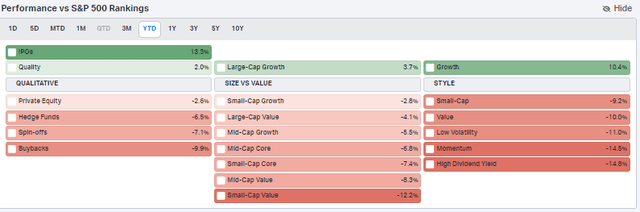

Amid a stunning first half of 2023 in which the Information Technology sector rose 40%, blue-chip, high-dividend-yield companies have sharply underperformed. Through June, in fact, the “High Dividend Yield” factor has been the worst, according to Koyfin Charts data. One large cap fits that mold, and its year-to-date total return story is one and the same.

I have a hold rating on shares of International Business Machines (NYSE:IBM) due to its fair valuation, solid earnings picture, and unimpressive chart.

Investors Shun “High Yield” Stocks In the First Half of 2023

Koyfin Charts

According to Bank of America Global Research, IBM is a leading provider of enterprise solutions, offering a broad portfolio of IT hardware, business, and IT services, and a full suite of software solutions. The company integrates its hardware products with its software and services offerings in order to provide high-value solutions. IBM is comprised of four major segments: (1) Infrastructure, (2) Consulting, (3) Software, and (4) Financing.

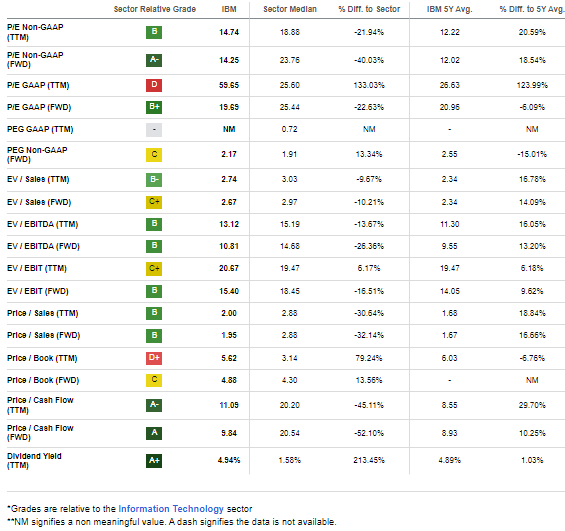

The New York-based $122 billion market cap IT Consulting and Other Services industry company within the Information Technology sector trades at a low 14.3 trailing 12-month operating price-to-earnings ratio and pays a high 5.0% dividend yield, according to The Wall Street Journal. Implied volatility is low at just 21%.

IBM has a stable business model with high recurring revenue, solid cost-cutting efforts, and a clean balance sheet. With somewhat stable margins, I view the 5% yield as safe, but I would like to see its management team engage in more buybacks to benefit shareholders.

One interesting trend we’ve seen is a pickup in acquisition activity. Just last week, IBM confirmed that it would buy Apptio for $4.6 billion. The cash deal should have synergies with Red Hat and IBM’s consulting business in the coming quarters and years. The added penetration into software may help the company’s portfolio to become more diversified with more cloud presence.

IBM also has potential upside with AI. Back in June, the firm announced that it was collaborating with Adobe for content logistics driven by generative AI. IBM is in a decent spot to invest in strategic AI investments given its recurring revenue and high cash-flow business structure.

Key risks include poor execution as its market expansion progresses and a general decline in corporate IT spending, should we see a broad economic slowdown, which would undoubtedly hurt IBM’s profitability.

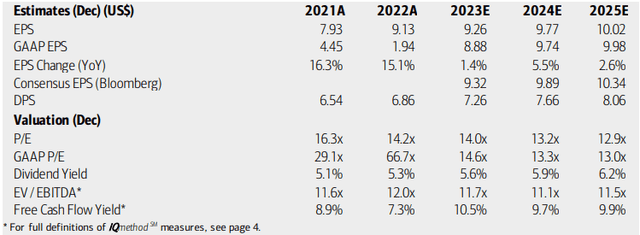

On valuation, analysts at BofA see earnings about flat this year after two strong years of double-digit-percentage EPS growth. Out-year per-share profits are expected to creep higher, but its growth rate is not impressive and recent EPS revisions have been poor as well. The Bloomberg consensus forecast is slightly more sanguine compared to BofA’s earnings projection.

IBM is highly profitable, and that is borne out by its high free cash flow yield – hovering right near 10%. That allows IBM to distribute a higher portion of cash flow via dividends, though its buyback yield is small. Annual dividends are expected to rise toward $8 in the coming quarters while its forward non-GAAP P/E should gradually ease toward the low teens should the stock continue to be rangebound. Finally, IBM’s EV/EBITDA is at a slight discount to the S&P 500’s average.

