Re-Cap of My Last Report

This is a follow-up to my March 27, 2023 report, Talkspace: Turnaround Continues; Cautious Response to Guidance Creates an Opportunity.

In summary, my report made the case that new management brought on board over the course of 2022 was fixing a business that had been poorly run by the founding management team. The company had come public via a de-SPAC in June, 2021 and promptly mis-executed its way into the universe of de-SPAC disasters despite being a leader in the attractive virtual behavioral health market.

Signs of progress in the 4Q 22 earnings report included significant improvements across all operating metrics and the reinstatement of guidance that included profitability by mid-2024. But despite the recent progress, the stock was still being valued at a significantly negative Enterprise Value due to the company’s negative history as a tainted de-SPAC.

I paid particular attention to the skeptical reaction by key sell-side analysts; I argued that they tendentiously characterized the new guidance as “aggressive” due to the lack of incentive to turn bullish on a tainted, relatively illiquid name. I made the case that the guidance for 2023 actually appeared quite conservative. My take was that the correct basis for assessing 2023 revenue and expense guidance was 4Q 22 annualized run rates, not the full-year 2022 results used by the analysts, due to the significant improvement to results late in the year.

My previous report was mainly about what I saw as excessively low expectations for the near-term business. Given Talkspace’s (NASDAQ:TALK) rapid progress since then, it now seems timely to shift focus to the drivers of the attractive longer-term opportunity.

1Q Results – Important Implications for Long-Term Story

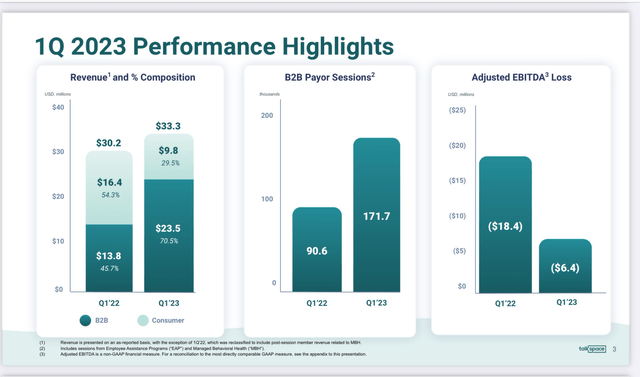

The company announced 1Q results on May 3. The greatest surprise was the upward inflection in payor revenue growth, up 38% sequentially and 83% year/year. The initiatives to grow this segment laid out by new management over the course of 2022 appear to be gaining traction to an extent that seems entirely disconnected from the company’s negative history. 1Q’s acceleration in payor revenue growth suggests an open-ended growth opportunity as more of TALK’s eligible individuals learn that therapy is a covered benefit and they choose to take advantage of it.

Other 1Q highlights included Adjusted EBITDA of -$6.4 million, a surprising 27% sequential decline, and an increase to guidance that appears to leave room for further raises that could include profitability and a $100 million+ cash balance by year-end 2023.

1Q Performance Highlights (TALK 1Q Earnings Presentation)

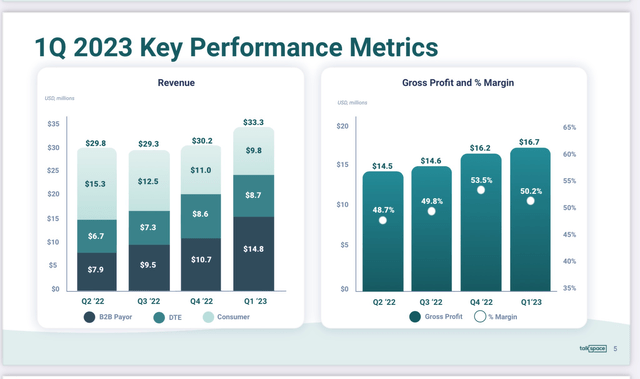

1Q Key Performance Metrics (TALK 1Q Earnings Presentation)

