(This article was co-produced with Hoya Capital Real Estate)

Introduction

In today’s world where there seems to be an ETF for almost any investment theme or group of investors, I came across the American Conservative Values ETF (NYSEARCA:ACVF) and decided to review it for Seeking Alpha readers since it had not been done yet. In this same vein, there is also the Point Bridge America First ETF (MAGA), whose ticker tells you who their target investor is. Not to be left (pun intended) out, there is the Democratic Large Cap Core ETF (DEMZ), again the ticker indicates the targeted investor.

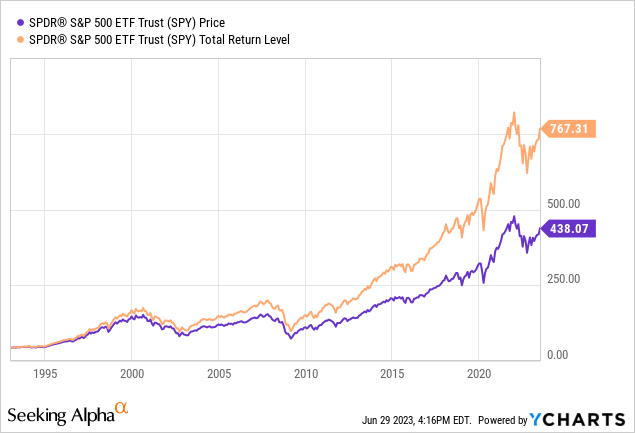

Investors who put their politics aside, basically want to know if such funds are providing better returns, safety, or income compared to a non-political fund like the SPDR® S&P 500 ETF Trust (NYSEARCA:SPY). This article answers those three points and the results are very close on all three counts after about 30 months of data for the ACVF ETF.

SPDR S&P 500 ETF review

Since this ETF is better known, I chose to review it first. Seeking Alpha describes this ETF as:

The SPDR S&P 500 ETF seeks to track the performance of the S&P 500 Index, by using full replication technique. SPDR S&P 500 ETF Trust was formed on January 22, 1993.

Source: seekingalpha.com SPY

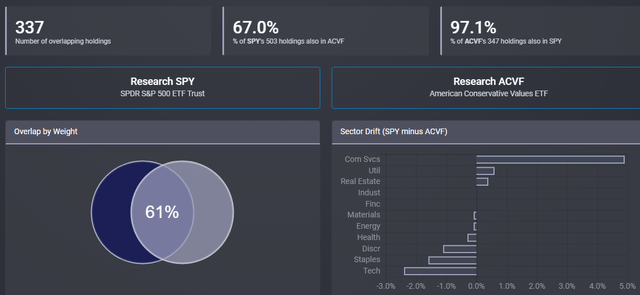

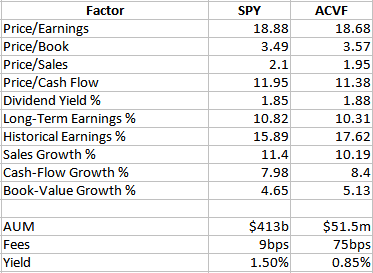

SPY, the world’s largest ETF, has $413b in AUM and sports a low 9bps fee. The TTM Yield is 1.5%.

Index review

S&P describes their index as:

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. According to our Annual Survey of Assets, an estimated USD 15.6 trillion is indexed or benchmarked to the index, with indexed assets comprising approximately USD 7.1 trillion of this total (as of Dec. 31, 2021). The index includes 500 leading companies and covers approximately 80% of available market capitalization.

