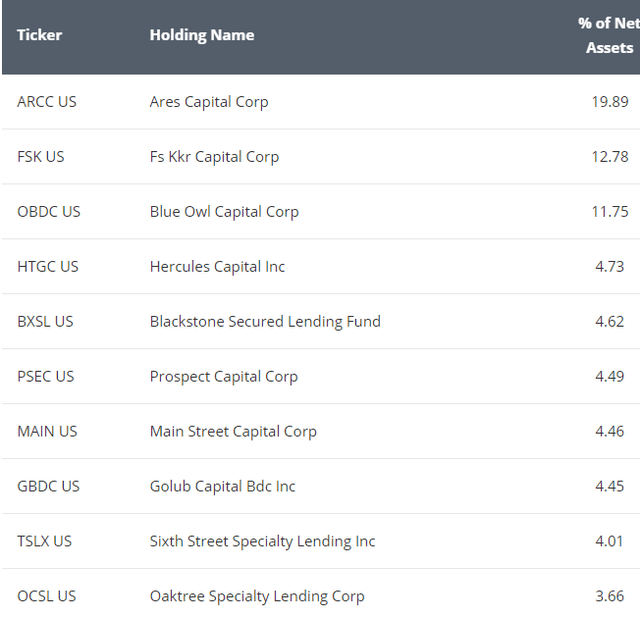

VanEck BDC Income ETF (NYSEARCA:BIZD) is an exchange-traded fund that focuses on business development stocks. The fund uses a passive index approach and its components are weighted by market cap. Since the pool of business development companies is fairly small, the fund typically has fewer than 30 stocks and top 3 stocks typically account for close to half of the weight. The fund currently has a dividend yield of 10.8% which is paid quarterly.

BIZD top 10 holdings (Vaneck)

Business development companies are rather unique and buying a business development stock is like making a bet on the state of the American economy any given time because these companies’ performance will correlate very strongly with the state of the economy. In fact, business development could be one of the most cyclical industries out there. This is why they outperform when the economy is booming and underperform while the economy is in trouble or in recession.

Business development companies can offer such high yields to investors because they typically provide loans with high interest rates to smaller companies. These sometimes include start-ups or companies that have yet to turn a profit. Some business development companies specialize in certain sectors while others are more generalist in term of industry. There are also some business development companies that are regional while others are nationwide. Generally most business development companies do a majority of their business (if not all) in the US, which is why their performances are so dependent on the performance of the overall economy.

Also since they often work with companies that don’t have the best access to credit, these companies can get in deep trouble when there is a credit crunch and lack of liquidity in the general economy. When there is excess liquidity in the system like we’ve been seeing since 2020, business development companies tend to make a lot of money with relatively low risk because there is less risk of companies being able to roll their existing debt and get access to new debt.

There are also other considerations specific to this industry. Most small businesses typically work with regional banks when obtaining credit. When regional banks in a particular region are in trouble, those companies might be inclined to use business development companies in order to obtain loans. Keep in mind that since business development companies don’t have depositors like banks do, they don’t run the risk that banks do in terms of bank runs where a large number of people try to pull their money at once and bank is having trouble meeting the cash demand. Also, business development companies are nowhere near as leveraged as banks due to their nature of business.

Investors who are invested in business development companies should also pay attention to yield curve because it can usually tell where the overall economy is headed and how credit availability conditions are going to look like in the near future. It’s not a 100% reliable sign that works every single time but it can be quite telling when yield curve signals a possibility of credit crunch not to mention many loan companies’ profitability will rely on how yield curve looks at any given time.

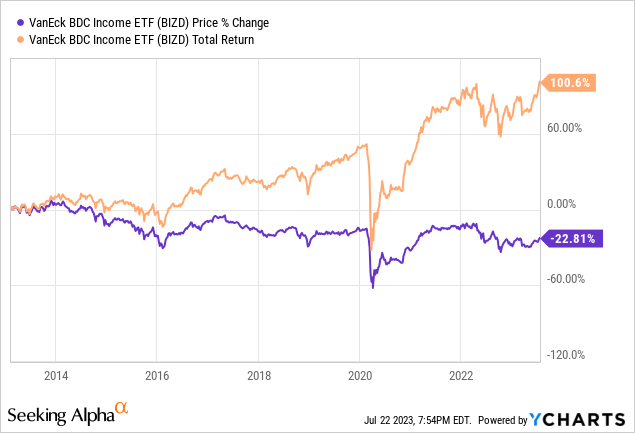

Now let’s take a closer look at the fund itself. BIZD has been around for about a decade and its share price since inception is down -22.81% but it’s total return is up 100.6% including reinvestment of its dividends. The fund generated an annual compounded return rate of 6.6% since its inception which is about 61% of its dividend yield. As I often say, if a high yield fund’s total annual return is less than half of its dividend yield, you want to avoid it because most of the money you get from dividends will go towards paying off the decay in NAV. This fund comes close but this is partially because of how fast interest rates were hiked last year by the Fed’s aggressive tightening policy.

