Investment thesis

Aris Water Solutions (NYSE:ARIS) was a hot stock last month with an almost 20% rally and that was the reason it grabbed my attention. But, after my in-depth analysis, I cannot conclude that it is a “Buy”. Despite the strong momentum in revenue growth, the costs side still suffers from the unprecedented inflation of 2022, which still echoes the company this year. As a result, the company is losing its solid revenue momentum and is unable to demonstrate profitability expansion in this favorable environment for top-line growth. I also do not like the valuation considering the substantial net debt position. Thus, I assign the stock a “Hold” rating.

Company information

Aris Water Solutions delivers full-cycle water handling and recycling solutions to reduce energy companies’ water and carbon footprints. The company’s integrated pipelines and related infrastructure provides comprehensive water management, recycling, and supply solutions to operators in the core areas of the Permian Basin.

ARIS’s fiscal year ends on December 31 with a sole operating segment. There are two primary revenue streams: Produced Water Handling and Water Solutions. According to the latest 10-K report, in FY 2022, Produced Water Handling’s revenue comprised about 76% of the total.

Financials

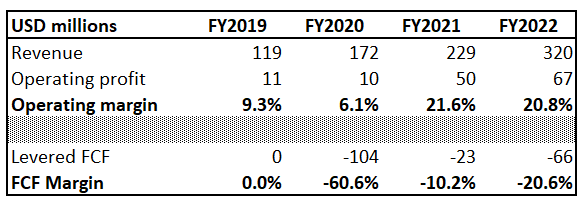

Aris Water Solutions went public in 2021. Therefore, we do not have much historical financial information to analyze long-term trends. Revenue grew with an impressive 39% CAGR since 2019 and the operating margin expanded notably, from 9% to almost 21%.

Author’s calculations

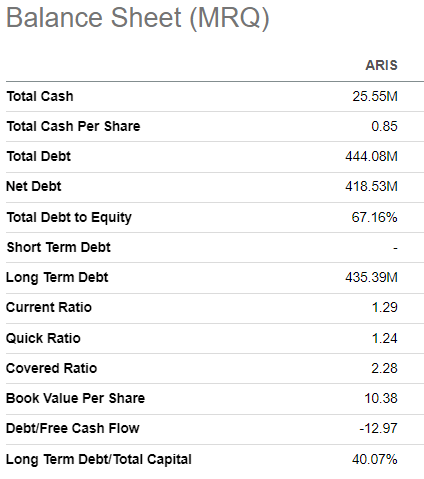

The company is in a substantial net debt position of about $420 million. This is substantial and represents about 70% of the market cap. For a company not yet generating significant free cash flow, this is a risk and I am not comfortable with the covered ratio.

Seeking Alpha

The latest quarterly earnings were released on May 8. The company smashed consensus estimates. Revenue grew 29% YoY, though the EPS was flat at $0.17. The operating income did not grow as well.

Seeking Alpha

As the management explained during the earnings call, the company continues to face the unprecedented inflation of 2022. While we see that the inflation tempered this year, prices still did not go down. The management said it’s focused on cost-optimization initiatives, but the inflationary pressure is still a big challenge. According to the management, cost-optimization initiatives mainly include improving and streamlining the internal operating processes.

The good news is that some customers have forecasted additional volumes to come online in the second half of 2023 and early 2024. Overall, the management expects that the demand for high-capacity water management solutions will expand.

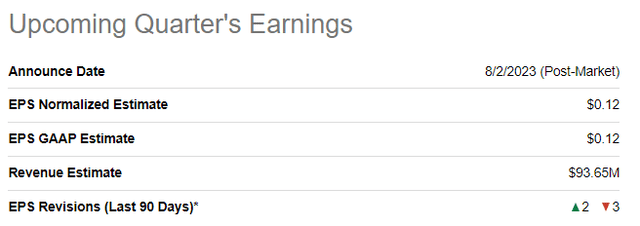

The upcoming earnings release is scheduled on August 2. Revenue growth is expected to decelerate but still be above 20%. The red flag to me is that the adjusted EPS is projected to shrink from $0.15 to $0.12. Profitability metrics should expand, or at least stay flat, as the business scales up, otherwise, there is no point in scaling up.

Seeking Alpha

To conclude, since ARIS is a relatively young company, there is still a lot of instability and uncertainty related to its financial performance. It is good that revenue demonstrates consistent above 20% YoY increases, but when it happens I want to see improvement in profitability metrics. I also consider the balance sheet weak, especially given the volatile free cash flows. I think that despite the year-to-date decline in oil and gas prices, the industry is still in the favorable phase of the secular cycle line. That said, prospects for ARIS’s revenue growth look bright because I do not expect oil and gas companies to cut their water management spending since it is an insignificant part of their budgets. But the inflationary pressure is still in place and we see that this significantly affects the company’s profitability, not letting it expand margins as the business scales up.