Source: spglobal.com index

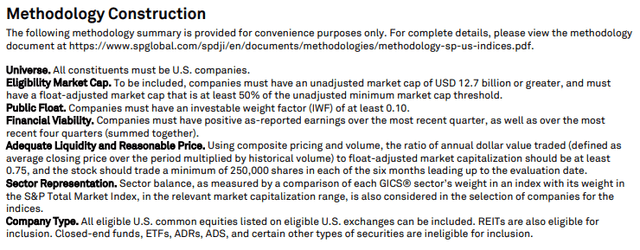

Provided were these methodology rules.

spglobal.com Index rules

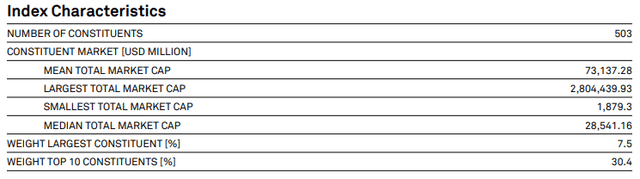

Current index characteristics include:

spglobal.com Index facts

SPY holdings review

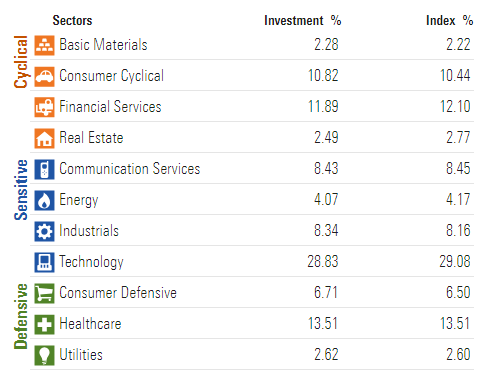

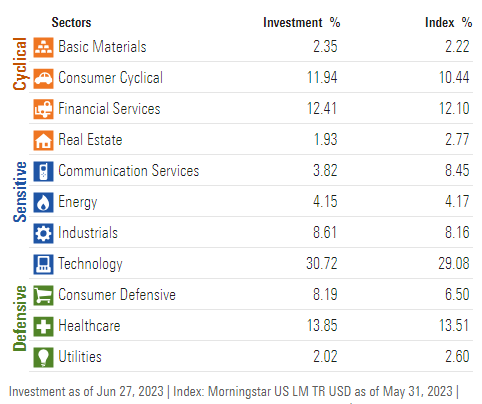

I chose to use the Morningstar data, which is up-to-date, as it shows the sectors by economic sensitivity.

morningstar.com SPY sectors

Being a market-cap weighted ETF and Index, drift from the index should always be minimal. The Index shown is the Morningstar LM Index but I suspect it mirrors the S&P 500 closely.

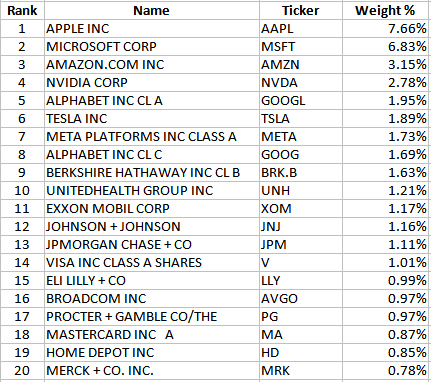

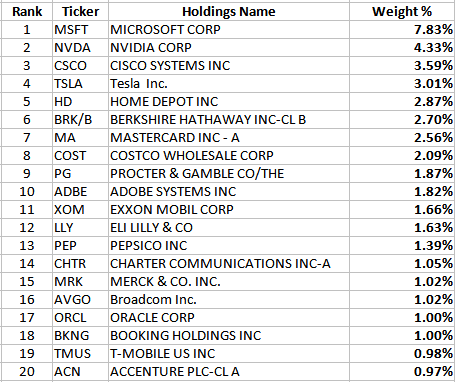

ssga.com SPY holdings

The performance of the Top 20 will drive SPY’s results as they account for 40% of the portfolio’s weight. The bottom 250 are only 11% of the weight.

