Receive free Hedge funds updates

We’ll send you a myFT Daily Digest email rounding up the latest Hedge funds news every morning.

Not every alternative asset star of the early 2000s can match Blackstone’s journey to $1tn in assets under management. Take Och-Ziff Capital. The hedge fund was managing $27bn when it went public in 2007. It now runs $34bn.

In real terms, this is around the same amount. The business has just sold itself for $11.15 per share to Rithm Capital. That compares with a split-adjusted listing price of $320 per share.

It is painfully apt that Och-Ziff rebranded as Sculptor in 2019: stone carvers typically produce an object smaller than the one they started with.

In the past 15 years, the hedge fund model has proven shakier than private equity. Hedge funds often allow quarterly withdrawals of capital, leaving them vulnerable to investor flightiness. Tough competition has made it difficult for many previously successful hedge funds to sustain strong performance.

For Sculptor, scandal has been a further drag. It settled with US authorities for more than $400mn after it was accused of paying bribes in a number of African countries. The ignominy was so great that a name change soon followed.

Rithm, Sculptor’s buyer, is a collection of various operating businesses involved in mortgage originations and servicing rights. It is a former affiliate of Fortress Investment Group with a market worth of $5bn. The Sculptor acquisition is a bet on diversifying into managing external credit and other funds.

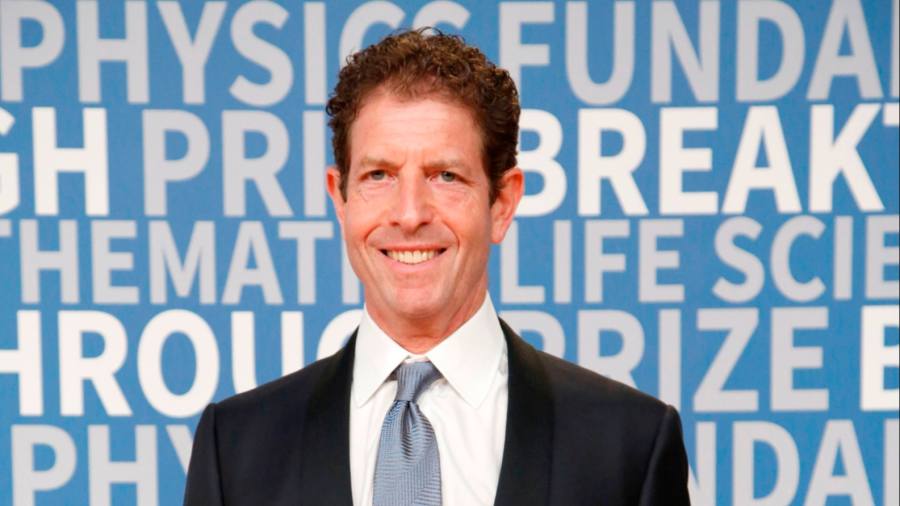

Even as Sculptor limped along in recent years, it maintained one important tradition of the private funds industry: high pay. Chief executive Jimmy Levin, who initially met founder Daniel Och as a teenage water ski instructor, was awarded an annual $127mn pay package in 2021.

A lawsuit from Och that opposed the pay deal led, in time, to the company’s decision to sell.

Private hedge funds often wind up after a finite lifespan. Endings are trickier for publicly-traded peers. But for Sculptor’s bosses, there was evident merit in having a longer period with which to scratch out their fortunes.

Read the full article here