In response to Russia’s unprovoked aggression against Ukraine on February 24, 2022, the major western countries, led by the United States, unleashed a flurry of sanctions to punish Russia. Their goal was to impose severe consequences on Russia for its actions and to try to thwart Russia’s ability to continue its aggression.

Sanctions

The US, the UK, Canada and the European Union froze the assets of Russia’s central bank held in their countries.

Major Russian banks were removed from SWIFT, the international messaging system, delaying payments for oil and gas.

The UK froze the assets of Russian banks and banned Russian firms from borrowing money.

The EU placed limits on the amount of money Russians can deposit at banks.

Combined, these actions froze $350 billion of Russia’s $604 billion, or 58%, in foreign currency reserves. see here

The US and the UK banned all Russian oil and gas imports.

Germany stopped the opening of the Nord Stream 2 gas pipeline.

The EU stopped importing Russian coal and banned refined oil imports.

A handful of Russian oligarchs were personally sanctioned and had their assets frozen.

The US and other western nations agreed to stop exporting high tech products, like semiconductors to Russia.

More than 500 foreign brands, such as Apple. Nike, Adidas, Ford, Meta, Volkswagen, McDonalds, and KFC either scaled back or suspended their operations in Russia.

Initial Impact of Sanctions

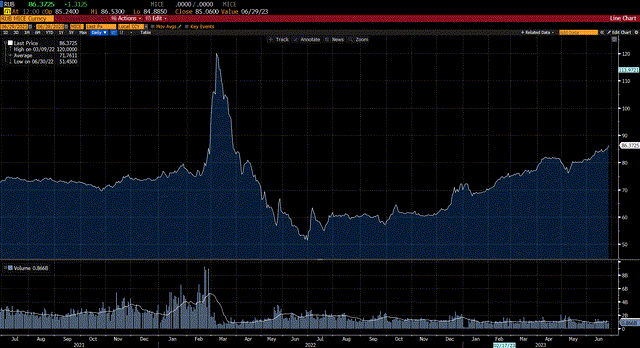

The initial impact of the sanctions was severe. It was immediately seen in the dollar exchange rate of the ruble. The ruble, which was trading at 75 to the dollar before the invasion, fell to 120, a loss of 38%. Many tried to move money out of the country.

Bloomberg

Economists were predicting a severe contraction in the Russian economy, to the order of a 10% – 15% decline.

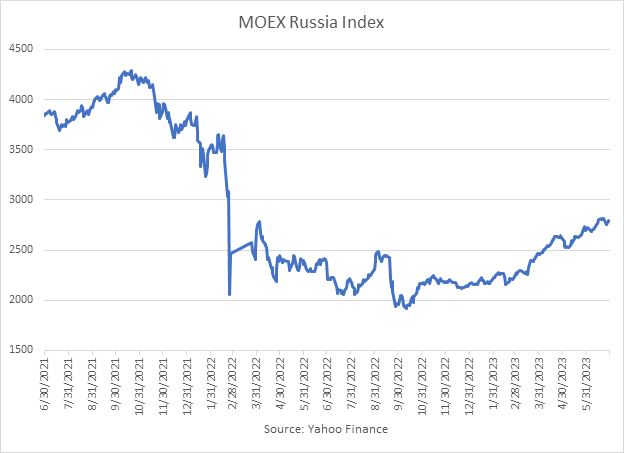

The Moscow Exchange (MOEX) the largest stock market exchange in Russia, collapsed. Once the “special military operation” was announced, MOEX fell as much as 45%. Then trading was suspended.

Yahoo Finance

Russian Response to the Sanctions

In a game of cat and mouse, Russia responded to the Western nations sanctions to shore up its economic defenses.

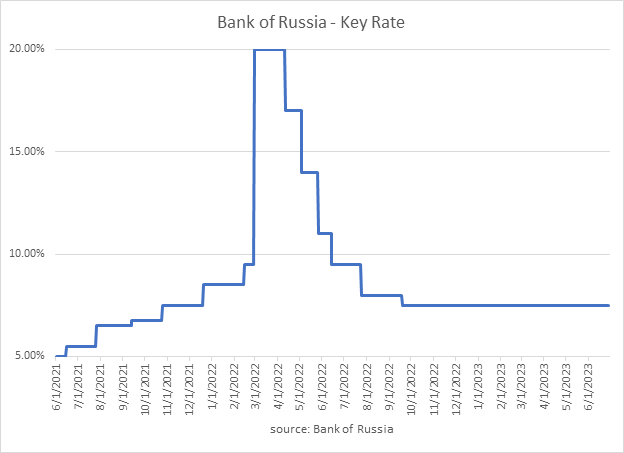

After suspending trading on the MOEX, the Bank of Russia more than doubled its Key Rate from 9.5% to 20%.

