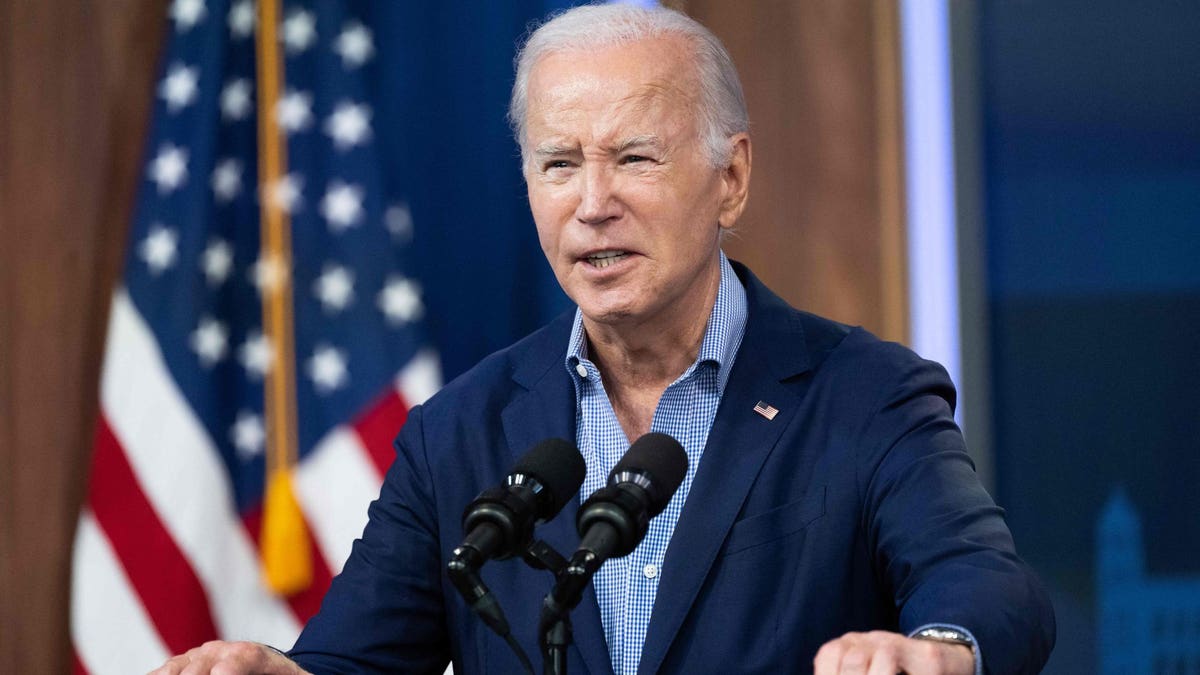

Last week, the Supreme Court rejected President Joe Biden’s student loan forgiveness plan, a central element of his student debt relief agenda. That plan would have provided up to $20,000 in federal student loan cancellation for close to 40 million Americans.

In response to the ruling, top administration officials said the Court made the “wrong” decision, both legally and morally, in denying student debt relief to so many borrowers. President Biden has referred to the Supreme Court’s conservative majority as “not normal” following a series of controversial decisions made along ideological lines, including rulings on affirmative action and LGBTQ rights.

But the Supreme Court’s ruling on student loan forgiveness was limited only to President Biden’s one-time debt relief plan. Other pathways to loan forgiveness are still very much available to borrowers.

PSLF Waiver Still Leading To Student Loan Forgiveness

The Public Service Loan Forgiveness program, also known as PSLF, rewards public servants with student loan forgiveness after 10 years of service. Borrowers who work full-time for nonprofit or government organizations can receive complete federal student loan forgiveness after 120 “qualifying payments.”

The PSLF program was riddled with problems for years, however, largely due to complicated program requirements and poor implementation and oversight. Most borrowers who applied for student loan forgiveness through PSLF were denied.

The Biden administration enacted the Limited PSLF Waiver to address the program’s shortcomings. The waiver initiative allowed the Education Department to waive certain rules and requirements about what constituted a “qualifying payment,” allowing millions of borrowers to receive PSLF credit for past loan periods that would not have counted.

In response to the Supreme Court ruling, President Biden touted the success of the Limited PSLF Waiver, noting that hundreds of thousands of borrowers have received tens of billions of dollars in loan forgiveness. The Court’s decision last week does not impact the PSLF program or the waiver initiative. And while the waiver ended last fall, the Education Department is continuing to process applications.

Congressional Republicans had introduced legislation that advocates had suggested could reverse student loan forgiveness for some borrowers who had received Limited PSLF Waiver benefits. But Biden vetoed that legislation, so those threats are effectively over for now.

IDR Account Adjustment Will Lead To More Student Loan Forgiveness

The Biden administration is just starting to implement the IDR Account Adjustment, which also is not impacted by the Supreme Court ruling. This initiative is similar in many ways to the Limited PSLF Waiver program, but applies to Income Driven Repayment plans. These IDR plans allow borrowers to repay their loans using a formula based on their income and family size, with any remaining loan balance forgiven after 20 or 25 years.

