By Tom Nelson, CFA, Head of Asset Allocation Portfolio Solutions, Franklin Templeton Solutions and Miles Sampson, CFA, Senior Research Analyst, Franklin Templeton Investment Solutions

Equity markets have rallied since October, but the Franklin Templeton Investment Solutions team thinks markets have run ahead of both current and expected growth. Learn why – and what it may mean for investors.

The “Running of the Bulls” is a tradition that occurs every summer in Spain which involves running in front of a group of bulls that have been let loose on sectioned-off streets in a town, usually as part of a summertime festival. Part of the allure is the inherent danger of this activity – poor timing and calculation could lead you to be on the wrong end of a bull horn.

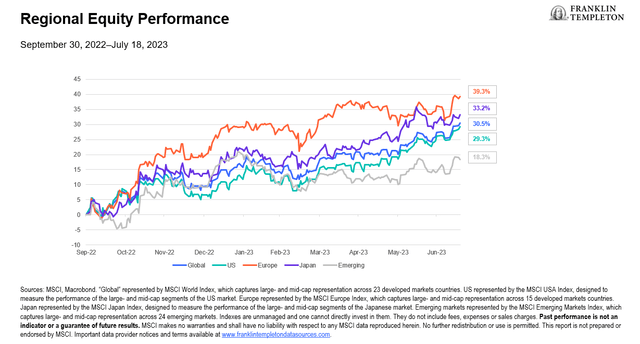

Since the equity market lows in October, many regions have entered a new bull market (Exhibit 1). As equity markets have rallied, sentiment has improved and volatility has diminished. A market that was previously obsessed with recession risk seems to have quickly moved on.

Exhibit 1: Bull Markets Are Emerging Across the World

We believe there is risk in trying to run with the current bull markets. Asset prices are suggesting cyclical growth will not only remain positive, but will accelerate above-trend in the coming months.

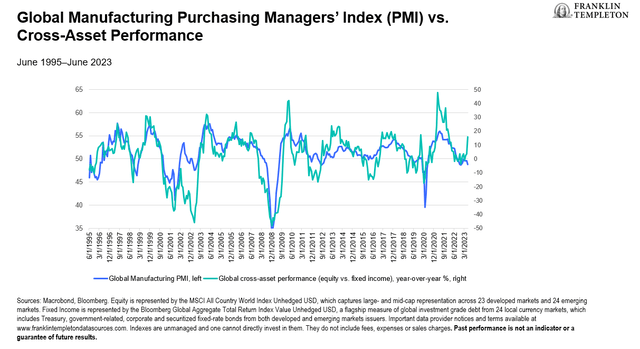

We think this is unlikely as central banks remain restrictive and cyclical growth momentum, outside of asset prices, remains subdued (Exhibit 2). In our view, even bullish macro forecasts should include positive – albeit below-trend -growth, for inflation to continue slowly normalizing.

Exhibit 2: Asset Prices Are Suggesting a Strong Rebound in Growth – We Think This is Unlikely

Is there a catalyst?

Restrictive central banks and weak growth momentum are nothing new – so what’s the catalyst for equity markets to move lower in the near term? We think the upcoming earnings season will be pivotal for a few reasons.

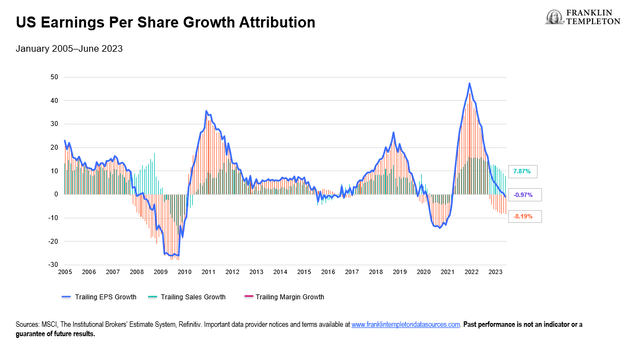

US earnings growth may worsen. In the United States, profit margins have declined 8% year-over-year, but EPS growth has barely contracted as sales growth remains strong. There are a few reasons why we expect this dynamic to weaken moving forward.

First, profit margins typically lead sales growth lower when earnings turn negative (Exhibit 3). We expect margins to remain weak, if not deteriorate. Second, lower inflation is contributing to weaker pricing power for companies. We expect inflation to continue to normalize, and this will likely dampen sales growth and put additional pressure on margins.

Exhibit 3: Negative Margin Growth Is a Leading Indicator for Sales Growth to Weaken Further

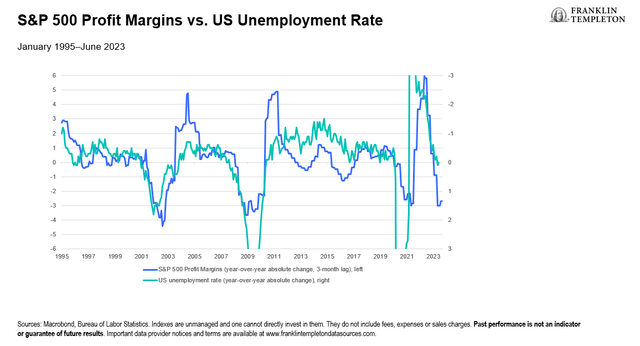

Weak profitability may lead to weaker labor markets. The resilient labor market has buttressed equity markets, and this resilience naturally pushes back on recession probability, as a weak labor market is typically needed for recessions to occur. So far, the strength of the labor market can be explained – firms entered the growth slowdown with record-high profits and weak labor supply.

However, these factors have corrected recently. US profit margins have moved meaningfully lower, and earnings growth has turned negative. Labor supply for prime-age adults is now stronger as compared to pre-COVID levels.

In fact, many leading indicators in the US labor market suggest some softening is already taking place, including a slight rise in initial unemployment claims, lower hours worked, weak hiring intentions, and weakening breadth in payroll growth. We think additional weakness in earnings and profitability will push these employment trends weaker.

Exhibit 4: Weaker Corporate Profitability May Lead to Higher Unemployment

Multi-asset allocation: Putting it all together

Overall, our tactical view is to position multi-asset portfolios defensively; we currently prefer fixed income over equities. While our macro outlook supports this positioning, as we outline above, we also think relative valuations support fixed income.

Equity risk premium, which measures the relative attractiveness of equities to interest rates, is currently more supportive of government bonds. Cash is another attractive option over equities, in our view. Many cash rates are near cyclical highs and now offer positive real returns – a rarity over the last decade.

There are also a number of sentiment and positioning indicators that suggest equity markets are over-extended and due for a pullback. While a growing number of investors are gaining confidence in running with the bulls, we exercise caution. We will continue to monitor leading economic indicators and corporate fundamentals going forward.

What are the risks?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

The allocation of assets among different strategies, asset classes and investments may not prove beneficial or produce the desired results.

To the extent a strategy invests in companies in a specific country or region, it may experience greater volatility than a strategy that is more broadly diversified geographically.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Active management does not ensure gains or protect against market declines.

Original Post

Read the full article here