The Nuveen Short-Term REIT ETF (BATS:NURE) is a pure play U.S. equity REIT ETF, which offers an exposure towards REITs that exhibit less price sensitivity to interest rate changes. The overall approach is to track equity REITs, which generate cash flows mainly from short-term leases. The main constituents of the index are apartment buildings, hotels, self-storage facilities and manufactured home properties.

The relative price inelasticity to rate of change in interest rates stems from the underlying exposure to lower duration cash flows. Typically, REITs stipulate long-term lease agreements with predictable cash flows and pre-defined expiries, resembling characteristic of plain vanilla fixed income instruments. So, whenever you have an exposure to predictable cash flows with finite time horizon, the duration and convexity risk comes into play.

In the chart below, we can clearly see how the overall REIT market has responded to the sudden shift in the monetary policy in early 2022.

Seeking Alpha

The price performance of the Vanguard Real Estate ETF (NYSEARCA:VNQ) has moved in perfect tandem with the Vanguard Long-Term Bond ETF (NYSEARCA:BLV). In other words, there is a notable exposure to duration and convexity risk embedded within typical equity REITs.

Weak case for NURE

There are two main objectives for NURE:

- To reduce interest rate sensitivity, while still providing an exposure to U.S. equity REITs.

- To provide attractive dividend yield.

Let’s take a look at whether NURE has delivered on these objectives.

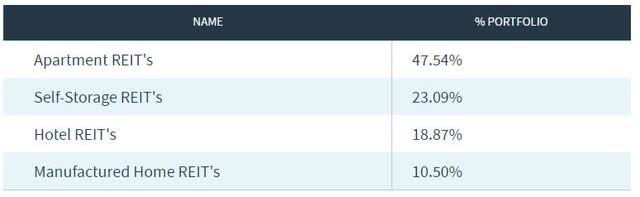

As of now, NURE holds allocations across 4 REIT sectors all of which could be deemed defensive in the current macroeconomic environment. One would perhaps question whether the hotel REITs are safe given the massive underperformance since the outbreak of COVID-19. However, looking at the prevailing sector-wide fundamentals, hotels REITs actually carry more conservative balance sheets now than compared to the pre-COVID era. Some of the stocks went belly up and the majority of the remaining ones were forced to take prudent actions in shielding their balance sheets from future uncertainty. Now, however, hotel REITs are bouncing back and enjoying the overall return to the normalcy.

So, in my humble opinion, the NURE’s REIT sector exposures are more on the defensive side as there are no allocations made towards office REITs and some of the struggling healthcare names.

Nuveen, LLC

In total NURE holds 37 U.S. equity REITs in its portfolio from which Top 10 positions account for ~51% of the AuM.

Nuveen, LLC

The quality and financial resiliency of the top largest holdings are excellent as, for example, 8 out of Top 10 largest holdings carry investment grade balance sheets. Going deeper in the holding list, we can see that the quality remains unchanged with a heavy skew towards rated companies.

Now, so far we know that NURE offers an exposure towards less interest rate sensitive REITs, which also possess strong balance sheets.

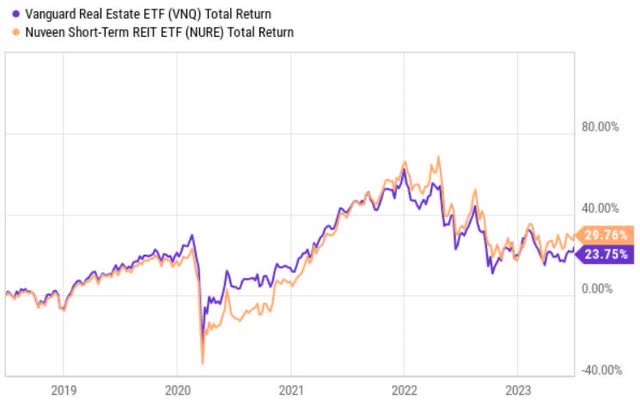

As we saw in the stock price performance above, the overall has REIT fallen in line with the bonds and experienced additional headwinds associated with the office meltdown. Considering the optical characteristics of NURE, one might expect a superior performance (compared to VNQ) since the FED initiated its aggressive rate hiking policy.

Seeking Alpha

In reality, NURE has delivered almost the exact same level of return as VNQ, providing no notable extra protection from the surging interest rates. Put differently, the ‘equity story’ of NURE has failed and seems to not yield the promised benefits.

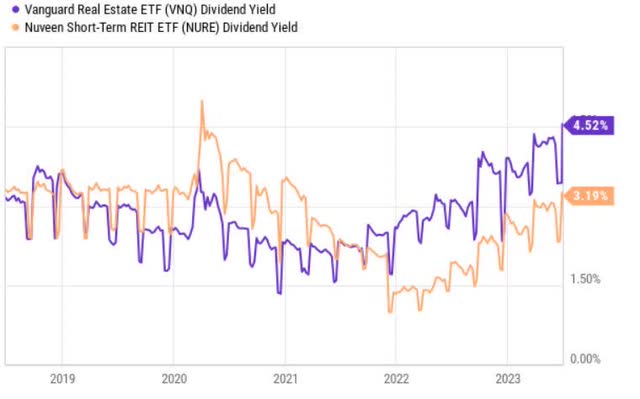

Seeking Alpha

At the same time, NURE’s second objective to provide attractive yield has not been achieved either starting from late 2019.

Bottom line

The recent history has proved that the underlying objective of NURE to protect its investors, who would like to have an exposure to equity REIT factor but with lower interest rate risk, does not work. Moreover, currently NURE does not offer more attractive yield (its second objective) than the overall REIT market (i.e., VNQ). So, the only advantage of investing in NURE boils down to the allocations into four relatively safe REIT sectors, where the underlying constituents / stocks have sound balance sheets.

In my humble opinion, we are currently experiencing an environment in the REIT space, where individual stock picking entails greater probability of capturing alpha. In other words, I would avoid NURE due to its inability to protect investors from interest rate changes and the corresponding opportunity cost.

Read the full article here