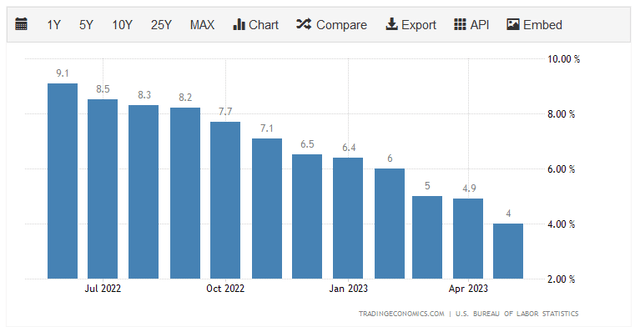

There can be little doubt that one of the biggest problems affecting the average American today is the rapidly rising cost of living. This is evidenced by the change in the consumer price index, which claims to measure the price of a basket of goods that is regularly purchased by the average American consumer. As we can see here, this index has increased by far more than the 2% year-over-year rate that is generally considered healthy during each of the past twelve months:

Trading Economics

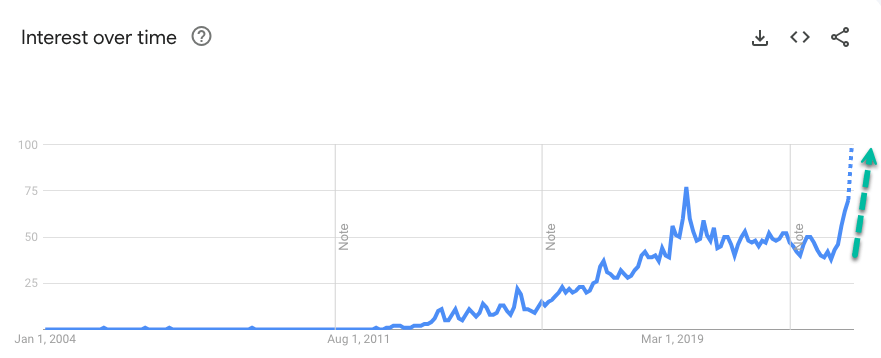

As I have pointed out in previous articles (such as this one), the actual cost of living increase experienced by many people is substantially higher than this due to the fact that nearly all of the progress bringing down the inflation rate over the past year has been caused by the weakness in energy prices. If we look at the core consumer price index, we can see that inflation has not really come down at all. Another anecdotal source of evidence that Americans are struggling financially can be found in Internet search data. Google Trends data shows that searches for “pawn shop near me” or something similar have skyrocketed since January:

Zero Hedge/Data from Google Trends

While there are a lot of possible causes for this, the timing does force one to conclude that people are so desperate for cash that they are looking to pawn some of the items that they purchased over the past few years just to pay their bills or feed themselves. Regardless, this is just more evidence (along with the falling savings balances and increasing credit card balances) that people are desperate for additional sources of income to maintain their standard of living.

As investors, we are certainly not immune to this. After all, we need food and other necessities just like anyone else. However, we do have alternative methods through which we can obtain extra income rather than taking on a second job or selling our possessions. After all, we have the ability to put our money to work for us to earn an income. One of the best ways to do this is to purchase shares of a closed-end fund aka CEF that specializes in income generation. These funds are unfortunately not very well-followed by the market and many financial advisors are unfamiliar with them, so it can be difficult to obtain the information that we would like to have in order to make an informed investment decision.

This is a shame, because these funds offer a number of advantages over more familiar open-ended or exchange-traded funds. In particular, these funds are able to employ a variety of strategies that have the effect of boosting their yields well beyond that of any of the underlying assets or indeed nearly anything else in the market.

In this article, we will discuss the Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE:EVT), which currently boasts an impressive 7.78% yield. That is certainly enough to get the attention of any investor that is seeking a high level of income. I have discussed this fund before, but a few months have passed since then so naturally several things have changed. This article will focus specifically on those changes as well as provide an updated analysis of the fund’s financial performance. Let us proceed onward and see if this fund could be a worthy addition to your portfolios.

