It’s been about 17 months since I last wrote about Louisiana-Pacific Corporation (NYSE:LPX), and that’s too long, so I thought I’d correct that by writing today. In my most recent missive, I thought writing puts was the most effective strategy, and I’m happy with the results that they delivered, especially on a risk adjusted basis. Specifically, the stock basically flatlined from the time I wrote these puts, up about 4.5% against a gain of 2.5% for the S&P 500, so the puts expired worthless this past January. This isn’t just an options play for me, though. I’ve been very willing to buy the actual stock when the valuation made sense to me, and that led to a nice 50% return, so I thought I’d review the name to see if it makes sense to buy back in or not. I’ll make that determination by looking at the most recent financials, and comparing those to the assumptions embedded in price.

We’re on the cusp of the weekend, and so I assume that you’re all busy making plans about which supermodel you’re going to hang out with this weekend, or whether to take up the glider or the helicopter. For my part, I’ve got a monster dungeons & dragons game to plan for Sunday, so I too have a busy and full life. Anyway, because we’re all very busy, I put a thesis statement at the beginning of each of my articles. This allows the reader to get in, understand my perspective, and then get out again before being exposed to too much “Doyle mojo.” You’re welcome. If it wasn’t clear from the title of this article, and from the bullet points above, I’m going to remain on the sidelines here. I think the signs of business slowing are too great to ignore. Additionally, the shares are expensive at the moment. In many ways, this is a mirror image of my great long trade on this stock some time ago. Back then, the shares were cheaply priced, and the business was about to explode higher. Today, the opposite is true in my estimation. Additionally, in this article, I defend my use of ratios. Although they are “backward looking”, they offer us a valuable tool to interrogate our assumptions about the future.

Financial Snapshot

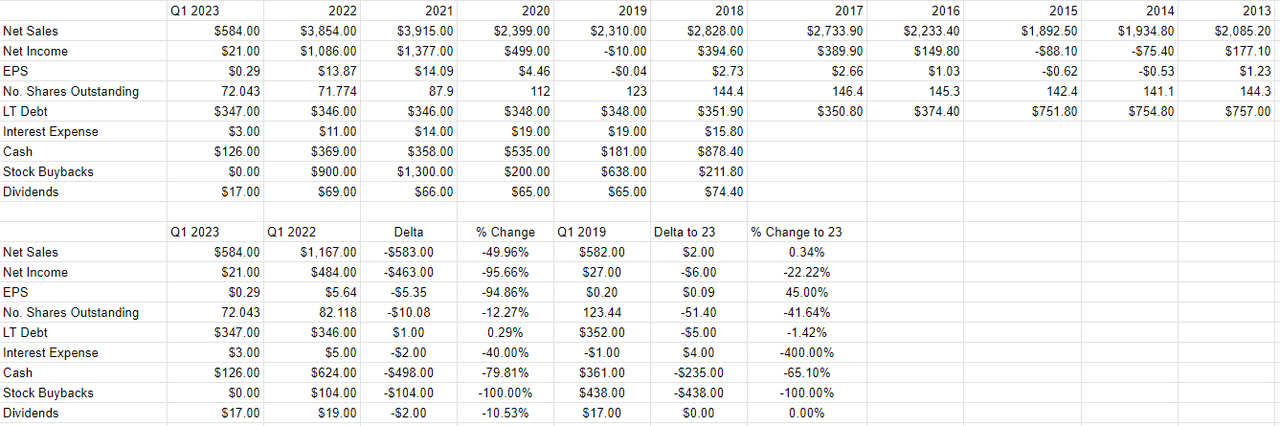

If an investor who is interested in residential real estate had only these financials go to by, they’d have to conclude that “housing” as an asset class, has crashed. Relative to the same period last year, revenue and net income for the most recent quarter were down by 50%, and 96% respectively. Sometimes you can attribute a reduction of this size to some extraordinary event, like a write down or similar. Not in this case, I’m afraid. Although SG&A expenses rose by about 6.5%, cost of sales was down fully $64 million, or 11.7%. When you compare the first quarter of 2023 to the same period pre-pandemic, you come to a very similar conclusion. Revenue during the most recent quarter was higher by only about $2 million, or .34%, but net income in 2023 is lower by about 22% from the 2019 period. The same explanation applies to this drop in net income, because there’s nothing extraordinarily different from 2019 to now. The cost of sales in 2023 was $18 million lower, while SG&A expenses were up in 2023 by $9 million. The only conclusion I can draw is that the business is slowing.