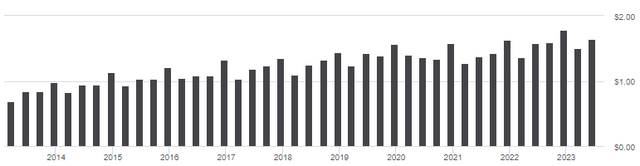

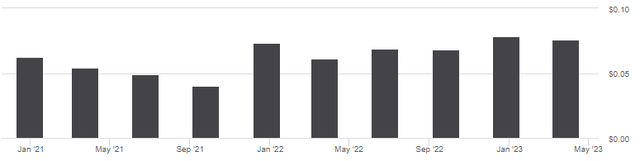

SPY distribution review

seekingalpha.com SPY DVDs

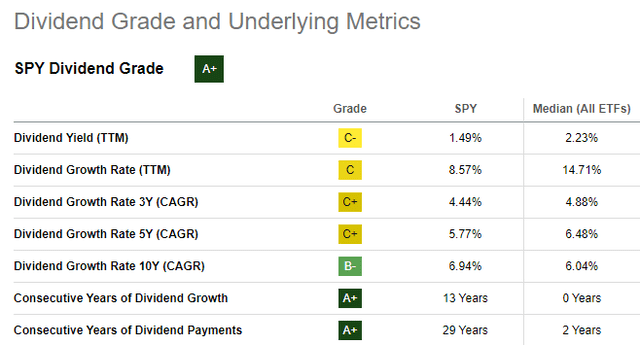

Payouts have grown just under 7% annually over the last decade, slowing to 4.44% over the last three; still enough to get a “A+” grade from Seeking Alpha.

seekingalpha.com SPY scorecard

American Conservative Values ETF review

Seeking Alpha describes this ETF as:

The investment seeks to achieve long-term capital appreciation; capital preservation is the secondary objective. Under normal circumstances, the fund seeks to meet its investment objective by investing at least 80% of its net assets, plus borrowings for investment purposes, if any, in equity securities of U.S. companies that meet its politically conservative criteria. The equity securities in which it invests will generally be those of companies with large market capitalizations. Benchmark: S&P 500 TR USD. ACVF started in October of 2020.

Source: seekingalpha.com ACVF

ACVF has just $51.5m in AUM and comes with 75bps in fees and only a .85% yield.

ACVF holdings review

This ETF Strategy article discusses the launch of ACVF and their selection flexibility. The managers provide an interesting overview that also shows the importance of looking beyond a fund’s name to appreciate how they invest.

We understand the importance of performance. Nobody wants to leave money on the table. For that reason, ACVF is not “ideologically pure,” but a balance between performance and advocacy. ACVF is a diversified large-cap portfolio that maintains sector and style exposure similar to the overall market. We are seeking to balance performance, which is competitive with benchmarks such as the S&P 500 and Russell 1000, with the advocacy of avoiding the worst-offending liberal companies. If we avoided all the “woke/liberal” companies, sadly we would not have many companies left to invest in. The easiest way to evaluate our holdings is to look at what we do not own, our Boycotts.

Source: acvetfs.com/faqs

Currently, there are only 35 companies on the ACVF boycott list. To be consistent, I used Morningstar here also.

morningstar.com ACVF sectors

More on sectors in the ETF comparison section later. ACVF is even more dependent on its largest 20 holdings as they are 44% of the portfolio.

acvetfs.com holdings

The lower half of the portfolio represent 9% of the total weight.

ACVF distributions review

seekingalpha.com ACVF DVDs

There has been some payout growth over ACVF’s short life but the yield is still below 1% so income investors need not apply.

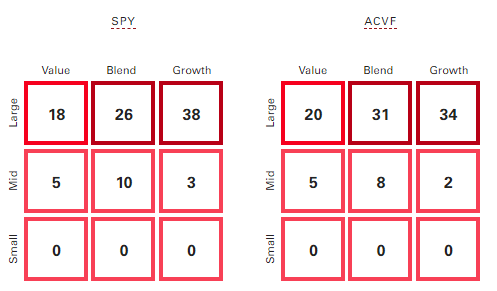

Comparing ETFs

I will start the comparison by looking at both market-cap and style allocations.

advisotrs.vanguard.com compare

The ACVF screens had little effect on either of these factors. The sector allocations do show some differences, though none over 5%.

