Semiconductors are the common denominator across the burgeoning technology trends of the next decade. Artificial Intelligence, 5G, high-performance computing, Internet-of-Things, gaming, electric vehicles, and robotics, among others, all require semiconductors to power them. These trends make semiconductor stocks an ideal investment and perhaps the most important space for tech investors to monitor.

For years now, we have published on semiconductors as leaders in tech– even when cloud, e-commerce, connected TV and others were more favored. In fact, we have been pointing out quite clearly that semiconductors are the sector that has provided the most returns in the past decade.

Below, we update our semiconductor sector analysis to look at which companies have performed well in the most recent quarter, and also which companies stand out on a forward-basis with revenue growth estimates, profits, cash flows, earnings surprises, and we also look into management insights.

Top Semiconductor Stocks with the highest revenue growth rates in Q1

Navitas Semiconductor had the highest revenue growth among semiconductor stocks in the recent quarter. The company’s revenue grew by 98% YoY to $13.4 million. Management’s revenue guidance for next quarter is $16 million to $17 million, representing YoY growth of 92% at the mid-point.

Ron Shelton, CFO of the company, said in the earnings call, “Our guidance is based on robust strength in EV, solar, appliance/industrial, and the beginnings of a recovery in the mobile and consumer market, all further evidenced by a more than 50% increase in backlog during the quarter.”

The company acquired GeneSiC Semiconductor in August last year and helped to diversify into the fast-growing Silicon Carbide market. Navitas has a strong pipeline of $760 million with $432 million of this recognized by fiscal year 2026.

Analysts expect revenue in the next quarter to grow 92% YoY to $16.51 million and robust revenue growth close to or over 100% on a YoY basis for the next several quarters. The risk to consider is that the bottom line is weak. Analysts don’t expect Navitas to be profitable on an adjusted basis until Q1 2025 and GAAP profitable roughly around 2027.

Semi Stocks Q1 Revenue Surprise

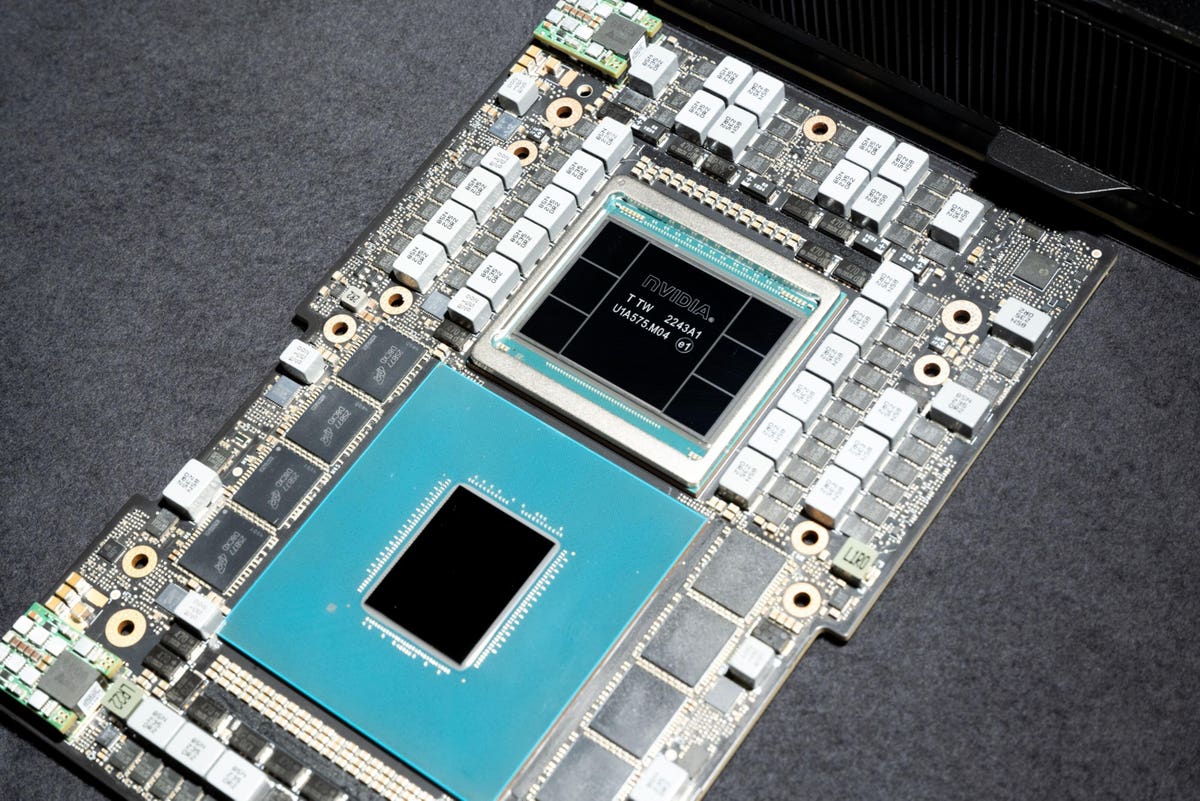

Nvidia crushed analysts’ revenue estimates by 10.4%. The company’s revenue declined by (13%) YoY and is up 19% QoQ to $7.19 billion.

The strong sequential growth was led by record data center revenue, primarily helped by accelerated computing. The company’s CFO, Colette Kress, said in the earnings call, “Generative AI drove significant upside in demand for our products, creating opportunities and broad-based global growth across our markets.” Gaming and professional visualization segments also witnessed improvement from the inventory correction.

