Introduction

I own AbbVie (ABBV) in my dividend growth portfolio. Despite its struggles with competition from biosimilar products, I’m extremely happy with my investment, as I believe in a strong future for well-managed biotech companies.

One of these well-managed companies is Amgen (NASDAQ:AMGN). This biotech giant with a market cap of almost $120 billion is struggling a bit. Its shares are 25% below their 52-week high and down 16% year-to-date. The company is fighting regulatory headwinds and competition from biosimilar products, which is not something biotech investors want to encounter.

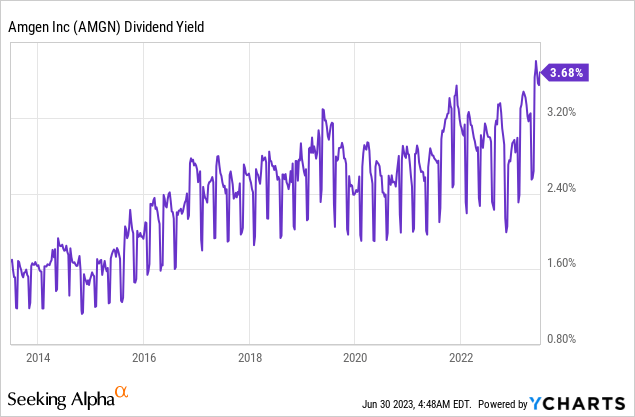

The good news is that this unlocks value. AMGN is currently yielding 3.9%, which is its highest yield ever. Furthermore, its business continues to do well, which comes with strong expected free cash flow and an attractive valuation.

In this article, we’ll discuss all of this and assess the risk/reward for (dividend) investors at current levels.

So, let’s get to it!

AMGN & Its Struggles

When investing in biotech, investors aren’t just dependent on a company’s ability to innovate but also on its ability to deal with interference from policymakers.

Last month, the Wall Street Journal ran a headline that perfectly captured the company’s ongoing struggles.

Wall Street Journal

Essentially, AMGN is hit a number of headwinds that have caused investors to stay away.

According to the WSJ, the IRS is pursuing Amgen for billions of dollars in back taxes, while the Federal Trade Commission, led by Lina Khan, is seeking to block its $27.8 billion acquisition of Horizon Therapeutics (HZNP).

Additionally, the Supreme Court recently ruled against Amgen in a significant patent case.

However, the most pressing concern for Amgen is the looming patent cliff, with many of its top-selling drugs expected to face revenue declines due to patent expirations and increased competition in the coming years.

One of the company’s blockbuster drugs, Enbrel, which treats autoimmune diseases like rheumatoid arthritis, is already facing challenges due to competition from AbbVie’s Humira (which also lost its patent).

AbbVie’s aggressive rebates to pharmacy-benefit managers have put pressure on Enbrel’s market share, leading to a decline in sales.

Another drug, Otezla, has also missed estimates due to competition from a competitor owned by Bristol-Myers Squibb (BMY). Prolia and Xgeva, two bone health drugs, have helped offset some growth pressure. However, they will face patent expirations in the future as well.

But wait, there’s more bad news!

Amgen’s acquisition of Horizon Therapeutics was primarily driven by Horizon’s key product, Tepezza, a drug used to treat thyroid eye disease. In 2022, Tepezza generated roughly $2 billion in sales. For the Horizon deal to be successful, Amgen would need to see Tepezza’s sales continue to grow. However, the drug’s first-quarter sales declined by 19%, leading Wall Street to doubt its long-term prospects.

As bad as all of this sounds, the company is making progress, while the company’s stock price decline has priced in a lot of bad news.

Despite Struggles, AMGN Isn’t Doing Half-Bad

With regard to the Horizon deal, Amgen’s CEO, Bob Bradway, commented on issues with the FTC during the Goldman Sachs Annual Global Healthcare Conference.

Despite the aforementioned issues, Mr. Bradway remains confident that the deal will eventually close. Amgen believes there are no anti-competitive issues preventing the two companies from joining forces. The company is prepared for a hearing in the autumn where it will present its viewpoint and listen to the FTC’s concerns.

Bradway also emphasized that international regulators have not expressed any concerns about the combination.

Hence, Amgen expects the deal to close by the end of the year.

Furthermore, with regard to TEPEZZA (Horizon’s key drug), the company emphasized potential post-merger synergies that are expected to enhance the value of this important drug. During the aforementioned conference, Amgen highlighted its international presence, manufacturing capabilities, and expertise in designing molecules for rare diseases as factors that will contribute to the success of the combination. Regarding TEPEZZA, Amgen stated that there are no unexpected developments, which is what analysts needed to hear.

