Last month, I looked at the ONEOK (NYSE:OKE) – Magellan Midstream (MMP) pending merger from the side of MMP, and thought that MMP unitholders should reject the deal. One of the main reasons behind this was the huge potential tax consequences for many of the investors in the stock. Today, I want to look at the deal from the OKE perspective, and company I last looked at in March.

ONEOK Company Profile

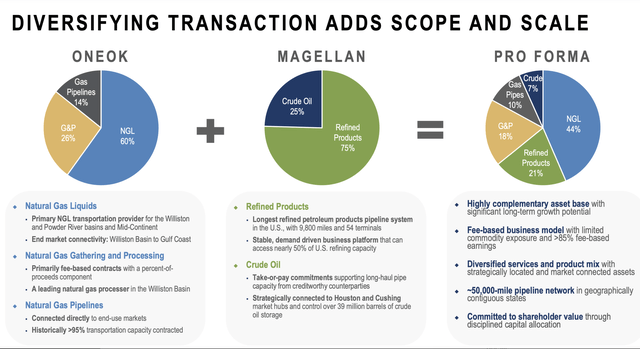

OKE is an integrated midstream operator that owns approximately 40,000 miles of natural gas and natural gas liquids (NGL) pipelines. Its Natural Gas Liquids (NGL) segment is forecast to represent about 60% of its 2023 EBITDA, with over 90% of the segment’s earnings being fee-based. OKE’s Natural Gas Gathering & Processing segment is projected to be about 25% of its 2023. At just over 10% of its 2023 EBITDA, OKE’s Natural Gas Pipeline segment is its smallest. OKE’s contracts are largely fee-based.

Magellan Company Profile

MMP, one the other hand, is focused on the transport, storage, and distribution of refined products and crude oil. Nearly a quarter of its business is refined products, and the rest crude oil. The company has the largest refined petroleum products pipeline system in the U.S. MMP’s contracts are largely fee based, with about 85% of its operating income coming from fee-based activities. Its tariffs, meanwhile, are generally tied to PPI or other market factors.

Company Presentation

Merger

As a reminder, OKE agreed to purchase MMP in mid-May in a deal valued at $18.8 billion, including debt, at the time. OKE is paying for the deal with a combination of stock (0.667 OKE share to 1 MMP unit) and cash ($25 per unit). The deal was a 22% premium to MMP’s closing price before the deal was announced as well as to its 20-day VWAP. The merger is expected to close in Q3. OKE shareholders will own 77% of the pro forma company, with MMP unitholders owning the other 23%.

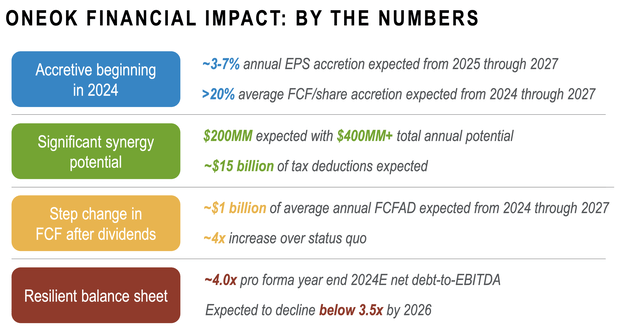

OKE is expecting $200 million in synergies from the deal. About $100 million will come from reducing G&A costs. The other half is expected to come from commercial opportunities, such as bundling services and creating a one-stop shop for customers with things like NGL and crude services. It also thinks it can get more demand pull for its NGL products, as well as gain more export expertise from MMP.

Company Presentation

Discussing the rationale of the deal at a Sanford Bernstein conference, CEO Pierce Norton said:

“So really 4 things with the strategic rationale. First is to address risk, second one is scope, the third is scale, and then the fourth one is opportunities. So I’ll kind of go through each one of those. As it relates to risk, if you look at the portfolio of what ONEOK had today, it became apparent to us that we would like to diversify our portfolio to get a little bit more balanced approach. … And as far as scope goes, if you look at our natural gas business, we supply the needs of residential, industrial, commercial and electric generation customers. But what this does is it introduces the transportation piece. …. And with our NGL business, we’re supplying the needs of the pet chem industries, which can either go here in the United States or anywhere in the world to basically increase the quality of life. And then scale, we do think that scale does matter. I think when the rating agencies came out and immediately said, okay, we’re going to basically give you a stable rating when you basically issued $5 billion as far as to pay for the cash for us in this thing, that was meaningful to us. And so that just demonstrated that the size of your company does matter going forward and the resiliency.”

Now the deal does certainly increase OKE’s diversity and makes it a larger company. The two companies are involved in completely different products, so on that front it will gain diversity.

Generally when companies make acquisitions in the midstream space, it is done for several reasons. One is because the assets are complementary, and perhaps as part of a system there are worth more together. For OKE-MMP, this would only be moderately true, since they are serving different products. Sure, offering three-stream gathering service (crude, gas, water) has some appeal, but MMP is still mostly a refined pipeline operator.

