Celsius Holdings (NASDAQ:CELH), maker of Celsius-branded functional drinks and liquid supplements, has one of the most compelling growth trajectories in the entire market. Fueled by a partnership and distribution agreement with PepsiCo (PEP), Celsius is greatly positioned to capitalize on the fastest-growing segment in the beverage market, and it’s still in the very early innings of its U.S. and international expansion.

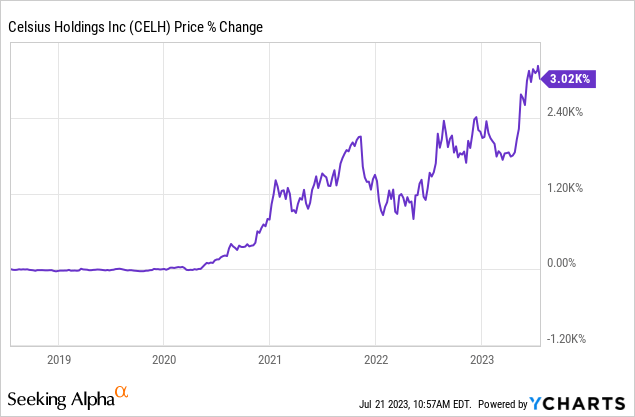

The secret is no longer a secret, as the stock has already multiplied 35x since its pandemic lows. The question that’s on the minds of investors is whether or not the growth story is fully priced.

So, let’s dig deeper into the company’s growth prospects and profitability drivers, and see if there’s still meat left on this bone.

Company Overview

Celsius operates in the functional energy drink and liquid supplement categories in the United States and Internationally. The company develops differentiated formulas which are catering to the health-conscious consumer, with most of its products having zero sugar in them.

Its core offering is the Celsius branded energy drink which accelerates metabolism, burns calories, and provides energy. This product line comes in a ready-to-drink format as well as an on-the-go powder form. Other offerings include Celsius HEAT and Celsius Amino Acids, which cater to pre- and post-workout needs. According to six different studies, one serving of the company’s core product burns 100-140 calories, increases resting metabolism by 12%, and provides sustained energy for three hours.

Nothing better than trying their product yourself. Personally, I like the drink as a coffee supplement around the afternoon, and find it very tasty and refreshing. I recommend the Cherry Lime flavor!

Back to business, the company’s products are sold through retail channels, including physical locations and e-commerce platforms, as well as health clubs, gyms, and food locations.

Products are distributed under a very material agreement with PepsiCo, signed in August 2022. According to their agreement, PepsiCo acquired an 8.5% stake in Celsius for $550M, and additional rights which include the right to sell and distribute Celsius products in the U.S. and internationally, as well as the right for a special accumulated dividend that accrues at a rate of 5.0% per annum.

The Energy Drinks Market & The Growth Story

The energy drinks market became a famous discussion point for investors due to one very successful company, namely, Monster Beverage Corp (MNST).

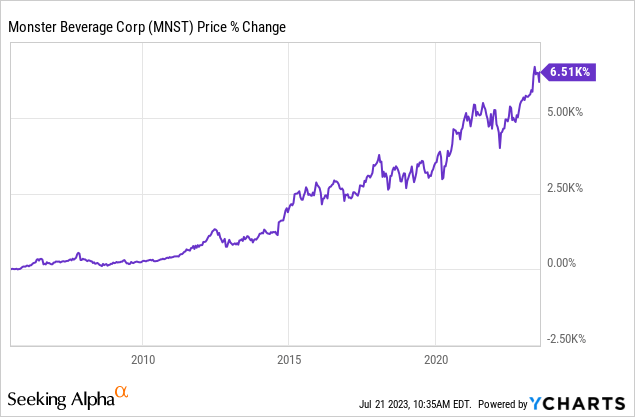

Monster is among the top-performing investments in the entire market since 2005, with its stock growing 65x over the period. Today, Monster owns approximately 37% of the market, generating $6.3B in sales with an astounding 25% operating margin.

Celsius hasn’t been too bad of an investment as well, with a 30x return over the last five years. Between 2017-2022, Celsius revenues have grown nearly 20x, and today, the company holds a 7.5% market share, more than double its share a year ago.

The energy drinks market is projected to grow at a high-single-digit to low-double-digit pace for the rest of the decade, as new products are introduced, and international popularity grows sequentially.

Aside from Monster and Celsius, there’s Red Bull, which holds a 35% share, PepsiCo with 5%, and other smaller names like Bang, which is being acquired by Monster. Clearly, the winners in this industry could provide investors with a very appealing growth runway, as they take more share of a fast-growing pie.

Celsius Vs. Monster Beverage

As we established our interest in the industry, we need to go ahead and pick our horse. Red Bull isn’t a public company, and while I do find PepsiCo an attractive investment [read my latest article here], its energy exposure isn’t significant. Thus, we are left with Celsius and Monster Beverage.

