Summary

Airtel Africa (OTCPK:AAFRF) is a Sub-Saharan telecom operator with a large market share lead in many of its markets. AAFRF, in particular, has expanded its 4G coverage to support the growth of the mobile data market share.

The stock was on its way to my previous price target of 160pence until the Nigerian Central Bank announced their new Foreign Currency Policy in order to stabilize their currency against the USD. This has resulted in the USD strengthening against the dollar, which has investors concerned because AAFRF operating costs are denominated in USD but revenues are received in local currency. As a result, the stock dropped from 144pence to 106pence, a 27% drop. This is a valid concern, but I believe the movement is excessive, as management has explicitly stated that the new policy has no material impact on EBITDA margins because the dollar component of operating costs within the Nigerian subsidiary is minimal.

I would argue that this free market intent will result in a more stable currency over time, which will benefit AAFRF. Furthermore, AAFRF continues to perform admirably with a growing customer base, supporting revenue growth across mobile voice, data, and money. In constant currency terms, revenue and EBITDA increased 18% and 17%, respectively, according to the report results. As a result, I believe the current share price represents another good time to buy. I reiterate my buy recommendation.

No issues continuing growing

There should be no issues for AAFRF to continue growing because the underlying demand trend is strong. The markets that AAFRF has huge population growth filled with young individuals that are more likely to consume more data as they age. Particularly, a lot of them still do not have a mobile phone or sim card, which means there is still a huge room left for penetration. AAFRF, a leading player, benefits from this as they have the necessary distribution infrastructure in place to capture these demands – either physically or virtually via digital channels. Secondly, AAFRF has already rolled out the underlying fibre network and hence, has the data capacity to meet the needs of consumers. There are also a lot of people who don’t have bank accounts in these markets, and I think mobile money is the key to getting them banked. AAFRF has the distribution channels, consumer contact points, and data infrastructure to fully exploit this opportunity.

Nigeria continues to perform strongly

AAFRF largest market – Nigeria – continues to perform very strongly with revenues up around 20% in constant currency term. Given such a large and growing market, I expect growth to continue at this rate for a very long time. In fact, growth could be much faster than this if AAFRF were to increase prices along the way. So far, AAFRF has been growing the business through volume (customers adds and increased usage of minutes and data), which I think is the right strategy as acquiring market share today is more important that immediate profits (AAFRF is profitable at 48% EBITDA margin, so they are not in a rush). That said, management reaffirmed that they are in discussions with the local regulating body regarding a possible price hike. I believe this is to provide management the flexibility to increase prices to meet cost inflation down the route. Approval by regulators would also provide investors with more confidence on EBITDA margin sustainability.

In addition, I remain optimistic on the mobile money opportunity in the Nigerian market, where a significant portion of the population is unbanked. For these people, a reliable brand is very important, which is what AAFRF will have an advantage because of its branding in the mobile market, long operating history, and physical distribution networks.

Balance sheet

As management works to reduce foreign currency debt at the holding company level and localize debt at the operating subsidiary level, I believe AAFRF’s balance sheet quality is improving. Debt localization provides AAFRF with a tax advantage while protecting it from currency fluctuations.

Valuation

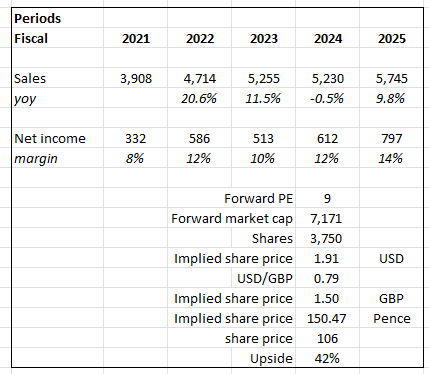

Overall, I believe the growth story remains intact, and valuation remains appealing. I believe AAFRF earnings are supported by strong medium-term growth vectors in data and mobile money, which are not yet reflected in current valuation levels. I updated my model estimates to reflect similar values as consensus, which I believe has been revised downward due to currency impact – which I believe is a one-time adjustment as the market adjusts to the new policy.

To be conservative, I assumed the multiple would remain at 7x. Given the strong growth profile, I now believe the realistic assumption is that AAFRF will eventually trade back to its historical average. Furthermore, I anticipate that the Nigeria mobile money launch will result in significant mobile money revenue growth, which I believe will lead to AAFRF fetching a higher multiple over time.

Author’s calculations

Risk

Recently, the significance of FX as a threat to AAFRF has become clear. The potential impact of inflation/FX on capital allocators may become more difficult to overlook over the longer term. AAFRF’s ability to repay its hard currency debt may be hampered if local currencies are weaker than expected.

Conclusion

Despite the recent drop in stock price due to concerns over foreign currency policy, I believe AAFRF still deserves a buy rating. The company has a strong market position in Sub-Saharan Africa and has expanded its 4G coverage to support the growing mobile data market. The Nigerian market, AAFRF’s largest market, continues to perform well, and the company has the infrastructure to capture the growing demand for mobile services and mobile money. The balance sheet quality is improving as management works to localize debt and reduce foreign currency exposure. Valuation remains appealing, and I anticipate that AAFRF’s strong growth profile will lead to a higher multiple over time. While there are risks related to foreign exchange, I believe the long-term growth prospects outweigh these concerns. Overall, I reiterate my buy recommendation for AAFRF stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here