About The Fund

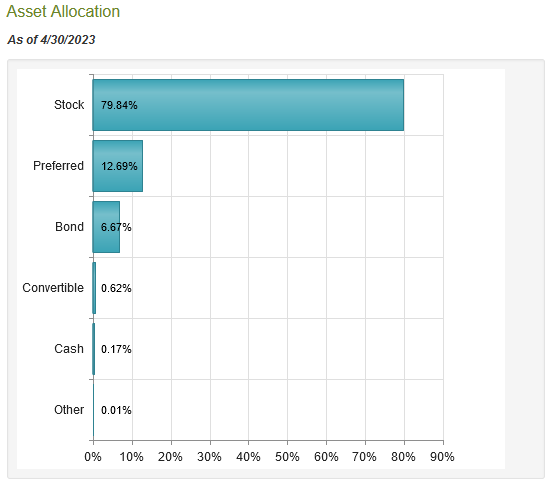

According to the fund’s webpage, the Eaton Vance Tax-Advantaged Dividend Income Fund has the stated objective of providing its investors with a high level of after-tax total return. This is not a particularly surprising objective considering that this is primarily an equity fund. As we can see here, 79.84% of the fund’s portfolio consists of common stock, although it does have allocations to both preferred stock and bonds that should not be ignored:

CEF Connect

The fact that the fund is focusing on achieving a high level of total return makes sense in this light. After all, common stock is generally considered to be a total return instrument. Investors purchase common stocks to receive income in the form of dividends as well as benefit from the capital appreciation that accompanies the growth and prosperity of the issuing company. There are very few people who will buy common stock purely for income today as, other than a few companies in the traditional fossil fuel sector, very few stocks have a yield that beats a money market fund. Thus, fixed-income assets will make much more sense for anyone that is seeking a high level of income.

This fund appears to recognize that, as it includes a respectable allocation to fixed-income assets to provide it with a higher level of income than it could achieve solely by investing in common stocks.

As the name of the fund implies, the Eaton Vance Tax-Advantaged Dividend Income Fund focuses its efforts on investing in stocks that pay a dividend. The fund’s fact sheet explicitly states that:

The fund invests primarily in dividend-paying common and preferred stocks and seeks to distribute a high level of dividend income that qualifies for favorable federal income tax treatment.

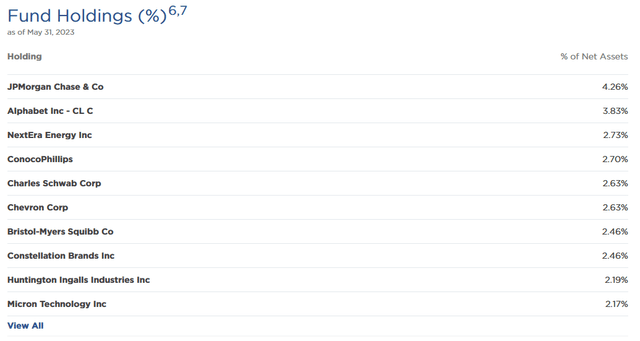

The fund’s portfolio does generally reflect this, although there are a few holdings that are rather strange given this strategy. Here are the largest positions in the fund:

Eaton Vance

We do see a number of financial firms and energy companies here. This is not particularly surprising since these are the two highest-yielding sectors in the market. We do see Alphabet (GOOG) here though, which pays no dividend, as well as Micron Technology (MU), which has a yield that is so low that it is basically pointless. For the most part, though, the largest positions in the fund have a yield that is above the 1.47% current yield of the S&P 500 Index (SP500):

| Company | Dividend Yield |

| JPMorgan Chase & Co. (JPM) | 2.77% |

| Alphabet | N/A |

| NextEra Energy (NEE) | 2.49% |

| ConocoPhillips (COP) | 1.96% |

| Charles Schwab (SCHW) | 1.76% |

| Chevron (CVX) | 3.86% |

| Bristol-Myers Squibb (BMY) | 3.52% |

| Constellation Brands (STZ) | 1.42% |

| Huntington Ingalls Industries (HII) | 2.18% |

| Micron Technology | 1.99% |

A money market fund yields about 5% right now, so none of these yields are particularly impressive. With that said, a few of these companies do tend to grow their dividends over time so anyone buying today will end up with a very attractive yield-on-cost after several years. However, it is uncommon for closed-end funds to use a very long-term buy-and-hold strategy that is necessary to benefit from this. This fund had an annual turnover of 31.00% last year, which is lower than most equity funds, so it does appear to be holding some of its positions for more than a year or two but we really need a ten-year horizon or longer for a typical dividend-growth stock to deliver an attractive yield-on-cost in today’s richly valued market. This certainly explains the presence of the fixed-income securities in the fund’s portfolio as it really needs the boost from these securities to provide an acceptable yield to the investors.