With regard to its international presence, AMGN is essentially saying that TEPEZZA sales can accelerate once it benefits from the larger size of AMGN and its sales capabilities. It’s hard to disagree with that.

Adding to that, AMGN is ramping up its biosimilar investments.

The company believes its capabilities in manufacturing proteins and clinical development position them well for success in the biosimilar market. AMJEVITA, their most recent biosimilar launch, has been received positively, and Amgen is confident about its long-term prospects.

In this case, AMJEVITA is a direct competitor to HUMIRA, the key drug of AbbVie, which recently lost its patent protection.

Amgen Inc.

Amgen plans to launch additional biosimilars, and they expect this business to contribute significantly to their growth through the end of the decade and beyond.

Recent Events Support Long-Term Growth

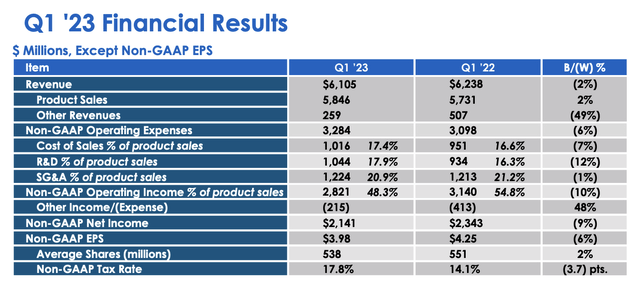

While the company saw 1Q23 adjusted net income fall by 9% due to higher expenses, volume growth was strong.

Amgen Inc.

The company witnessed 14% volume growth, which gives it confidence for the remainder of this year. This was caused by a number of tailwinds, including the impact of COVID on the healthcare system, which appears to be fading, reflected in year-over-year prescription growth across various specialties in the US, including cardiology and oncology.

In this case, AMGN is one of the few pharma giants that benefits from fewer COVID cases (the end of COVID).

The recovery also shows that patients are returning to their pre-pandemic routines and seeking appropriate diagnoses and treatments from healthcare providers.

As a result, a number of key drugs, like Repatha, EVENITY, BLINCYTO, and KYPROLIS, achieved record sales during the first quarter.

Speaking of Repatha, Amgen believes that there is significant upside potential for this drug, especially for high-risk cardiovascular patients who struggle to reach their recommended LDL levels. Given the severity of heart diseases in developed nations, I believe the company is onto something here.

On a side note, the surge in heart diseases is also why I like hardware suppliers like Abbott (ABT).

Adding to that, the company is making great progress in its international business.

Outside the US, Amgen saw more than 20% volume growth, with the Asia-Pacific region leading the way with nearly 50% growth.

The company is expanding its patient reach in Japan and China, two rapidly aging nations, with medicines like Repatha and Prolia. The focus on global expansion aims to serve a broader patient population while contributing to long-term growth.

Moreover, given the company’s earlier comments on favorable regulatory environments, I believe that AMGN will put a much bigger focus on international sales.

The company also saw strong growth in the inflammation area, which saw expansion with the US launch of AMGEVITA, alongside growth in TEZSPIRE and TAVNEOS.

Despite challenges like price erosion and competition, Amgen remains optimistic about its potential for growth, driven by its strong portfolio and ongoing clinical development of its pipeline.

Speaking of its pipeline, R&D investments were boosted by 12% in 1Q23.

Shareholder Returns

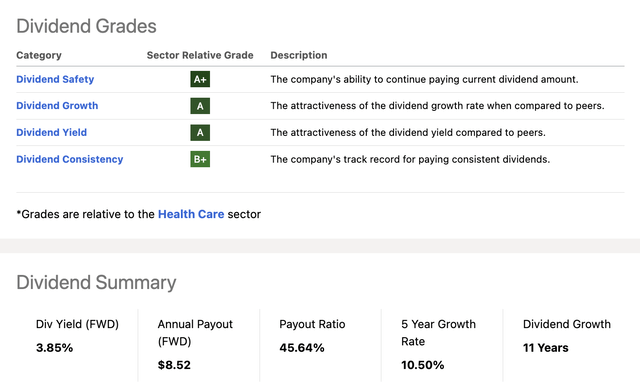

With all of this said, AMGN is a dividend growth stock. The company has one of the best dividend scorecards I’ve seen in a long time.