Thankfully, the company never loaded up on debt, and in fact long term debt is less than half of what it was in 2013. This is a rarity today. Anyway, the fact that the debt level is relatively low suggests that this company will be able to weather the inevitable drop in business. That written, the interest expense of $3 million this quarter is about 14% of net income, which is disconcertingly high in my view.

Given all of this, I’d be happy to buy the shares if the valuation makes sense to me.

Louisiana-Pacific Financials (Louisiana-Pacific investor relations)

The Stock

If you’re one of those people who subject yourself to my stuff, it should come as no surprise to you that I consider the stock and the business to be very different things. The business sells building solutions. The stock, on the other hand, is a slip of virtual paper that gets traded around by a crowd that can be capricious. A stock may be bid up in price simply because it’s part of a basket that makes up an index. A stock may be bid up or down simply because of what’s happening to interest rates. A stock may be bid up or down as a function of changes in taste for “stocks” as an asset class. A stock may be affected by the utterances of a fashionable analyst.

For those who recoil at this notion that we’re buying and selling stocks, I would point out that the people who bought this “business” on February 2nd of this year, are down about 1.5% since. The people who bought this “business” 20 days later are up about 25% since. The changes the business underwent in 20 days don’t account for a near 27% variance in returns. You’re buying stocks. In my experience, the only way to profitably trade stocks is by spotting discrepancies between expectations and subsequent reality. If the market is unreasonably optimistic, you avoid the stock, and if the market is overly pessimistic, you buy. Additionally, another way of writing “overly pessimistic” is “cheap.” I like cheap shares because they have that great combination of lower risk and higher potential reward. They’re lower risk because much of the bad news has already been “priced in.” They represent higher potential rewards because a small bit of good news has the potential to send the shares skyward.

