The first half of 2023 featured massive gains for large swaths of the global market. One niche that did not fare so well was biotech. The SPDR S&P Biotech ETF (XBI) was essentially flat as the speculative area was shunned in favor of established large-cap growth companies. But what will the second half have in store?

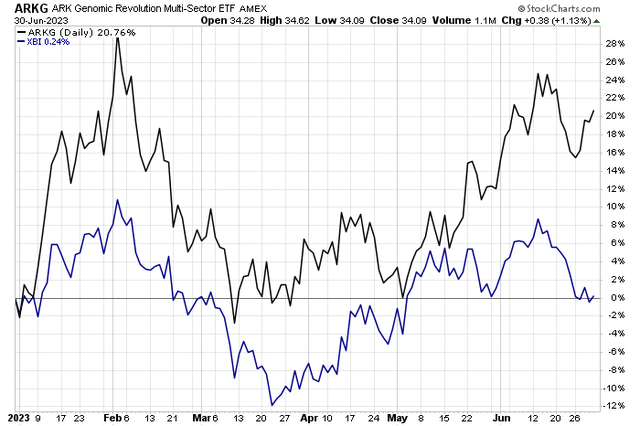

Today, I’m looking at the ARK Genomic Revolution ETF (BATS:ARKG). After generally matching XBI’s net return through early May, the final nine weeks of the first half featured a pronounced outperformance stretch for ARKG. In all, the strategy returned more than 20%.

I have a buy rating on the fund for its reasonable valuation and potentially-bullish technical outlook, despite lackluster seasonal signals.

Year-to-Date ETF Performance Heat Map: Biotech A Bust

Finviz

ARKG With Major Alpha Vs XBI Last 2 Months

Stockcharts.com

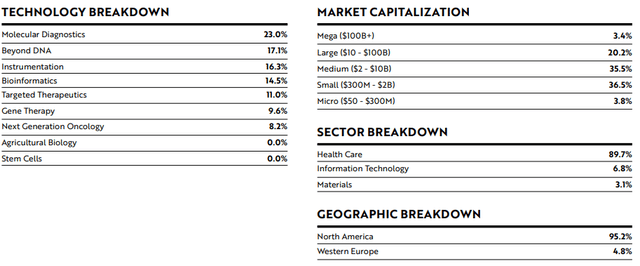

According to the issuer, ARKG is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily (at least 80% of its assets) in domestic and foreign equity securities of companies across multiple sectors, including health care, information technology, materials, energy, and consumer discretionary, that are relevant to the Fund’s investment theme of the genomics revolution. Companies within ARKG are focused on extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

With net assets of more than $2 billion as of May 31, 2023, ARKG features a somewhat high annual expense ratio of 0.75% and it typically holds 40 to 60 individual equities. The current weighted average market cap of the portfolio is $33 billion while the median market cap is just $1 billion in size.

In terms of tradeability, the 30-day median bid/ask spread is narrow at just three basis points and average daily trading volume is near 100,000 shares. In terms of the regional breakdown, the ETF is more than 94% invested in North American companies with the balance of the allocation coming from Western European nations.

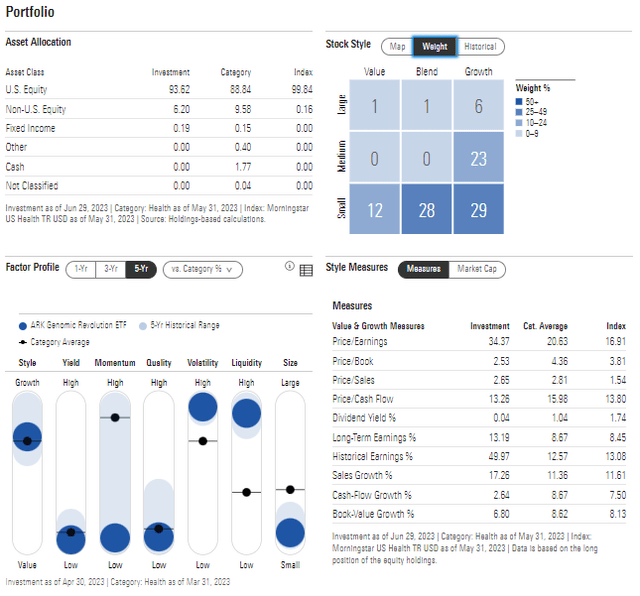

Digging into the portfolio, data from Morningstar reveal that ARKG is very much a small-cap growth fund. Notice in the style box below that just 13% of the allocation is considered value and only 8% is large cap in size. With a very low yield on the factor profile and low momentum, earnings quality is volatile and of low quality, typically.