I know some companies don’t even find gathering crude and natural gas in the same basin as being that synergistic. When speaking to Crestwood (CEQP) management a few years ago, I know they only had minimal interest in bidding for the oil gathering dedication that came up for sale after it already had the natural gas dedication in the Powder River Basin. If the synergies were there, they surely would have been able to be the highest bidder.

Growth is another big reason midstream companies will do a deal, but MMP is not a growth company. In fact, since Covid hit, MMP has had trouble finding a lot of meaningful growth projects. The company only spend about $100 million in growth capital the past two years, and planned to bump it up to $150 million this year. Under the OKE umbrella, I don’t foresee a lot of new growth opportunities suddenly appearing.

Meanwhile, with the rise of EVs, refined products is one area in the midstream space where investors seem the most worried about. Given MMP’s lack of growth capex in recent years and management agreeing to sell the company to OKE, perhaps they share a similar worry about the longer-term outlook for the refined product space.

Finally, a midstream company could do a deal to deleverage. However, with the acquisition, leverage is expected to rise from 3.5x to 4.0x. Now given MMP’s strong coverage ration OKE may have a little more room to grow the distribution by lowering its coverage ratio a bit, but that in and of itself isn’t a great reason to do the deal.

Valuation

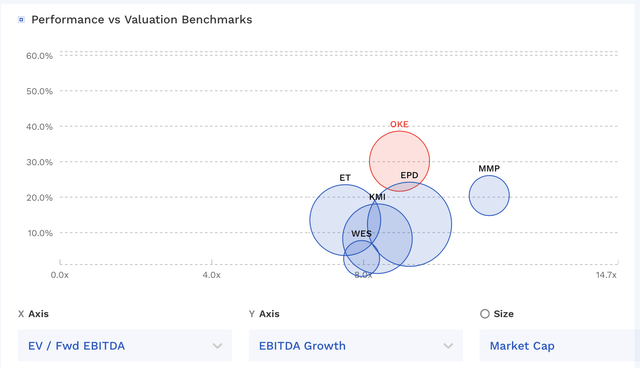

OKE trades at 9x the 2023 EBITDA consensus of $4.6 billion. For 2024, it trades at 9.9x the 2024 EBITDA consensus of $4.2 billion.

It has 2023 FCF yield of 8.4%, and a dividend yield of 5.8%.

MMP, meanwhile, trades at 11.4x the 2023 EBITDA consensus of $1.54 billion. For 2024, it trades at 11.1x the 2024 EBITDA consensus of $1.58 billion.

It has 2023 FCF yield of 8.6%, and a distribution yield of 6.4%.

Both stocks trade towards the higher end of midstream valuations, with MMP now among the highest after the deal was announced.

OKE Valuation Vs Peers (FinBox)

OKE Insider Buying

For their part, OKE’s CEO seems to be excited about the deal, and he was out buying shares as soon as he legally able to following the expiration of the Hart-Scott-Rodino Antitrust Improvements Act. Norton laid out $1.5M to buy shares at $60.96. Director Brian Derksen also picked up $292,000 worth of shares as well.

The purchase by Norton is the first since he was buyer last June at $55.50, when he bought nearly $500,000 worth of shares. No other insiders have bought between these two purchases by Norton and Derksen.

Norton had 13,400 RSUs vest on June 28th, and yet he still made a large open market purchase showing his conviction.

While I do not love the deal, I do give a lot of credit to Norton for putting his money where his mouth is. It is very refreshing to see from the C-suite.

