Background

Long gone are the days of the Marlboro man on billboards across the United States, along with smoking sections in restaurants (remember those?), and cigarette lighters that come as a standard feature in automobiles. Smoking is down worldwide, but the major tobacco players live on, trying to find new ways to thrive and bring consumers into their fold of products.

Enter Philip Morris (NYSE:PM). The one-time promoter of Marlboro and a leading cigarette manufacturer globally now bills itself as a company “working to deliver a smoke-free future and to evolve our portfolio for the long term to include products outside of the tobacco and nicotine sector”, according to its latest 10K.

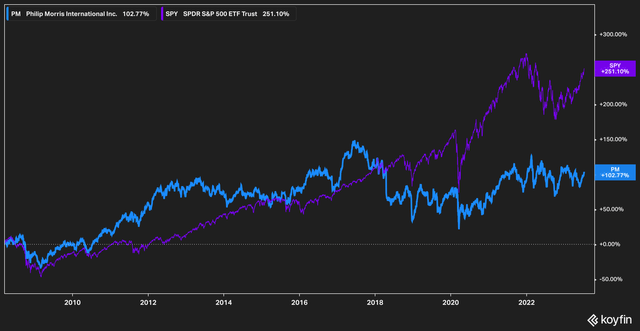

No stranger to controversy, the stock has perhaps unsurprisingly underperformed the broader S&P 500 (SPY) over a long term basis (although viewing the stock on a total return lens narrows this gap substantially).

Koyfin

Given the nature of its business, PM has the ability to elicit emotional reactions from investors, prompting its inclusion in such indexes as the VICE (VICE) ETF, which invests in companies that investors who take a certain moral approach may find unappealing.

However, while the company now invests in new spaces that are, as stated above, diversified away from tobacco and nicotine, it also has an apparent new hit on its hands in the smokeless and tobacco-free nicotine market with its late 2022 acquisition of Swedish Match.

The new dynamics of the business and different regulatory sales framework surrounding tobacco-free nicotine pouches present an opportunity for Philip Morris that, in our view, the market has yet to appreciate.

Let’s dive in.

New Day, New Product

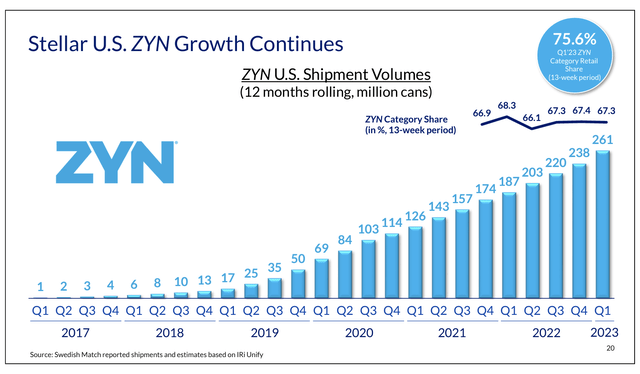

Marketed in the U.S. as ZYN, Philip Morris recently completed its first full quarter of tobacco-free nicotine pouch offerings. The results from this first quarter were, to say the least, good for Philip Morris.

Investor Presentation

ZYN enjoys a strong position in the market, with 67.3% estimated market share amongst its peers, and strong sales of 261 million cans in the first quarter, a 40% increase year-over-year from first quarter 2022 sales of 187 million cans.

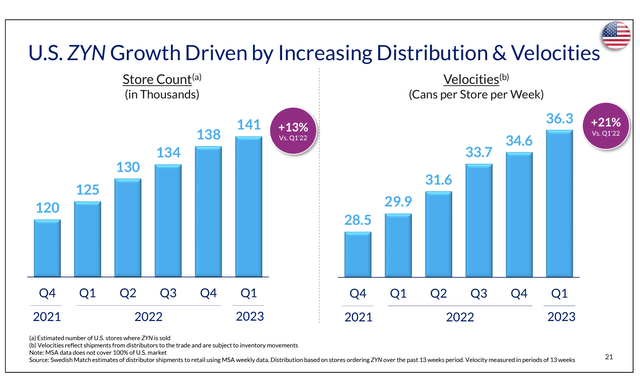

Participating store count and through-put of ZYN on a weekly basis is also growing at a rapid clip, posting a 21% increase year-over-year in cans per store per week sales.

