Renewable energy companies are great from an environmental and virtue-signaling standpoint, but they have always been challenging as businesses. They are capital-intensive as there are high upfront costs and there is always competition from conventional energy sources which are more mature and hence provide better returns on capital. But any industry in its nascent stages has to face this. The hype during the adoption phase gives birth to multiple companies but only a few manage to survive by the time the technology matures. Case in point, between 1900 and 1920, there were around 2,000 car companies in America. By the 1930s, the number had dwindled down to mid-double digits. As the years went by the numbers came down even further. Similarly, I believe it is highly likely that most renewable energy companies would provide poor returns to shareholders and would not make a good investment. Our only way of increasing the odds in our favor is to ignore the hype and the noise and evaluate the companies based on their strength instead of just blindly buying into a narrative. One such company that comes out on top would be Northland Power (TSX:NPI:CA).

Strong Portfolio

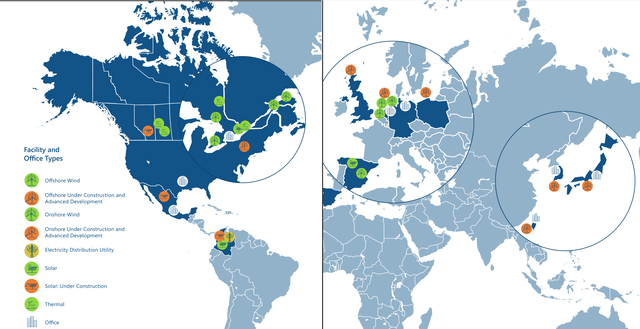

The company has a wide portfolio of projects and has active development in 12 countries. They have a major presence in Europe, North America, and Asia with a small presence in Latin America. Almost 60% of their power generation is through offshore wind projects.

Portfolio of projects by geography (Annual report)

Northland owns or has a net economic interest in 2,616MW of power-producing facilities with a total gross operating capacity of approximately 3,026MW.

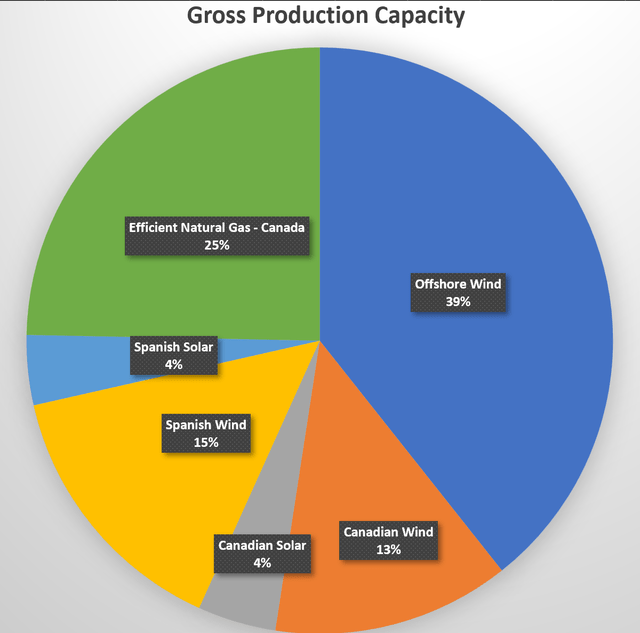

Gross Production Capacity Split by Type (Author generated from Annual Report)

Aside from operational assets, Northland has a number of significant projects in various stages of construction and development, as well as other projects that are in the early stages of planning.

| Projects | Gross Capacity (MW) |

| Under construction (Est. 2023) | 350 |

| Under development (Est. 2025 – 2027) | 3282 |

| Identified (Est. 2025 – 2030+) | 9760 |

All of this means that the company not only has a rich portfolio at present but also has a robust pipeline of projects coming up in the near future.

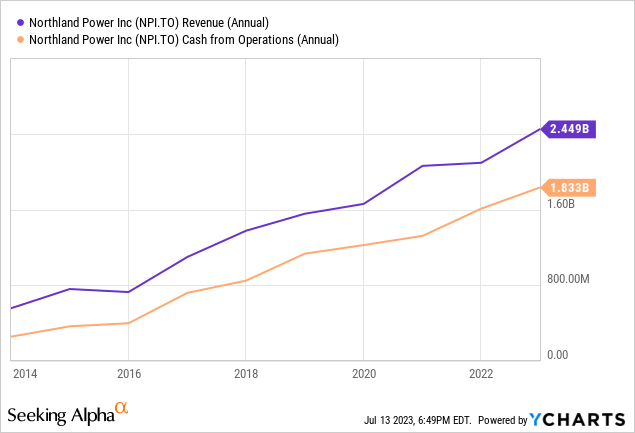

Cash flow generation

It’s impressive the company has grown its revenues by almost 350% in the last nine years but what’s even more impressive is that the company has continuously produced positive operational cash flow that has grown from $250M in 2013 to $1.8B in 2022.

