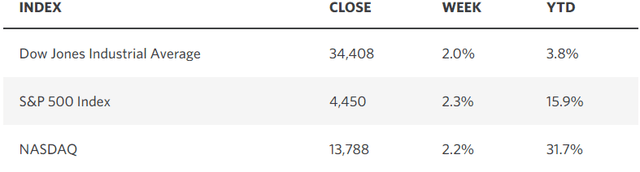

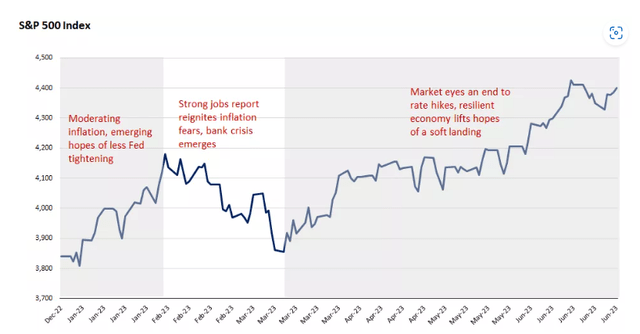

The first half of this year was an outstanding one for most of the major market averages, but not so much for the average stock. I think that will change and be a theme for the second half that starts today. Defying expectations of an overly pessimistic consensus at the beginning of this year, inflation has fallen at a consistent pace, while the economy remains resilient. As a result, corporate earnings have outperformed, as the Fed nears the conclusion of its rate-hike cycle. A soft landing for the economy should gradually become the consensus view in the months to come.

Edward Jones

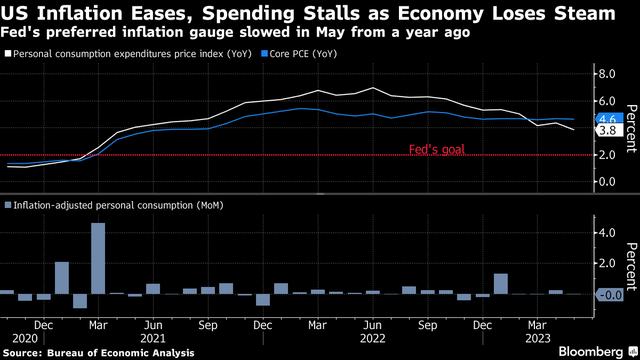

In support of that narrative, we learned last week that the rate of economic growth in the first quarter of this year was stronger than expected, fueled by an upward revision in consumer spending. At the same time, the Fed’s preferred inflation gauge declined more than expected to its slowest pace in two years. Furthermore, services inflation excluding housing and energy services, which is a key metric noted by Chairman Powell, increased by the smallest amount since last summer at just 0.2%. This should be enough of a reason for the Fed to stop raising interest rates, but investors are still anticipating one more increase in July. The markets do not seem concerned, and I still believe the Fed will pause again, which would improve the odds of a soft landing and the continuation of the bull market.

Bloomberg

The first half was certainly not smooth sailing, and I suspect we will see a similar situation during the second half of this year, as bulls and bears battle for direction of the overall market. Stronger-than-expected economic data raises fears of inflation and more restrictive monetary policy, while weak data stirs concerns of the elusive recession that Wall Street has been forecasting for more than a year. I warned on February 7 that we might see a pullback in the S&P 500 to 3,900 after a blistering start to the year, which would be healthy in terms of consolidating those gains. The index bottomed at 3,855 on March 13 before resuming its advance. Days before I asserted that would see an eventual rebound take the S&P 500 to 4,300. We surmounted that level last month, after which I raised my target to 4,500. Last week I concluded that we would see a new all-time high over the coming 12-month period.

Edward Jones

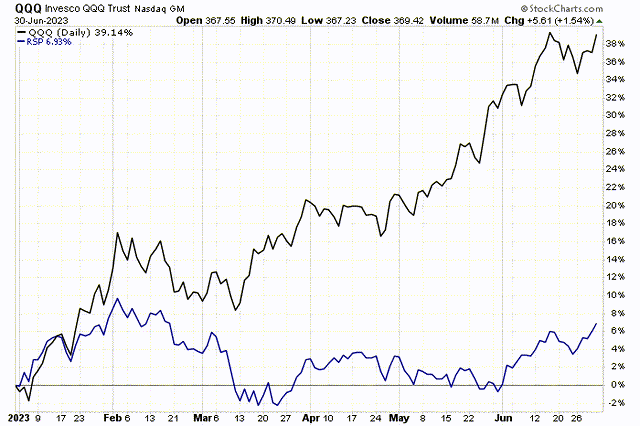

My optimism is grounded in rates of change that I think will continue to improve, but I suspect we will see periods of consolidation along the way, as we did earlier this year. Consolidation is likely to be caused by investors rotating from technology-related names where excessive valuations have been fed by the artificial intelligence craze. The result should be a reversion to the mean whereby the average stock, as measured by the equal-weight S&P 500 index, outperforms the handful of market leaders, as measured by the Nasdaq 100 index, which have driven index gains.

Stockcharts

I was asked recently how I rationalize a new all-time high for an index that most consider to already be overvalued, but I never said it would be rational. Valuation is a pendulum that swings in both directions to excess. The S&P 500 at 4,450 trades at better than 18 times next year’s bottoms-up consensus estimate of $246 in earnings. That is expensive, but so long as rates of change in the high-frequency economic data, corporate earnings, and sentiment continue to improve, valuations can sustain or increase. The improvements I see coming should be capable of realizing new all-time highs. When rates of change start to deteriorate, so will my outlook for the index.

That said, I think the more prudent approach to investing in this market today is to focus on the sectors and individual constituents of the index that have more reasonable valuations, and which have yet to participate from a performance standpoint.

Happy 4th of July!

Read the full article here