First, we need to acknowledge these are companies in a very different stage of their business. Celsius is just now coming out of its development phase and is projected to surpass $1B in annual sales for the first time this year, a mark that Monster achieved more than 15 years ago.

However, Celsius is constantly taking market share, mostly from other competitors but from Monster as well, and it’s backed by one of the strongest (if not the strongest) distributors in the world, PepsiCo. Thus, Monster doesn’t really enjoy major scale advantages as it would have without PepsiCo in the picture.

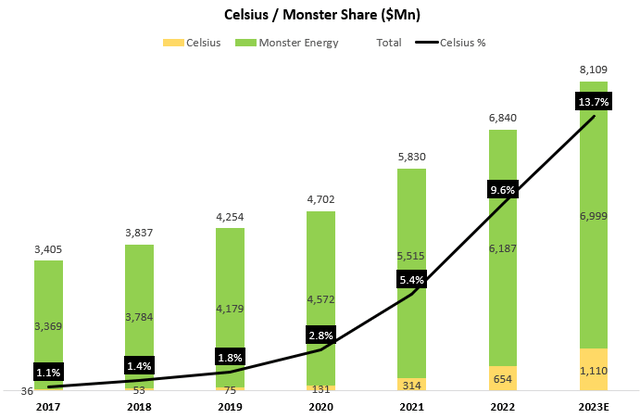

Created and calculated by the author using data from the company’s financial reports and consensus estimates; Monster energy shows only revenues derived from Monster Beverage’s energy businesses.

For the sake of certainty, we’ll rely only on public data provided by the companies. As we can see, Celsius’s share in the narrowed market we created is on a sharp incline, and according to consensus estimates, should reach 13.7% in 2023.

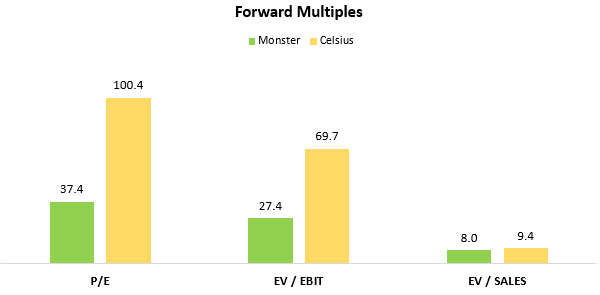

Created by the author based on data from Seeking Alpha; Data as of July 21st, 2023.

As we can see, Celsius is clearly trading at a premium compared to Monster, with a whopping 100.4x forward P/E. Looking at a more comparable and relevant metric, Celsius trades at a 9.4x EV/Sales multiple, compared to Monster’s 8.0x.

Looking at their growth metrics, Celsius is projected by analysts to grow revenues by 70% in 2023, while Monster is expected to grow by 13.1%. As Celsius is expected to continue to outgrow Monster, if we look at their 2024 multiples, Celsius is actually cheaper in terms of EV/Sales, with a 6.9x multiple compared to Monster’s 7.2.

As I consider myself a fundamental investor, I have a hard time making decisions based on a sales multiple. However, I think that we can get the feeling the valuation gap between the two companies makes sense, considering Celsius’ much higher growth prospects.

Near-Term Projections

Celsius doesn’t provide guidance, which makes sense due to the many unknowns in this early stage of its expansion. However, let’s try to piece the puzzle together.

As is typical in the functional energy drink and supplement industries, sales of products are seasonal, with the highest sales volumes generally occurring in the second and third fiscal quarters, which correspond to the warmer months of the year.

— Celsius 2022 Financial Report (10-K).

Beginning with revenues, we know that the second and third quarters should be higher than the first and fourth. Furthermore, as Celsius is still growing exponentially with its distribution chain, it grows sequentially QoQ due to organic expansion as well. Therefore, I expect Celsius’ 94.9% growth in the first quarter to set the pace for the entire year, which means I expect 94.9% YoY growth for the full year.

And looking out across the year, we continue to believe that we will operate with gross margins in the mid-forties with some pressure during the first half of the year while we fully integrate into our new distribution system and began to better optimize our supply chain with upside in the back half of the year.

On a full-year basis, we continue to expect our sales and marketing expenditures to remain consistent with historical run rates. As noted, this quarter benefited by timing as well as some inventory builds within our mixing centers. The goal for the year was to end the year roughly at that kind of 22% marker.

G&A expense as a percentage of sales was 8% for the first quarter of 2023 versus 9% in the prior year, which is in line with expectations. We’d expect to see this area begin to leverage against our growth during 2023.

— John Fieldy, President, CEO and Chairman, Q1-23 Earnings Call

Looking at margins, the company expects a mid-forties gross margin and a cumulative 30% SG&A as a percentage of sales. Therefore, we can conclude the company expects a 15.0% operating margin for the remainder of the year.

