Meta’s (NASDAQ:META) hugely successful launch of Threads broke the record for fastest growth to 10m users (within 2 hours of launch the platform had 2m signups, and within 24 hours had hit 30m users), the previous record holder was ChatGPT with 5 days.

This author is one of the early sign-ups to the platform, and his own perception of the general reactions to the app have been (anecdotally) mostly curious about the hype, positive about the platform, suspicious of how brands and grifters will use the platform, and excitement about the opportunity to join a fresh social space.

But from an investor’s perspective, there are several items and questions that have come out of the last few days. Other SA authors have already written extensively about whether Threads is a Twitter killer,

Meta Is Not Afraid To Compete Directly, But Timing Is Everything

This author believes strongly that Mark Zuckerberg carefully bided his time before launching Threads. In the months prior to launching, Elon Musk made several large (and unpopular changes) to Twitter.

These changes included:

- Limiting the number of posts a user could see per day (Occurred only days prior to the Threads launch). Allegedly this was due to an issue with paying Twitter’s Google (GOOG) Cloud service bill.

- Suspending the Twitter API which allowed other third-party apps to interact with it.

- Reinstating controversial accounts previously suspended from Twitter, including Donald Trump, Ye (Kanye West) and Andrew Tate.

- Introducing Twitter Blue and removing (then reinstating) the Twitter verified system. The blue tick system has since been abused by individuals to obtain a level of legitimacy, including by members of the Taliban.

- Musk also claimed to have been able to rid the site of bots, however, users were quick to point out out that simply tweeting key-words would attract tweet replies full of bots offering everything from shirts to online tutors, to “sugar daddy’s” and cryptocurrency scams.

Meanwhile, Musk himself has been accused of sharing and amplifying damaging and dangerous conspiracy theories. This is comes while over 50% of the app’s top advertisers have left the Twitter platform over brand safety concerns.

With the chaos engulfing the app, it was clear that the environment was perfect for a competitor app to step in and offer an alternative. And Zuckerberg’s timing was perfect, almost down to the day (with Musk revising post read limits 3 times on July 2 amidst mass-criticism, while Threads launched on July 5).

Twitter quickly threatened to launch legal action against Threads, but this author doesn’t believe litigation would be likely to succeed in shutting down the platform.

Note Carefully The Instagram / Threads Pairing

For Meta investors, the launch of a new platform is exciting in that it has been so successful and showcases the reach and power of Meta, justifying the brand’s position in financial markets as a growth firm.

However, it is curious to note how Meta has made significant efforts to ensure that Threads is more closely aligned in the public eye with Instagram, rather than the parent company Meta.

Meta’s own press release announcing Threads only mentions “Meta” once in the 994-word release, while mentioning “Instagram” 17 times (with all 17 occurrences appearing before Meta is mentioned). Facebook is not mentioned at all.

While Threads was built by the Instagram team, and so it makes sense that the focus is Instagram, the careful and deliberate pairing of Instagram to Threads must be noted, as opposed to Facebook to Threads. This author believes this gives a clue as to how Meta views the future of the company and it’s platforms, as we enter the next stage of the social media life cycle.

Is A Social Media Consolidation Coming?

Also in the press release were details of soon-to-be-released features including making Threads compatible with social networking protocol ActivityPub. Why is this particularly important? Well Meta has traditionally tightly controlled the way platforms in the social media ecosystem interact and severely limited that interaction.

By opening up to ActivityPub, a photo posted to Instagram could be commented on by a user on by users on “Mastodon and WordPress” (the two platforms Meta singled out in their press release). This change would significantly shift the social media environment.

For brands and influencers, this means a significant simplification of their day-to-day operations and a porting of followers from one platform to all their social media accounts. In practical terms, this means brands would only need to post on one platform to receive engagement across all other platforms. Followers per platform would be largely irrelevant individually and would be aggregated.

Perhaps this is an indication that Meta believes consolidation of the social media environment is coming, as many other industries have faced over time. And by showing they are happy to consolidate by competing directly (in the case of Threads) or acquire (Instagram & WhatsApp), the question becomes: Now that Meta has shaped the field, what happens next?

Is Facebook Still A Relevant Platform?