If Nvidia is adding roughly $4 billion in revenue, primarily driven by the data center, then Q2’s data center growth will accelerate to an incredible 100% growth rate, up from $3.8 billion in the year ago quarter. It also means the data center will roughly double from the first quarter (sequentially) as the segment was $4.28B in the current quarter.

Put another way, this means Nvidia’s data center segment in the upcoming quarter will be as large as the company’s entire revenue this quarter – if we assume $7.75B in the data center compared to $7.2B total revenue this quarter.

We have highlighted in the past that AI will add $15 trillion to GDP compared to mobile’s $4.4 trillion. Mobile brought us three FAANGs: Apple, Google, and Facebook. It has been my stance for years that AI will bring us a new set of FAANGs, one of which will be Nvidia.

The company’s revenue guidance for the next quarter is $11 billion, representing YoY growth of 64% at the midpoint. The Q2 guidance was 53% higher than consensus. The historic beat in estimates is driven by data center revenue doubling from $4.28 billion in revenue in Q1 to $8 billion in revenue in Q2.

Semiconductor Stocks Q2 Revenue Growth Estimates

indie Semiconductor has the highest expected revenue growth rate for Q2. The company’s recent quarter revenue grew by 84% YoY to $40.5 million. The company has guided for 102% YoY revenue growth in the next quarter.

Analysts expect revenue to grow 102% YoY to $51.97 million. The company is benefiting from growth trends in advanced-driver assistance systems (ADAS) and electric vehicles. indie has a large Serviceable Addressable Market (SAM) of $56 billion by 2028. The company is on track to be profitable on an adjusted basis this year.

Donald McClymont, indie’s co-founder and CEO, said, “Our growth trajectory reflects continued design win momentum spanning ADAS, vehicle electrification and user experience applications. At the same time, our deeper R&D investments and targeted acquisitions are beginning to contribute, enabling us to sharply outpace our peer group. Accordingly, today we are even better positioned to capitalize on the 2025 Autotech market opportunity of $42 billion.”

Revenue Growth Estimates for Current Fiscal Year: Navitas and indie Semiconductor

For the current fiscal year, analysts expect indie Semiconductor to have the highest revenue growth estimate among the semiconductor stocks. It is followed by Navitas Semiconductor, which analysts expect to grow 100%. Among more established players, Nvidia leads and is expected to grow by 59%.

Semiconductor equipment provider ACM Research ranks fourth and is expected to grow 40% in the current fiscal year. The company’s revenue in the recent quarter grew by 76% YoY to $74.3 million. The management’s FY23 revenue guidance is in the range of $515 million to $585 million, representing YoY growth of 41% at the midpoint.

Needham Analyst Quinn Bolton mentioned in his note, “As the fastest growing SemiCap stock in our coverage with ~$400MM in cash and very little debt, we believe a 12.5x multiple is more than fair. The stock is currently receiving little attention from investors due to its high-exposure to China. However, we believe this ACMR sentiment will change over time as its growth proves too difficult to ignore.”

Semiconductor Top Line Valuations

Nvidia has the highest forward P/S ratio of 24.4 among the semiconductor stocks. The company has commanded a premium valuation due to its unrivaled position on GPUs. It is followed by Navitas, which has a forward P/S ratio of 22.4.

Per our analysis, Navitas is expected to have strong revenue growth in the next several quarters.

Free Cash Flow Margin

The majority of semiconductor stocks have positive free cash flow margins. Among the semiconductor stocks we track, 16 companies have more than 20% free cash flow margin. During times of macro uncertainty, stocks with strong free cash flows are considered a safer bet.

Broadcom leads the semiconductor sector with a free cash flow margin of 50%, followed by 47% for Synopsys and 47% for Monolithic Power Systems. Broadcom’s free cash flow in the recent quarter grew by 5% YoY to $4.4 billion. The management also expects cash flows to be strong in the next quarter.

Operating Margin

Broadcom leads the semiconductor stocks with an operating margin of 46%, followed by 45.5% for Taiwan Semiconductor Manufacturing and 44.2% for Texas Instruments.

TSM’s operating margin of 45.5% was higher than management’s guidance of 41.5% to 43.5%. The company’s cost control efforts led to a reduction in operating expenses.

Wendell Huang, CFO of the company, said in the earnings call, “Total operating expenses accounted for 10.8% of net revenue, which is lower than the 12% implied in our first quarter guidance mainly due to stringent expense control and lower employee profit sharing”. Management guidance for Q2 is 39.5% to 41.5%.

Due to its leadership position in manufacturing advanced chips, TSM is able to negotiate better prices with its customers. Cost improvements also help the company to maintain strong margins.

Conclusion:

Nvidia is a well-known semiconductor stock at the moment, yet there are others in the semiconductor space that are outperforming, as well. Broadcom and Taiwan Semiconductor continue to be defensive stocks with strong bottom lines. Navitas and indie Semiconductor are high beta stocks that are putting up nearly triple digit growth (notably, their margins are in the red until they reach scale). Our firm closely monitors tech stocks and issues real-time trade alerts when we enter or exit a stock. We also hold weekly webinars to discuss our portfolio, held every Thursday at 4:30 pm Eastern. Learn more here.

Equity Analyst Royston Roche contributed to this article.

Please note: The I/O Fund conducts research and draws conclusions for the company’s portfolio. We then share that information with our readers and offer real-time trade notifications. This is not a guarantee of a stock’s performance and it is not financial advice. Please consult your personal financial advisor before buying any stock in the companies mentioned in this analysis. Beth Kindig and the I/O Fund owns Nvidia, TSM, and may own stocks pictured in the charts.

If you would like notifications when my new articles are published, please hit the button below to “Follow” me.

Read the full article here