AI hype & hoopla replaces crypto, blockchain, and FinTech hype & hoopla. You’ve got to go with the times.

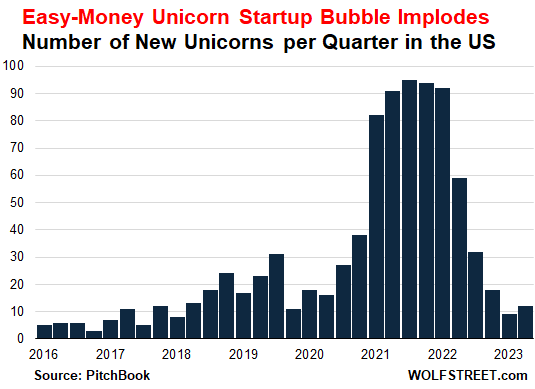

In the second quarter 2023, only 12 venture-capital-backed startups in the US became “unicorns”: meaning they received funding that valued them at over $1 billion. In Q1, 9 startups became unicorns in this manner, the lowest since January 2018, according to the quarterly unicorn tracker by PitchBook.

In Q3 2021, the peak of the easy money unicorn startup bubble, 95 startups became unicorns. In the year 2021 – the last year of the Fed’s easy money – a total of 362 new unicorns appeared in the US, with a combined valuation of nearly $1 trillion!

The Fed began hiking rates in Q2 2022, and the number of unicorns plunged by 36% from the prior quarter to 59 new unicorns. In Q3 2022, there were only 32 new unicorns.

By Q1 2023, with the Fed’s interest rates approaching 5%, unicorn creation plunged by 90% from the peak, to just 9 new unicorns. And now the top end of the Fed’s rates is 5.25%, and more rate hikes are coming. So some kind of normalcy is returning to the startup scene:

So 12 unicorns being created in a quarter is pretty good in normal times. But during the Fed’s easy money bubble, everything and anything became a unicorn.

As you’d expect, given all the hype and hoopla about generative AI, five of the 12 newly minted unicorns in Q2 (42%) came with “artificial intelligence” labels.

By contrast, during Q3 2021, the peak of the unicorn bubble, only 17% of the 95 new unicorns had AI labels. As you’d expect, popular labels back then were Crypto, Blockchain, Fintech, AdTech, Saas, Marketing Tech, Clean Tech, etc. Hype-and-hoopla has got to go with the times.

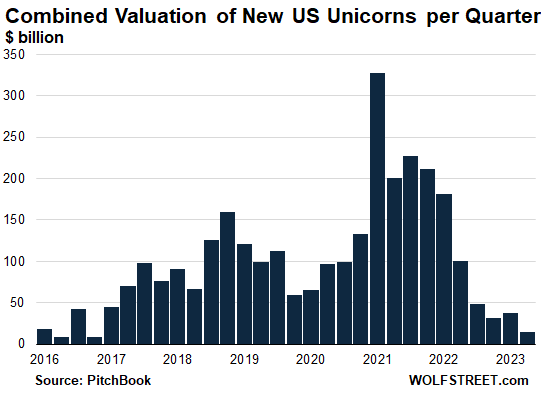

Valuations plunged

In Q2 2023, the 12 new unicorns had a combined valuation of $15 billion, the lowest since Q4 2016, which caused the average valuation per unicorn to plunge to $1.2 billion, the lowest in the PitchBook data going back to Q1 2016.

By contrast, in Q1 2021 – with the Fed’s easy money policies in full swing with near-0% interest rates and $120 billion a month in QE – the 82 new unicorns had a combined valuation of $327 billion, for an average valuation of $4.0 billion per unicorn.

The Fed hiked rates, unicorn bubble imploded

By now, the stocks of hundreds of former unicorns and less-than-unicorns that had managed to go public during this easy money bubble via IPO, direct listing, or merger with a SPAC, have collapsed and have become heroes in my pantheon of Imploded Stocks.

Given this backdrop, and given the hundreds of billions of dollars that gullible retail investors lost on this hype-and-hoopla show, it’s now difficult for iffy outfits to pull off overpriced IPOs and SPAC mergers.

And big corporate buyers have cut back too. And so the exits for VC firms and other early investors – when they’re able to sell their stakes to others at a huge profit – are just about closed.

This has had a sobering effect. It put a damper on VC funding overall. It brought down valuations. It led to funding rounds at lower valuations than prior rounds – the dreaded “down rounds.” It allowed recent investors to impose terms that are much more favorable to them, and less favorable to the earlier investors, founders, and other stakeholders.

These are signs that some sort of normalcy might set in again – a dreaded concept after years of easy money that made everything possible and led to some of the worst and costliest decisions and capital misallocations all around.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here