Investment Thesis

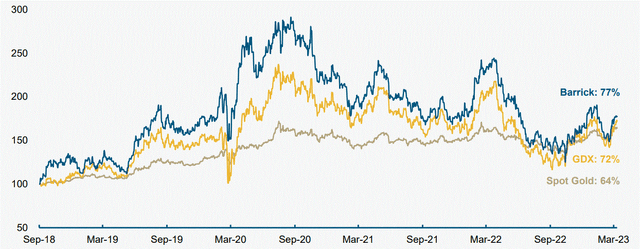

Barrick Gold stock (NYSE:GOLD) has been underperforming relative to the price of gold (XAUUSD:CUR) in the past few years. It also underperformed the GDX (GDX) gold miner ETF in the past year, meaning that there are company-specific issues that are weighing down the stock. It should be noted however that taking a longer timespan view of the past five years, it has not underperformed the ETF, nor the price of gold, in other words, its performance is in line with the wider industry. The current period of underperformance should be seen as an opportunity to invest in my view, on two factors. First and foremost, there are arguably improved future longer-term prospects for the company. Second, the global economic & geopolitical trends that seem to be prevailing at the moment, may trigger another major leg up for gold prices, which should greatly improve the prospects of most gold mining companies.

Rising costs are denting Barrick’s results, but the debt situation remains solid

For the first quarter of the year, Barrick saw a net income of $120 million, which was a significant drop compared with the same quarter from a year earlier, of $438 million. It was however a big improvement on the net loss of $735 million it saw in Q4 of last year. Revenues were also down by about 7% on the year.

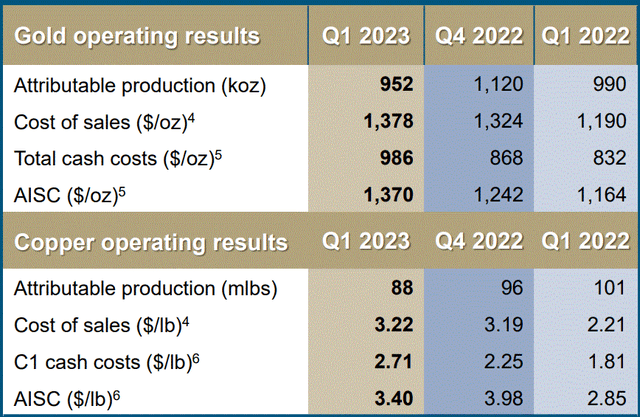

Barrick production & costs (Barrick Gold)

As we can see, both gold and copper production declined significantly, which plays a significant role in the decline in revenues. The cost of gold sales has been rising rapidly, by about 20% since the same quarter last year, even as gold production declined by about 4%. This explains to a great extent the decline in profits.

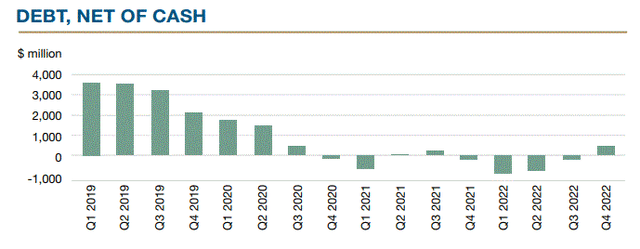

Other metrics of note, include Barrick’s debt situation, which is always something that investors need to keep a careful watch on, given the volatile nature of the mining business.

Barrick Gold

As we can see, there has been a significant improvement in this regard, which should be seen as a sign that the company is on solid financial ground. In the unlikely event that gold prices will experience a sustained decline, Barrick is financially prepared to weather the storm and wait out better times, which for investors, it means that they too can ride it out if need be and if they are willing to do so.

The reserve situation is solid, with long-term production forecast to rise significantly

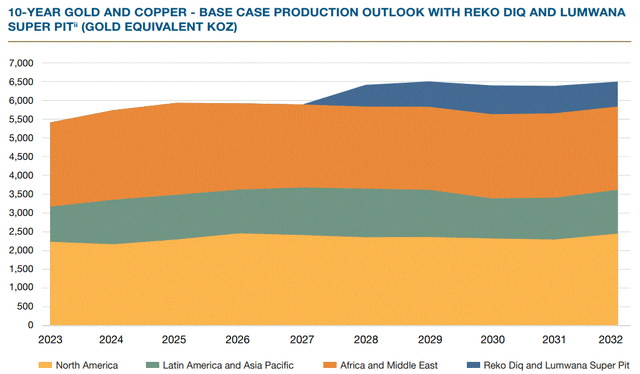

For long-term investors who are willing to ride out any potential market downturns, it is comforting to know that by the end of this decade, Barrick is projecting significantly higher production from current levels. It is mostly on the back of its Pakistan project.

Barrick Gold

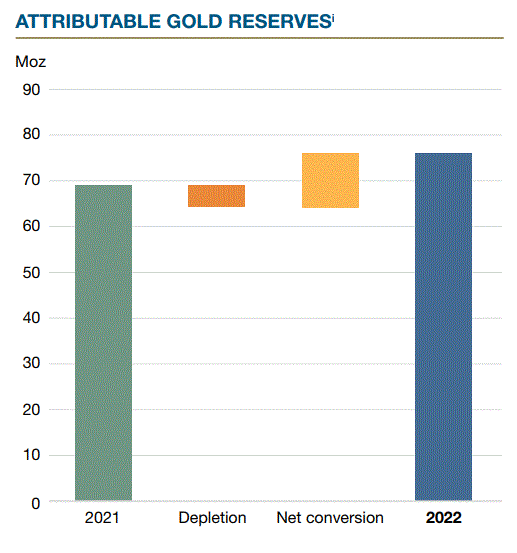

Underpinning production is a solid reserve base, which is the main reason that I see long-term value in this stock.

