Investment thesis

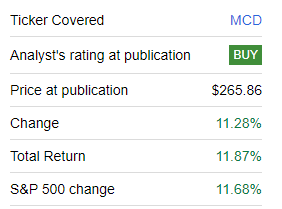

My first call on McDonald’s (NYSE:MCD), which I shared in March, aged well. The stock delivered an 11.87% total return since then, which was slightly better than the broad market.

Seeking Alpha

The company demonstrates stellar financial performance, with profitability metrics expanding notably. The momentum is still strong because the upcoming earnings release is also expected to inspire investors. I like the management’s ability to improve financial performance even during the harsh environment. All in all, I reiterate a “Buy” rating for McDonald’s stock.

Recent developments

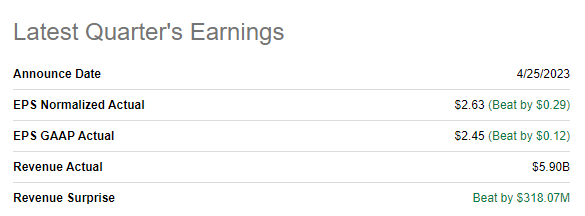

The company reported its latest fiscal quarter on April 25, delivering above-the-consensus earnings. Revenue demonstrated a 4% YoY growth, and the adjusted EPS expanded from $2.28 to $2.63, which is impressive, in my opinion. Revenue topped the consensus forecast by more than $300 million.

Seeking Alpha

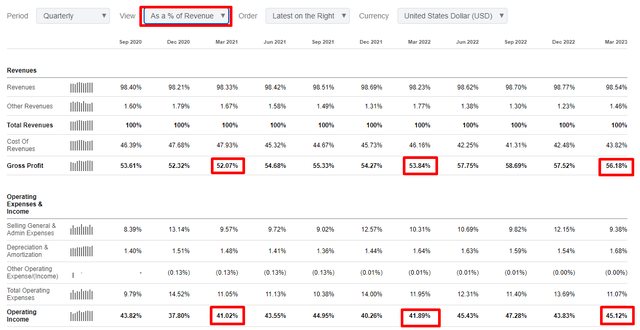

Overall comparable sales increased by 12.6%, which indicates very strong demand. It is impressive, given the current challenging environment. I also like that the profitability metrics expanded YoY significantly as well. The gross margin expanded both compared to Q1 of 2022 and Q1 of 2021. The same with the operating margin. Expanding margins amid the challenging macro environment is a very bullish sign for me, meaning the management is very responsible for keeping an eye on the costs.

Seeking Alpha

I also like that during the latest earnings call, the CEO underlined the importance of “Accelerating the Organization”, meaning they strive to streamline and accelerate internal processes. I think that simplification of the company’s internal processes will unlock new opportunities to improve profitability. The managements plans to increase the level of digitalization within the company with the help of new digital tools and platforms. I think that streamlining routine tasks for the company’s employees is important because now the company’s brightest managers will have more time to analyze the changing environment and deliver more value to shareholders.

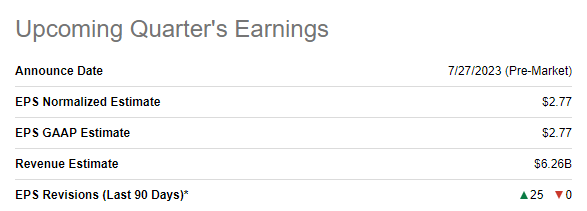

The momentum is expected to remain solid for McDonald’s in the near term because the upcoming quarter’s earnings are also expected to be strong. Consensus estimates forecast quarterly revenue at $6.26, which is about 9% higher YoY. The bottom line is expected to follow the top line with an adjusted EPS expansion from $2.55 to $2.77. Fiscal Q2 financial results are expected to be announced on July 27.

Seeking Alpha

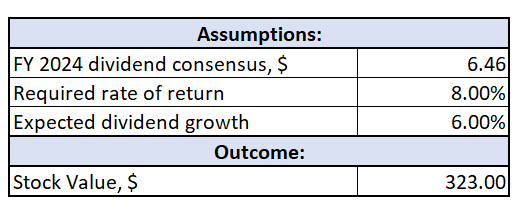

The company’s financial position remains robust, despite the significant net debt position. But if we look historically over the past five years, MCD was dancing near the $50 billion net debt position for quite a long period. And it was not a problem for dividend hikes with an 8.4% 5-year dividend growth rate, which is stellar. Therefore, I think MCD’s dividend growth is safe, especially given the strong momentum we see in the quarterly performance. It is also important to mention that in a highly uncertain environment with high inflation, customers are more keen to choose McDonald’s value menus over the more expensive options, like full-service restaurants.

