The Universal Investment Thesis Remains Robust Here

Comcast (NASDAQ:CMCSA) has outperformed this year indeed, with The Super Mario Bros. Movie already generating $1.34B in box office by mid July 2023, easily the only film to “cross the billion-dollar mark” globally this year so far.

This feat is impressive indeed, and many other films haven’t been able to accomplish this, such as Disney’s (DIS) Guardians of the Galaxy Vol. 3 at $843M, Lions Gate Entertainment’s (NYSE:LGF.A) (NYSE:LGF.B) John Wick: Chapter 4 at $426.9M, and Paramount Global’s (NASDAQ:PARA) Transformers: Rise of the Beasts at $420.9M.

While many more exciting movies may be released in H2’23, such as PARA’s Mission: Impossible – Dead Reckoning Part One and Warner Bros. Discovery’s (NASDAQ:WBD) Aquaman And The Lost Kingdom, it remains to be seen if these may be able to break Mario’s record thus far.

Most importantly, CMCSA’s Mario movie is produced on a tight $100M budget, suggesting a rich profitability in FQ2’23, likely to smash the consensus revenue estimates of $30.15B (+1.5% QoQ/ inline YoY) and adj EPS of $0.98 (+6.5% QoQ/ -2.9% YoY).

While it is uncertain if any of CMCSA’s H2’23 releases may achieve the same success, we are already encouraged by the accretive effect Mario will have on its FY2023 performance, with FQ1’23 already bringing forth improved studio EBITDA margins of 9.3% (+3.5 points QoQ/ +0.9 YoY).

CMCSA’s theme parks appear to be doing well too, with an adj EBITDA of $658M (-15.8% QoQ/ +45.8% YoY) and adj EBITDA margin of 33.7% (-3.2 points QoQ/ +4.8 YoY) in the latest quarter, compared to DIS’s adj EBITDA margin of 27.9% (-7 points QoQ/ +1.6 YoY).

Perhaps this has to do with Universal Studio’s increased popularity, already nearing, or potentially even surpassing, pre-pandemic attendance levels.

For example, CMCSA’s Universal Studios Florida reported 10.75M visitors in 2022 (+19.7% YoY), compared to 10.92M in 2019. Islands of Adventure smashed expectations with 11.02M visitors in 2022 (+21.4% YoY) as well, exceeding 2019 visitors of 10.37M.

Therefore, while DIS’s Magic Kingdom may still record the top spot with 17.13M visitors in 2022 (+34.9% YoY), that number is still shy of the 20.96M reported in 2019, with all of its parks have yet to return to pre-pandemic attendance levels.

While some of the shortfall may be attributed to the reduced international travel and Chinese tourists, it appears that CMCSA’s Universal Studios does not suffer from the same malaise, despite the supposedly tightened discretionary spending from the peak recessionary fears.

This is impressive in our opinion, especially since the management is launching a new park by 2025, doubling its footprint in Orlando, Florida, while offering new rides and attractions, to the excitement of many fans.

With DIS still locked in legal battle with the state’s governor, Ron DeSantis, and the newly appointed board likely to scrutinize any new developments, it seems unlikely that CMCSA may face as much additional theme park competition over the next few years.

So, Is CMCSA Stock A Buy, Sell, or Hold?

For now, CMCSA’s valuation continues to be moderated to a NTM EV/ EBITDA of 7.47x, compared to its 3Y mean of 8.60x and 3Y pre-pandemic mean of 8.18x.

Based on the market analysts’ FY2025 adj EBITDA projection of $39.24B and its latest shares outstanding of 4.22B, we are looking at an approximate $9.29 in adj EBITDA per share, triggering a long-term price target of $69.39.

This suggests a more than excellent upside potential of +62.2% from CMCSA’s current levels, otherwise, an impressive +80.8% to $75.99, based on its normalized valuations.

These numbers are not overly ambitious in our opinion, since the stock trades comfortably near its media peers median EV/ EBITDA valuation of 7.62x and mean of 9.86x, with the former expected to return to pre-pandemic EBITDA margins of 31.4% by FY2024.

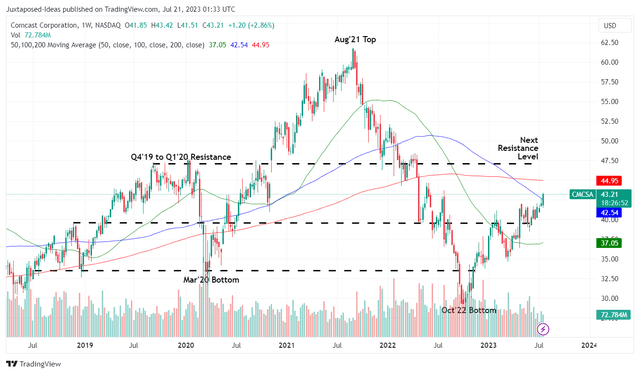

CMCSA 5Y Stock Price

Trading View

For now, those lofty goals are near CMCSA’s previous August 2021 top, implying that the stock may need to break through multiple resistance levels over the next two years.

However, with the stock appearing to be well-supported at $40, we believe investors may initiate a small position here, due to the highly attractive risk reward ratio.

To put a cherry on top of the cake, CMCSA consistently pays out an annualized dividend of $1.16 at the moment, suggesting a decent 2.76% forward yield based on current prices, compared to its 4Y average of 2.20%, though lagging behind the sector median of 3.24%.

Due to these promising developments, we are rating the CMCSA stock as a Buy here.

Naturally, interested investors must note that its D2C streaming, Peacock, continues to be unprofitable despite the expanding subscriber base to 22M (+10% QoQ/ +69.2% YoY) by the latest quarter.

With many other streaming services encountering the same D2C profitability issues, except for the market leader, Netflix (NFLX), we believe that the next two years may bring forth potential consolidation events, triggering moderate volatility for CMCSA.

Combined with the elevated interest rate environment, naturally increasing the media company’s interest expenses to an annualized sum of $4.04B (+3.6% QoQ/ +1.7% YoY) thanks to its elevated long-term debts of $94.4B (-2% QoQ/ -3.2% YoY), investors may want to calibrate their expectations and be patient during this uncertain macroeconomic outlook.

However, we remain highly optimistic about CMCSA’s long-term prospects, due to the growing annualized Free Cash Flow generation of $17.88B (+102.2% QoQ/ -14.8% YoY) and FCF margin of 15.1% in the latest quarter, compared to FY2019 levels of $14.62B and 13.4%, respectively.

This cadence suggests that its dividend payout remains more than safe, despite the high capex business model and the $12.8B of debts due through FY2025.

Read the full article here