Investment Summary

ATI Inc. (NYSE:ATI) is a company that specializes in the manufacturing and selling of specialty materials and components. The business has been aligned in two different segments that make up the company, those being: High-Performance Materials & Components (HPMC) and Advanced Alloys & Solutions (AA&S). The market for materials that ATI uses has been quite volatile and created a difficult environment for many companies to operate in. But the latest earnings report from them showed both resilience and growth for the top and bottom lines. An EPS growth of 109% YoY seems to have helped set off a rally for the stock price as it’s up over 100% in the last 12 months.

Where I am slightly worried is that we will see a pullback in the price as ATI is trading a fair bit above its historical average multiples like the p/e, 31% above that. This presents more downside risks for the share price. In the long term, I am rather bullish on ATI as the reshoring of a lot of manufacturing back to the US will be a key driver for growth over the coming decades. But I think we may see better entry points in the short term. Rating ATI a hold for now.

Manufacturing Returning And Bringing Demand With It

Some of the key drivers for growth in the coming years I think will be the reshoring of a lot of manufacturing to the US. As political tensions rise with China the Asia Pacific region as a whole becomes difficult to operate efficiently for a lot of businesses. The appeal to have manufacturing in the US becomes much bigger and it almost has a snowball effect with more and more companies setting up shop there. But the US government is also creating incentives for this, like the CHIPS Act in 2022, aimed at boosting the semiconductor capabilities of the country and increasing manufacturing. This is a market that ATI has exposure to, but it doesn’t make up a majority of its revenues, $34 million in the last quarter. It has also declined by 30 – 34% YoY but I think tailwinds like these acts are going to turn it around.

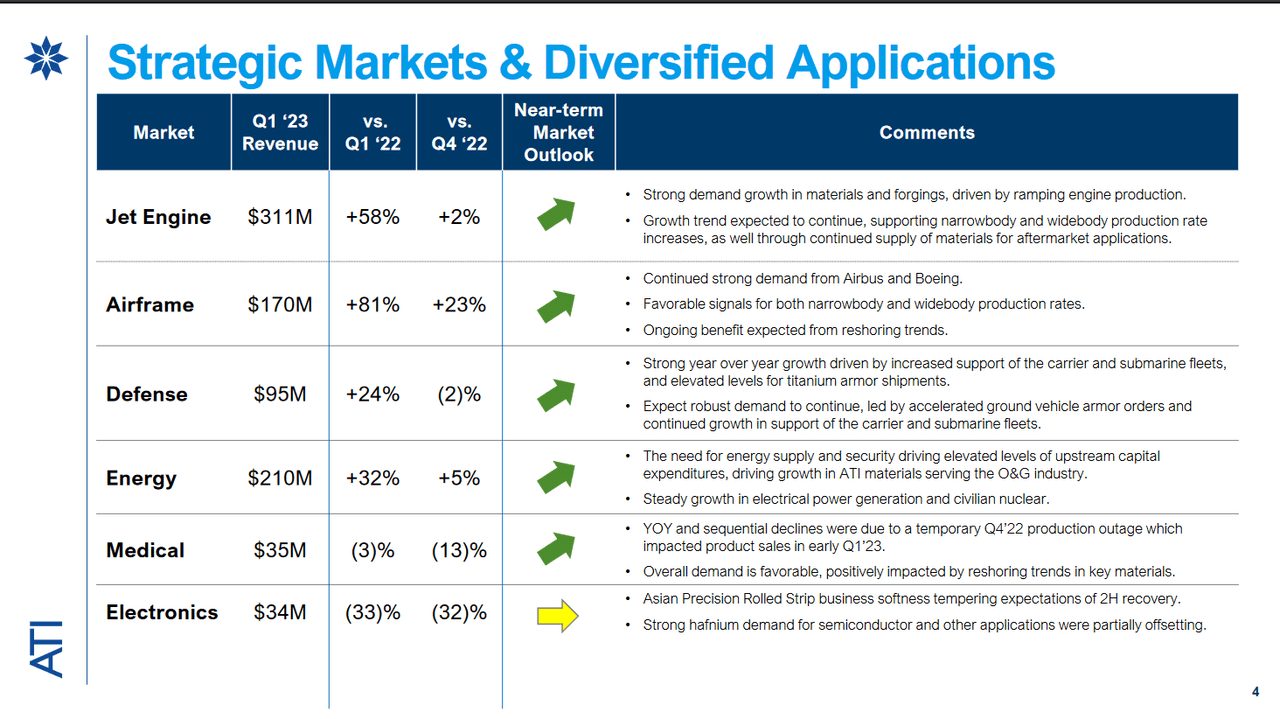

Key Markets (Earnings Presentation)

