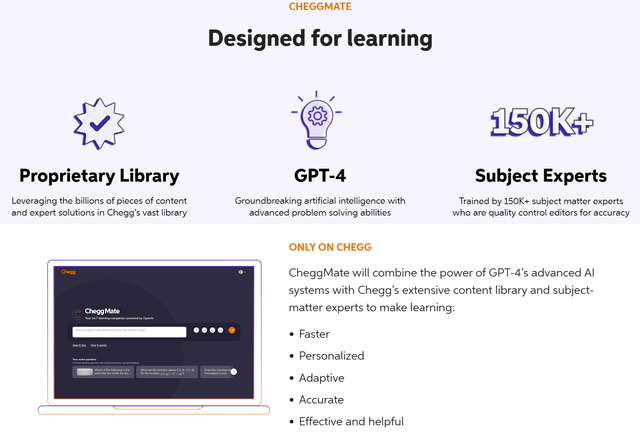

Chegg (NYSE:CHGG) is working overtime to unveil its new CheggMate product, a reaction to the Artificial Intelligence [AI] craze of 2023. The company was already perhaps the leading tool for helping students find answers to homework and write papers for better grades, with related instructions for learning. It’s database for schools and students is relatively unparalleled with 150,000 teachers and experts refining the product to date.

Chegg Homepage – June 28th, 2023

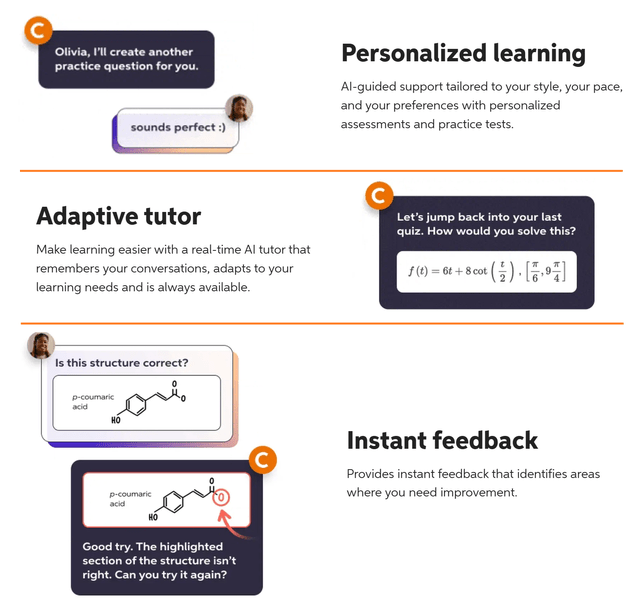

And, now the company is partnering/licensing OpenAI‘s latest GPT-4 invention to work inside its cloud-based environment. The idea is subscribers to CheggMate (to be rolled out soon) will now have a “personal assistant” on their computer, that remembers past queries by users, and to a degree develops a relationship with students. How cool is that?

Another advantage of what the company is developing is teaching links and processes will be given to students, a major upgrade for learning how to solve problems and think creatively on your own, beyond just Googling or Binging for a quick answer to a specific question.

CheggMate AI Product Under Development – Company Website CheggMate AI Product Under Development – Company Website

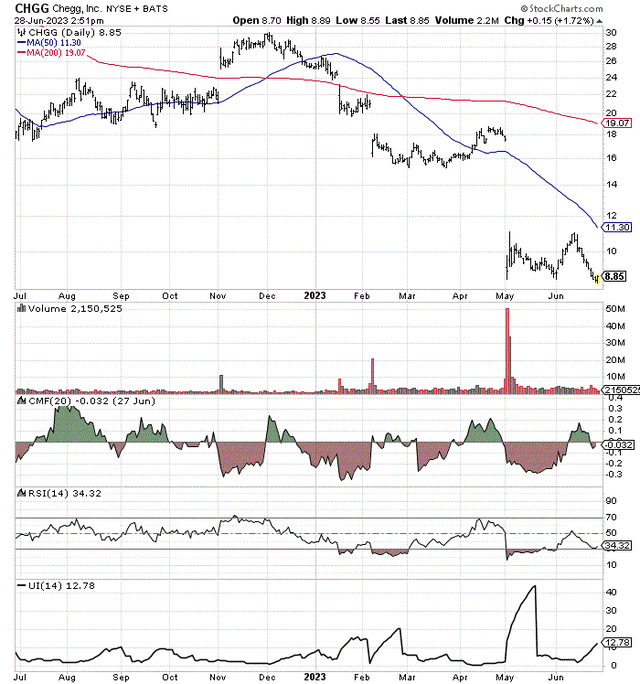

Technical Trading Weakness an Opportunity?