Bank of Russia

The Bank of Russia also intervened in the forex market to support the Ruble. see here

In addition, the Bank of Russia banned Russian brokers from selling securities held by foreigners, paying coupons for foreign investors holdings of ruble denominated sovereign debt and paying dividends to foreign shareholders of Russian companies.

Finally, the central bank also instituted strong capital controls to prevent sending foreign currency abroad.

Trading was resumed on MOEX after being closed for thirty days.

Together these measures had the desired stabilizing effect, in that within two months the ruble returned to its pre-invasion level.

The Paradox of the Sanctions

The Western countries wanted to punish Russia with their sanctions, but paradoxically, the sanctions ended up benefitting Russia in the short term.

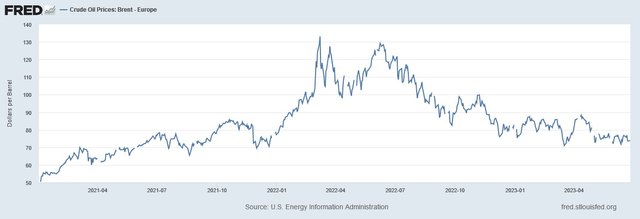

Russia derives more than 40% of its revenues from oil and gas. To hurt Russia, the main sanction was to stop buying Russian oil and gas. Of course, this necessary resource needed to be replaced, increasing demand for oil from other countries. The end result was that the global market price of crude oil was driven higher.

One week before the invasion of Ukraine, Brent Crude was trading at $95 per barrel. One week later, Brent spiked 40% to $133 per barrel.

FRED

As it turned out, some of the main consumers of Russian oil were the European Union countries that were imposing the sanctions on Russia. As much as these countries wanted to stop buying Russian oil, it was now the middle of the winter, and the oil was needed. Reality dictated that the EU countries could not just go cold turkey on their Russian oil consumption. It simply could not be replaced instantaneously. There was not enough excess capacity immediately available elsewhere, and even if there were, logistically switching to new suppliers could not happen right away.

In the paradoxical situation, the EU countries that wanted to punish Russia and stop buying their oil, were instead paying Russia a higher price for the oil they needed because of the sanctions they were imposing on Russia.

In effect, they were allowing Russia to benefit from the sanctions in the form of higher revenues they were receiving due to the spike in oil prices. They were helping Russia finance its invasion of Ukraine.

It took some time for this situation to straighten itself out.

The collapsing price of oil

Oil prices remained elevated at around $130 per barrel through the end of June 2022. This allowed Russia to bolster their foreign reserves and provided a windfall budget surplus. The ruble continued to appreciate and hit an exchange rate of 53 to the dollar. This represented a 126% gain from the lows, and the Ruble at that point was the strongest currency in the world, year to date. see here It allowed the Bank of Russia to reduce their Key Rate.

But as winter ended, worldwide demand for oil declined. The Western countries were able to shift their consumption away from Russia.

The US, UK and Canada eliminated all purchases from Russia, although before sanctions, Russian oil only provided a small portion of their consumption.

The US also announced the release of 180 million barrels of oil from their strategic petroleum reserve over a six-month period.

The EU was able to find alternative supplies.

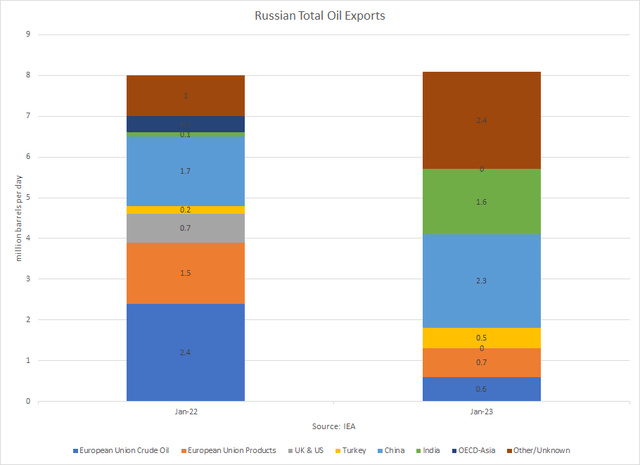

Between January 2022 and January 2023, the US and the UK’s Russian purchases went from 700,000 barrels per day (bpd) to zero. The EU was able to reduce their Russian consumption by 75% going from 2.4 million bpd to 600,000 bpd. The price of oil fell to $75 per barrel by year end 2022.