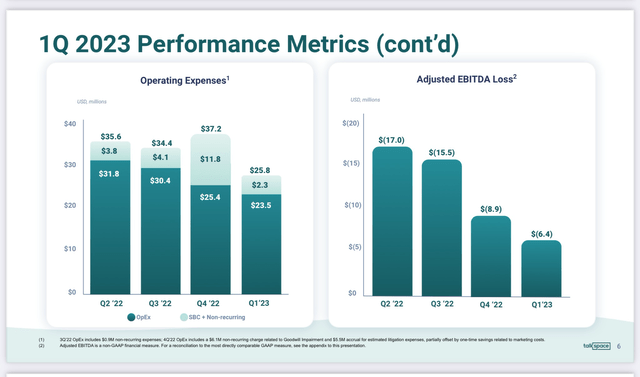

1Q Key Performance Metrics (cont’d) (TALK 1Q Earnings Presentation)

A Closer Look at Payor Revenue Growth

As I discussed in my previous report, TALK under its “mission-driven” founding management team was built around attracting consumers paying for therapy out-of-pocket. This was a relatively small target market that had become very expensive to reach via digital ads over the course of the pandemic, and then particularly in 2021, fueled by a surge in competition from VC-backed companies (most notably much-maligned Cerebral) who had raised money at bubble valuations. The high cost of therapy to end users, combined with TALK’s poor execution on service delivery, led to rapid customer churn and untenable unit economics. The company’s effort to pivot to the B2B market was hampered by dysfunctions such as a website that made it frustratingly difficult for new customers to sign up using their insurance and back office processes that led to insurers rejecting a substantial portion of TALK’s reimbursement claims.

Over the course of 2022, TALK’s new management team began putting the pieces in place to successfully target the B2B opportunity. Changes apparent to outside observers include a new website launched in September of 2022 that enables new users to easily find their insurer and determine the co-pay for therapy sessions; this has led to a significant improvement in conversion rates for individuals drawn to TALK’s website. Starting in early 2023, TALK’s advertising messaging began to emphasize the ability to have insurance pay for virtual therapy, a benefit not known about by a significant portion of the target market. It seems clear that TALK is now reaching a much larger target market than before, and one that should prove much stickier than out-of-pocket consumers who have an average customer life of only about four months.

Covered Lives – the Key B2B Growth Driver to Date

Covered lives are individuals covered by insurance or by their employers under contract with TALK. The company has continued to see strong growth in this cohort, primarily by adding new payor relationships, and the addition of covered lives was the predominant driver of B2B revenue growth until last quarter (more on this below). The arrival of CEO Dr. Jon Cohen in November, 2022, with his extensive experience working with the healthcare insurance industry, should help further solidify TALK’s leadership position on the payor side of B2B.

TALK finished 1Q with 98 million covered lives, up 28% year/year, and disclosed that 14 million more lives had been added during April for a total of 112M. Optum was added in 1Q and an undisclosed major player, presumably Aetna’s commercial business based on postings on TALK’s LinkedIn page, was added after quarter-end. Management indicated that several new relationships are on the way. While potential covered lives within the U.S. are finite, it seems likely that a few more years of runway are in place for new covered lives to be a significant growth driver.