The stock has suffered mightily this year, as investors and analysts worry the company’s database and subscription services will become somewhat obsolete in a world of AI and free internet searches. I am saying – not so fast with this judgment. In fact, a personalized tutor for $15 to $30 a month could make Chegg incredibly relevant and desirable for purchase.

The investor shock in early May of lowered company guidance for the rest of the year, on top of lower sales and earnings for Q1 (blamed on rising student interest in free ChatGPT), created a tsunami of selling and bearishness in Chegg’s stock. However, management is committed to turn lemons into lemonade by reconfiguring the whole business with its own CheggMate AI solution, pushed as its main offering for students, due for release shortly.

Technically speaking, the Chegg trading chart is downright ugly. Yet, this picture of unease may be opening a terrific buying opportunity. If like to purchase a stock when there is “blood in the street” by sticking your neck out (putting capital at risk), a substantial reversal in sentiment may reward bullish owners today handsomely in the not-too-distant future.

In terms of improving indications, the 20-day Chaikin Money Flow reading, 14-day Relative Strength Index, and 14-day Ulcer Index are hinting the large wave of selling in May is subsiding. The wickedly oversold condition of mid-May is now gone. It’s entirely possible a retest of the massive price gap back to $15.50 could begin any day.

StockCharts.com – Chegg, 12 Months of Daily Price & Volume Changes

Valuation Story

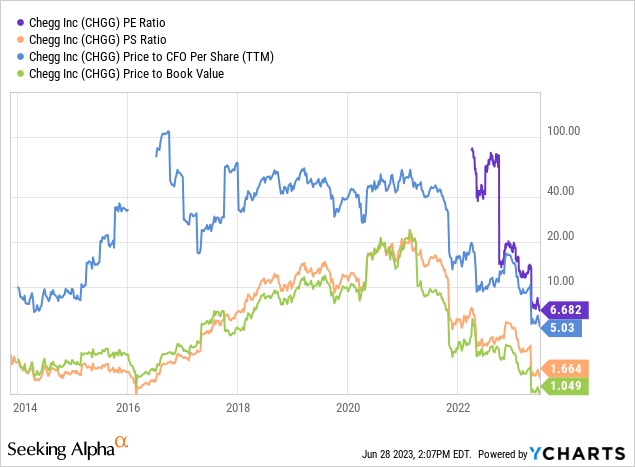

If company results do not implode the rest of this year, shares are clearly at bargain-basement levels. Valuations on trailing and future estimated results by analysts are the cheapest (in combination) since the company went public in late 2013.

Ratio analysis of price to trailing earnings, sales, cash flow, and book value point to a solid buy entry on basic fundamental valuations. A P/E under 7x really stands out.

YCharts – Chegg, Price to Basic Fundamentals, 10 Years

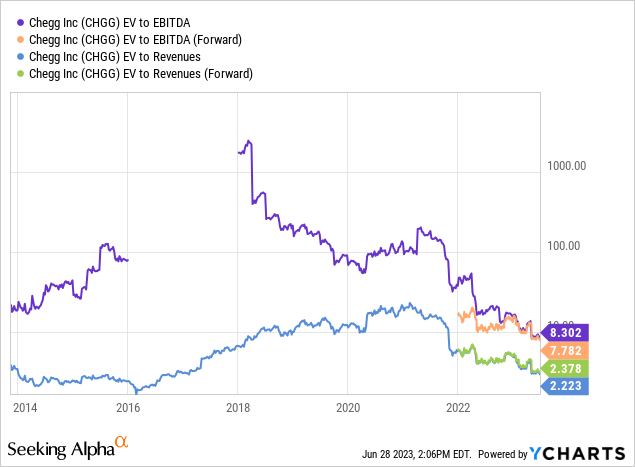

And, when we include debt while subtracting cash, “enterprise value” calculations highlight a similarly inexpensive buy point (assuming results do not fall appreciably). The enterprise valuation of 8x EBITDA and 2.3x sales is sitting at far lower multiples than other SaaS businesses, with super-high gross profit margins around Chegg’s 75%.

