Investment Thesis

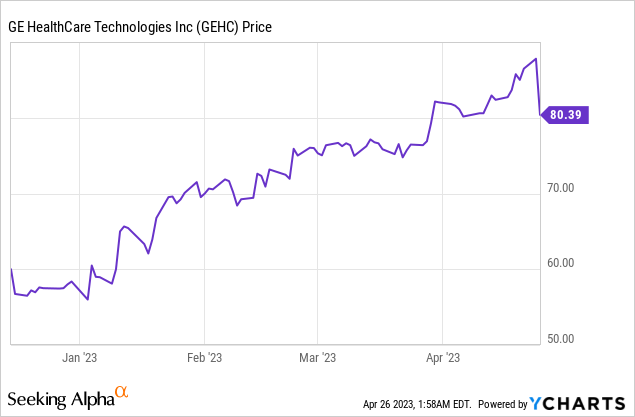

While GE HealthCare Technologies (NASDAQ:GEHC) is still up roughly 7% since my last coverage in February, the company plummeted over 8% yesterday after reporting its first-quarter earnings. The share price’s reaction seems vastly exaggerated as the results are actually very solid with broad-based growth across all segments, especially when considering the current macro conditions. I believe the drop presents a great buying opportunity for investors interested in the company, as fundamentals remain strong while valuation remains discounted compared to peers. Therefore, I am reiterating my buy rating on the company.

Great Q1 Earnings

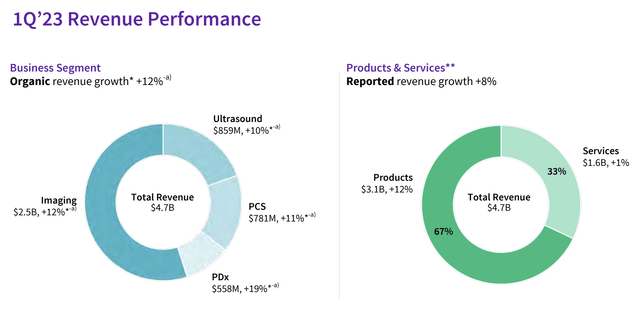

GE Healthcare announced its first-quarter earnings yesterday and the results are very decent in my opinion, as every segment reported solid growth while margins also improved. The company reported revenue of $4.71 billion, up 8% YoY (year over year) compared to $4.34 billion. On a constant currency basis, revenue growth was 12%. Product sales accounted for roughly 66.5% of revenue while service sales accounted for roughly 33.5%.

The growth was very broad-based with strong traction across all segments. Imaging, the largest segment accounting for 53.1% of revenue, grew 8% from $2.31 billion to $2.5 billion. The increase is mostly driven by the strength of Magnetic Resonance Imaging and Molecular Imaging. The ultrasound segment grew by 5% from $815 million to $899 million, mainly attributed to the upbeat traction in general imaging and cardiovascular.

The PCS (patient care solutions) segment increased 11% from $716 million to $798 million, largely due to better backlog fulfillment and supply chain efficiency. While the PDx (pharmaceutical diagnostics) segment grew 15% from $484 million to $558 million, driven by both higher pricing and volume.

GE Healthcare

The bottom line was also excellent thanks to improvements in costs. Costs as a percentage of sales declined 160 basis points from 61.4% to 59.8%, thanks to improved execution and favorable pricing. This resulted in the gross profit up 12.7% YoY from $1.68 billion to $1.89 billion, or 40.2% of revenue. Spending remains slightly elevated due to ongoing investment in growth. Operating expenses were $1.33 billion compared to $1.17 billion, up 13.7% YoY. Most of the increase was attributed to SG&A (selling, general, and administrative) expenses, which grew 14.1% to $1.06 billion.

The operating income was $559 million compared to $509 million, up 9.8%. The operating margin expanded by 20% basis points from 11.7% to 11.9%, largely attributed to improved cost efficiency, partially offset by higher spending. The net income and adjusted EPS declined by 4.7% and 11.5% respectively. However, this is largely due to higher interest expense and tax payments rather than operational issues, therefore I am not too worried. The company also reaffirmed its guidance for FY23 and expects revenue growth to be 6% at the midpoint and adjusted EPS growth to be 9% at the midpoint.

Discounted Valuation

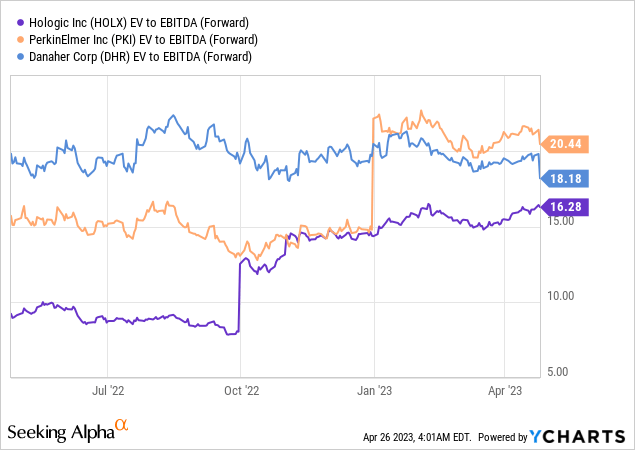

As mentioned in the previous article, I believe GE Healthcare’s valuation remains attractive. The company is currently trading at an fwd EV to EBITDA ratio of 14x, which is discounted compared to healthcare peers such as Hologic (HOLX), PerkinElmer (PKI), and Danaher (DHR) (I am using EV to EBITDA as it can take the company’s debt into account as well). As shown in the chart below, the peer’s average EV to EBITDA ratio is currently standing at 18.3x, which represents a meaningful premium of 30.7%. According to the recent earnings, the company’s result also seems to be holding up better. For instance, Danaher’s Q1 revenue declined by 6.4%, much weaker compared to GE Healthcare which saw revenue growing by 7%. Given the solid performance, I believe the company’s valuation will catch up to peers soon.

Investors Takeaway

Overall, the recent earnings were great in my opinion. Despite facing a tough macro backdrop, all segments reported decent sales growth and operational efficiency continues to improve, as shown in the rising margins. The large and growing market opportunities for medical imaging alongside its best-in-class technology should continue to drive durable growth in the long term. I believe some investors may be worried about the decline in net income and EPS but they were solely impacted by non-operational factors and should normalize in the coming quarters. Despite the solid execution and strong fundamentals, the company’s valuation continues to lag behind its peers. There may be some skepticism in regard to the GE brand but this healthcare division is one of its best subsidiaries in my opinion. I believe this overreaction presents a great buying opportunity and I reiterate my buy rating on GE Healthcare.

Read the full article here