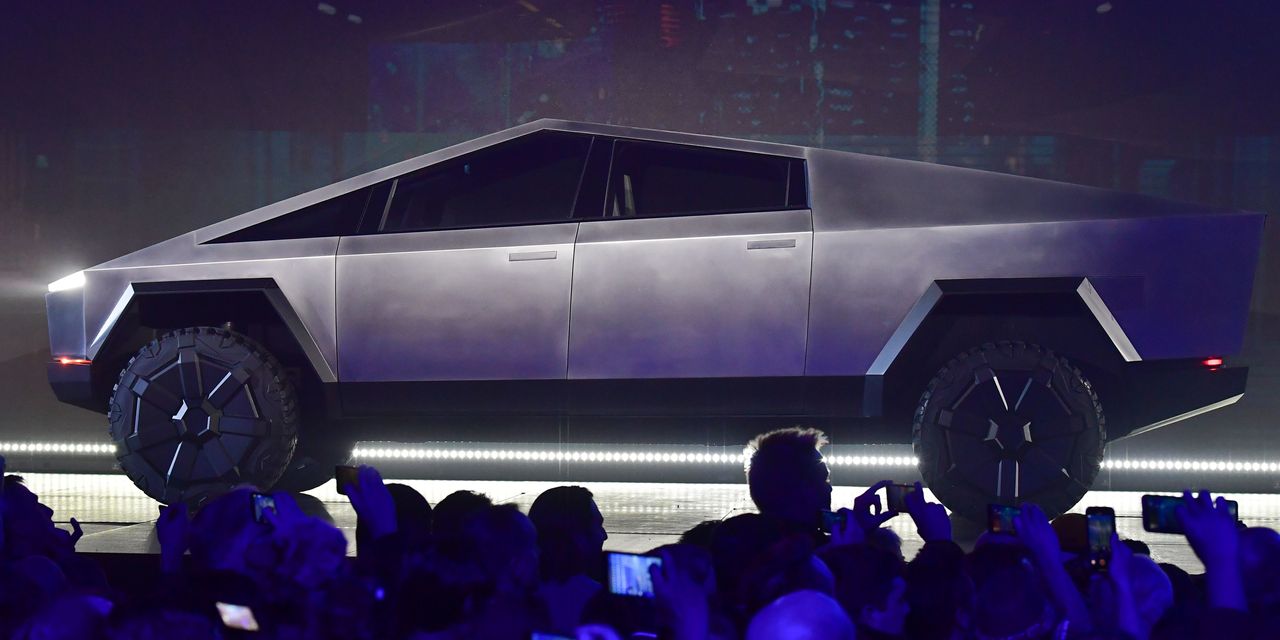

News about Tesla Inc. and Ford Motor Co.’s electric pickup trucks shook up EV-related stocks on Monday, dragging General Motor Co.’s stock along.

Tesla’s

TSLA,

first Cybertruck rolled off the assembly line Saturday in Austin, Texas, with the company firing off a celebratory tweet. And earlier Monday, Ford

F,

announced price cuts for the F-150 Lightning, the all-electric version of its best-selling F-150 pickup truck.

Don’t miss: Tesla is looking at its best sales quarter ever

The price cuts come as “[Ford Chief Executive Jim Farley and other Ford executives] hear the footsteps of the Cybertruck and others such as [Rivian Automotive Inc.

RIVN,

] coming,” Wedbush analyst Dan Ives said in a note Monday.

Ford shares were poised for their lowest close in three weeks and the largest one-day percentage drop in six weeks. GM

GM,

stock, down 3%, was also looking at its biggest one-day percentage decline since late May.

Shares of Fisker Inc.

FSR,

whose business model leans heavily on focusing on design and consumer interfaces, leaving manufacturing for third parties, rose more than 4% to its best in a week and snapping a two-day losing run.

Tesla kicks off third-quarter earnings season for auto makers and auto-parts suppliers. The EV maker is slated to report results on Wednesday after the bell.

See also: EV sales stall as, aside from Tesla and BYD, there’s a ‘step back from euphoria’

“A rollercoaster of a year for Tesla has seen a return to an $800-900 [billion] market cap on a mix of AI/Tech excitement and a stream of charging announcements from OEMs” preparing to use Tesla’s fast-charging network, analysts at ISI Evercore said in a note Monday.

The analysts said they expect “downward earnings revisions” going forward as Tesla could cut vehicle prices again, leading to a drop in revenue. The “negative tone” on Tesla in the near-term, however, is related to the stock, they said.

“They remain the EV leader in the US and part of a global duopoly” alongside China’s EV maker BYD CO. Ltd.

BYDDY,

the analysts said. Until the launch of Tesla’s cheaper next-generation vehicle, however, the company “has exhausted its [total addressable market]” on its current models, they said.

Read the full article here