Introduction

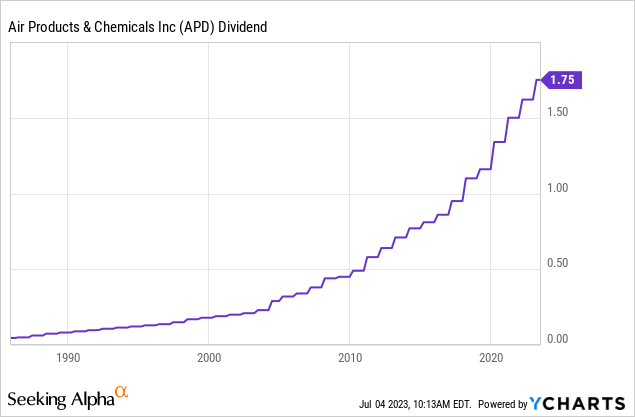

It’s time to dive into Air Products and Chemicals (NYSE:APD), one of my favorite chemical companies. This stock comes with a decent yield of 2.4%, 40 consecutive annual dividend hikes, and a business model that allows investors to benefit from emerging trends like hydrogen.

Especially when it comes to hydrogen, I made a big mistake by betting on a smaller growth stock. That mistake taught me to stick to what works best: buying trusted companies with great business models and the ability to reward shareholders.

That’s where APD comes in.

In this article, I’ll update my bull case and explain why it’s one of the best chemical dividend stocks money can buy.

So, let’s get to it!

Wide-Moat Energy/Chemical Innovation

In January, I wrote an article covering Plug Power (PLUG). I gave the stock a buy rating based on the strong hydrogen demand upswing.

I was right on hydrogen, as the bull case keeps developing nicely. I was wrong about PLUG, which is currently 38% down since I wrote that article.

That one time I divert from my strategy, I get burned.

The valuable lesson I learned was to stick to what works, which is buying high-quality companies. Even if the potential upside might be limited compared to some growth stocks, lower risks make the longer-term risk/reward so much better.

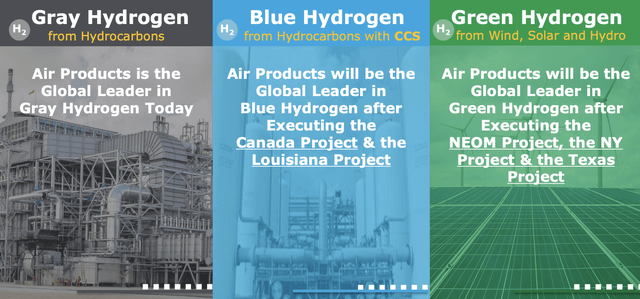

In the area of hydrogen, Air Products is a leader in the production and distribution of industrial applications. The company is actively involved in developing clean hydrogen projects, including blue and green hydrogen production methods.

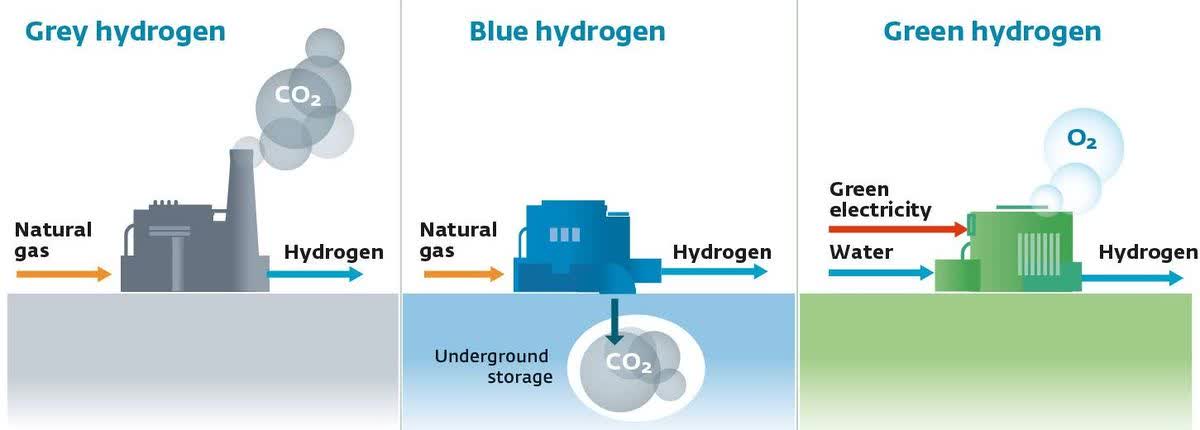

Energy Education

- Blue hydrogen involves capturing and storing or utilizing carbon emissions generated during hydrogen production.

- Green hydrogen is produced using renewable energy sources like wind or solar power.