Valuation update

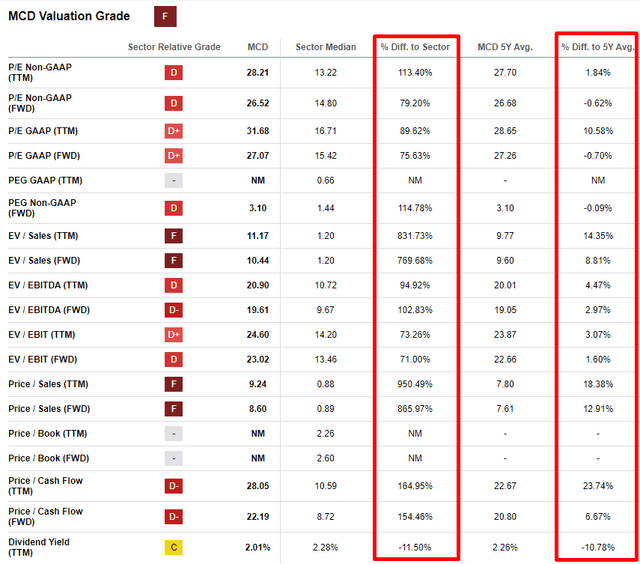

MCD delivered an 11.87% stock price appreciation year-to-date, which is weaker than the broad market. Valuation multiples are high compared to both the sector median and the 5-year averages. That is why Seeking Alpha Quant assigned the stock the lowest possible “F” valuation grade.

Seeking Alpha

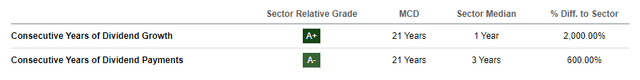

Based on valuation multiples, the stock might look overvalued. But the company has unique brand power and unmatched profitability metrics. Therefore, relatively high multiples might be misleading, and we need more evidence before we can say the stock is overvalued or undervalued. Since McDonald’s has a stellar consistency of dividend hikes, I will use the dividend discount model [DDM] for my additional valuation analysis.

Seeking Alpha

I need three assumptions to perform the DDM analysis. I use the consensus dividend estimates for FY 2024 for the current dividend, which is $6.46. I use the 8% WACC suggested by valueinvesting.io, which I consider fair. The last time I used a 6% expected dividend growth. This level of dividend growth seems to be conservative, given the company’s dividend growth profile.

Author’s calculations

Incorporating all the above assumptions into the DDM formula gives me MCD stock’s fair value at $323, meaning there is still about 9% upside potential from the current level.

Overall, MCD is a unique company, and multiples analysis should not prevail since the premium to the stock price is logical. Therefore, I better prefer to trust the DDM more, which suggests that the stock is about 9% undervalued.

Risks update

According to the latest 10-Q report, the company generates about 60% of its sales outside of the U.S. That said, MCD is vulnerable to several risks related to operating globally. First, operating in multiple countries means operating in different currencies. Unfavorable fluctuations in foreign exchange rates will adversely affect the company’s earnings. Second, operating at the multinational scale means the company operates in various countries with diverse political and regulatory environments. Unfavorable government policy and regulation changes will highly likely adversely disrupt the company’s operations. Third, operating globally means the company has to sustain a sophisticated supply chain to ensure the availability of ingredients and other resources. Managing logistics, quality control, and supplier relationships across different countries can be challenging.

The volatility in the cost of beef is also a significant risk. The price of beef plays a crucial role in the company’s costs, mainly as it is a major ingredient in most part its products. Volatility in beef prices can have a direct impact on the company’s profitability. According to John Staszak from Argus Research, a 7%-9% increase in beef prices would reduce annual EPS by a penny. Therefore, the company’s earnings are very vulnerable to changes in the price of a commodity, and MCD has little power to control this risk. On the other hand, the company has a powerful brand and solid pricing power, enabling MCD to share the risk of rising costs with its customers.

Bottom line

Overall, McDonald’s stock is still a “Buy”. I think so because the stock offers a 9% upside potential and a decent 2% forward dividend yield. Moreover, the stock is defensive, a big pro in a looming recession. The company is very successful in navigating the current harsh environment with confident topline growth together with margin expansion. Therefore, I reiterate a “Buy” rating for McDonald’s stock.

Read the full article here