There have surprisingly been quite a few changes to the fund’s portfolio over the past few months since we last discussed this fund. The biggest of these is that Walt Disney & Co. (DIS), American International Group (AIG), Johnson Controls (JCI), and Verizon (VZ) have all been removed from the largest positions in the fund. In their place, we find ConocoPhillips, Charles Schwab, Bristol-Myers Squibb, and Micron Technology.

This is a surprisingly large number of changes given the relatively low turnover of the fund. I cannot complain about these changes, though, particularly the removal of Walt Disney & Co., as Disney has been experiencing a considerable amount of financial stress lately and it could be in very real trouble should Comcast exercise its put option with respect to Hulu. Disney almost certainly cannot afford that transaction, depending on the value of Hulu at the time. Thus, it makes a lot of sense for the fund to dispose of that stock in advance of any real fallout from it.

As my long-time readers on the topic of closed-end funds are no doubt well aware, I generally do not like to see any individual asset account for more than 5% of the fund’s portfolio. This is because that is approximately the point at which that asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification, but if the asset accounts for too much of the fund’s portfolio, then it will not be completely eliminated. As such, the concern is that some event may occur that causes the price of a given asset to decline when the market as a whole does not. If the asset in question accounts for too much of the portfolio, then it may end up dragging the entire fund down with it in such a scenario.

As we can see above, there are no individual assets that account for such a high proportion of this fund’s assets, which is quite nice. It, therefore, appears that this fund is reasonably well-diversified and we should not need to worry about the risks of any individual stock or other asset.

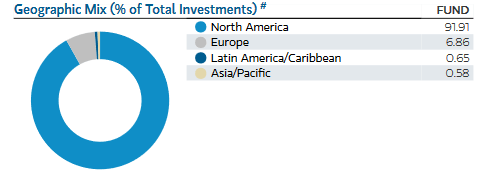

We note by looking at the largest positions in the fund that it appears to be heavily invested in American companies. This remains true if we look across the entire portfolio. As we can see here, the fund’s portfolio is currently 91.91% invested in common equities issued by North American companies, far more than any other nation:

Fund Fact Sheet

This fund does not explicitly state that it is a global fund though, so this is not a problem. However, it is important to keep in mind when constructing your portfolios. This is because most American investors are over-allocated to their own home nation so need to have some foreign diversity. This fund is doing little to help investors achieve that, so it is important to invest some of your portfolios into foreign funds or securities in order to achieve sufficient international diversification.

Leverage

In the introduction to this article, I stated that closed-end funds like the Eaton Vance Tax-Advantaged Dividend Income Fund have the ability to employ certain strategies that have the effect of raising their effective yields beyond that of any of the underlying assets. One of these strategies is the use of leverage. In short, the fund borrows money and then uses that borrowed money to purchase dividend-paying common stocks. As long as the purchased securities are able to deliver a higher total return than the interest rate that the fund has to pay on the borrowed securities, the strategy works pretty well to boost the effective yield of the portfolio.

This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, it will normally be the case that the strategy works properly. With that said though, the interest rate on borrowed money today is going to be much higher than the yield of just about anything except for certain energy partnerships so the strategy is not nearly as effective as it was a year ago.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of assets for that reason. Fortunately, this fund satisfies that requirement as its levered assets only comprise 20.10% of the portfolio as of the time of writing. Thus, the fund seems to strike a reasonable balance between risk and reward.

