Investment Thesis

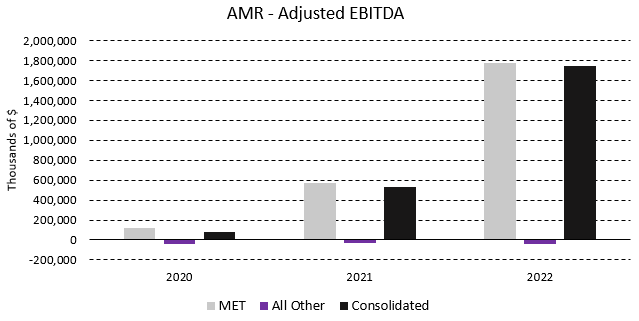

Figure 1 – Source: Data from Annual Reports

In this article, I wanted to discuss Alpha Metallurgical Resources (NYSE:AMR), where more than 100% of adjusted EBITDA comes from the metallurgical coal (“MET”) segment, even if the company has some very minor production of thermal coal as well, partly as a biproduct. Alpha is the largest metallurgical coal producer in the United States and the company accounts for just over 20% of total U.S. metallurgical coal production.

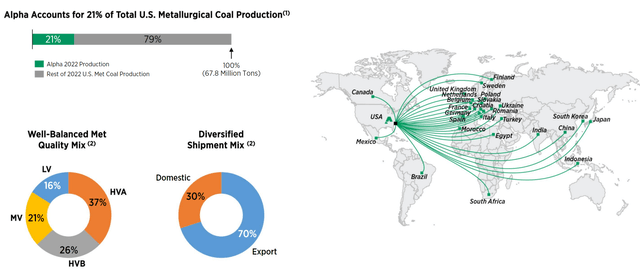

Figure 2 – Source: Alpha Metallurgical Resources Corporate Presentation

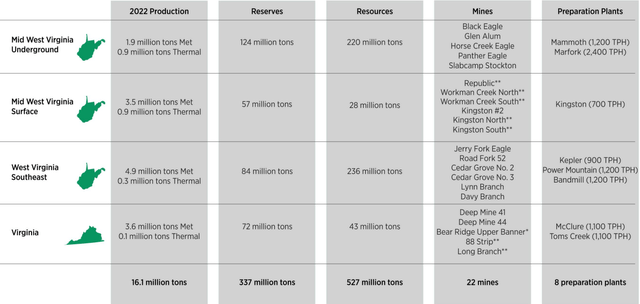

Alpha is a very well-diversified coal mining company with 22 mines in Virginia & West Virginia. The company has just under 20 years or reserves, based on the production volume in 2023, and plenty of additional resources.

Figure 3 – Source: Alpha Metallurgical Resources Corporate Presentation

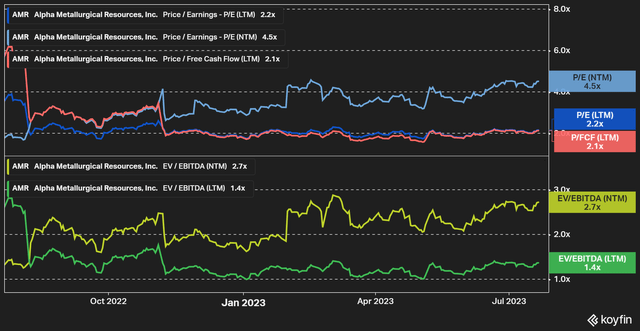

Despite Alpha’s good diversification, healthy reserves, and the fact the company is aggressively buying back its shares, we are looking at a very attractive valuation. The forward Price/Earnings ratio is presently at 4.5.

Figure 4 – Source: Koyfin

Sales, Cost, & Margin

Alpha has over the last few years sold around 16 million tons of coal per year and the mid-point of the 2023 guidance is for 17.55 million tons, so we are looking at a slight increase this year.

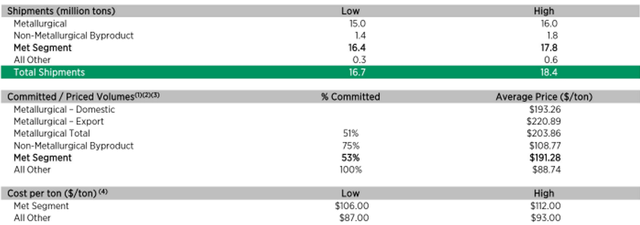

Figure 5 – Source: Alpha Metallurgical Resources Corporate Presentation

The small amount of thermal coal Alpha produces is often sold with a smaller or sometimes negative margin. So, the earnings and cash flows for the company will primarily depend on metallurgical coal sales. Alpha did in April of this year indicate that as much as 53% of the committed volume in the MET segment was fixed at a very healthy price of $191.28, while the mid-point of cost guidance in the MET segment is only at $109/t.