These clean hydrogen initiatives align with global efforts to transition to a low-carbon economy and reduce reliance on fossil fuels, which provides the company with a strong long-term tailwind.

The difference compared to smaller growth stocks is that APD is an established chemical player.

With a market cap of $66 billion, APD serves customers in various industries, including refining, chemicals, metals, electronics, manufacturing, medical, and food. They also develop, engineer, build, own, and operate large industrial gas and carbon-capture projects.

The company holds leading positions in growth markets such as hydrogen, helium, and liquefied natural gas (“LNG”) process technology and equipment, turbomachinery, membrane systems, and cryogenic containers on a global scale.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Industrial Gases – Americas |

4,168 | 40.4 % | 5,369 | 42.3 % |

|

Industrial Gases – Asia |

2,921 | 28.3 % | 3,143 | 24.8 % |

|

Industrial Gases – Europe |

– | – | 3,086 | 24.3 % |

|

Corporate and Other |

279 | 2.7 % | 971 | 7.6 % |

|

Industrial Gases – Middle East and India |

– | – | 130 | 1.0 % |

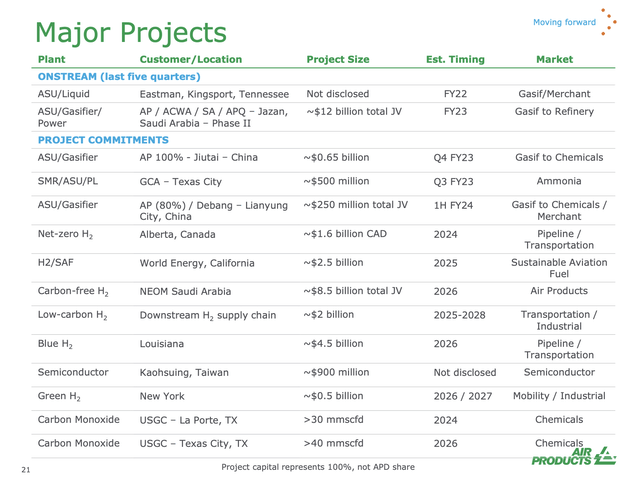

With regard to hydrogen, the company has a number of major projects. For example, the NEOM green hydrogen project, which was launched three years ago, capitalized on renewable energy resources in the Middle East, and it uses ammonia as an effective transport medium for hydrogen.

Air Products & Chemicals

Similarly, APD believes that its Louisiana blue hydrogen project, announced in 2021, demonstrates its leadership in carbon capture and sequestration on the US Gulf Coast.

Air Products & Chemicals

Air Products remains confident in its first-mover advantage and believes that its experience, know-how, and proprietary assets will secure its position as a global leader in clean energy and clean hydrogen development for years to come.

While the company is obviously saying positive things about its operations, I agree with them. APD is a wide-moat company with capabilities that others cannot compete with – at least not without significant investments that are too big for smaller players.

This brings me to the next part of this article: capital spending and shareholder returns.

APD Shareholders Are In A Great Spot

APD combines two things:

- Investments in sustaining and growing its operations.

- Rewarding shareholders.

The company has hiked its dividend for more than 40 consecutive years, which makes it a dividend aristocrat with less than ten years until it can be crowned a dividend king.

APD shares currently yield 2.4% with a 5-year average annual dividend growth rate of 10.5%. The most recent hike was on January 26, when the company hiked by 8%.

The best thing is that dividends are sustainable on top of the company’s investments in growth.

In its 2Q23 earnings call, the company noted that it generated significant distributable cash flow. Over the past four quarters, distributable cash flow was $3.2 billion, or more than $14 per share.

From this cash flow, Air Products paid over 45% and $1.4 billion as dividends to shareholders while maintaining more than $1.7 billion for growth investments.

The company believes that its ability to generate cash flow, especially in challenging conditions, demonstrates the strength and stability of its business, enabling the creation of shareholder value through increased dividends and capital deployment for high-return projects. As I already briefly said, smaller companies are unlikely to be able to compete with that.

The potential capital deployment through fiscal 2027 remained stable at around $35 billion, including cash, additional debt capacity, and expected availability by 2027.

Air Products believes this capacity is conservative, considering the potential for additional EBITDA growth, which would generate more cash flow and borrowing capacity.

Needless to say, managing the debt balance to maintain the targeted A/A2 rating remains a priority. APD isn’t just a dividend aristocrat, but it also has a credit rating even fewer companies can compete with.

