With BlackRock (BLK) filing for its own Bitcoin ETF, many are expecting Bitcoin prices to increase with SEC approval. BlackRock is not alone in these efforts as many other players are also vying for the chance to create their own Bitcoin ETF.

With momentum building for Bitcoin, I believe Marathon Digital Holdings, Inc. (NASDAQ:MARA) is a buy as the rising value of Bitcoin will improve the profitability of its mining operations. SEC approval for Bitcoin ETFs could open the floodgates for Bitcoin demand – potentially causing MARA stock to rally as a result.

Spot Bitcoin ETF

There have been 30 failed applications to launch spot Bitcoin ETFs from players like ARK, Valkyrie, and Invesco, which is why I was surprised when BlackRock filed for its own Bitcoin ETF, especially since it has Coinbase (COIN) as its Bitcoin custodian.

So for BlackRock to apply for its own Bitcoin ETF and have Coinbase as its custodian indicates that it may know something the market doesn’t. Another reason to be bullish on BlackRock’s application is its very high approval rate. For all of its 576 filings, BlackRock has a 99.82% approval rate, meaning it’s been rejected only once.

It seems BlackRock is “not uncertain” that it will be approved, and it looks even more likely now that the SEC has approved the first Leveraged Bitcoin Futures ETF. This decision follows its earlier approval of other bitcoin futures ETFs like ProShares Bitcoin Strategy ETF (BITO). It seems very strange that the SEC would approve a 2x leveraged futures product before a spot ETF for BTC, which is one reason why I expect the SEC to approve a spot Bitcoin ETF soon.

I believe that if one Bitcoin spot ETF is approved, it will spark a wave of new filings for Bitcoin ETFs. There are already 12 active Bitcoin ETF filings and if one is granted approval it could open the floodgates for more.

Needless to say, a Bitcoin ETF would increase liquidity as well as institutional investments in Bitcoin, which is an important catalyst for MARA.

Trust in Banking System

As a result of the 2023 banking crisis, trust in traditional banks has declined. According to a poll released by the Associated Press, 31% of those surveyed hardly have any confidence in banking and financial institutions.

The Fed expects two more interest rate hikes in 2023, putting more pressure on regional banks. Bitcoin and decentralized finance have always been proposed as an alternative to traditional banking. The recent uncertainty and the potential opportunity for investors to invest in spot Bitcoin ETFs could bring additional liquidity to Bitcoin, thereby benefiting MARA.

On the other hand, increasing interest rates have caused investors to turn away from risky assets like crypto. The two remaining rate hikes this year could dampen investors’ enthusiasm for volatile assets like Bitcoin – impacting MARA’s operations.

But in the long term, the outlook appears much brighter as the Fed expects to begin cutting interest rates in 2024. This will gradually change investors’ behavior as they become more inclined to take on high-risk, high-reward investments.

Bull Case for MARA

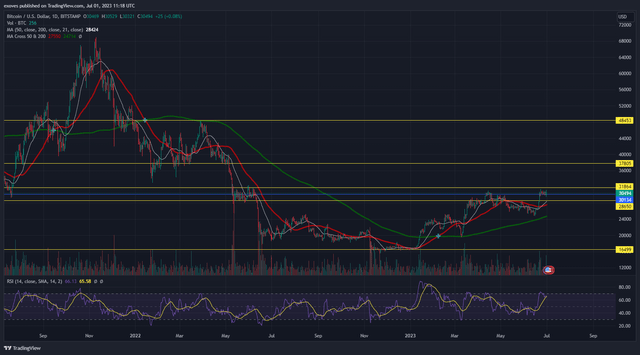

Already, BTC is up 23% on news of the BlackRock ETF; if a BTC spot ETF is approved, it could catalyze the famously volatile cryptocurrency. The added liquidity, institutional investments, and overall momentum could trigger a run for BTC.

TradingView

In this case, Marathon’s May inventory of 12,259 BTC would appreciate in value. Additionally, MARA’s mining operations would become more profitable.

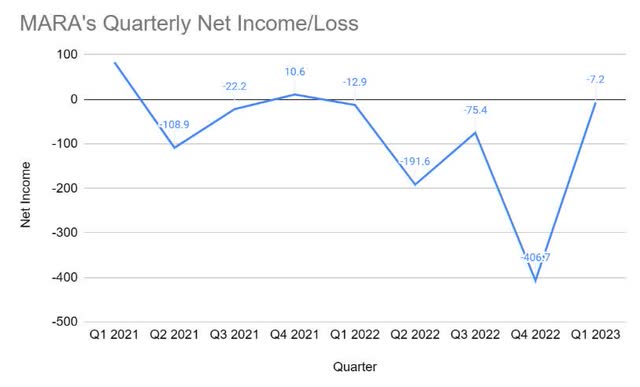

Looking at the last five quarters, MARA’s mining operations reached its lowest total cost per Bitcoin in Q1 2023. However, it is worth noting that its total costs were offset by a $17 million gain on digital assets

| Quarter | BTC Mined | Cost of Revenue | Total Cost | COR per BTC | TC per BTC |

| Q1 ’23 | 2,195 | 51,110,000 | 3,880,000 | 23,284 | 1767 |

| Q4 ’22 | 1,562 | 43,563,000 | 395,779,000 | 27,889 | 253,379 |

| Q3 ’22 | 616 | 40,067,397 | 19,268,739 | 65,044 | 31,280 |

| Q2 ’22 | 707 | 41,394,556 | 161,788,636 | 58,549 | 228,838 |

| Q1 ’22 | 1,259 | 26,393,636 | 34,450,350 | 20,963 | 27,363 |

Q1 2022 marked its best quarter in terms of COR per BTC and on average MARA’s COR per BTC has been $39,145 based on the last five quarters. As MARA continues to ramp up BTC production and optimize its operations, I expect its TC per BTC to decrease gradually.