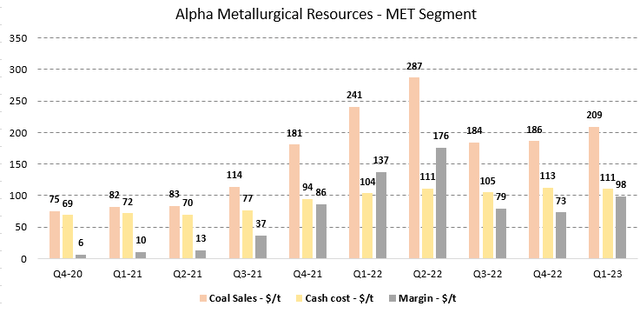

The price of coking coal is down from the more extreme levels seen during part of 2022, but we are still at a level which will allow Alpha to generate a very good margin.

Figure 6 – Source: Quarterly Reports

Quality Features

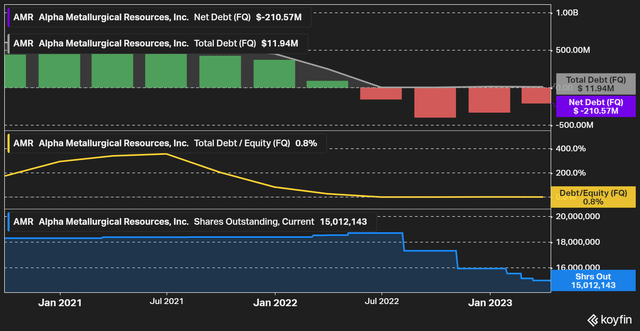

Alpha does, apart from an attractive valuation, have other quality features. The company did in March of 2023 have a net cash position of $211M, after having deleveraged aggressively over the last few years. The company is effectively debt free.

Figure 7 – Source: Koyfin

This has been achieved due to the extremely strong operating cash flow of $1.5B in 2022, but also because Alpha has kept CAPEX relatively low. The vast majority of operating cash flow has consequently been available for deleveraging and shareholder returns.

With regards to shareholder returns, Alpha has a smaller dividend payment each quarter, but has primarily used the excess cash for buybacks, and the CEO had the following to say on the topic on the most recent conference call.

But as long as the market allows, we think that the best allocation of that shareholder return program is still to repurchasing the shares.

Some investors might prefer a higher dividend over buybacks, but I tend to agree with the CEO that it would be shame not to take advantage of the current disconnect between the company’s ability to generate cash and the valuation. With that said, if we were to see another period of depressed coking coal prices, the timing and price of the buybacks might turn out to be less than ideal. However, based on what we know today and futures prices of coking coal, aggressive buybacks certainly looks like the right approach.

Valuation, Risks, & Conclusion

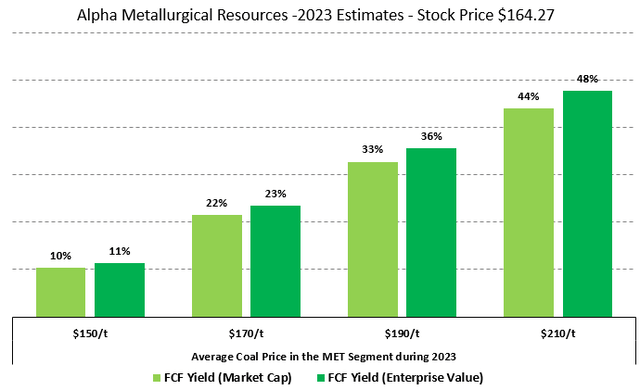

If we rely on the production, cost, and other line items the company has provided guidance for. The free cash flow yield will in 2023 look something like the chart below, depending on what realized price the company achieves in the MET segment. Where I would note, as illustrated in figure 5, that 53% of the committed sales have so far been priced at $191.28/t.

Figure 8 – Source: My Estimates based on Guidance

We are at this point tracking a 2023 free cash flow yield somewhere in the 20-30% range, where the Q2 result in early August will likely narrow that range substantially. Longer term, a re-rating is probably likely for companies focused on metallurgical coal, but even if that takes longer to materialize. A free cash flow yield of 20-30% combined with aggressive buybacks are likely to offer a strong tailwind for the share price going forward.

It is however important to remember that mining is a cyclical business, and a softer global manufacturing economy has the potential to lower the demand for steel going forward, and consequently metallurgical coal. If we were to see coking coal prices going below $150/t and remain there for a while, Alpha will be unlikely to thrive due to profitability concerns and less cash flows for buybacks.

Another potential risk factor, which is likely more pronounced with higher metallurgical coal prices and good profitability, would be a potential labor action that would disrupt operations and production for an extended period. However, Alpha has over the last year seen higher labor costs and bonuses paid to employees across the organization. So, it is not just shareholders which have been rewarded by the good operational performance lately, which should hopefully minimize the risk of potential labor actions.

Coal mining is no doubt in the crosshairs of environmental groups as well, which partly explains the lower valuation, even if thermal coal mining would be more exposed in this regard.

While I am not long Alpha today, I could certainly see myself building a position over the next few months. There are a lot of cheap coal mining stocks available to choose from, where I think Alpha is one of the better ones for anyone looking for exposure to metallurgical coal and thinks coking coal prices will remain around current levels or higher going forward. I think the risk reward is very favorable all things considered.

Read the full article here