But price action (momentum) has improved considerably in the last two months as hinted at earlier. With a 34.4 price-to-earnings ratio, the fund seems pricey at first blush, but with earnings growth being 50% in the past, the forward PEG is not all that high.

ARKG: Portfolio & Factor Profiles

Morningstar

ARKG Portfolio Construct (March 31, 2023)

ARK Invest

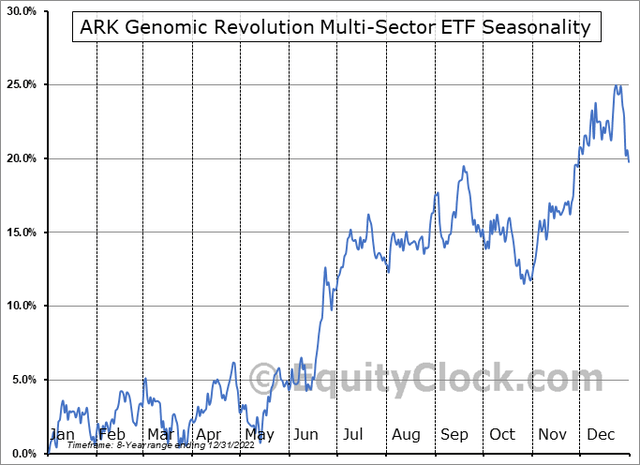

Seasonally, ARKG tends to stall out a bit in the third quarter. A year-end rally is commonly seen in November and December, though, according to data from Equity Clock.

ARKG: Sideways Q3 Performance History

Equity Clock

The Technical Take

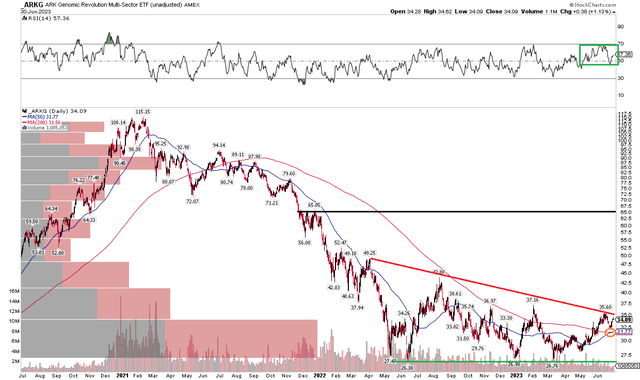

What I like about ARKG is that the bulls are defending the key $26 to $27 range. Notice in the chart below that the ETF is working on a descending triangle pattern. This is considered a continuation pattern – meaning the trend of larger degree should eventually prevail. In this instance, the broader trend is down (off the $115 all-time high notched in early 2021). The presumption is that ARKG will break down under $26. But if shares rally above the $35 to $37 zone, then a measured move price objective to near $65 would be in play – that would coincide with the late 2021 highs.

Take a look, however, at the latest key development: A bullish golden cross has taken place. We have not seen that in several years, and it may be a sign that the bulls are slowly regaining their foothold on ARKG. Still, I would like to see the long-term 200-day moving average turn positive to help confirm the upside trend shift. For now, the chart is neutral but has bullish potential as we venture into the second half.

ARKG: Descending Triangle Consolidation, Improved RSI Momentum, Bullish Golden Cross

Stockcharts.com

The Bottom Line

I have a soft buy rating on ARKG. The valuation is not too pricey considering the portfolio’s growth characteristics. What’s more, the trend appears to be changing hands in favor of the bulls, but we need to see a bit more momentum confirmation on that front.

Read the full article here