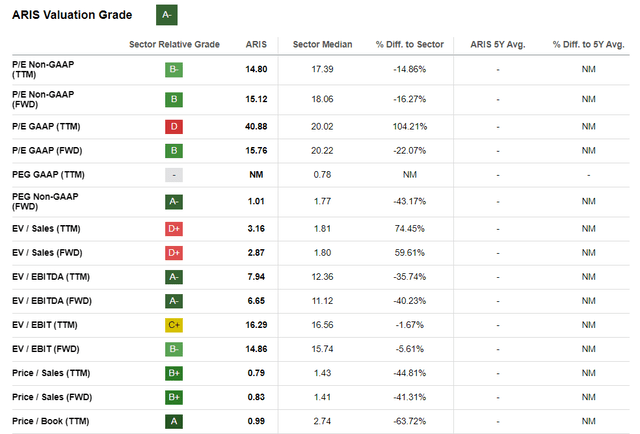

Valuation

The stock price declined 23% year-to-date, significantly underperforming the broad market. ARIS has a relatively high “A-” valuation grade from Seeking Alpha Quant, thanks to the multiples, which are mostly lower than the sector median. This might indicate undervaluation.

Seeking Alpha

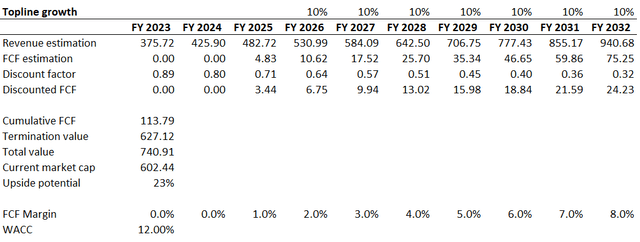

I want to proceed with my valuation analysis with the discounted cash flow [DCF] approach. I use a 12% WACC given the company’s relatively small scale and volatility in the FCF margin. I have earnings consensus estimates projecting a double-digit revenue growth over the next three years. For the years beyond, I have implemented a 10% revenue CAGR. I expect the FCF margin to be positive starting from FY 2025 and expand by one percentage point yearly.

Author’s calculations

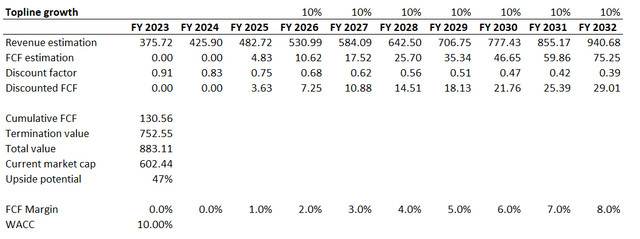

The valuation might look attractive due to the 23% upside potential, but we should not forget the substantial net debt position above $400 million. Therefore, I cannot say that the stock is attractively valued. ARIS bulls might argue that a 12% WACC is unfair, but even if I implement a 10% WACC, it does not help much.

Author’s calculations

As you can see, the gap between the fair value of future cash flows and the current market cap is still lower than the company’s net debt position. To conclude, the valuation does not look attractive to me.

Risks to consider

The company is highly dependent on the spending of the operators conducting business in the Permian Basin. Reductions in customers’ spending could significantly adversely impact ARIS’s earnings. The revenues of the company are highly reliant on cycles in the oil and gas industry, including commodity prices which directly affect the free cash flows of energy companies. ARIS has no power to control customers’ budget allocation decisions, and reducing spending is at their discretion.

The industry is highly competitive and the risk of losing market share is significant. According to the company’s latest 10-K report, some of the competitors have greater resources and geographic scope than ARIS. There is also an elevated risk that customers themselves might develop their in-house water management services.

The company also faces a substantial concentration risk. During FY 2022, the three largest customers accounted for about 57% of the total sales. Any adverse developments affecting these three customers will highly likely lead to a reduction in spending on ARIS’s services. That said, securing and maintaining strong business relationships with these customers is a crucial task for the business.

Bottom line

To conclude, ARIS is a “Hold”. The revenue growth momentum is strong, but the company’s bottom line faces intense inflationary pressure despite general inflation easing in 2023. Moreover, I am not comfortable with a substantial net debt position, especially given the instability of the FCF. The valuation also does not look attractive to me.

Read the full article here