Lindsay Corporation (NYSE:LNN) offers road infrastructure and water management services globally. They work in two segments, Infrastructure and Irrigation. In the infrastructure segment, they offer Quickchange barrier systems used in road widening, tunnel and bridge repairs, and highway reconstruction. They manufacture center pivots, hose reel travelers, chemical injection systems, flow meters, and soil moisture sensors in the irrigation segment. LNN recently announced its Q3 FY23 results. I will analyze its quarterly results in this report. I think LNN is overvalued; hence, I assign a hold rating on LNN.

Financial Analysis

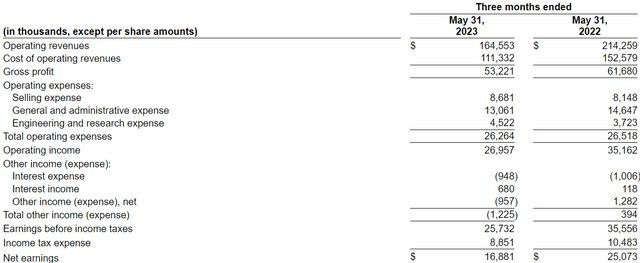

LNN recently posted its Q3 FY23 results. The operating revenues for Q3 FY23 were $164.5 million, a decline of 23.1% compared to Q3 FY22. I believe a decline in revenues in its irrigation and infrastructure segments was the reason behind the revenue decline. The revenues from the irrigation segment declined by 24% in Q3 FY23 compared to Q3 FY22. Its revenue in North America declined by 22%. I believe the decline was mainly due to lower unit sales, and I think farmers holding off capital investment decisions led to lower unit sales. Its revenues in the international irrigation markets also saw a decline of 27%. The revenue decline in both the irrigation market was responsible for the revenue decline in the irrigation segment. The revenue from the infrastructure segment declined by 14% in Q3 FY23 compared to Q3 FY22. I believe lower sales of the Road Zipper System and road safety products were the main reason behind the revenue decline in the infrastructure segment. Their operating income margin in Q3 FY23 was the same as in Q3 FY22.

LNN’s Investor Relations

The net earnings for Q3 FY23 was $16.8 million, a decline of 33% compared to Q3 FY22. I believe losses from foreign exchange transactions and lower operating income was the main reason behind the decline. I think a double-digit decline in revenues and net earnings is not a pleasant sight, and I think the quarterly result of LNN was disappointing because it missed the market revenue estimate by 21%, which is a big miss. I think another big reason behind the revenue decrease was the net farm income in 2022 was quite higher than what it is in 2023, and it is expected that the farm income might continue to decrease in 2023. Hence, I believe its lower sales in the irrigation segment can be attributed to the lower net farm income. So I think LNN and the sector in which they compete might see weakness in 2023 due to a decline in the farm income. Hence, I expect that LNN might continue to see revenue decline in the coming quarters.

Technical Analysis

Trading View

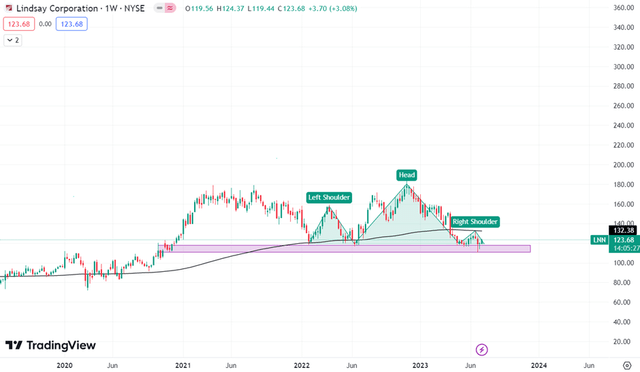

LNN is trading at the $124 level. It is currently near a crucial support level of $120. One should stay cautious with this stock because two points concern me. In the past three years, there has been only one instance where the stock has traded below its 200 ema, and it was just for one week. In one week, the stock rebounded and started to trade above its 200 ema, but recently in April, the stock gave a huge breakdown, and it has been four months that the stock has been trading below its 200 ema, which is a matter of concern and shows weakness in the stock. In addition, as I mentioned earlier, it is near the support zone of $120; it has tested the support zone four times, and whenever a stock touches a particular zone multiple times, that zone becomes weak. The stock has also made a bearish pattern called head and shoulders, where the neckline of the pattern is at $117. So if the stock gives a breakdown below $117, we might see more downside in the stock. The 200 ema breakdown, several tests of the support zone, and the bearish pattern all indicate that the stock is weak; therefore, I believe that it is best to stay away from it for the time being. I also believe these indicators are sufficient to show that it is not the right time to trade in this stock.

Should One Invest In LNN?

First, look at LNN’s valuation. It has a P/E [FWD] ratio of 20.87x compared to the sector ratio of 17.71x and a Price / Sales [FWD] ratio of 2.04x compared to the sector ratio of 1.39x. The ratios clearly show that LNN is trading at a higher valuation compared to the sectoral average. But its higher valuation is not backed up by strong financial performance. In addition, if we compare LNN to its peers, we will get know that LNN has been lagging behind some of its peers in terms of revenue growth. Some of its peers, like HYFM, UGRO, AGCO, and TTC, have a five-year revenue [CAGR] of 11.26%, 34.38%, 8.89%, 13.67%, and LNN has a five-year revenue [CAGR] of 4.61%. This shows that LNN has been underperforming compared to its peers. Hence, looking at the financial ratios and its performance compared to its peers, I believe LNN is overvalued. In addition, the farm income is expected to remain lower than the previous year. Hence, I believe this might affect the company’s revenue growth, and I expect FY23 revenue to be lower than FY22 revenue.

Hence, looking at its disappointing quarterly results, declining revenues, and high valuation. I assign a hold rating on LNN.

Risk

Exports of parts or finished products from the United States are involved to some degree in the Company’s foreign sales. The movement of agricultural and other commodities internationally could be negatively impacted by policies and geopolitical events that impact exchange rates, which could lead to a decline in the demand for agricultural equipment in many parts of the world. Additionally, any appreciation of the US dollar or any other major currency (such as the Euro, the Brazilian real, the South African rand, the Turkish lira, and the Chinese renminbi), as well as any depreciation of local currencies may result in an increase in the price of the Company’s goods in its international markets. Regardless of any impact on the overall market for agricultural equipment, these changes may lessen the competitiveness of the Company’s products compared to those of regional producers and, in some situations, may prevent consumers from finding the Company’s products to be cost-effective. As a result, the Company’s global sales and profit margins may see a market decrease.

Bottom Line

I think LNN is overvalued, and its quarterly result was disappointing. So I think it might remain under pressure in the near term. Hence, I believe there is no buying opportunity in it. Hence, I assign a hold rating on LNN.

Read the full article here