Distribution Analysis

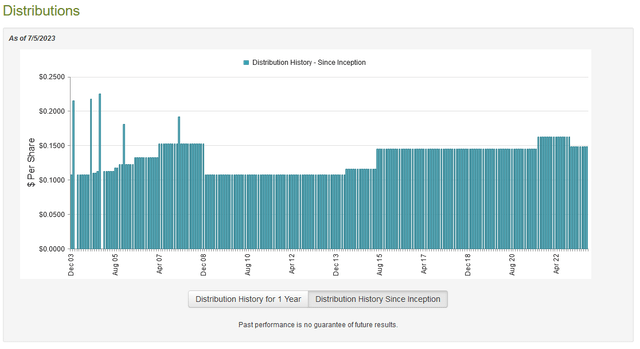

As stated earlier in this article, the primary objective of the Eaton Vance Tax-Advantaged Dividend Income Fund is to provide its shareholders with a high level of total return. It aims to do this partly through dividend income from both common stocks and fixed-income assets. It also wants to obtain capital gains that can be paid out to the shareholders, which can easily exceed the money that is collected from dividends. The fund also adds a layer of leverage in order to boost both its effective yield and any capital gains. As such, we can assume that the fund boasts a fairly high yield since it aims to maintain a relatively stable asset value and pay its investment profits out to the shareholders. This is indeed the case as the fund pays a monthly distribution of $0.1488 per share ($1.7856 per share annually), which gives the fund a 7.78% yield at the current share price. The fund had a very respectable distribution history prior to the end of last year:

CEF Connect

As we can see, the fund generally has a history of increasing its distribution over time, although it cut it in 2009 and in November 2022. Neither of these is particularly surprising as there were market crashes following both distribution cuts. The fund’s current distribution is still higher than it was in 2020 though, so that is certainly saying something. Overall, this history will probably appeal to anyone that is seeking a safe and secure source of income to use to pay their bills and finance their lifestyles. Naturally, though, we want to ensure that the fund can actually afford the distributions that it pays out. After all, we do not want to be the victims of another distribution cut that reduces our incomes and probably causes the fund’s share price to go down.

Fortunately, we have a very recent report that we can consult for the purposes of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. This report will therefore give us a pretty good idea of how well the fund performed in the first half of this year, which saw a market rally but that was limited to about seven stocks. It is also a newer report than we had the last time that we discussed this fund, so it should be able to give us a good idea of how well it is covering the current distribution. During the period, the fund received $23,186,962 in dividends and $10,120,231 in interest from the assets in its portfolio.

When combined with a small amount of income from other sources, the fund had a total investment income of $35,408,392 over the six-month period. It paid its expenses out of this amount, which left it with $13,866,011 available for shareholders. As might be expected, that was nowhere near enough to cover the distributions that the fund actually paid out. The fund paid out $66,551,796 in distributions over the period. At first glance, this may be concerning as the fund was unable to cover its distributions solely out of net investment income.

Fortunately, the fund does have other methods through which it can obtain the income that it needs to cover its distributions. For example, it might have capital gains that can be paid out to the shareholders. The fund did, in fact, have a great deal of success in this area during the period. It reported net realized gains of $74,295,526 but these were partially offset by $34,402,775 net unrealized losses.

Overall, the fund failed to cover its distributions as its assets declined by $12,793,034 after accounting for all inflows and outflows. With that said, net investment income plus net realized gains were easily enough to cover the distributions. Thus, it can probably sustain the distribution if if can keep performing similarly going forward but we do want to watch and make sure that it does not keep experiencing unrealized losses that sink the fund’s asset value.

Valuation

It is always critical that we do not overpay for any assets in our portfolio. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Eaton Vance Tax-Advantaged Dividend Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. That is, fortunately, the case with this fund today. As of July 5, 2023, the Eaton Vance Tax-Advantaged Dividend Income Fund had a net asset value of $23.84 per share but the shares currently trade for $22.56 per share. This gives the fund’s shares a discount of 5.37% to net asset value at the current price. That is in line with the 5.53% discount that the shares have traded at on average over the past month. As such, the price certainly looks very acceptable today.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged Dividend Income Fund certainly looks like a reasonable way to earn a high level of income from a blended portfolio of stocks and fixed-income assets. Unlike many of Eaton Vance’s other funds, this one does not use options or any other exotic strategies to earn its returns. Although it did have to cut the distribution late last year, the fund appears able to sustain the current payout and should not have any real trouble maintaining its current yield going forward as long as it can duplicate the performance that it had over the past six months. The fund is also trading at a slight discount to its intrinsic value, so the price looks acceptable today. Overall, Eaton Vance Tax-Advantaged Dividend Income Fund fund may be worth an investment today.

Read the full article here