The primary market that ATI serves is the aerospace market seems with $310 million in revenues generated from the “Jet Engine” market. It seems that the manufacturing of airplanes is increasing in 2023 as traveling is rebounding and companies want to get ahead of growing demand. I think this will be a medium-term impact on the revenues generated here, but the focus will have to be on other key markets that are growing too. This will help ensure that ATI has a very diversified set of revenue streams and hedge against downturns, like a recession.

Quarterly Result

As I said in the beginning part of this article, the latest report from ATI was in my opinion a showcase of resilience and strength in a difficult environment. The price of many materials has not come back to highs in the last year, which had a positive impact on many of the revenues for companies in the sector.

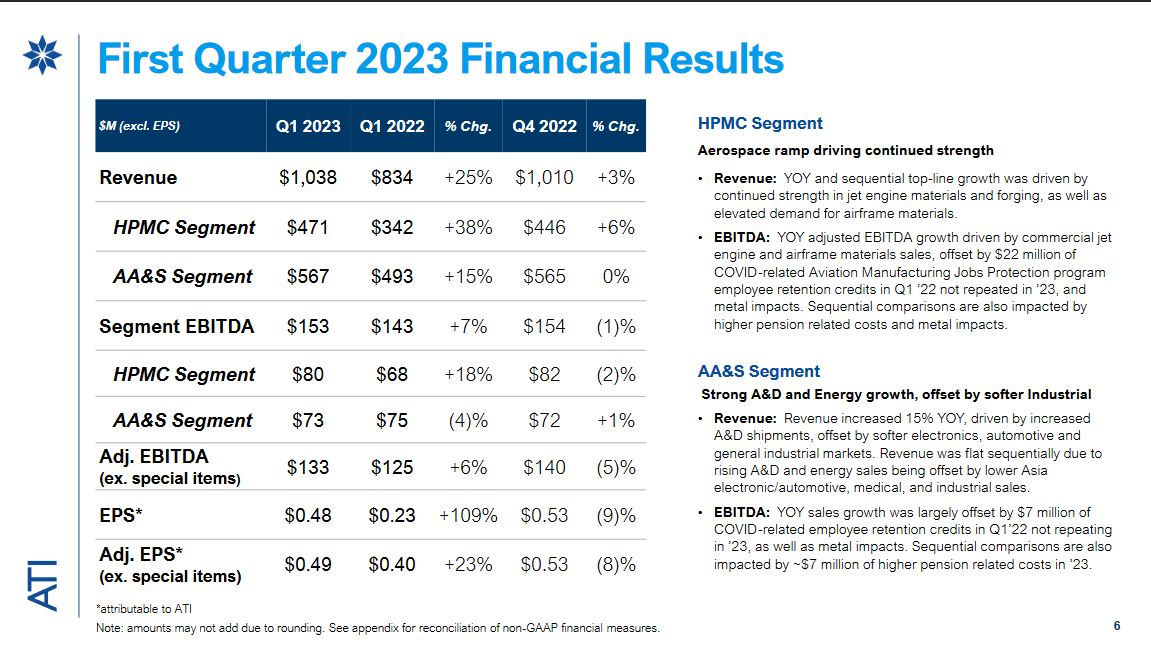

Q1 Results (Earnings Presentation)

The first quarter of 2023 had revenues grow 25% YoY ad the EPS grew by 109% YoY as well. The CEO Robert S. Wetherbee had some positive remarks on the quarter and said the following: “Our transformation is optimizing the differentiated capabilities our customers value. We’re well-positioned to capture growth in our key markets”. I think this highlights the importance that is having a diversified set of markets that you serve. When one is struggling perhaps another one is doing very well. Over time this brings consistent growth for the company and that has in my opinion been visible here with ATI.