The elephant in the room is what remains for Meta’s traditional brand, Facebook.

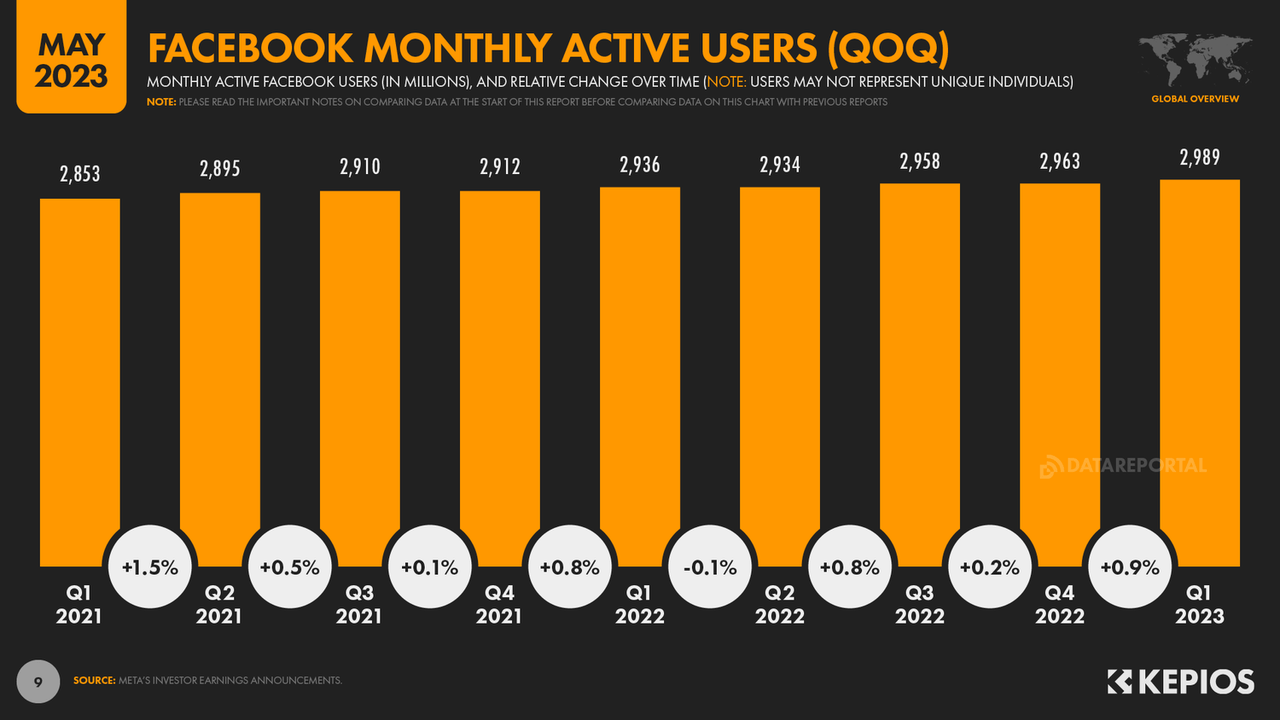

It’s clear that user growth is beginning to flatline for the brand, with only marginal gains from 2021 onward, with negative growth in the 2nd quarter of 2022. The lack of user growth threatens to revoke Facebook’s title as a growth company, and it’s huge market valuation.

Quarterly Facebook Monthly Active User (MAU) counts (Kepios)

It’s impossible for this (or any) author to predict the future of the Facebook platform, though if Meta is toying with ActivityPub compatibility a portion of it’s brand portfolio, then Facebook may potentially tap into that as well, somewhat guaranteeing it’s future. This move would make sense, bringing content and engagement from across Meta’s portfolio natively to it’s nearly 3 billion users. The next question is how this will impact advertisers, and whether this new level of cross-platform engagement will attract premium rates for views and clicks. And ultimately, Meta’s revenues.

Overall, It’s Hard To See Threads As Anything But A Buy Signal

Analysts have indicated Threads would only represent an additional $2.92 to $14.60 in value to Meta shareholders, despite the potential for significant advertising revenues if the app can attract Twitter’s traditional advertising partners.

Read the full article here