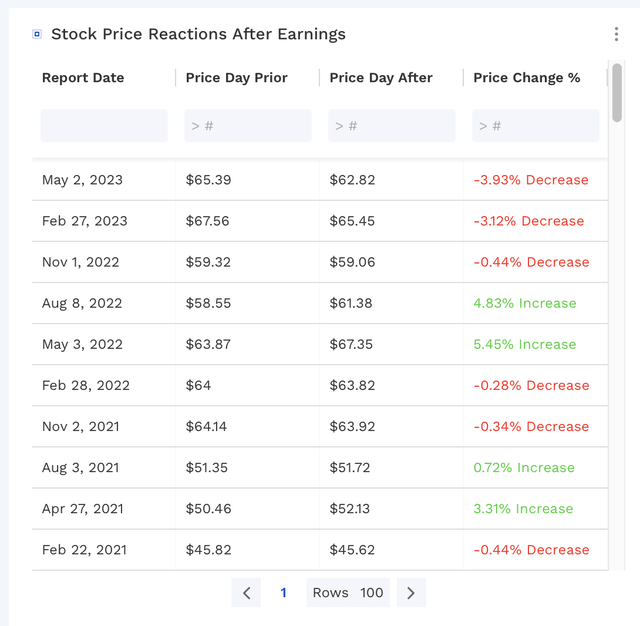

OKE Earnings Preview

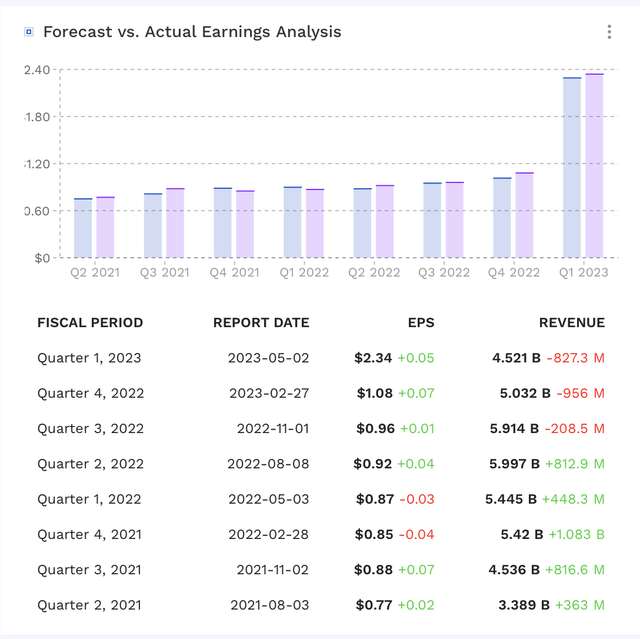

OKE will report earnings in early August. While midstream stocks don’t tend to make big moves following their earnings, OKE has seen its stock dip over -3% the last two times it has reported results. It’s also seen increases of 4.8% and 5.5% several quarters ago, so OKE does show a little more volatility than most midstream companies.

FinBox

The company has beaten EPS estimate 6 of the past 8 quarters. On the revenue side, it has beaten 5 of the past 8 quarters of the past two years, but missed the past 3 quarters. Do to the pass-through nature of their businesses, though, I don’t view revenue as a good metric for midstream companies.

FinBox

Q2 EPS estimates have held pretty steady since March, although are down nearly 3% from a year ago.

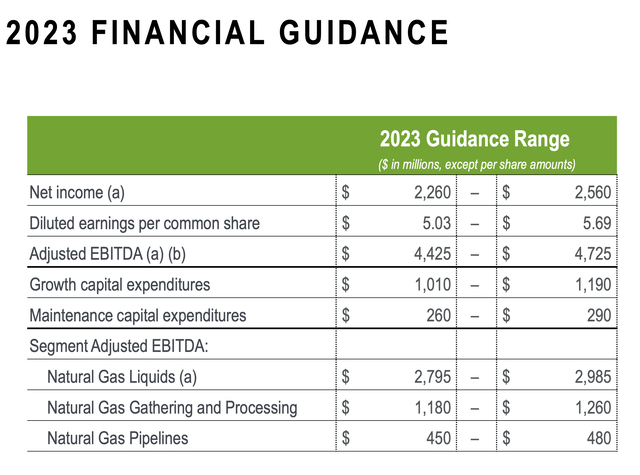

OKE did not provide Q2 guidance when it reported Q1 results, but it did reaffirm its full-year guidance, as seen in the chart below.

Company Presentation

Overall, I’m expecting a solid quarter from OKE, as volumes pick up in the Bakken. Harsh winter weather has impacted the basin the last two quarters, and I expect that many producers have been looking to complete the bulk of their wells in the basin in Q2 and Q3. This is mostly a timing issue, and one of the reasons behind the stock’s weak performance the past two quarters. Given that this was mostly a timing issue, expect a positive shift to happen for OKE.

Merger Conclusion

Right now, OKE is paying a higher valuation for MMP than its own stock trades at, despite a lack of growth opportunities for MMP. And while I think midstream stocks are generally undervalued, it’s buying MMP at a valuation much higher than most of its peers.

I don’t get the rationale of buying a low-growth asset with minimal synergies in the midstream space. MMP is a nice stock to own because of its management’s discipline and capital allocation strategy, but it’s not the type of assets you buy to kick-start growth.

Now while natural gas and NGL focused, OKE is largely operating in oil basins, so I can see some rationale for wanting to try to get a more integrated system. I just don’t think it is worth it adding all those refined pipelines in the process and increasing leverage half a turn from 3.5x to 4.0x.

Now OKE investors don’t have to worry about the tax hit that MMP investors do, so I don’t think this investment hurts them, I just don’t think it will help the stock a whole lot over the long term. MMP investors, on the other hand, have more to be upset about.

OKE Standalone Conclusion

Without MMP in the equation, I think OKE by itself remains a “Hold.” As I noted in my original article on the company in March, OKE has been benefiting from a gassier Bakken, and I do think Q2 will be solid as noted above. However, I think Enterprise Products Partners (EPD) and Energy Transfer (ET) have better assets at similar or more attractive valuations. You can’t rate every midstream company a “Buy,” and I much prefer those two names in the midstream space.

Now OKE isn’t bad stock to hold, as it has a nice balance sheet and has been solidly managed. I also continue to believe the space is a bit undervalued.

Read the full article here