Investment thesis

Limbach Holdings, Inc (NASDAQ:LMB) stock attracted my attention because, at the moment, it is the number one top-rated stock by Seeking Alpha Quant. The stock price delivered a massive above-a-hundred percent rally year-to-date, increasing about five-fold over the past twelve months. My analysis suggests that the rally was fair, and the stock is still massively undervalued. I like that the company’s balance sheet is strong, meaning the company is ready to weather potential storms in the macro environment. The latest earning report suggests that revenue growth momentum is solid and profitability metrics are expanding. Therefore, I assign the LMB stock a “Strong Buy” rating.

Company information

Limbach is a building systems solutions company providing comprehensive facility services consisting of mechanical construction, complete air-conditioning maintenance, energy audits, engineering services, constructability evaluation, equipment and materials selection, and prefabrication construction.

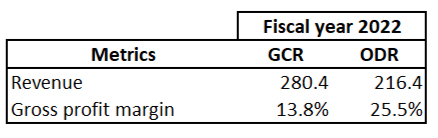

The company’s fiscal year ends on December 31. LMB operates in two segments: General Contractor Relationships [GCR] and Owner Direct Relationships [ODR].

Compiled by the author based on the latest 10-K report

Financials

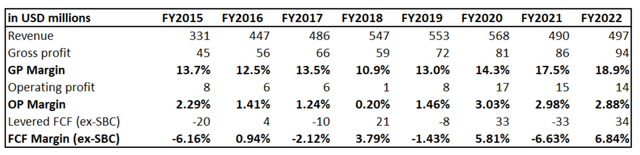

Over the past eight years, available for long-term trend analysis, LMB demonstrated steady revenue growth at a 6% CAGR with little volatility. The operating margin is razor-thin, with a historical peak at slightly above 3%. All-time highs of the free cash flow [FCF] margin look more attractive. Though, this metric was way unstable historically, with four negative years out of eight years analyzed in total. On the other hand, I like that the gross margin demonstrated a notable improvement over the long term as the business scaled up.

Author’s calculations

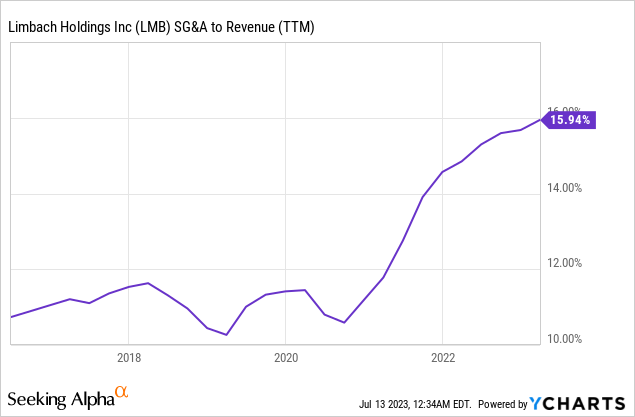

To understand the potential upside in the operating margin, I would like to dig deeper into the trend in operating expenses. As you can see, the SG&A to revenue ratio increased substantially in recent years. I think there is substantial room for improvement. At least returning to a 10% SG&A to revenue ratio looks doable in the historical context. If the company manages to improve SG&A to revenue to 10%, the operating profit will look much better at 7%.

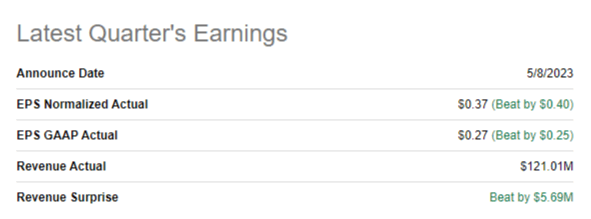

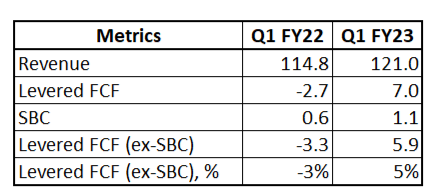

Now let me narrow down my financial analysis to the quarterly level. The latest quarterly earnings were released on May 8, and the financial performance was strong, with above-the-consensus top and bottom lines.

Seeking Alpha

Revenue demonstrated a solid 5.4% YoY growth and a notable EPS expansion: from -$0.15 to $0.27. I like that the gross margin expanded substantially and demonstrated a third consecutive quarter above 20%. Due to the seasonality, Q1 was historically the weakest from the operating margin perspective, but this year it was at a decent 4% level. On the other hand, the SG&A to revenue was notably higher than in the previous quarters. Therefore there is still plenty of room for improvement. Improved profitability margins also led to an improvement in the FCF, a bullish signal.

Author’s calculations

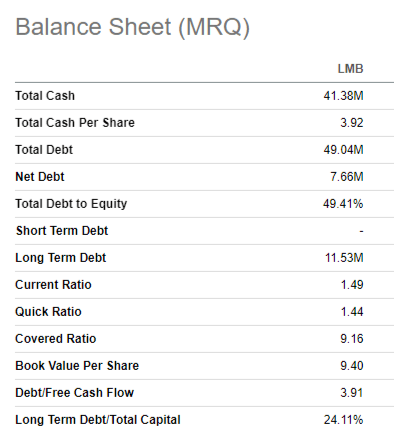

I like the company’s modest capital allocation approach. The company is in a net debt position but is not so far above the latest quarterly levered FCF, meaning it’s low in significance compared to the business’s scale. The debt-to-equity and the covered ratios look conservative. I also like the firm’s short-term liquidity position, especially given the current uncertain environment.

