Intro

Epsilon Energy Ltd. (NASDAQ:EPSN) came across our desk from a screen we ran where the goal was to find compelling value setups with bullish technicals to boot. Although an official natural gas and oil company, Epsilon Energy is not an operator but rather an investor seeking to generate healthy returns from its growing asset base. This means it has experienced operators that operate the leases. Although it may be stated that Epsilon gives up a lot of control (by not operating the leases) as the company is essentially at the behest of the speed of the operator on site, there are clear advantages in this model also primarily around cost reduction as well as the ability to scale and diversify the company in other commodities & areas (something which an investor would invariably do).

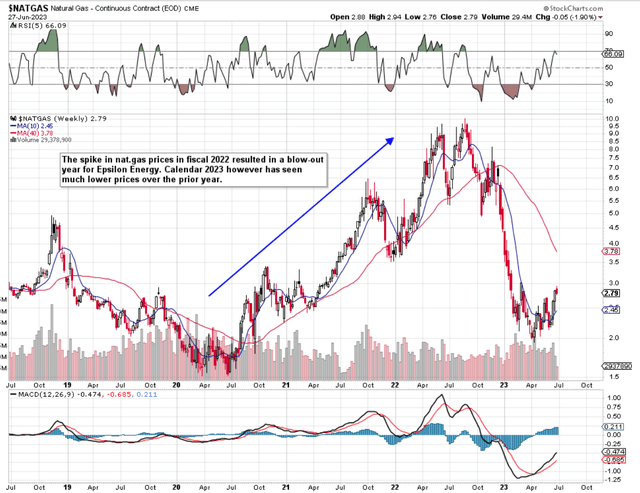

Intermediate Nat.Gas Chart (Stockcharts.com)

Strong Diversified Income Streams

In terms of diversification, however, concerning the company’s asset base, Epsilon is not necessarily starting from a low base. In fact, when we break down the company’s recent first quarter-fiscal 2023 numbers, we see that Epsilon’s mid-stream assets made up 28% of the top-line quarterly take. In fiscal 2022, the ratio was a much lower 12% compared to the company’s upstream assets. Suffice it to say, the more cash-producing assets Epsilon can have interests in outside of the upstream nat-gas space, the less volatile (and more predictable), the company’s financials will become over time.

To this point, although management did not delve into forward-looking returns on a recent liquid investment in the Permian on the Q1-2023 earnings call, Epsilon has since invested in more liquid acres to beef up its diversification efforts even more. These deals along with the natural gas hedge that management put on for 2023 stem from Epsilon’s strong balance sheet which holds no debt and reported almost $50 million in cash & ST investments at the end of Q1 this year.

Epsilon’s forward-looking returns look compelling because of how much of the company’s reported sales essentially drop to bottom-line profitability. In fact, in the face of plummeting natural gas prices, Epsilon was still able to report $4.4 million in operating profit in Q1 of this year. Now if we use these earnings as our baseline and annualize them out to a 12-month period ($17.6 million), we get an adjusted return on capital percentage of 25% which is an excellent number considering how trading conditions changed in recent months. This number is achieved by using the formula below where we remove Epsilon’s large cash balance (as this is not needed to generate returns) from the calculation.

Return On Capital (Adjusted) (oldschoolvalue.com)

Suffice it to say, when a company can generate these types of returns in volatile times, it stacks the odds in favor of the long-term investor. Why? Well, by being able to continue to pay out a well-covered 4.7%+ dividend (18% pay-out ratio), by reducing the share count as well as by growing the company’s book value over time, Epsilon is demonstrating that it wants to look after its shareholders which is something that investors obviously want to see.

Bullish Technicals

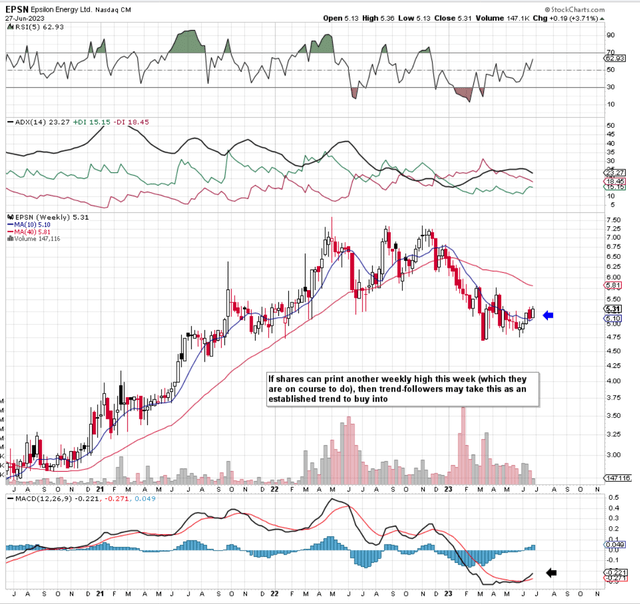

Now if we go to a three-year weekly chart, we see that shares recently printed a MACD bullish crossover signal which may be significant for the following reason. Since shares have already printed a higher weekly high this week, we now have the ‘4-week rule’ in operation if indeed we move above $5.36 a share next week. 4 weeks of consecutive higher highs invariably bring trend followers into the fray and we see Epsilon as a prime candidate here given how the company continues to grow its asset base as mentioned above.

Epsilon 3-year Chart (Stockcharts.com)

Cheap Valuation Minimizes Risk

Given the micro-cap nature of Epsilon and hence, the low trading volume, risks are obviously elevated due to how volatility in commodity prices could essentially move the share price meaningfully. However, almost $2 million of insider buying transactions have already been realized this year, in my opinion due to the company’s assets continuing to trade on the cheap. For every $1 invested in Epsilon at present, $0.86 cents is received in assets (equating to a p/b multiple of 1.16).

Now, this book multiple is cheap in our eyes as Epsilon has no debt and practically all of the company’s equity is made up of its large cash position ($49.2 million in cash & ST investments) and its assets ($67.8 million in property, plant & equipment). Furthermore, only a small percentage of its assets are owed to the company ($4.8 million in receivables) which means Epsilon’s liquidity and solvency positions have plenty of strength.

Therefore given the returns the company’s assets are presently returning (as alluded to above), it stands to reason that these assets remain cheap from a long-term standpoint. Furthermore, the sustained moving away from upstream nat-gas dependence will continue to remove volatility over time and dependence on one commodity or jurisdiction.

Conclusion

Therefore to sum up, the combination of Epsilon’s growing diversified asset base, balance sheet strength, and high return on capital leads us to believe that this stock can move above $5.36 per share next week. $5.36 is the highest high shares have printed over the past four weeks so final confirmation will be a higher high next week. We look forward to continued coverage.

Read the full article here