IEA

G7 Price Cap on Russian Oil

Another element to Western nations policies was when the G7 agreed to implement a price cap on Russian oil, to prevent Russia from earning a wartime premium. The price cap worked to achieve two seemingly contradictory goals; restricting Russia’s oil revenue while maintaining the supply of Russian oil on world markets. see here

The price cap went into effect on December 5, 2022 at set a price target of $60 per barrel of Russian crude oil.

The net effect of the price cap is that Russian oil sells at a discount.

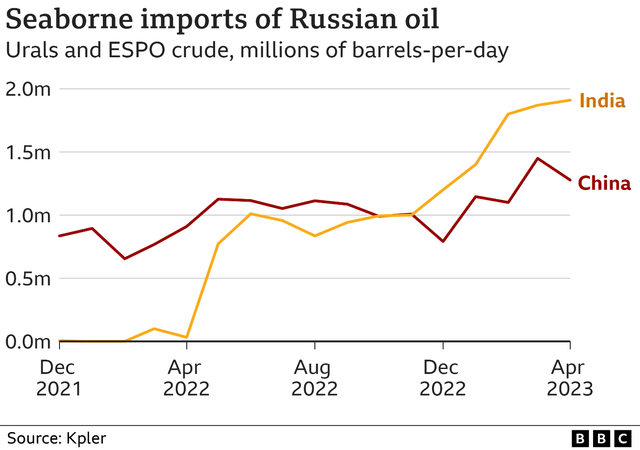

While the US, UK and the EU cut back on Russian oil purchases, Russia sought new trading partners. China and India stepped in to fill the void. China increased their consumption of Russian oil, while India became a new customer.

KPLER

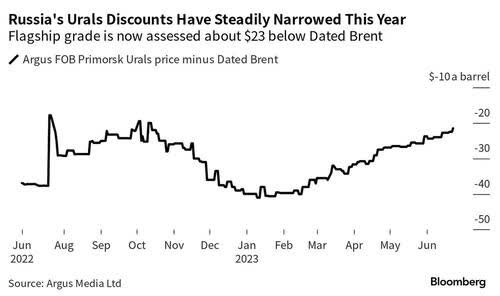

In order to incentivize these new relationships, Russia offered huge discounts on their oil. Russia’s Urals oil traded at steep price concessions to the global benchmark, Brent crude oil. These discounts ranged from $20 to $40 per barrel.

Argus Media/Bloomberg

The success of the sanctions

The original goal of the sanctions imposed on Russia was to punish them for their aggression against Ukraine.

We are finally beginning to see the impact.

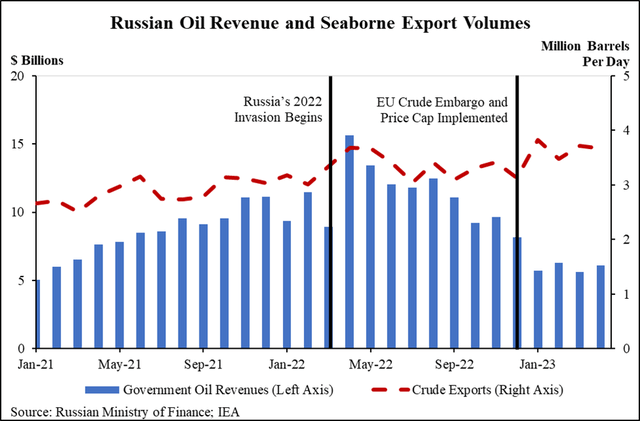

While Russian oil exports continue at roughly the same level, the windfall profits they experienced initially have dissipated. The monthly revenue they are earning from their oil exports has fallen from $16 billion immediately following the commencement of hostilities to $6 billion a month in April 2023, a 63% decline.

Russian Ministry of Finance/IEA

This has dramatically weakened Russia’s finances.

According to Russia’s Ministry of Finance, see here revenues for 1Q23 were 5.7 trillion rubles, a 21% decline y/y. This was primarily due to falling oil revenues.

Meanwhile, expenditures were 8.1 trillion rubles, a 34% gain y/y. The increase was due primarily to military spending.

This resulted in a huge 2.4 trillion ruble deficit.

The Russian economy is shrinking. According to OECD Russian GDP declined by 2.1% in 2022. Their current forecast is for another 2.5% decline in 2023.

With the war dragging on, the situation will not improve. Russia needs money, and there are few options. They can either raise taxes or force the public to buy war bonds. Neither choice is popular. They could erode already weak public support, in my opinion.

As initially stated, the impact can be seen in the exchange rate of the Ruble.

As of June 30, 2023 the Ruble was trading at 89 to the dollar, its lowest level since March 2022.

This represents a 6% drop in one week due to the instability following the aborted military mutiny.

The ruble is down 18.5% year to date.

And the ruble is down 41% y/y as the impact of the sanctions has finally kicked in.

The outlook is bleak.

Read the full article here