Seeking Alpha

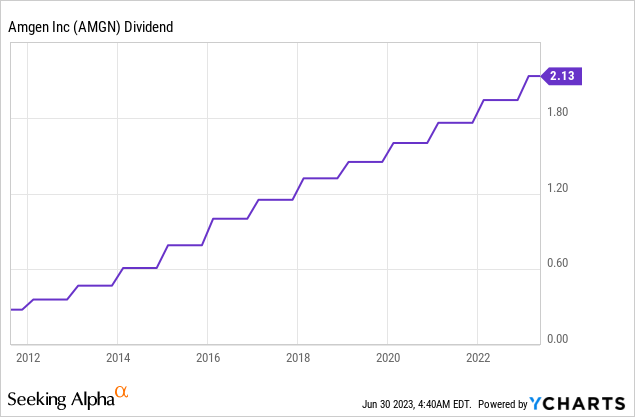

The company currently yields 3.9%. This yield is backed by a 46% payout ratio. Over the past five years, the average annual dividend growth rate was 10.5%. The company has hiked its dividend for 11 consecutive years.

In other words, the company has hiked its dividend every year since initiating a dividend.

Due to the combination of dividend growth and stock price weakness, the stock’s yield is now at an all-time high.

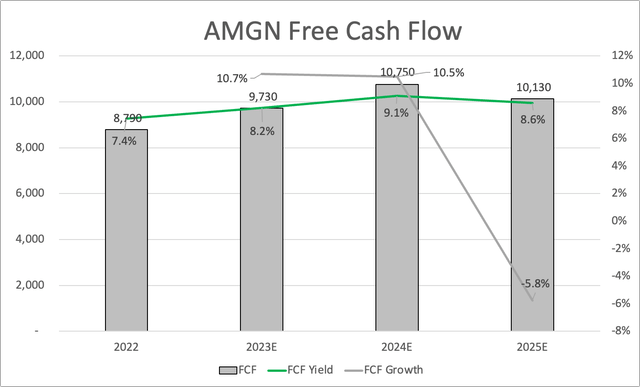

Furthermore, the company is not expected to encounter free cash flow weakness in the next two years. In 2024, AMGN is expected to generate enough free cash flow to end up with a free cash flow yield that exceeds 10%.

This would indicate a cash payout ratio of less than 40%, which opens up a lot of room to reduce debt (post the potential acquisition of Horizon) and buybacks.

Leo Nelissen

AMGN has a 2023E net leverage ratio of just 1.5x EBITDA. It enjoys a BBB+ credit rating, which is one step below the A-range.

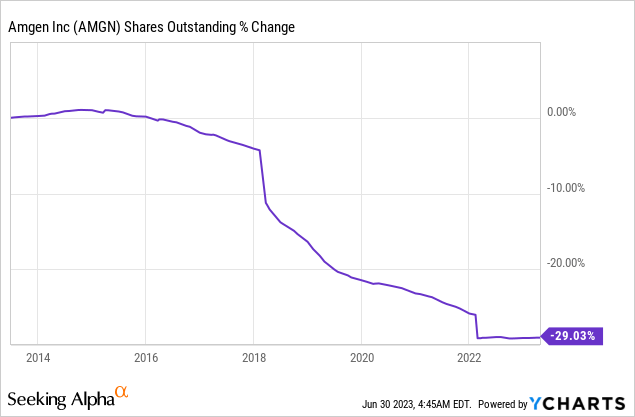

As a result, excess free cash flow has been used to buy back stock in the past, resulting in a reduction in shares outstanding of 29% since 2013.

This year, buybacks are not expected to exceed $500 million.

According to the company:

We plan to continue to meaningfully increase our dividend. We continue to expect share repurchases not to exceed $500 million in 2023.

Full-Year Guidance & Valuation

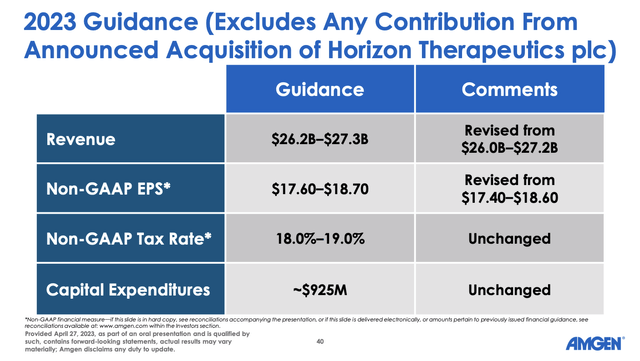

On a full-year basis, the company has raised its revenue guidance range to $26.2 to $27.3 billion, from $26.0 to $27.2 billion. These numbers exclude Horizon.

