Introduction

Farmers National Banc Corp (NASDAQ:FMNB) has a broad set of offers for customers, spanning from retirement consulting to insurance. It has been one of the most consistently solid regional banks I have seen. They have for 161 quarters in a row been profitable. The last quarter showed the company buyback a significant amount of the shares outing, 2.2% to be exact. A dividend yield of 5% and a valuation that is in my opinion quite low given the quality and fundamentals of FMNB.

I find the business to have a very bright future going forward and whilst serving an important group of people, farmers, they are also building value for investors. FMNB has very successfully faced challenges and remains well-positioned to grow further. For investors seeking a solid dividend income addition, then FMNB ticks all those boxes, I think.

Company Structure

Operational since 1887 FMNB has a rich history of supporting its local communities in Ohio and Pennsylvania where they have 65 banking locations in total. Since its start, the company has grown its wealth management assets under care to $3.1 billion in total. FMNB has been solid in terms of leveraging this and boasts a 13.49% ROE in the last 12 months.

Summarizing what FMNB does could be something along the lines of it being a company that operates as a bank holding company that is helping its local communities with banking services, and commercial and mortgage installments. Besides that, they also help with financial management businesses.

Growth Vision (Earnings Presentation)

FMNB has a very ambitious outlook for the business where they aim to expand further through acquisitions and grow their noninterest incomes. In terms of gross loans for FMNB the last 10 years it has grown an impressive 18.19% yearly. That has meant strong growth for the company and helped them establish a solid dividend yield for investors. Going forward investors should expect explosive growth, but rather consistently solid results from a company with a proven management team able to execute efficiently in the difficult market environment.

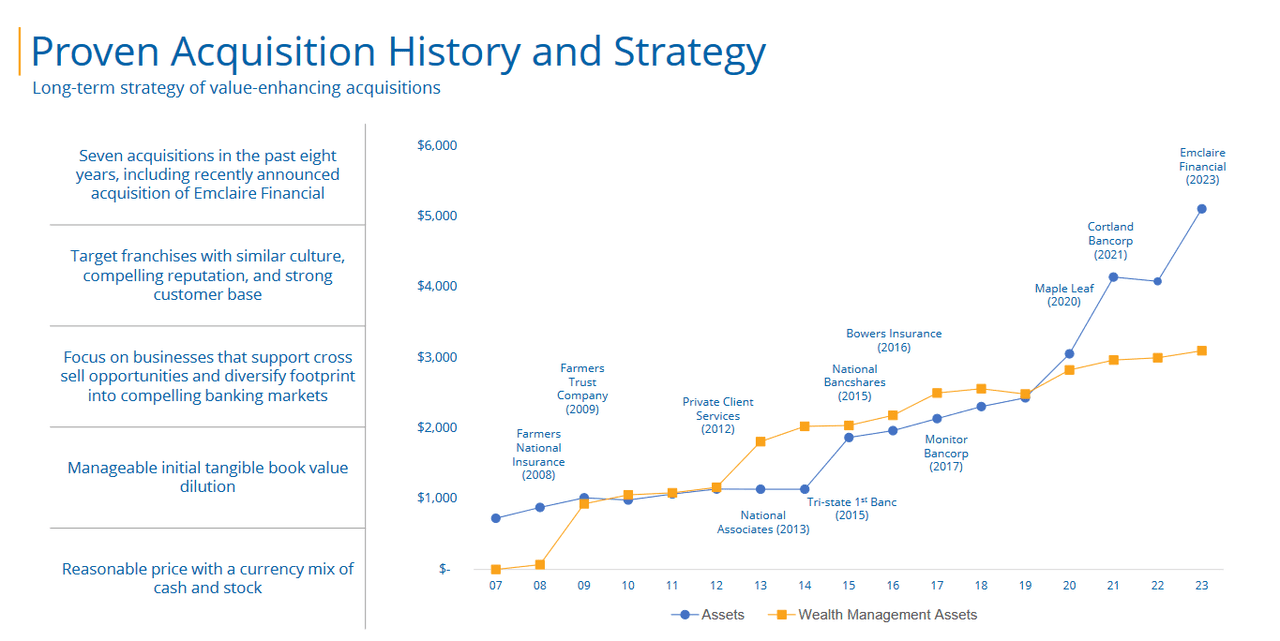

Acquisition History (Earnings Presentation)

Besides growing its wealth management assets, FMNB has been very active in growing through acquisitions as well. Most recently the company completed a merger with Emclaire. This marks the seventh acquisition from FMNB in the last 7 years, an impressive feat that has helped them grow the way they have. The addition helped FMNB reach $5 billion in banking assets and $2.9 billion in wealth management assets. What FMNB is looking for in new acquisitions is primarily similar business models that are easier to integrate into their structure and begin growing straight away.

Fundamentals

The fundamentals of FMNB remain in my opinion incredibly strong as they grow their deposit base efficiently from acquisitions.