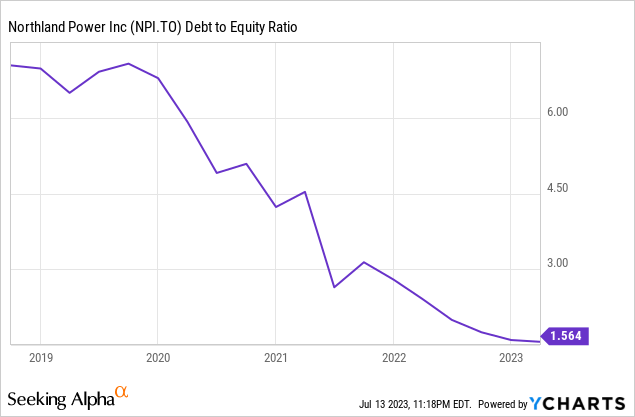

This indicates that the company’s core operations are generating more cash than they are consuming, an indicator of stability, and that the company has more funds available to invest in growth initiatives. It can use the cash to expand its operations, invest in research and development, acquire new assets, or pursue other strategic opportunities. No wonder its portfolio is rapidly expanding and growing! The other area where it has been putting its cash flow to use is to reduce its debt. The end result is that its equity value is steadily increasing, and its debt is slowly decreasing with its debt-to-equity ratio coming back to healthy levels.

Valuation when compared to its peers

| Company | P/OCF |

| Constellation Energy (CEG) | – |

| Brookfield Renewable Partners (BEP) | 7x |

| Algonquin Power (AQN) | 11.7x |

| Brookfield Renewable Corp (BEPC) | 7.3x |

| NextEra Energy Partners (NEP) | 7x |

| Boralex (BLX: CA) | 6x |

| Ormat Technologies (ORA) | 20x |

| Clearway Energy (CWEN) | 4x |

| Northland Power | 4x |

In the table above, I picked a good sample of renewable energy companies to compare against Northland Power. The company ranks quite highly and is trading at a discount when compared to the other companies in our sample set. I picked this metric as renewable energy companies are capital-intensive and therefore have high Depreciation and Amortization making the P/OCF ratio more suitable (Companies with significant depreciation and amortization expenses may report lower net income, even if their core operations are generating healthy cash flow. In certain situations, companies may also inaccurately estimate lower depreciation and amortization levels boosting net income. Therefore, the P/OCF ratio can offer a more accurate assessment of the company’s value in capital-intensive industries in my opinion).

One key risk for shareholders

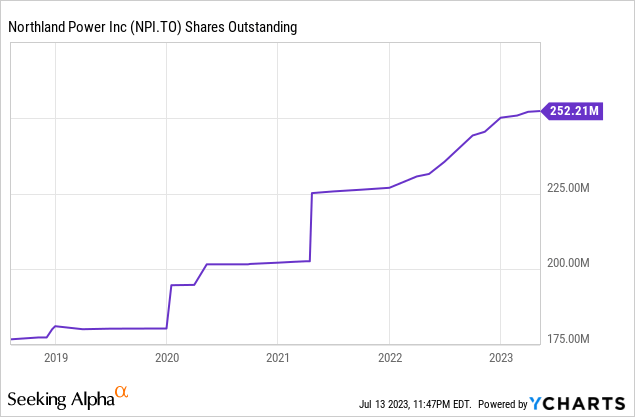

If you asked me one reason that would dampen this thesis, it would be shareholder dilution. One of the ways the company has been able to raise money for its expansion is through share offerings. In the last three years, more than $2B has been raised through stock sales. Management was smart to raise money through stock sales instead of debt as it was able to take advantage of the rise in the share price, but the side effect of this is that it results in shareholder dilution. Share count has increased by more than 25% during this time period.

In Q1 of 2023, the company raised another $40M through stock sales. If this continues to be the management’s preferred route to raise capital, I suspect the shareholder dilution could continue for much longer.

Final Call

There is no doubt that renewable energy would play a major role in the future and if an investor wants exposure to this industry it is much better to go with strong names and I believe Northland Power is one such strong name. Its fundamentals look solid, its future looks bright with an expanding portfolio of upcoming projects, and it’s valued well when compared to its peers. I rate this company as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here