ETFRC.com

One view of the ACVF is that it is just a subset of SPY, with 97% of its stocks also held by SPY and 61% allocation overlap. For investors liking Communication Services and wanting less Technology exposure; they might consider ACVF despite how it got there.

Comparing common equity factors reveals the screens had little effect.

morningstar.com; compiled by Author

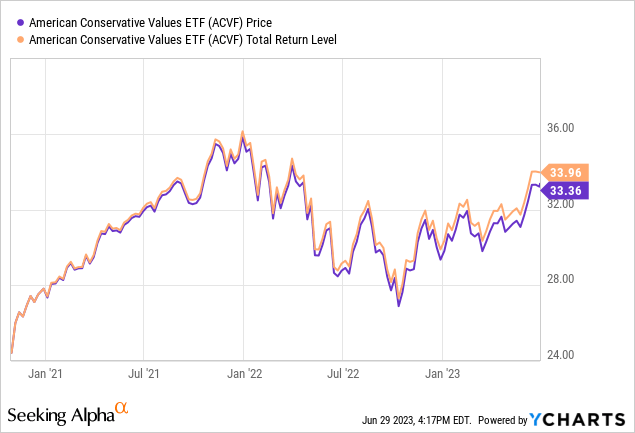

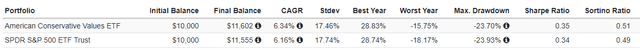

ACVF’s biggest disadvantage to SPY is the 66bps in higher fees; which effects the net return investors see, which look like this.

seekingalpha.com charting

With beginning and ending data rounded to month-ends, the risk data show no large differences between the ETFs.

PortfolioVisualizer.com

Portfolio strategy

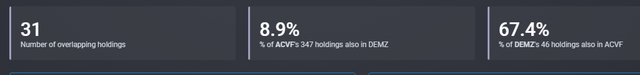

The question then is “Do such funds actually meet most of their investors’ expectations?”. One test is looking at overlap between a conservative ETF and one I think would be classified as on the liberal side. Since I mentioned DEMZ earlier, this how much ACVF and DEMZ share in common.

ETFRC.com

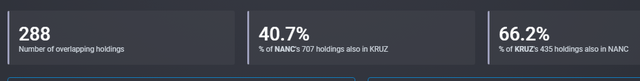

ACVF’s low percent is due the large difference in stocks held, whereas over 67% of ACVF’s stocks are also owned by DEMZ. I saw the same when comparing two other ETFs, one on either side of the “aisle”. Pardon if my politics are showing, but I will call NANC liberal, KRUZ conservative.

- Unusual Whales Subversive Democratic ETF (NANC)

- Unusual Whales Subversive Republican ETF (KRUZ)

Now look at the overlap they have.

ETFRC.com

Here, we see a large overlap in both directions, with KRUZ holdings almost a super majority of NANC’s stocks. Some ETFs show less overlap, as there are only two stocks that overlap between MAGA and DEMZ.

That overlap shows how difficult it is to pigeon hole a stock into some definition, whether it be conservative/liberal or an ESG screening. This article, US conservative-values fund shares almost a third of holdings with LGBTQ+ strategy, highlights that as it relates to what ACVF holds.

A good example of the “Why is this in the portfolio?” is Home Depot, one of ACVF’s largest holdings, yet many conservatives started boycotting their stores after the CEO criticized Georgia’s voting law changes.

Final thoughts

My denomination has long used Socially Responsible Investing (SRI) screens to avoid profiting from products they deem destructive to people or the world in general. Some within the denomination are asking for fossil fuels to be added, but the church body that would add that restriction so far has no. They also do minor screening using Environmental, Social, and Governance (ESG) criteria as developed and mentored by a third party to ban holding a few stocks. While not everyone agrees with either/or SRI or ESG screens, at least there is some logic behind both. I cannot recommend the ACVF ETF or others who use political criteria as investments as their screening criteria can be unstable and, as discussed above, hard to nail down.

Read the full article here