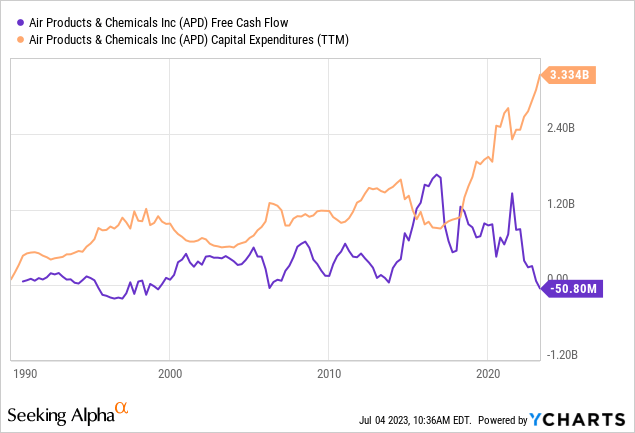

The backlog of projects, adjusted to reflect recent developments, stands at approximately $16 billion, providing substantial growth potential. As the overview below shows, the only reason why free cash flow is down is because of an acceleration in capital expenditures. These have resulted in a higher backlog, which will provide the company with accelerating free cash flow down the road.

With that said, until at least 2025, free cash flow will remain negative. This means the company will use its balance sheet to support dividend growth and investments. In 2025, the company is estimated to end up with $11.9 billion in net debt. That would be a significant increase from $1.8 billion in 2021.

However, this surge is expected to boost EBITDA from $3.9 billion to $5.2 billion during this period.

In fact, both sales growth and EBITDA growth are expected to pick up meaningfully.

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | |

| Net sales | 8,930 | 8,919 | 8,856 | 10,323 | 12,699 | 13,332 | 14,222 | 15,553 |

| EBITDA | 3,116 | 3,468 | 3,620 | 3,883 | 4,247 | 4,694 | 5,199 | 5,786 |

| YY Net sales | -0.1% | -0.7% | 16.6% | 23.0% | 5.0% | 6.7% | 9.4% | |

| YY EBITDA | 11.3% | 4.4% | 7.3% | 9.4% | 10.5% | 10.8% | 11.3% |

Additionally, $11.9 billion in net debt would be just 2.1x EBITDA, which means the company remains in a fantastic spot to prepare its business for sustained double-digit growth on a prolonged basis.

So, what about the valuation?

Valuation

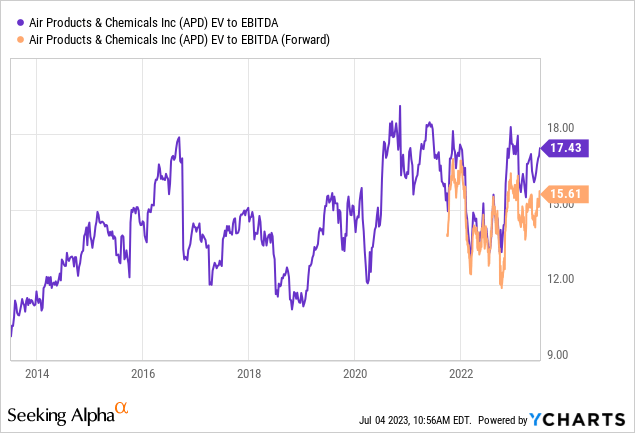

APD doesn’t have positive free cash flow for the time being. So, I’m not going to use free cash flow multiples – that would be pointless.

Using 2024E EBITDA, the company is trading at a 12.8x EV/EBITDA multiple. This calculation includes roughly $600 million in minority interest.

That said, looking at the LTM and NTM EBITDA multiples, we see that these numbers perfectly incorporate the company’s expected EBITDA acceleration.

12.8x 2024E EBITDA is a good deal – however, as I’m using 2024 numbers, it needs to be said that some growth has been priced in already.

Based on that context, APD is currently trading 10% below its all-time high after rallying 36% from its 52-week lows. The stock is down 4% year to date.

The consensus price target is $328, which is 10% above the current price.

I think that’s fair – or even a bit too low.

That said, if I didn’t already own so much cyclical exposure, I would be on the hunt for an entry.

Given the deterioration in (global) economic growth, I would be a buyer on 10-15% corrections.

Takeaway

Air Products and Chemicals is a standout chemical company with a focus on hydrogen and a terrific track record of shareholder returns.

As an established player in the industry, APD is well-positioned to benefit from the global transition to a low-carbon economy. While smaller growth stocks may offer tempting potential, sticking to high-quality companies like APD proves to be a wiser investment strategy, offering lower risks and a better long-term risk/reward.

APD’s wide-moat status, market leadership, and involvement in clean hydrogen projects make it a compelling choice. The company’s consistent dividend growth, dividend aristocrat status, and sustainable dividends alongside investments in growth demonstrate its commitment to shareholders.

Despite temporary negative free cash flow, APD’s solid balance sheet and projected EBITDA growth set the stage for sustained double-digit growth.

Trading at a reasonable 12.8x EV/EBITDA multiple, the stock seems a bit undervalued. For potential investors, a 10-15% correction could be an attractive entry point.

Read the full article here