Barrick Gold

With the current and mid-term annual production rate of about 5.5 million ounces, its current gold reserve life is about 13-14 years. Within the context of global gold reserves of about 52,000 metric tons and production of about 3,100 tons that provides the global gold mining industry with a roughly 16-17 year reserve life, Barrick’s reserve ratio is decent. We should keep in mind that some of the companies with sizable reserve life ratios are either state actors or Russian and other foreign companies that are not available as investment opportunities for us. Some reserves are by-product reserves, meaning that they are tied to other mineral mining, like copper, with more significant reserve life than most gold-focused mines. Taking these factors into account, I’d say that Barrick is sitting on a decent reserves-to-production ratio.

My outlook on long-term gold prices is dominated by recent central bank buying, as well as a seeming trend of de-dollarization that is taking root around the world

While company-specific metrics are obviously important when it comes to all mining companies, the outlook for typically price-volatile commodities prices is at least as important. It goes without saying that predicting commodities prices is tough, with much margin for error. There are simply too many variables and unpredictability of the trends & direction within those variables. The best that we can do is try to figure out which variables matter the most at the moment and where they may be headed.

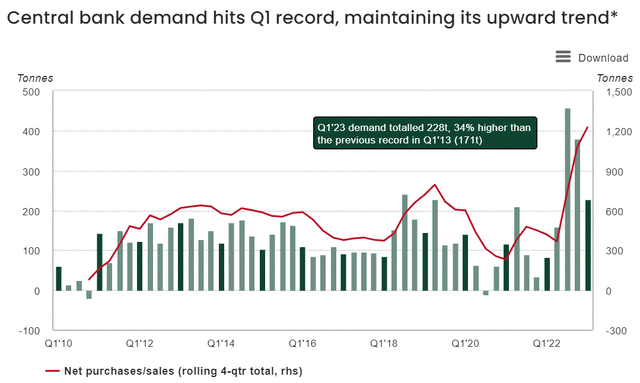

The most important variable that I am currently looking at in terms of the gold market is the net buying of physical gold by central banks.

Gold.org

As we can see, central banks around the world are currently net buyers of gold, reaching a magnitude where they are buying about 40% of all the mined gold hitting the market. If the current trend continues, it at the very least provides a solid price floor for the gold market, but it is more than likely that it will drive the price further up in fiat currency terms.

In regard to the question of why central banks are so eager to accumulate gold, the answer that I see as the most plausible is that they see heightened risk to the global fiat system ahead. I personally think that they might be right. For instance, Zoltan Pozsar of Credit Swiss sees the end of the current financial era approaching, giving rise to a new one where commodities-based currencies will prevail. Perhaps the Russian-Iranian proposed joint gold-backed stablecoin project meant to facilitate bilateral trade may be a template for what a future commodities-based currency system might look like in the future. Or perhaps it may take on other forms.

Even as assurances came fast and furious in regard to the USD-dominated global financial system remaining in place, we saw a number of countries like India for instance, pushing hard to establish bilateral deals in order to establish the use of local currencies in bilateral trade instead of using the USD or the euro as an intermediary. Heavily sanctioned countries like Russia are pushing to completely cut reliance on the USD or the euro in their trade with the rest of the world.

All of these developments are causing a significant decline in the USD as a global reserve currency, dropping by 8% just last year. Most of the arguments against the USD losing its leading role as a global reserve currency point out that no other fiat currency comes close to challenging the dollar. The current trends of central banks around the world continuing to stock up on gold may suggest that other fiat currencies may not necessarily be the greatest threat to the USD FX dominance.

The prospect of the end of an era in terms of global financial dominance is the likely culprit behind the apparent surge in central bank gold demand. It may become a situation that feeds on itself. More and more gold is acquired by central banks, making it imperative for them to find practical ways to use the gold either as a collateral backstop for existing fiat currencies or by launching stablecoins backed by gold. The appearance of such alternatives to the US dollar will in theory displace the use of the US dollar, as well as arguably the euro and other major fiat reserve currencies that are backed by nothing. Their decline will in turn lead to a surge in demand for the rising alternative commodities-based currencies in their various forms as a rush to jump ship may occur at some point. Higher demand for gold as a result should push prices higher from current levels, at least when measured in unbacked fiat currency terms.

Investment Implications

Barrick Gold

Even though Barrick stock has underperformed versus the GDX ETF, as well as against gold prices in the past year, looking back further at its five-year performance, it managed to do slightly better than both. Looking forward, I see no reason why it might not manage to repeat the same performance in the next five years, especially when looking at it from current levels. It has the reserves needed to make it happen, and production is set to increase significantly if all will go well with its Pakistan project. All this is within the context of what I see as being a favorable market environment for gold prices.

A word on Barrick’s prospects of becoming a major copper producer, courtesy of its Pakistan project, and what it might mean for its future outlook as a company. As I pointed out in an article I wrote about half a year ago, the Reko Diq project in Pakistan has the potential to greatly increase Barrick’s copper reserves and production, in addition to the gold reserves that come with it. I personally perceive the copper price outlook to be a bit of a wildcard in terms of Barrick’s future long-term prospects. The Pakistan project is also a bit of a wildcard, given regional political and geopolitical issues. This project raises Barrick’s overall risk profile, while at the same time, it provides it with a decent production growth profile which makes it an attractive long-term investment opportunity. In the event that both gold and copper prices will do well going forward, and Barrick’s Pakistan project will go smoothly, it could potentially make Barrick a top-performing stock this decade, after what can be described as a somewhat lackluster and arguably disappointing start.

Read the full article here