Introduction

As my May article says, we’re seeing the transformation to battery electric vehicles (“BEVs”) at Volvo Car (OTCPK:VLVOF)(OTCPK:VLVCY). Momentum in this area has picked up as Volvo has agreed to join Tesla’s (TSLA) North American Charging Standard (“NACS”). Additionally, the new EX30 SUV BEV discussed at the Capital Markets Update shows a great deal of promise. My thesis is that electrification is being taken seriously at Volvo Cars.

At the time of this writing, SEK 100 is about $9.28.

NACS

The June 27th release repeats the fact that Volvo aims to be a fully electric car maker by 2030 and it states that they are the first European car maker to sign an agreement with Tesla (TSLA) and join the NACS. Volvo Car is showing they are serious about their North American BEV efforts by providing access to easy and convenient charging infrastructure.

The Numbers

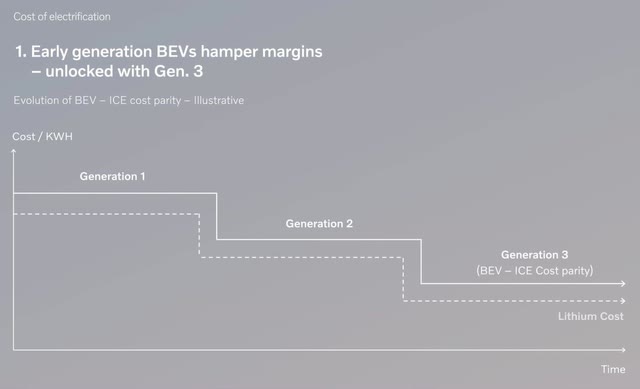

Apart from Polestar, Volvo Car has been relying on the XC40 and the C40 for all their BEV sales so new BEV models are needed. Per the EX30 webcast at the June 8th Capital Markets Update, the new EX30 model creates an opportunity to democratize electrification as its price point is very low compared to other Volvo models. Regarding the lower price point for the EX30, it is explained in the Financials presentation from the June 8th Capital Markets Update that the XC40 and C40 are part of Generation 1 whereas the EX30 is part of Generation 2 where costs are lower:

Volvo Generations (Financials presentation from the June 8th Capital Markets Update)

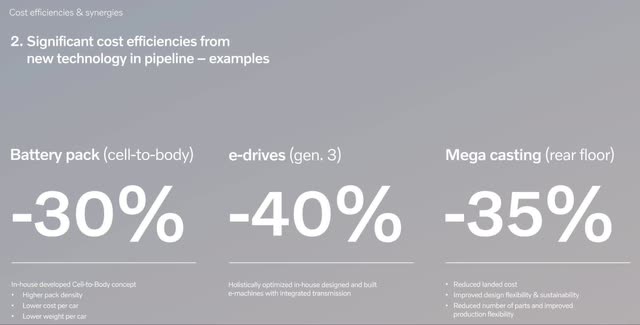

The Financials presentation from the June 8th Capital Markets Update shows an economically viable path to BEVs with cost cutting developments such as cell-to-body battery packs. BEV margins will continue to improve as we move to Generation 3 where the mega casting for rear floor will save costs:

Volvo cost efficiencies (Financials presentation from the Capital Markets Update)