This reflects our confidence in the underlying business and the improving overall market conditions for our patients to access our medicines that Bob and Murdo mentioned. We are also raising our 2023 non-GAAP EPS guidance to $17.60 to $18.70 versus previous guidance of $17.40 per share to $18.60 per share.

Amgen Inc.

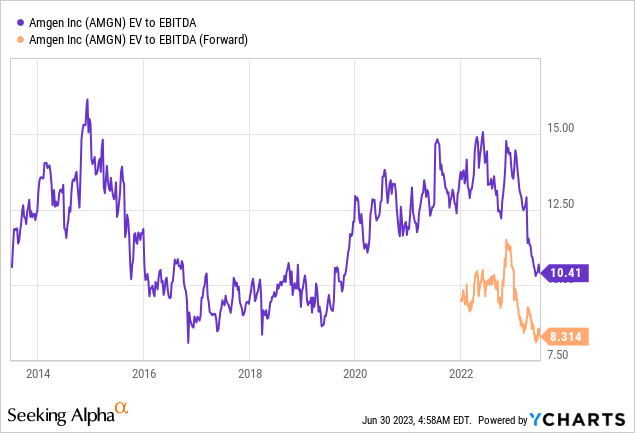

With that said, the company is trading at 8.3x NTM EBITDA, which is a huge discount versus its longer-term median. While I agree that uncertainty needs to be priced in, I believe AMGN has become highly attractive.

Despite its challenges, the company keeps getting buy and outperform ratings.

The current consensus price target is $255 after Oppenheimer gave the stock a $290 target. The consensus price target is 15% above the current price.

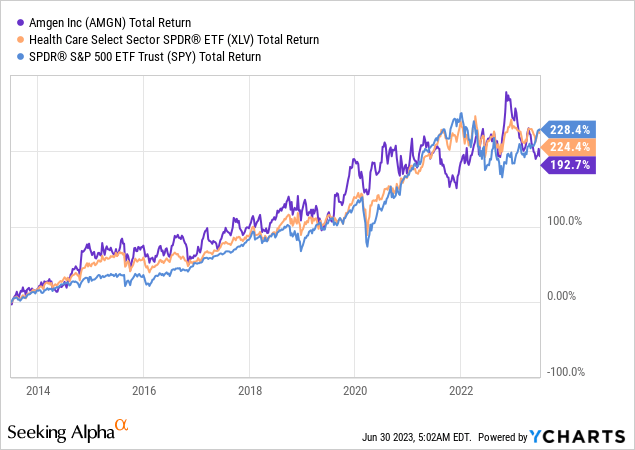

While the company’s struggles are not insignificant, I expect the share price to work its way to its consensus price target over the next 12 months, followed by a prolonged upswing with above-market returns. Prior to 2022, AMGN used to outperform the market. I believe it will remain that way in the future.

However, despite its attractive valuation and improvements, this isn’t a no-brainer. Biotech is hard to predict and dependent on Washington-based policymakers. Investors need to be aware of these risks. It’s also why I won’t go overweight in biotech stocks, as much as I love what they bring to the table as dividend-growth stocks.

Takeaway

Despite facing significant struggles, including regulatory headwinds and competition from biosimilar products, Amgen presents an opportunity for dividend investors.

The company’s stock price decline has already priced in much of the bad news, making it an attractive investment.

AMGN’s high dividend yield of 3.9% and strong business performance, with expected free cash flow and an appealing valuation, contribute to its appeal.

The company is making progress, as reflected in its potential acquisition of Horizon Therapeutics and its efforts in the biosimilar market.

Additionally, recent events, such as strong volume growth and record sales of key drugs, support AMGN’s long-term growth prospects.

While risks exist, including the unpredictable nature of the biotech industry and dependence on policymakers, AMGN has the potential to outperform the market and deliver above-average returns to shareholders.

Pros & Cons

Pros:

- High dividend yield of 3.9%.

- Strong business performance and sales growth.

- Investments in the biosimilar market for future growth.

- Attractive valuation with a discount compared to its historical median.

Cons:

- Regulatory challenges and uncertainties.

- Patent expirations and increased competition.

- Dependence on policymakers and potential regulatory changes.

Read the full article here