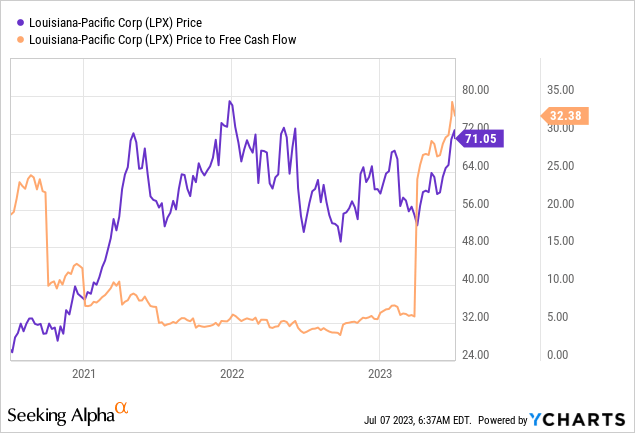

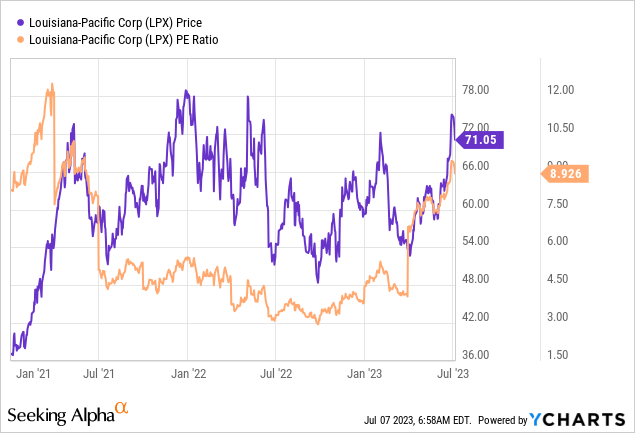

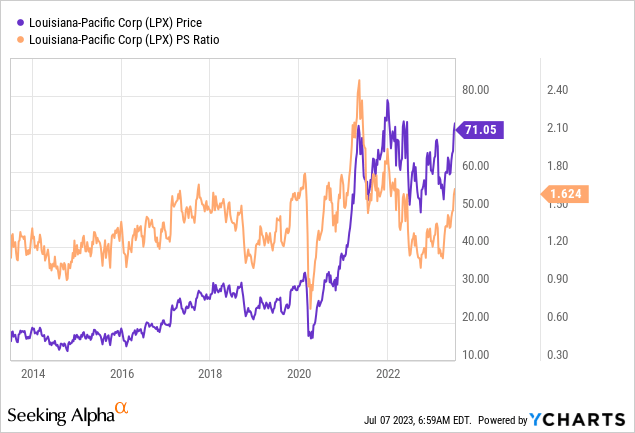

I measure the market’s expectations in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, book value, and the like. I want to see the company trading at a discount to both the overall market and its own history. I bought Louisiana-Pacific shares and sold puts aggressively when the market had dropped the price to free cash flow ratio to just under 15 times. I considered (and consider) this to be a very reasonable price to pay, so I’d be happy to buy at that price again. Unfortunately, the world today is very different, and the valuation is much worse in my view, per the following.

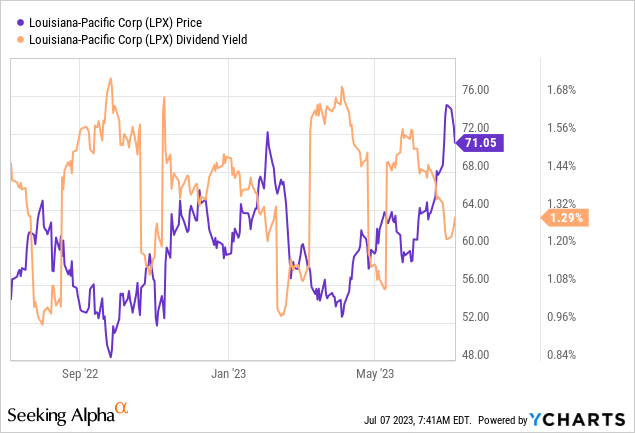

While investors are paying a premium for these shares, they are receiving a yield that’s about 276 basis points lower than the 10-year note at the moment. So, investors here are paying more to take on risk, while receiving less income than they would from a “sleep at night”, risk-free investment.

A Note On Ratios

I can imagine some readers may be clutching their pearls, and reaching for their vapors to avoid a collision with their fainting couch at this point. They may lament “why, Mr. Doyle, suh, I do declare that the ratio is a flawed metric because it is backward facing! It’s backward, suh, backward!” before they raise a hand to their forehead and collapse on their “reading disagreeable comments on the internet” settee. That’s fair enough. Ratios are, of course, backward looking, but that’s not the point. They offer us a way to quantify scenarios about the future. For instance, I became enamored with this stock when it was trading at a price to free cash flow of 15 times, so I’d likely be very happy to buy at that valuation again. The problem for me is that the valuation is now over twice that level. What will need to happen to return the price to free cash ratio to 15 (i.e. to an attractive price)? There are two extremes, and some combination of things that will bring the shares back to a reasonable valuation. If we hold the stock price constant, free cash flow will need to rise by about 214%. If we hold free cash flow constant, the stock will need to drop by about 53%. The most likely outcome is for some combination of increased cash flow, and lower stock price. This is how we can use backward looking ratios to attack assumptions about the future. So we now have to ask ourselves, is free cash flow likely to rise by 214%? If it did, and the stock price did not move at all, we’d get back to a reasonable valuation. In my view, the weight of probabilities is such that free cash will likely not grow by 214%, and so price decline is inevitable at this point.

Given all of the above, I’m of the view that there are greener pastures out there, and that the shares represent poor risk-reward potential at the moment. For that reason, I’m going to continue to avoid these shares, and I’d recommend other investors do the same. The market may take them higher, but I would remind investors that the market giveth, the market taketh awayeth.

Read the full article here