IBM: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

BofA Global Research

With soft earnings growth ahead, a below-market multiple is deserved. Being a quality company spitting off ample free cash flow with potential future exposure to AI, I assert the historical 12 multiple is too depressed. If we assume $9.50 of next-12-month EPS and use a 14 multiple, then the stock should be near $133 – right where shares trade today. Thus, a hold recommendation makes sense for now.

IBM: Fairly Priced Considering the Soft Growth Trajectory

Seeking Alpha

IBM’s Yield Holding Steady Near 5%

Koyfin Charts

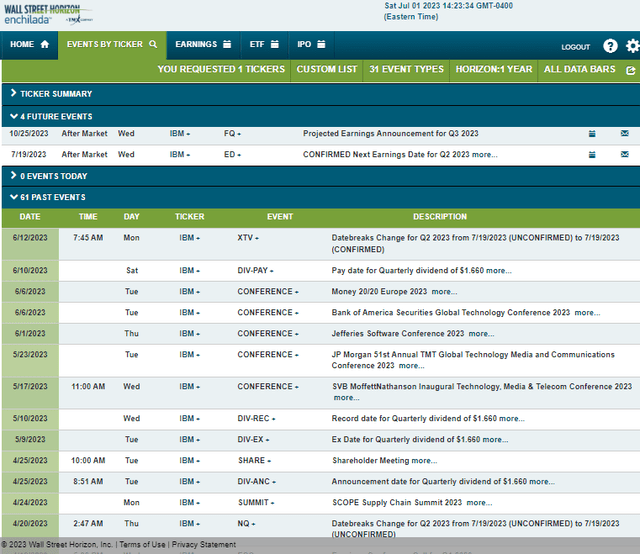

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Wednesday, July 19 AMC. No other volatility catalysts are on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

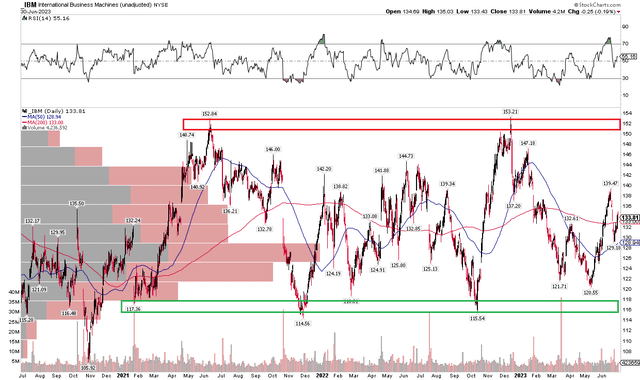

The Technical Take

While I like IBM’s profitability situation, the chart (like the valuation) leaves something to be desired from the bulls’ perspective. Notice in the chart below that a persistent range between $115 and $153 has been ongoing for the last three years. What’s encouraging, however, is that IBM had previously been in a downtrend, so this could be the start of an inflection.

Technicians want to see the stock close above $155 – should that happen, then an upside measured move price objective to about $190 would be in play. For now, with ample volume by price just under June’s closing price, there should be solid cushion on second-half pullbacks. Also, a flat 200-day moving average with price crossing above and below that indicator is further evidence that there is simply no trend.

IBM: An Ugly, Rangebound Technical Story

Stockcharts.com

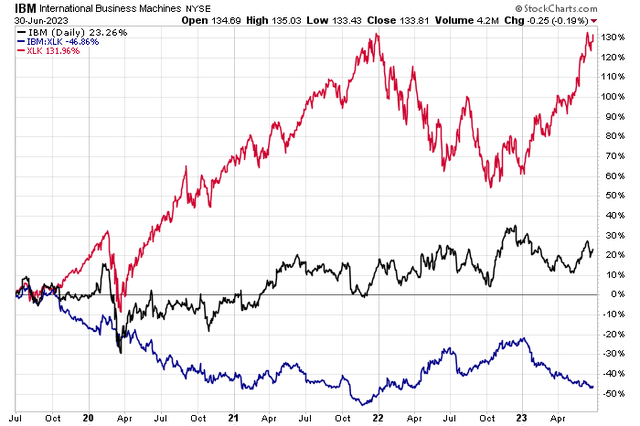

Lastly, we can take some insights from the total return chart below. IBM’s high yield has meant a general uptrend in total performance over the past 36 months, but relative strength to the Information Technology sector has been weak this year. Shares outperformed the growth-heavy IT sector during the bear market in the Nasdaq Composite, but this low-beta stock has been a bad place to be overweight during the big mega-cap-dominated rebound.

IBM: Bearish Relative Weakness In 2023

Stockcharts.com

The Bottom Line

I have a hold rating on IBM. It is a stable blue-chip company with solid free cash flow and a safe yield in my view. But the valuation and technical situations scream the same unexciting message: There’s no imminent upside.

Read the full article here