Utilization Rates – a More Powerful B2B Growth Driver Just Starting to Kick In

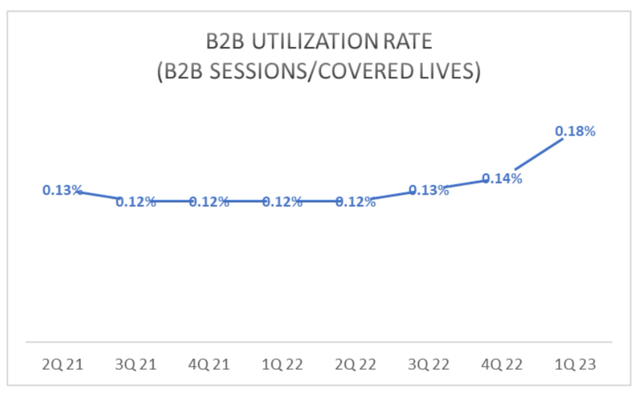

The relevance of the covered lives metric discussed above is limited by the fact that only a tiny proportion of eligible individuals actually use TALK’s service, e.g., 1Q’s utilization rate of 0.18% was a new high water mark for the company. TALK’s best long-term growth opportunity in B2B would therefore appear to be improvements to utilization from its historic noise-level rates. Utilization rates inflected upward 1Q and explained the majority of the year/year growth in B2B revenues (i.e., 50 points of the 82% growth in the segment). This was almost certainly the result of the improvements made by new management over the last year as discussed above.

TALK B2B Utilization Rate (TALK, TD Cowen, Kurt King)

How high utilization rates could climb? This important question is unanswerable at this point because of the recency of the changes that drove the pronounced improvement last quarter. What is clear is that further increases to utilization will translate directly into increased revenues, with a further boost coming from increases to the number of covered lives. In other words, TALK’s current 0.18% utilization rate doubling to a still-miniscule 0.36% would more than double TALK’s B2B revenues.

CDC data suggests that TALK is barely scratching the surface of its TAM. The CDC reported in 2021 that more than 20% of U.S. adults received some form of mental health treatment in the previous 12 months, and more than 10% received counseling or therapy from a mental health professional. TAM data suggests that TALK’s improving utilization rates could be a sustainable trend that, unlike adding covered lives, would have no foreseeable end point. The only clear constraint would be the capacity of TALK’s therapist network, a topic I discussed in my last report. Improvement to utilization rate will be one of the most important metrics to watch in the 2Q earnings report.

(Note that utilization rate is a standard industry metric but not one TALK discloses in its financial reports. It does disclose B2B sessions per quarter and covered lives at quarter-end, providing the data needed to independently calculate utilization rates.)

Expense Reductions Continue

My last report focused on sell-side analyst skepticism over the company’s ability to combine the rapid revenue growth and continued expense cuts indicated by management’s guidance. Characterizing the guidance as “aggressive” provided the analysts a pretext for remaining negative on the stock. I argued in some detail that the expense levels implied in the guidance actually appeared quite conservative.

1Q results showed guidance to be even more conservative than my analysis suggested. I had assumed adjusted op ex would remain flat at the 4Q 22 level of $25 million, while actual adjusted op ex of $23.2 million declined 7% sequentially and 31% year/year. This made for the fifth consecutive quarter where TALK’s op ex declined materially while B2B revenues grew at more than 40% year/year. Despite the company’s dysfunctional past, it seems clear at this point that current management has figured out how to grow the business with a smaller organization and a significantly more efficient customer acquisition strategy.

Raised Guidance Still Appears Conservative; Further Raises Seem Likely

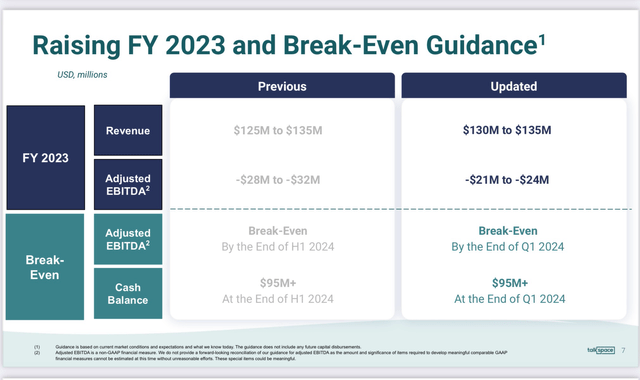

The company reinstated guidance on the 4Q 22 earnings call on February 22, having withdrawn the prior management team’s guidance a year earlier. In my last report I argued that the guidance for 2023 appeared quite conservative despite the sell side’s excessively-cautious characterization. My take was more than validated by the 1Q earnings report, which included an increase to guidance just ten weeks after reinstating it.

