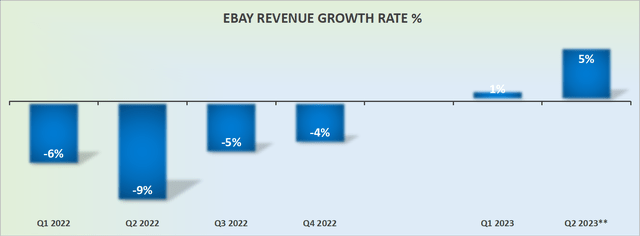

EBAY revenue growth rates

The graphic above is misleading. Why?

Because it points to a company that is re-accelerating its growth rates, as it puts behind the challenging 2022 period.

While that consideration is fair, I believe that a better and more accurate way to think about eBay is that Q2 2023 is likely to be as good as it gets for its growth rates this year.

After the easy comparable period with Q2 of last year, the remainder of 2023 is unlikely to be all that impressive.

Could we make the case that from this point forward, eBay is a business that is growing at 5% CAGR? I believe that is a very fair appraisal of its potential growth rates.

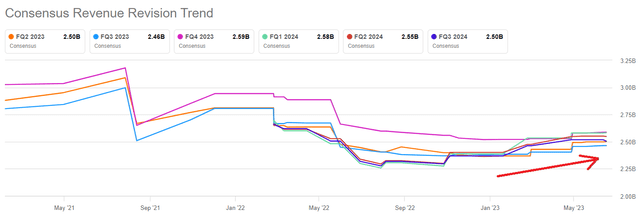

What’s more, consider the chart that follows showing analysts’ consensus revenue estimates for eBay:

SA Premium

What you see here is that in the past few months, analysts following eBay have been slowly raising their revenue growth expectations.

And despite analysts raising their expectations for eBay, the growth rates for the next few quarters are still expected to be sub 5% CAGR.

With that in mind, let’s discuss its valuation.

Investors Turn a Sharp Eye and Refocus On Profitability

If I told you that eBay is priced at about 11x forward EPS, your immediate response would be to push asides my contention about its slowing growth rates.

And indeed, I would agree, the stock is not expensive. Particularly given that, unlike many other e-commerce sites, eBay is not only profitable, but it’s clean GAAP profitable, too.

On the other hand, eBay does carry a net debt position of approximately $3.5 billion. Meaning that going forward, the pace at which eBay can repurchase its shares will be more muted when compared with the recent past.

On yet the other hand, recall that in 2022 eBay repurchased more than $3 billion worth of stock. At average prices higher than where the stock trades for today.

And I don’t believe that eBay has enough firepower left to deploy similar sums this year. I believe that in 2023, eBay’s share repurchases will be roughly half as much as in 2022.

The Bottom Line

eBay Inc. faces challenges in reigniting its growth prospects, making it an unappealing investment option.

While the stock is reasonably priced, the upcoming quarters are expected to be more challenging, resulting in limited growth potential.

Furthermore, eBay’s share repurchase program in 2023 is anticipated to be significantly reduced compared to the previous year.

The company’s growth rates are projected to hover around 5% CAGR, and analysts’ own revenue estimates point to sub-5% CAGR.

Despite delivering clean GAAP profitability, eBay holds a considerable net debt position, meaning that eBay’s ability to repurchase shares will be constrained. Overall, these factors contribute to my cautious stance on the future of eBay shares.

Read the full article here