Propane may be a familiar fuel for grills or patio heaters, but it also serves as a critical petrochemical building block. Propane and other natural gas liquids (NGLs) have been important growth drivers for midstream companies as global demand for these products increases, particularly for petrochemical applications. Today’s note discusses the growth seen in propane and how midstream companies could benefit.

Positive Fundamentals for U.S. Propane

Propane is one of the five NGLs, along with ethane, butane, isobutane, and natural gasoline (read more). NGLs are produced alongside oil and natural gas at wells. They separate from the natural gas stream at gas processing facilities, before fractionation into purity products. Just like a refinery processes oil into gasoline, fractionation plants process NGLs into their individual components like propane, ethane, and butane. Midstream companies own and operate gas processing plants and fractionators. NGL prices have been weak lately, but the long-term fundamentals for NGLs have been supportive.

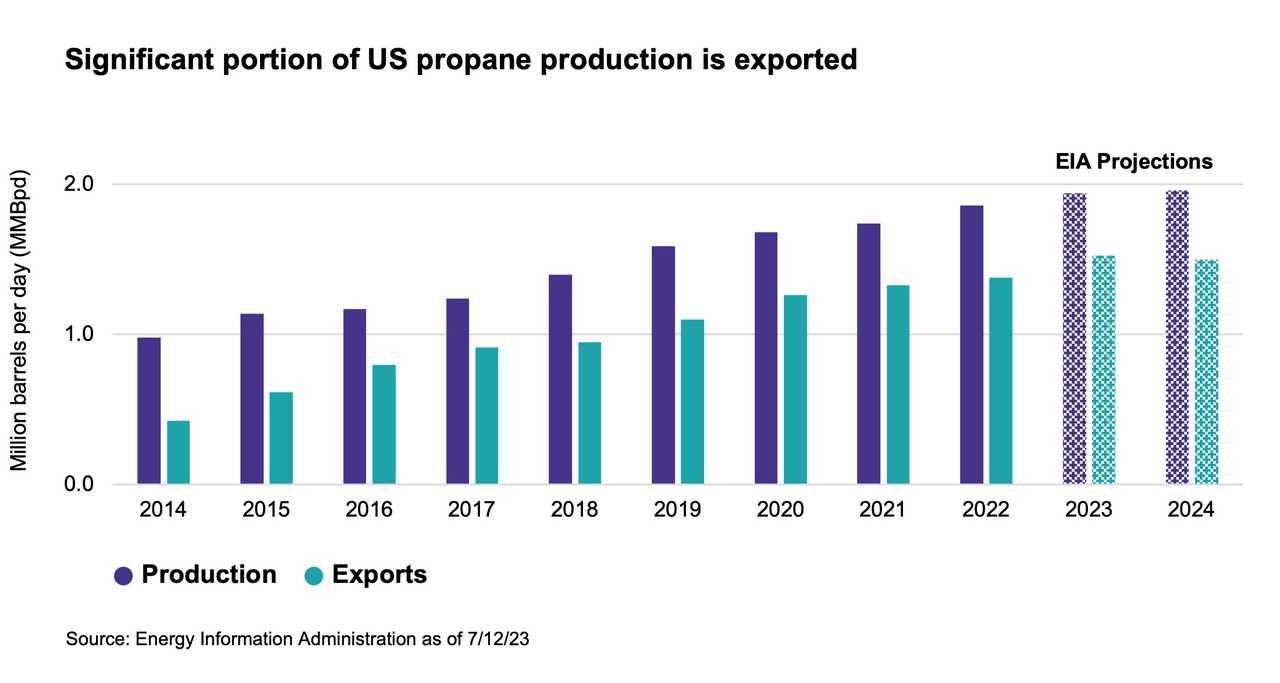

Since 2014, U.S. production of propane has nearly doubled to 1.9 million barrels per day (MMBpd) alongside the growth in oil and natural gas production. Meanwhile, exports have increased more than three-fold to 1.4 MMBpd over that timeframe. In March 2023, U.S. propane exports reached 1.7 MMBpd, a monthly record, according to the Energy Information Administration (EIA). As the chart below shows, the EIA expects production to grow moderately while exports step up in 2023 and hold steady in 2024. However, the plateau in exports could end quickly as companies look to add propane export capacity to meet growing global demand, particularly in Asia.

Petrochemicals Drive Growing Global Propane Demand

Growing global demand for plastics is driving increased demand for propane (and ethane). Specifically, propane dehydrogenation (PDH) units convert propane into propylene, a petrochemical needed in plastics manufacturing. Products like packaging supplies, clothing, toys, and housewares make use of propylene. As anticipation grows for more PDH units to come on-line, demand for propane should continue growing.

As shown above, most U.S.-produced propane is exported. Over 50% of all U.S. propane exports in 2022 went to Asian markets, led by Japan, China, and South Korea. In China, seven new PDH units started up in 2022, with six more expected to come on-line in 2023, which could result in higher demand for U.S. propane exports. S&P Global Commodity Insights analysts forecasted Chinese PDH plants would process 23.4% more in 2023 versus 2022.

Midstream Is Well Positioned to Capitalize on Growing Demand

Propane production should see moderate growth through 2024, as shown in the chart above. Growth in NGL production creates opportunities for midstream companies to add new fractionators and export capacity. For reference, propane typically accounts for roughly 30% of a mixed NGL barrel. In other words, 30% of a fractionator’s output will be propane. The rest will be the other NGLs like ethane, butane, etc.

Several companies are adding fractionation capacity at the NGL hub at Mont Belvieu, Texas. ONEOK (OKE) recently began operations at its new 125 thousand barrel per day (MBpd) MB-5 fractionator and expects to complete another 125 MBpd fractionator by 1Q25. Targa Resources (TRGP) is also adding two fractionation facilities, expected to come on-line in 2Q24 and 1Q25. Enterprise Products Partners (EPD) is expecting to complete its twelfth fractionator later this year, while Energy Transfer (ET) expects its new 150 MBpd Frac VIII to be in service by 3Q23.

On the export front, midstream companies are incrementally building capacity. Some cite capacity for liquefied petroleum gases or LPGs, which include propane, butane, and isobutane. TRGP is currently working on a 1 million barrel per month expansion to its LPG export facility. EPD is also expanding its Houston Ship Channel facility, which would add 120 Mbpd of LPG loading capacity to take the total to 883 MBpd by 1H25. ET is expanding NGL export capacity at its Nederland terminal by 250 Mbpd, which is expected to be in service by mid-2025, as discussed on its 1Q23 earnings call. ET’s management also noted during the call that the new PDH facilities being built around the world support its bullishness around its NGL business.

New PDH units are being built in the U.S. as well. EPD is building its second PDH unit, which is expected to begin service in mid-2023. This is a somewhat rare example of a midstream company with petrochemical operations. However, importantly, EPD operates its PDH units with a fee-based model.

Bottom Line

NGLs have been an important growth driver for midstream as global demand for these critical petrochemical building blocks increases. Midstream corporations and MLPs are capitalizing on this growth by adding fractionation and export capacity.

Disclosure: © VettaFi LLC 2023. All rights reserved. This material has been prepared and/or issued by VettaFi LLC (“VettaFi”) and/or one of its consultants or affiliates. It is provided as general information only and should not be taken as investment advice. Employees of VettaFi are prohibited from owning individual MLPs. For more information on VettaFi, visit www.vettafi.com

Original Post

Read the full article here