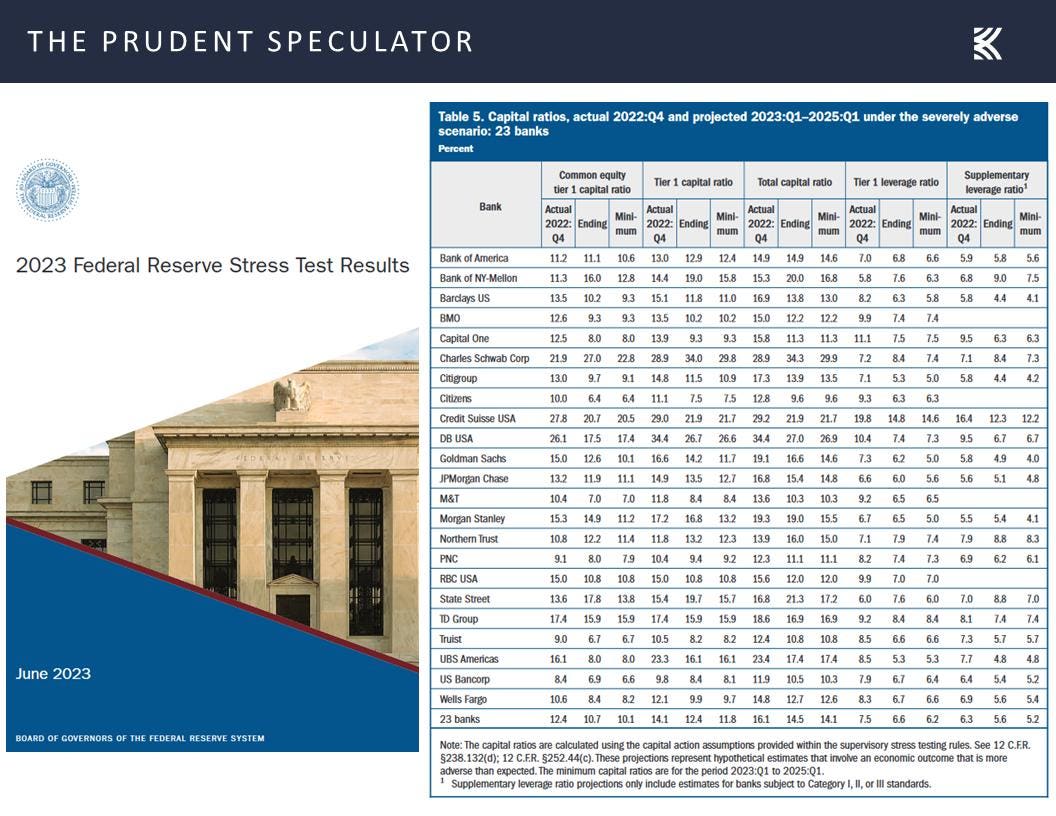

I was happy to see last week the results of the Federal Reserve’s annual stress test of 23 of the nation’s largest banks. Each of the banks survived the most adverse scenario with capital levels above the regulatory minimum of 4.5%, with Fed Vice Chair Michael S. Barr stating, “Today’s results confirm that the banking system remains strong and resilient.”

A year ago, the Fed hypothetically stressed 33 banks and featured a severe global recession accompanied by a period of heightened stress in commercial real estate and corporate debt markets. But even while last year’s test incorporated counter-cyclical shocks, it failed to foresee that the plunge in bond prices due to the Fed’s rate-rising regime might contribute to the fear-driven bank runs that occurred in March.

As such, Mr. Barr was quick to add, “At the same time, this stress test is only one way to measure that strength. We should remain humble about how risks can arise and continue our work to ensure that banks are resilient to a range of economic scenarios, market shocks, and other stresses.”

This year’s stress test seemed pretty harsh as it included a severe global recession with a 40% decline in commercial real estate prices, a substantial increase in office vacancies, and a 38% decline in house prices. It also included the unemployment rate rising by 6.4 percentage points to a peak of 10% and economic output declining commensurately.

As the Fed concluded, “All 23 banks tested remained above their minimum capital requirements during the hypothetical recession, despite total projected losses of $541 billion. Under stress, the aggregate common equity risk-based capital ratio—which provides a cushion against losses—is projected to decline by 2.3 percentage points to a minimum of 10.1 percent.”

REGIONAL BANKING POWERHOUSE

PNC is one of the largest diversified financial services institutions in the U.S. The Pittsburgh-based lender has historically managed risks well and presently boasts a broadly diversified loan book, solid capital ratios and strong credit quality.

The company is widely respected by regulators as evidenced by the results of the stress tests. PNC stated this week, “Based on PNC’s strong results, PNC’s calculated Stress Capital Buffer (SCB) for the four-quarter period beginning Oct. 1, 2023 is below the 2.5% regulatory floor and minimum SCB amount, resulting in an SCB established at the 2.5% floor. This is a decrease from the 2.9% SCB in effect through Sept. 30, 2023. PNC’s Common Equity Tier 1 (CET1) ratio significantly exceeds the regulatory minimum (4.5%) plus our SCB, reflecting our strong capital levels.”

As a result, the company boosted its quarterly dividend payout by 3%, pushing the yield up to 5%. CEO William S. Demchak proclaimed, “The increase in our dividend reflects the continued strength of our capital and liquidity levels, and our board’s confidence in our strategy and outlook.”

PNC will also continue with its stock buyback program, albeit at a reduced pace in the current quarter. Still, a sizable chunk of the 100 million share repurchase authorization remains available.

NET INTEREST INCOME HOLDING UP

Several regional banks have recently guided for net interest income to decline by double-digits on a quarter-over-quarter basis, including PNC. However, PNC’s projected dip in the range of between 2% and 4% represents a relatively modest drop.

Commercial real estate is 11.0% of PNC’s total loans, with the more worrisome Office category geographically diverse and accounting for 2.7% of total loans. CFO Robert Reilly said at a conference in April that PNC’s office portfolio “was originated with an approximate loan to value of 55% to 60% and a significant majority of those properties are defined as Class A.”

Of course, the bank has not been immune to a slowdown in fee businesses like capital markets and mortgage. But these segments could be starting to turn (at least capital markets), while the more than 20% decline for the stock this year incorporates an outsized share of bad news in my opinion. I think a high-quality bank like PNC will provide handsome long-term rewards for those willing to endure a bumpier ride along the way.

Read the full article here