As with PSLF, IDR plans were riddled with problems for years. In some cases, borrowers weren’t even told that IDR was an option. Advocates have long accused student loan servicing companies of improperly steering borrowers away from IDR and instead into costly forbearances, leading to ballooning balances.

The IDR Account Adjustment is designed to remedy these past problems. Under this program, borrowers can be credited with time toward their 20 or 25-year student loan forgiveness term, even if they have not been in an IDR plan. Most past periods of repayment, and many past periods of deferment and forbearance, can be counted. According to recently updated Education Department guidance, Parent PLUS borrowers and borrowers currently in default could also benefit from the program.

The Education Department indicates that borrowers who reach the milestone for student loan forgiveness by this August will begin to have their balances discharged before student loan payments resume in October. Other borrowers will receive IDR credit under the adjustment on a rolling basis through 2024.

Student Loan Forgiveness Updates For TPD Discharge Program

Borrowers with federal student loans who can’t work anymore, or who can work only minimally, may be able to receive student loan forgiveness through the Total and Permanent Disability (TPD) Discharge program.

This week, new TPD discharge regulations went into effect. These new rules are designed to streamline and improve access to the program. The regulations eliminate post-discharge income monitoring, which had resulted in thousands of borrowers having their forgiven loans reinstated. The updates will also expand the type of medical professionals who can certify that a borrower qualifies for a disability discharge, and makes it easier for Social Security disability benefits recipients to receive automatic student debt relief.

Student Debt Relief Under Borrower Defense to Repayment

The Borrower Defense to Repayment program is a federal student loan discharge program for borrowers who were misled by their school. Borrowers can qualify for student loan forgiveness if they can demonstrate that their school made misrepresentations about key aspects of the degree or certificate program in order to convince them to enroll or remain enrolled.

After a brief legal challenge that was ultimately rejected by the Supreme Court, the Biden administration is rolling out over $6 billion in student loan forgiveness under a landmark settlement agreement in the Sweet v. Cardona case. That class action lawsuit was originally brought by borrowers over stalled or rejected Borrower Defense applications.

In the meantime, new Borrower Defense regulations are now in effect as of July 1. These new rules expand the kind of school conduct that can be the basis for Borrower Defense relief, allow borrowers to receive complete student loan forgiveness, and make it easier for the Education Department to provide group relief. A federal court recently halted elements of the new regulatory system, but only for certain schools in Texas.

Biden Administration Makes It Easier To Receive Student Loan Forgiveness In Bankruptcy

Last fall, the Education Department and Justice Department released new policy guidance designed to make it easier for federal student loan borrowers to obtain bankruptcy discharges. Historically, it has been very difficult for borrowers to eliminate student debt in bankruptcy, as the bankruptcy code and associated case law impose special requirements for consideration of student loan discharges.

The new bankruptcy policy allows borrowers to request a bankruptcy discharge of their student loans through completion of a detailed financial attestation form. Government attorneys would review the information provided in the form, and would then make a determination as to whether the borrower has an “undue hardship” as contemplated by the bankruptcy code. If so, the government would not oppose a discharge request. While that doesn’t guarantee that a borrower would receive student debt relief through bankruptcy, it substantially increases the chances that a bankruptcy judge would approve a discharge.

Student Loan Forgiveness Under New IDR Plan

Last week, the Biden administration formally announced the release of a new IDR plan, called the Saving on a Valuable Education, or SAVE, plan. This plan is designed to provide more affordable payments and shorten the timeline for student loan forgiveness for at least some borrowers. SAVE is essentially going to be replacing the Revised Pay As You Earn (REPAYE) plan.

The SAVE plan will have a number of benefits including a higher poverty exemption (which means lower monthly payments for nearly all borrowers) and a more favorable payment calculation formula, particularly for borrowers with undergraduate student loans. SAVE will also feature a generous income subsidy that will eliminate excess interest accrual and prevent future balance growth.

According to new Education Department guidance, SAVE’s larger poverty exemption and interest subsidy will be available for borrowers by the time student loan payments resume later this summer. Other features, including a more affordable payment formula and a shorter timeline for student loan forgiveness for certain undergraduate borrowers, will go live in 2024.

Biden Developing New Student Loan Forgiveness Plan

While the above programs are not impacted by the Supreme Court’s ruling last week, President Biden also announced that he would be creating a separate, new student loan forgiveness plan in direct response to the Court’s decision. That plan will be established using a different legal authority under the Higher Education Act.

This week, the Education Department announced the first step in creating new regulations for this new student loan forgiveness plan. However, it will be quite awhile before the details of this plan become clear. And regardless, the effort will almost certainly face new legal challenges.

Further Student Loan Forgiveness Reading

Biden Officials Take First Step To Create New Student Loan Forgiveness Plan

Here’s When Student Loan Payments Resume, And What Borrowers Should Do Now

4 Big Student Loan Updates When Payments Resume (And They Resume Soon)

6 Key Student Loan Forgiveness And Repayment Dates To Write Down Now

Read the full article here