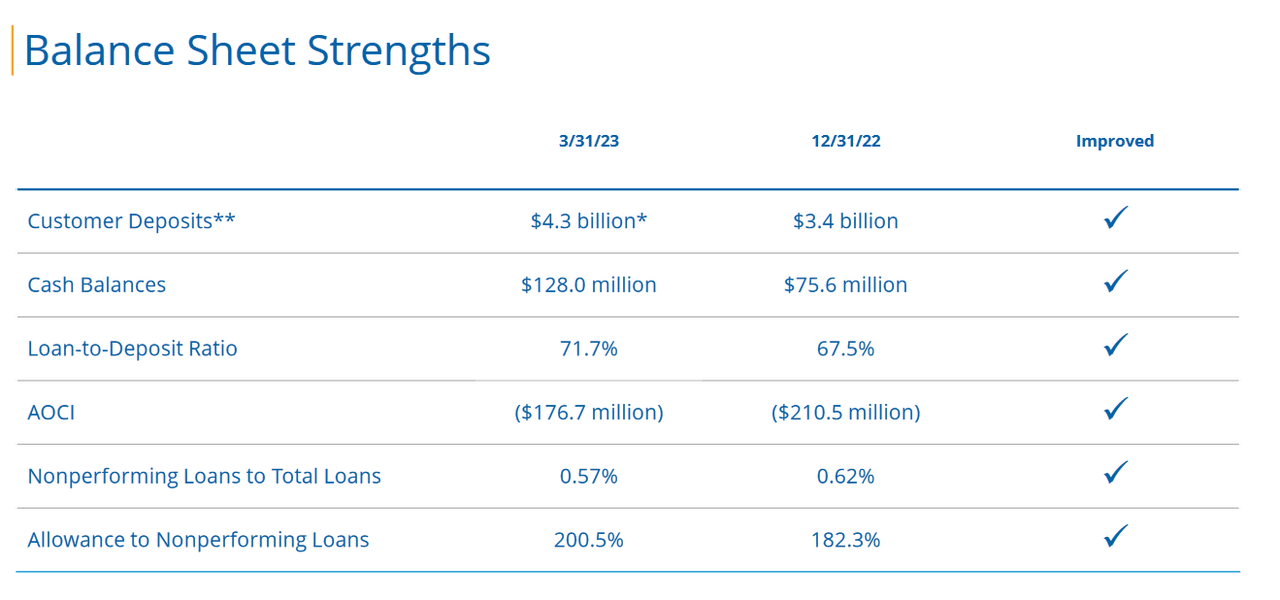

Balance Sheet (Earnings Presentation)

FMNB has been able to improve on many remarks and now boasts $4.3 billion in total customer deposits. This has also developed into a loan-to-deposit ratio of 71.7% and when viewing the efficiency ratio it’s at 56% when dividing the total noninterest expense by the revenues. This is a very healthy point to be at and proves that FMNB has been able to leverage its position and yield solid earnings given what they have. Historically FMNB has had a quite high ROE which sits at 13.49% right now, just 1% below the 5-year average.

Earnings Transcript

From the previous report by FMNB on April 26 the CEO Kevin J. Helmick had some valuable insight on the environment they are in right now.

-

“As volatility within the macro-economic environment has increased, we have remained focused on serving our retail, commercial, and wealth customers, controlling expenses, and managing capital levels. In addition, we continue to allocate capital to support our dividend policy and share repurchase program”

These remarks highlight some of the priorities that have FMNB so successful in its many years of operating.

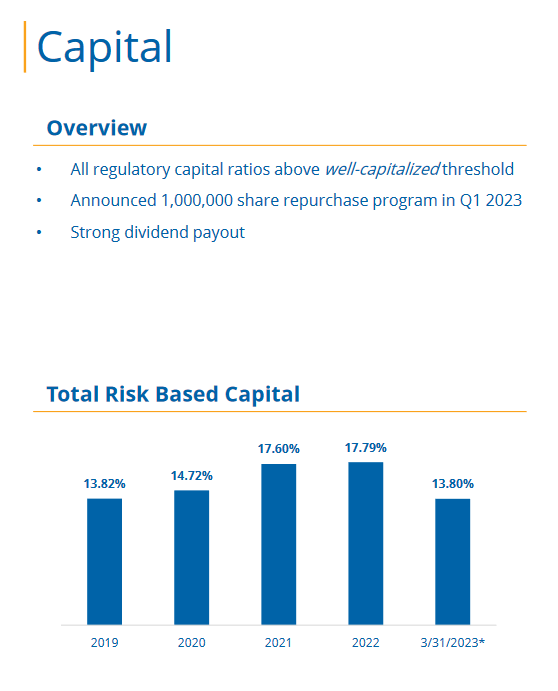

Risk Capital (Investor Presentation)

FMNB remains consistent in growing its dividend and pushing shares. The announcement of buying 1 million shares from the Q1 report would be valued at around $13 million. This would reduce shares outstanding by an additional 2.6%. With the dividend growing 20% in the last 5 years yearly the investor’s potential return here is very good.

Upcoming Earnings

We aren’t far off from the Q2 report for FMNB and I remain confident to keep a buy rating up until the report. Sometimes, maintaining confidence in stock up until earnings is crucial for short-medium-term gains. I find it very likely that the share price might if we see a beat on both the top and bottom lines. The JPM report that came out not long ago had a similar effect.

