Last year, we provided a comps analysis on Expedia numbers between the pre-COVID-19 level and the half-year 2022 performance (NASDAQ: NASDAQ:EXPE). As a reminder, Expedia is the world’s largest online travel agency (OTA). The company makes travel solutions available to numerous airlines, lodging properties (B&B and Hotel), car rental companies, cruise lines, and destination service providers. Our conclusion was: “Something Doesn’t Add Up.” In detail, our analysis was based on Expedia’s solid outcome with more bookings, higher top-line sales, and better profitability. One year later, Expedia’s stock price is up by 12.02%, outperforming the S&P 500 return but lagging behind the Dow Jones Travel & Tourism Total Stock Market Index, which delivers more than 60% (Fig 2). Over the year, there were additional key takeaways to consider: new cost-saving initiatives with centralized operations and brand unification, a lower headcount, a travel recovery story (after the pandemic outbreaks), and a deleveraging story. Indeed, as a comp basis vs Expedia’s 2019 financial figure the company had $3 billion more in debt.

Mare Past Analysis

Fig 1

U.S. Travel & Tourism Index (1Y performance)

Fig 2

Before commenting on the company’s latest results, it is important to report a few key value drivers that we believe will generate significant returns.

- First, we like the new Expedia feature powered by ChatGPT to help consumers plan vacations and travel experiences. With Machine Learning power by AI, US Expedia members can get recommendations on where to stay and how to get around. They might even plan vacations under a certain budget leveraging the 1.26 quadrillion variables that Expedia offers;

- On the technology side, the most relevant takeaway is the near completion of the migration of the company’s tech stack. Thanks to Vrbo’s completion, Expedia might develop faster products and improve clients’ experience, with a projection of higher bookings growth. This has been one of our internal bull cases; however, it is now time to benefit from this migration fully;

- Related to point 2), Q1 Hotel.com’s recent performance very well supports this positive evolution. In detail, the division returned to a positive growth trajectory of nearly 20% in Q1 following its migration to the Brand Expedia platform. Hotel.com importantly increased conversions leading to higher bookings. In the analyst call, Expedia Group CEO Peter Kern proactively reported Hotel.com’s higher conversion;

- The company has 168 million members and plans to unify its loyalty program. This One Key loyalty program rollout is expected in July, and we believe the company might realize greater marketing leverage through improved customer retention. In our internal assessment, we believe that a better loyalty program combined with a unified CRM will save the company higher expenses in digital marketing budget on Google and other channels such as Instagram to keep acquiring new clients.

Q1 results and Q2 projection

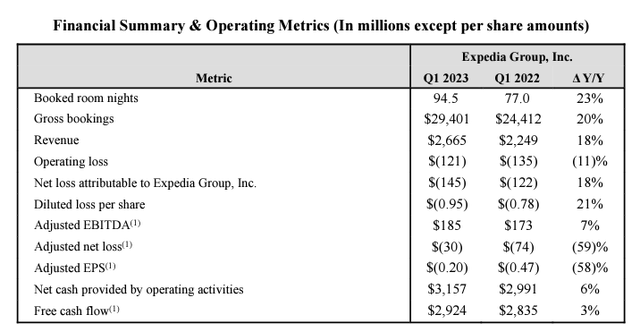

In Q1, the company reported solid revenue in line with Wall Street consensus estimates. In numbers, Expedia delivered top-line sales and adjusted EBITDA of $2.67 billion and $185 million versus an average consensus of $2.66 billion and $237 million. The company benefited from travel recovery in the EU and APAX and benefitted from B2B business. FX evolution negatively impacted the Q1 growth rate, which impacted revenue and EBITDA by 300 and 1600 basis points, respectively. Looking ahead with our projection, in Q2, we forecast gross booking value at $29.0 billion, with an 11% yearly growth rate, and our marketing costs are set at $1.6 billion. Turning to our internal model, we adjusted our estimates to account for higher marketing expenses in the USA area as Expedia leans into peak consumer travel. As a result, our Q2 top-line sales projection is estimated at $3.4 billion with an EBITDA of $632 million. Today, we are not providing an additional update on Q1 2019 vs. Q1 2023; however, having scrutinized the numbers, Expedia fully confirmed our initial thesis. Our adjusted EBITDA fiscal year 2023 projection is $2.6 billion, with a 2024 estimate of at least $2.75 billion.

Expedia Q1 Financials in a Snap

Conclusion and Valuation

In Q1, the company repurchased $600 million worth of shares. In addition, it deleveraged by $2 billion over the past year, and without any doubt, Expedia is more profitable with potential upside catalysts due to product innovation and marketing leverage. The former will drive higher bookings following the tech re-platforming, while the latter might ensure operating margin improvement. Therefore, we expect higher gross booking with double-digit revenue growth and better profitability. On an EV/EBITDA basis, the company stock price has historically traded between 5.0x and 26.5x, with an average of 11.0x and a standard deviation of 4.2x over the last decade. Valuing Expedia with an 11x EV/EBITDA, we derive an equity value of $26 billion (vs a $17.7 billion valuation). This implies a 50% potential upside vs the current stock price. Our target price is set at $178. Risks to our buy rating include: a stronger US dollar, worse-than-expected online advertising return on investment, potential share loss vs. competitors such as Airbnb and Booking.com, increasing marketing expenditure, and economic slowdown, which may alter clients’ willingness to travel.

Read the full article here