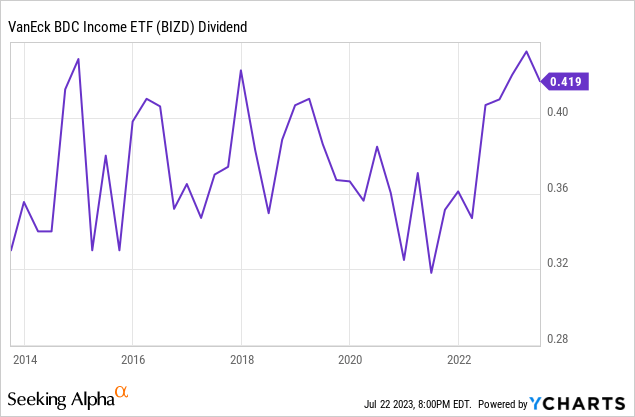

Over the years the fund’s dividend payments stayed pretty stable as its quarterly distributions often ranged from 32 cents to 40 cents per share with average around 36 cents. On the positive side, it’s been very predictable and there hasn’t been many dividend cuts like we often see with high yielding funds, on the negative side, we haven’t seen much dividend growth either.

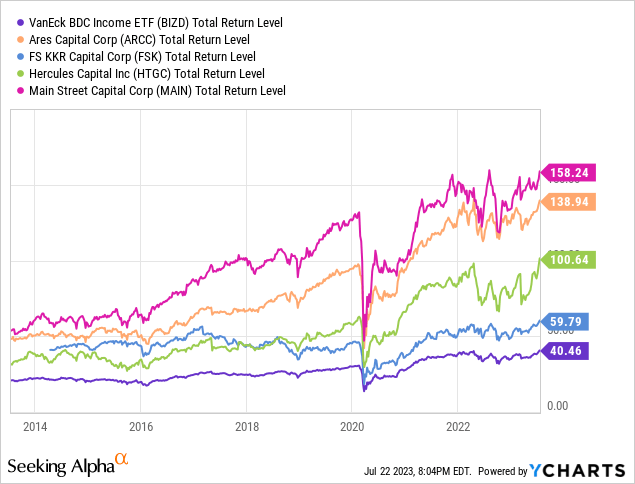

One thing I will hold against this fund is how much it underperforms some of its biggest holdings. It’s typically one of those things I’d call a red flag if a fund underperforms it’s biggest holdings by a large margin over a long period of time such as a decade. This is not a deal breaker by itself though in the absence of other red flags. S&P 500 (SPY) also underperforms it’s biggest holdings such as Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN) and Nvidia (NVDA) but this fact alone doesn’t make it a bad index to own. Still, some investors might be inclined to simply buy Main Street (MAIN), Ares Capital (ARCC) and Hercules Capital (HTGC) and call it a day and I wouldn’t argue too much against that either (except for diversification of course).

When it comes to business development companies, you have to have a lot of faith in their management and trust that they will be able to make good decisions most of the time and avoid bad decisions, especially costly ones. Since most of these companies provide debt and investments into private companies that are not publicly traded and whose debt usually has no rating from rating agencies, business development companies have to make a lot of judgment calls along the way when deciding whether to provide loans to a particular company, how much loan to provide and how much to charge in interest. You will also see a lot of companies in distress or turnaround efforts looking to get loans or investments from business development firms because they can’t get sufficient funding elsewhere under favorable conditions. This adds another risk factor for these types of investments and it becomes very important for a business development company to have a good management. Indexing provides an advantage where you don’t have to worry about management of different companies.

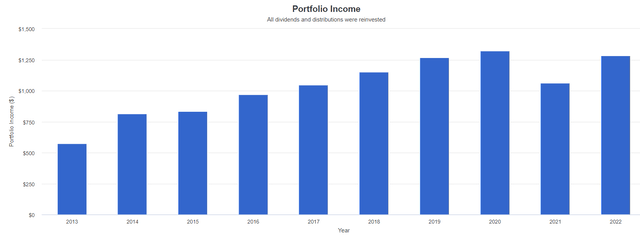

If you had invested $10k into BIZD when it launched about a decade ago and reinvested all dividends you’d be generating about $1,285 annually by now which represents a yield of 12.85% against your original investment. While this might look impressive, it’s only slightly higher than the current yield of 10.8% which means all those years of reinvestments and compounding might not be doing a lot of heavy lifting so far. Also keep in mind that this fund used to have a lower yield around 6-8% until recently and the current yield of 10.8% is actually much higher than its historical average though.

Income growth of $10k invested into BIZD including reinvestment of dividends (Portfolio Visualizer)

All in all, this is a decent fund that can generate income for you in the long run especially if you are bullish on the overall economy of the country. Don’t expect this fund to outperform in overall returns but it will generate reliable, stable and predictable income for years. On the other hand, if you are bearish on the overall economy and believe that we are headed towards a recession, you should wait until such recession comes and then buy this fund. The best time to buy a business development stock or fund is while we are in the midst of a recession and everything is on deep sale.

Read the full article here