Company Presentation

While of course we make no claims about the relative health benefits or pitfalls of nicotine versus combustible products (the science on this, according to some experts, is still too data-light to make a solid conclusion), we note that Think Global Health published a piece last year (which you can read here), stating that “[w]hile not “safe,” nicotine pouches are one of the least harmful ways to ingest nicotine.” A recent article from GQ on the rising use of tobacco-free nicotine pouches pointed to potential issues that users may face, particularly regarding their oral and gum health.

Again, we point out these potential issues being raised in the wider media not because we are medical professionals, or because we wish to take either side in a wider debate, but to rather inform readers about the current state of debate around these products. This is of particular importance for a company like Philip Morris, whose primary risk in the market is–we believe–regulatory and public perception risk.

Looking Ahead & Valuation

Management was very upbeat about the continued prospects for its non-combustible products, though they cautioned that gross margin would be impacted in the coming quarter on the latest conference call.

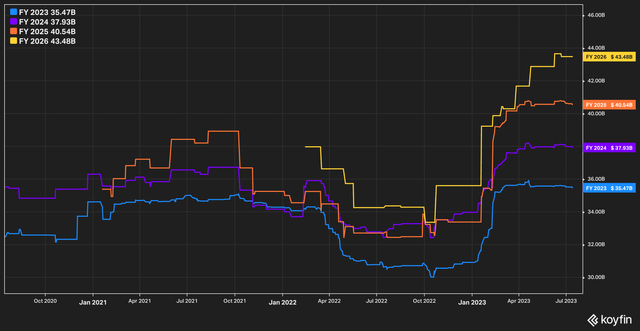

For those interested in the company long-term, particularly for its dividend, short-term issues and headwinds should be of little concern. Analysts, for their part, appear to believe that better days are ahead for Philip Morris, with average revenue estimates looking out several years ahead rising to new highs.

Koyfin

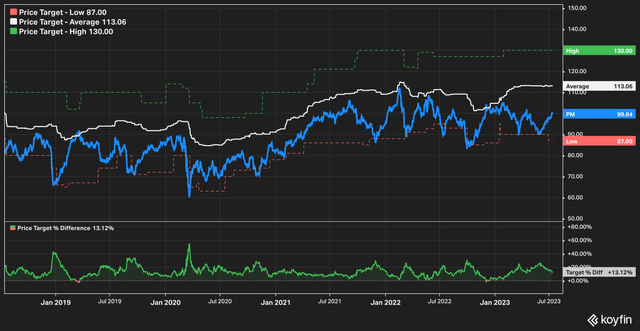

This improvement in revenue expectations is largely driven by the Swedish Match acquisition and the strong start to ZYN sales in the United States. The stock is also trading roughly 13% below analyst price targets, with 14 of 19 analysts in coverage rating the stock a buy or strong buy, according to Koyfin.

Koyfin

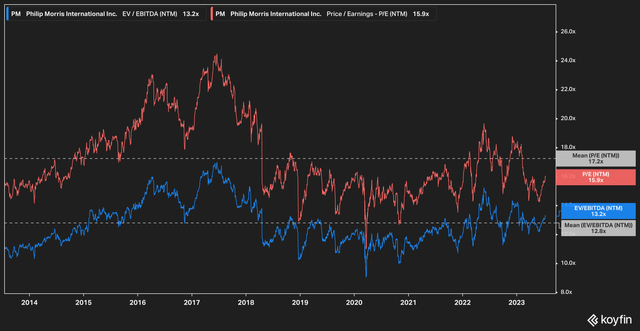

Most important to our underlying thesis, however, is that forward valuations of Philip Morris still reflect its business of yesterday, rather than its pre-tobacco-free nicotine business opportunity that exists today.

Koyfin

On a ten-year time frame, Philip Morris trades roughly in line with its historic valuation norms. The stock trades hands today at almost 16x forward earnings and 13x EV/EBITDA, both roughly aligning with the historic average.

This, in our minds, represents an interesting situation. Phillip Morris is now in possession of a market-leading product that currently enjoys lighter regulatory oversight than its legacy products, and which is growing in popularity at a rapid clip. Putting regulatory intervention risk aside, we think that a re-rating of the stock could be likely if the company’s ZYN product continues to outperform.

The Bottom Line

While we take no stance on the debate surrounding the health of Philip Morris’s new product, we think investors should be aware of its general contours since, again, we think regulatory and public perception to present the greatest risk to the company’s new ZYN product. However, early trends seem to show that tobacco-free nicotine is a rapidly-growing trend, and one that we believe Philip Morris and its shareholders are poised to reap benefits from.

Read the full article here