Back Of The Envelope Valuation

Before we go into a DCF valuation, I think it’s fitting with a company at such an early stage, which is very far away from achieving steady-state metrics, we’ll do some simple back-of-the-envelope valuation first.

Today, Monster Beverage is trading at a 27.4x EV/EBIT multiple. Let’s say that we find that too high and go with a 22.5x. Now, let’s take 2027 as our target year, as I find it reasonable to expect that in a little less than four years Celsius will reach steady-state after it expands internationally and U.S. channels mature.

In 2027, I expect Celsius to generate a little over $2.4B in sales, reflecting a 17.5% CAGR from 2023 levels. Taking a 25% EBIT margin, which is Monster’s lowest level for the past decade, we arrive at $607M of EBIT. Multiplied by our fair 22.5x multiple, our back-of-the-envelope takes us to $13.7B EV in 2027, which represents 31.0% upside over today’s valuation.

Therefore, I expect Celsius to return a 9.5% annual return over the next four years. In my view, that’s a little low. Considering all of the unknowns, I would seek at least a 12.0% annual return.

Discounted Cash Flow Valuation

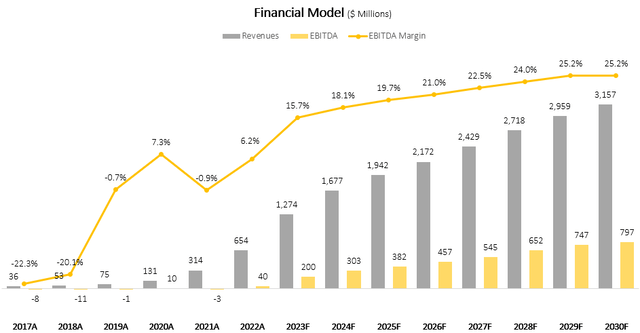

I used a discounted cash flow methodology to evaluate Celsius’ fair value. I assume the company will grow revenues at a CAGR of 13.8% between 2023-2030, based on the energy market growth rates, its ability to continue to take market share, and the upcoming international expansion.

I project EBITDA margins to increase incrementally up to 25.2% in 2030, primarily due to economies of scale which will result in a decrease of SG&A as a percentage of sales.

Created and calculated by the author based on Celsius financial reports and the author’s projections

Taking a WACC of 9.0% and adding Celsius’ net cash position, I estimate the company’s fair value at $13.0B or $169.60 per share. I want to state clearly, Celsius should be considered only as a long-term investment, and I don’t expect it to reach my price target in the near term. However, I do believe the company’s growth story, if it plays out, and I believe it will, could result in great returns for investors, even at the current valuation.

Risks

Despite its very compelling growth story, Celsius is a little too expensive for me at current levels. We need to assume a 10 percentage points operating margin expansion, and a double-digit annual growth rate, to achieve a decent upside. While I do believe those assumptions are very reasonable, I wouldn’t necessarily deem them as conservative. It seems that the market is already pricing in huge success, while we are very far from it actually occurring. That is usually a recipe for disappointment.

The energy market has been in a major uptrend for the last couple of decades, which is projected to continue. However, it’s still a niche market, which doesn’t appeal to the entire population, unlike other beverage categories like soda. Personally, I’m not a huge energy drinker, even though I work out and try to maintain a healthy, active, lifestyle. I think there’s always a risk of change in consumer preferences, and energy is clearly a non-essential category.

Another thing to keep in mind is the company’s dependency on PepsiCo. While the two companies have a two-decade commitment to each other before either party gets a right to terminate the partnership, and PepsiCo’s management is very satisfied with the relations, the fact that the company’s entire distribution chain is reliant on another company definitely portrays a risk.

Two other points we have to address are some of the company’s legal disputes. First, it’s under investigation by the SEC, but we don’t really have any detail about that. It’s been ongoing for over two years and isn’t considered material to its operations. Second, there’s the Flo Rida dispute, which made headlines in January, as the rapper won a jury trial that awarded him $82.6M compensation. The company plans to appeal the deal and claims it is highly unlikely that the rapper will get anywhere close to that. Rather, they claim if he deserves compensation, it should be in the amount of $2.1M. We’ll have to wait and see how those develop.

Conclusion

Celsius has one of the most compelling growth trajectories in the entire market, fueled by a partnership and distribution agreement with PepsiCo. Celsius is greatly positioned to capitalize on the fastest-growing segment in the beverage market, and it’s still in the very early innings of its U.S. and international expansion.

I find that even after the 68.2% surge in the past year, there’s still room for upside. However, I believe that the investment is very risky, with a lot of unknowns. Furthermore, I don’t believe that most of the upside will be generated over the longer term, as the current price already reflects the near-term opportunities.

To conclude, I rate the stock a Buy, with a price target of $169.60 per share.

Read the full article here