1Q Guidance (TALK 1Q Earnings Presentation)

Looking at the numbers, it seems clear that management has tried to set the stage for further increases to guidance in coming quarters. Most notably, the mid-point of the new 2023 revenue guidance can be achieved with almost no sequential growth from the 1Q level despite 1Q revenues having grown 10% sequentially. While total revenues close to flatlined through 2022, this was a time of steep declines in the B2C segment while the B2B segment was growing about 15% sequentially on average. Assuming the B2C segment stabilizes at $9 million per quarter in 2Q, consistent with management’s qualitative commentary, the mid-point/high end of guidance can be hit with average B2B revenue of only $24M/$24.8 per quarter through year-end vs. the $23.5 million reported in 1Q. This seems like a very low bar given the recent acceleration in the payor segment of B2B (up 38% seq. in 1Q, contributing 63% of total B2B rev).

Guidance for Adjusted EBITDA and balance sheet cash appears similarly conservative. Given the Adjusted EBITDA loss of $6.4 million in 1Q, 2023 full-year guidance calls for a remaining $16.1 million/$17.6 million loss at the mid-point/high end of guidance. This averages to $5.4 million/$5.9million per quarter, which seems excessively high given the significant sequential declines in losses in recent quarters and the guidance for Adjusted EBITDA breakeven in 1Q 24. Regarding the guidance for cash, a balance of only $95 million at the end of 1Q 24 would require a burn of $10 million per quarter on average, or $30 million in total, relative to the $125.1 million in cash at the end of 1Q 23. This level of cash usage would require an enormous increase in working capital to square with the Adjusted EBITDA guidance. Again, it seems clear that management has set the stage for further increases to guidance. A continuation of recent P&L trends would suggest that TALK can achieve profitability by the end of this year or even sooner, an idea that would have seemed far-fetched just a few quarters ago.

Looking Ahead to 2Q Results

TALK will likely report 2Q results in early August. The biggest question will be whether the accelerated growth in payor revenues seen in 1Q has continued. If so, results could lead to the following takeaways: 1) TALK is an open-ended growth story given the huge untapped potential within its cohort of covered lives, 2) the company can become significantly profitable given its growing revenues and relatively fixed expense base, and 3) the company’s large cash balance should allow for M&A within the fragmented behavioral health market. The latter is particularly opportune given the large number of sub-scale, specialized behavioral health companies that raised venture money over the last several years. With the VC spigot now turned off, a discounted sale to a strategic buyer (e.g., TALK) could prove the only viable path to an exit. TALK’s CEO said on its 1Q earnings call that the company would “seek compelling investment opportunities” as part of its post-cash-flow-breakeven strategy, so it seems reasonable that ongoing, accretive M&A could be part of TALK’s next chapter.

While the stock has had a nice move since my previous report, the gains seem to be explained primarily by TALK having regained Nasdaq minimum $1 bid compliance in early June as opposed to investors reacting to the improvements to the actual business, which were reported a month before the stock took off. Suffice it to say none of the post-2Q scenario described above is priced in at current levels; rather, I believe the current valuation is explained primarily by TALK being an illiquid, tainted de-SPAC with minimal institutional interest. I strongly believe the stock will ultimately be correctly valued on its fundamentals, the question being timing.

Valuation Remains Compelling

Based on what we know today, a one-year price target of $3 seems reasonable based on the broad-brush assumptions of $200 million in 2025 revenues, a 2X forward EV/sales multiple (in line with TALK’s profitable but slower-growing comps) and $100 million in cash. But 2Q results aligning with the scenario I described above would likely support a much more optimistic outlook than $3. And, longer term, a well-performing TALK would be an even more obvious acquisition candidate for one of the major healthcare platforms.

Read the full article here