Estimates are suggesting that FMNB will have an EPS of $0.41 for the quarter, representing strong QoQ growth. I lean towards them beating estimates actually seeing as we have higher rates and these have been shown to very positively affect the sector’s earnings, as highlighted in the JPM report. In terms of ROE, I expect them to inch ever so higher again, reaching above their TTM of 13.49%. Besides the results and expectations I have for the quarter, I think some announcements about dividends will be very appreciated by investors. A raise as earnings results are strong will certainly help in the possibility of the share price jumping. As far as I am concerned, FMNB has proven itself very capable of growing, and not maintaining a buy rating up until earnings seem like a mistake.

Valuation & Comparison

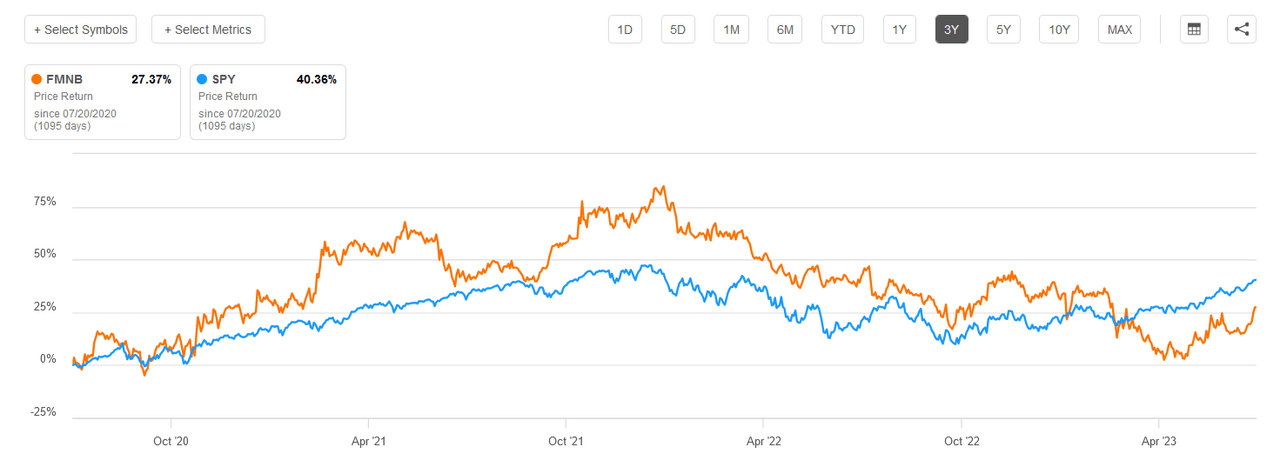

Share Growth (Seeking Alpha)

The historical price performance of FMNB has not been that impressive when comparing it to SPY. Up just 27% in the last 3 years, whilst the SPY is up 40%. But this of course isn’t including the dividend and then the decrease looks a little less bad. What makes FMNB still appealing though is as a dividend income addition to a portfolio. With a solid history of profitability, investors feel more assured that FMNB will continue benign and able to disturb a dividend and buy back shares. Besides, FMNB is also trading 10% below the sectors, which might be caused by the size of the business and the relatively low deposit size when compared to other banks. Nonetheless, this just makes the margin of safety larger in my view.

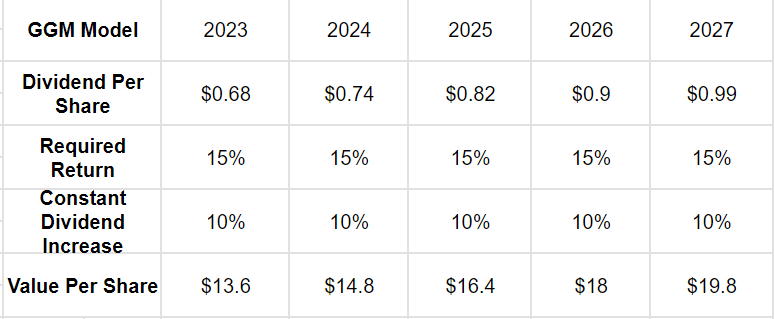

GGM Model (My Own Model)

Above here is a GGM model looking at where a good entry point for FMNB might be, it just so happens that we are essentially sitting at the preferred price target of 2023 right now of $13.6 per share. This would ensure a rate of return of 15% as we are also expecting a constant dividend increase of 10%. This is half of what the last 5 years have been, but being cautious ad not too optimistic about dividend growth is very wise in my opinion. As the share price is trading at or slightly below the target price for 2023 I feel comfortable rating it a buy now.

Investor Takeaway

For investors seeking a dividend income company that has a solid asset base that has been growing steadily, then FMNB should be up there with other considerations. The company operates as a bank lending company and has netted a ROE above 13%. Besides this, they are buying back shares at a fast rate, 2.2% in the last quarter alone. This together with a significant dividend increase each year makes FMNB a fantastic opportunity. I am rating it a buy, especially as my model concluded it is at a good entry price, and it’s also 10% below the sector’s average P/E.

Read the full article here