YCharts – Chegg, EV Ratios on EBITDA & Sales, 10 Years

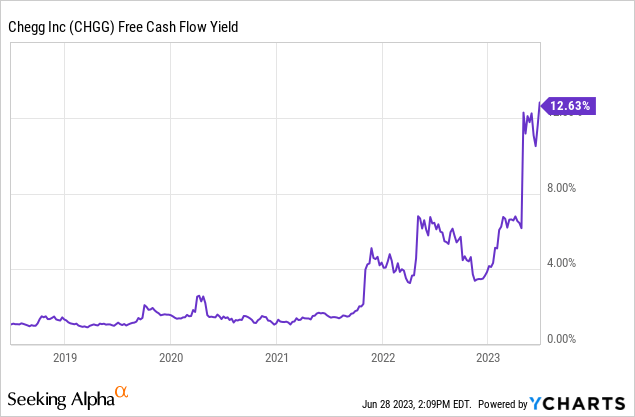

The most desirable and bullish data point to contemplate is free cash flow yield. If high rates of growth are approaching, related to CheggMate success, getting 12% upfront for a cash generation return is absurdly cheap. In other words, buyers today might be able to benefit from annual 15% or 20% free cash flow yields by 2024-25 on today’s sub-$9 quote. Where else can you find such a return in June 2023 from what may turn out to be a true AI beneficiary?

YCharts – Chegg, Free Cash Flow Yield, 5 Years

Final Thoughts

The share quote collapse from $30 to under $9 since December may prove an emotional overreaction, under the flawed assumption AI through basic search is the only way forward for students. Why would anyone pay for education and testing answers, when internet searches with AI tools can be done for free?

I am of the opinion AI will not turn the company’s business model obsolete. My logic revolves around the new CheggMate’s design of incorporating a personalized AI assistant for each user, on top of its massive question and answer database. If you pay a slight monthly subscription for essentially a private tutor tailored to each subscriber’s learning needs, human tutors and many teachers may become obsolete is my thinking.

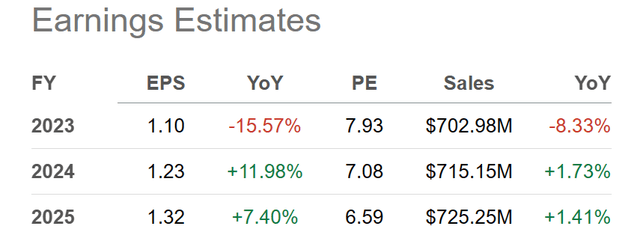

Believe it or not, the nearly 70% share price decline is not reflective of the minor growth rate still projected by analysts from continuing operations. If the below estimates prove on the low side, a CheggMate hit could propel the stock to double and triple in price during the remainder of 2023 and throughout 2024 from under $9 currently.

Seeking Alpha Table – Chegg, Analyst Consensus Estimates for 2023-25, Made June 28th, 2023

Honestly, AI tools used in combination with Chegg’s database may be one of the smartest and most efficient immediate winners of this new technology. Perhaps Wall Street’s first reaction is a little off base, and the soon to be launched CheggMate will be a tremendous success going into 2024. If this is our future, the stock valuation should be trading on the high end of past ranges, not the low.

Of course, if student users of Chegg’s long list of product offerings flee for free AI searches, the stock quote will likely languish under $10. In the end, you will have to make the binary decision on whether or not you think CheggMate will be the “killer app” for students (and paying, decision-making parents) wanting to further their education.

My forecast is Chegg’s stock could reverse sharply higher in the months ahead, moving from one of the worst performers on Wall Street during the first six months of 2023, to a leading growth pick in the second half.

Chegg could be one of the largest mispriced opportunities available on Wall Street today. While the average investor/analyst views the Chegg outlook as a glass almost empty proposition, the truth may be a glass full about to run over. I am finding it hard to locate other investment options with a similar disconnect in future expectations. I rate shares a Buy and own a position, because I feel the upside argument is too compelling to pass up.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here