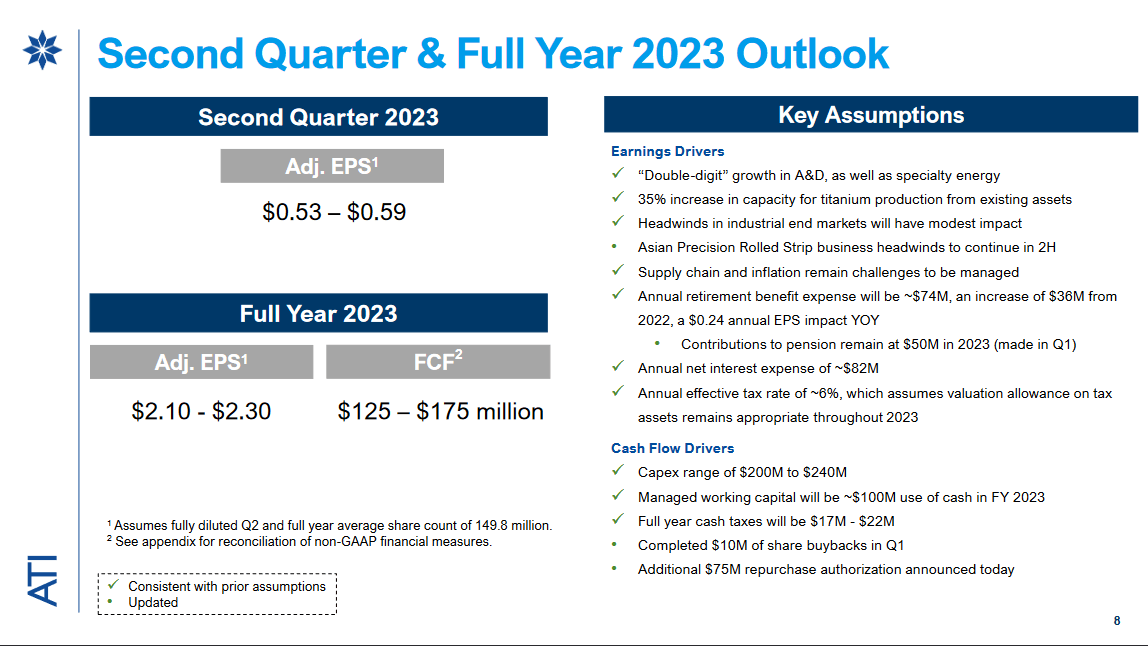

2023 Guidance (Earnings Presentation)

As for the outlook that ATI has for the remaining part of 2023 it seems quite positive. The adjusted EPS for Q2 is expected to land between $0.53 – $0.59, representing a QoQ growth of 20% if they achieve the higher end of the guidance. In terms of 2023 as a whole, the adjusted EPS is estimated to be between $2.1 – $2.3 per share. This would value at a 19x FWD earnings multiple. Something which is a fair bit above the sector’s average of 13 and also the historical multiple that ATI has been trading at, 16. I think this highlights some of the risks associated with investing in ATI right now. The company is growing at a strong rate, but above what might be considered fair value. That translates to ATI being a little overvalued here in my opinion. The coming quarters will need to show margin expansion and in my opinion more growth from markets that have in Q1 seen yearly decreases in revenues, like Medical and Electronics.

Risks

The primary risk right now with ATI in my opinion is the high multiple its trading at. I am confident that the company will continue to grow efficiently as they are experiencing solid demand from several key markets. But that doesn’t mitigate the risk that a pullback in valuation to more historical numbers might happen.

Stock Price (Seeking Alpha)

Apart from that, I am a little worried about the dilution that ATI is performing. Now, it should be said it’s not a significant amount each year, it’s barely even 1%. But when the company is expected to generate between $125 – $175 million in FCF for 2023 I want to see some of that capital used for buying back shares. The industry that they are in is filled with companies that perform significant buybacks, like United States Steel Corporation (X). The appeal of investing in ATI I think would be bigger if they start a program such as this.

Wrap-Up

Right now ATI is trading above the sector’s multiples as the share price has risen quickly in the last year. The very positive growth that was experienced in Q1 of 2023 for ATI seems to have been a key driver for this growth. But I think we are likely to see a pullback down to more reasonable levels like a 16 – 17 p/e. With more downside risk than I am comfortable with, I am rating ATI a hold at these prices.

Read the full article here