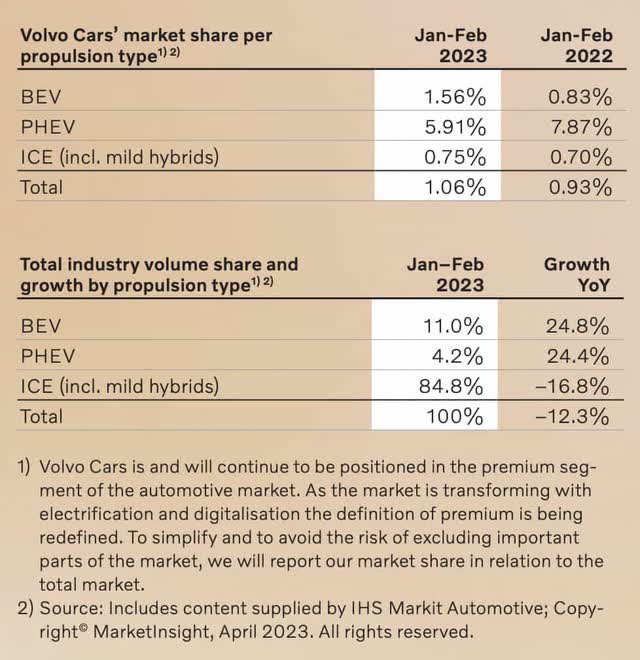

The 1Q23 report shows market share by type and we see Volvo’s year over year market share of BEVs has increased nicely:

Volvo market share (1Q23 report)

We see BEV and non-BEV margins in the 1Q23 report. Currently BEV margins are based on Generation 1 architecture and these margins are expected to improve as we move towards Generation 3:

Volvo profitability (1Q23 report)

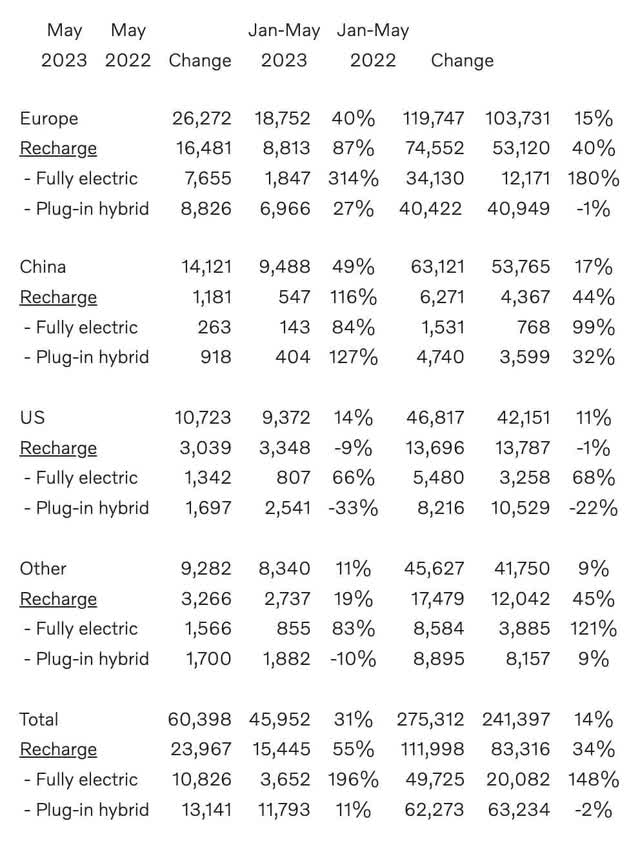

The May release shows BEVs increasing from 3,652 units in May 2022 to 10,826 units in May 2023 which was nearly 18% of overall units:

Volvo unit sales (May release)

Valuation

Trailing twelve month (“TTM”) EBIT through 1Q23 excluding share of income in JVs and associates was SEK 18.3 billion or SEK 6.3 billion + SEK 17.9 billion – SEK 5.9 billion. This is equivalent to about $1.7 billion and I think the company without the Polestar interest is worth about 6 to 8x this amount or $10 to $13.5 billion rounded to the nearest $0.5 billion. Volvo Car also owns nearly half of Polestar (PSNY) whose market cap is about $7.8 billion. Maybe Mr. Market is too optimistic about Polestar but I think we can value Volvo Car’s interest at about $3 billion such that their total valuation range is around $13 to $16.5 billion.

The VLVCY share price for June 28th was $7.83. The ratio for this instrument is 2:1 so we divide the 2,979,907,056 weighted average number of diluted shares from the 1Q23 report in half and multiply by the share price to get a market cap of $11.7 billion.

The market cap is less than my valuation range so I think the stock is a buy for long-term investors.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here