Seeking Alpha

Valuation

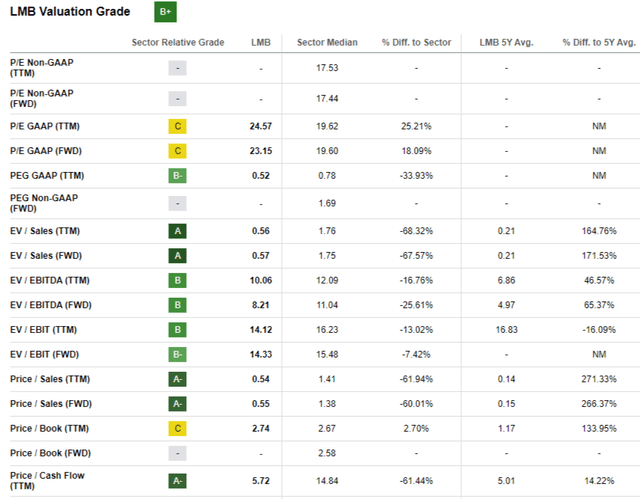

The stock’s year-to-date performance was stellar, with an above 130% rally. LMB outperformed the broad market multiple times. Seeking Alpha Quant assigns the stock a “B+” rating indicating an attractive valuation. Valuation multiples are lower than the sector median almost across the whole board. On the other hand, the current multiples are much higher than the 5-year averages. The P/E ratio looks high at above 20, but other metrics look very attractive, especially from the price-to-FCF perspective.

Seeking Alpha

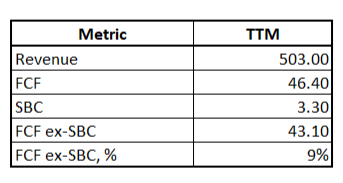

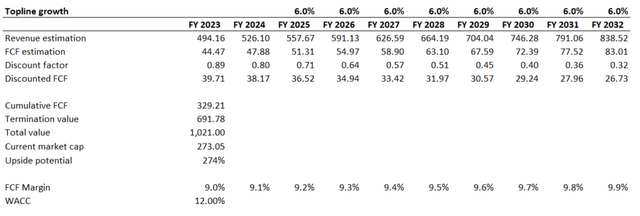

I need to add more valuation analysis to get more evidence about the undervaluation. LMB does not pay dividends. Therefore, I consider the discounted cash flow [DCF] the only reliable way to expand my analysis. Since the company is a small cap, I prefer a conservative 12% WACC discount rate. I have earnings consensus estimates available for the two upcoming fiscal years, and for the years beyond, I incorporate a historical 6% revenue CAGR. For the FCF margin, I use an ex-SBC TTM metric. I expect the FCF margin to expand by ten basis points yearly as the business steadily scales up.

Author’s calculations

Incorporating all the above assumptions into the DCF template returns me a fair value of the business at approximately $1 billion, which is about four times higher than the current market cap. A massive undervaluation looks too good to be true. Therefore I need to simulate a more pessimistic scenario.

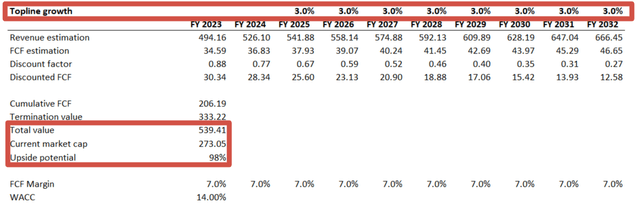

Author’s calculations

I implement much more conservative assumptions across the board for the conservative scenario. First, I use a two percentage points higher discount rate at 14%. Second, I decreased the expected revenue CAGR twofold to 3%. Third, I expect the current fiscal year’s FCF margin to be at 7% with no expansion in the future. Even under these pessimistic assumptions, the stock looks massively undervalued.

Author’s calculations

Overall, the valuation looks very attractive from both the multiples perspective and the DCF outcomes. The stock is about twice undervalued, even under very conservative assumptions in my view.

Risks to consider

The company’s business is highly dependent on the overall construction market. The harsh macro environment with expensive mortgages looks unfavorable for the construction market growth. On the other hand, the company’s offerings are diversified and historical patterns suggest that this revenue mix diversification allows to deliver stable and predictable revenue growth.

The subsequent risk I see is the razor-thin operating margin. My analysis suggests that there is a large room for improvement, but even if this profitability metric expands as I described in the “Financials” section, it still will be at a single digit. That said, any slight unfavorable fluctuations in the top line or from the costs side can drag the operating profit below zero.

Bottom line

Overall, I think that the stock is a “Strong Buy” even considering the substantial risks. My DCF analysis suggests that the stock price has the potential to double even under very tight underlying assumptions. I like that despite a challenging environment, the company demonstrated solid results in the latest reportable quarter. Limbach’s financial position is firm, and the approach to capital allocation looks well-balanced.

Read the full article here