Based on these calculations, if the price of Bitcoin stays above $23,284 MARA will break even on its energy, hosting, and other expenses. The company’s total costs for Q1 2023 were impacted by a $17.6 million gain on its digital assets, but setting this aside, the company’s COR and general and administrative expenses totaled $66.4 million for the quarter.

With this in mind, I estimate that MARA’s mining operations would become profitable – assuming that MARA was to mine 2,195 BTC – with Bitcoin’s price above $30.2 thousand.

| Quarter | Notes |

| Q1 ’23 | Total cost impacted by Realized gains on digital assets sold and unrealized losses on digital assets loan receivable +$17,615,000 |

| Q4 ’22 | Total cost including Impairment of mining equipment and advances to vendors ($332,933,000) |

| Q2 ’22 | Total cost including Impairment of digital currencies ($127,590,231) and Change in fair value of digital currencies held in fund ($79,688,590) |

Marathon is operating with a hash rate of 15.2 as of May and is planning to reach 23 EH/s by the end of the year – although this was initially its mid-year goal. Considering that the company has already increased its hash rate by 291% YoY, it’s made considerable operational progress. The company believes it has secured enough hosting capacity to support its target of 23.3 EH/s. Optimizing its hash rate will pay off if Bitcoin rallies, but as is, the company will need to increase its hash rate by 51% to achieve its goal of 23 EH/s.

And based on BTC’s current value of $30,494 the company’s financial situation may improve over the coming quarters if the rally continues.

Company Filings

Risks

My thesis is mainly focused on the potential for SEC approval of spot Bitcoin ETFs. Despite BlackRock’s application, there is no guarantee that the regulator will approve this financial instrument.

Even with SEC approval, Bitcoin may not rally. This digital asset is known for its volatility and, as demonstrated by the recent “crypto winter”, fluctuations in its price can negatively affect MARA’s own operations – posing a significant risk to investors. As is, MARA is held back by the costs of mining Bitcoin and if it is unable to lower its costs of operation or BTC does not increase in value, then the company runs the risk of never profiting from its mining operations.

Technical Analysis

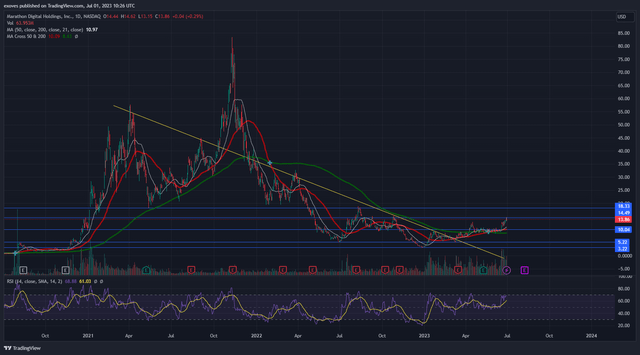

TradingView

On the daily chart, MARA is trading in a sideways channel between $5.22 and $14.49 after breaking out of a downward trend. This is a bullish sign overall. Looking at the indicators, the stock is trading above the 200, 50, and 21 MAs, which are also bullish indications. Meanwhile, the RSI is currently overbought at 69.

As for the fundamentals, MARA is up 50% following BlackRock’s filing for its own Bitcoin ETF. The stock is currently testing a resistance and I expect a pullback given the overbought RSI. This could be an opportunity for investors bullish on BTC or SEC approval. I recommend buying on retests of the 21 or 50 MAs.

Historically, MARA stock moves with BTC. If the crypto continues to rally, investors could hold for earnings on August 9th or take profit at retests of the resistances.

However, I would warn investors that given MARA’s run-up so far, if BlackRock’s application is approved it could result in a sell-the-news situation given the stock is already overextended on the daily timeframe.

Conclusion

I personally believe it’s only a matter of time until the SEC approves a spot Bitcoin ETF. BlackRock’s recent application has caused quite a stir in the crypto community, and even Fed Chair Jerome Powell’s statement that cryptocurrencies like Bitcoin have “staying power” are signs that there is movement in this sphere.

MARA would directly benefit from a Bitcoin rally and a spot ETF would bring liquidity and institutional investors to the cryptocurrency. The company has made significant advances in its mining operations and if the price of Bitcoin consolidates above $23,284 – its COR per BTC in Q1 – then MARA’s outlook could continue to improve as it works towards its EOY goal of 23.3 EH/s.

Read the full article here