Gladstone Investment (NASDAQ:GAIN) is a well-managed business development company with a large allocation of investment capital to Equities which makes the BDC a top bet on robust economic growth an ongoing interest rate hikes.

I value that Gladstone Investment Corp has considerable Equity exposure which gives the BDC a net investment income catalyst and which could lead, in the best case, to a raise in the BDC’s dividend.

Other benefits of investing the BDC include consistent portfolio growth in the last three years as well as the compelling valuation. The BDC has valuation upside in a pro-cyclical environment and GAIN is just about priced at book value.

Equity-Heavy BDC With Income Upside

The main difference between Gladstone Investment Corp and other BDCs is that GAIN has large allocation of investment funds to the Equity category. Equities don’t pay interest but they could nonetheless generate a lucrative pay-out if Gladstone Investment Corp successfully exits an investment through an initial public offering or an outright sale.

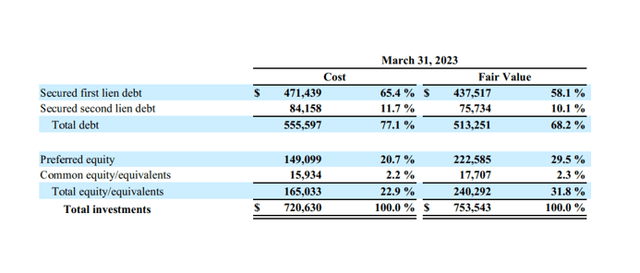

Gladstone Investment Corp’s focus is on Secured First Liens which accounted for 58% of the company’s total debt investments at the end of March. About 10% of investment are Secured Second Liens. The interesting part is the Equity portfolio which as of March accounted for a whopping 32% of Gladstone Investment Corp’s total investments.

Investment Overview (Gladstone Investment Corp)

Obviously, in order to monetize Equity investments, Gladstone Investment Corp relies on a strong economy and healthy primary and secondary markets. This makes Gladstone Investment Corp, contrary to most other BDCs, an Equity-centric, pro-cyclical investment.

U.S. GDP growth for 1Q-23 was recently revised upward to 2.0% (up from 1.3%) and the labor market continues to produce a lot of new jobs. This environment favors BDCs that have significant Equity exposure.

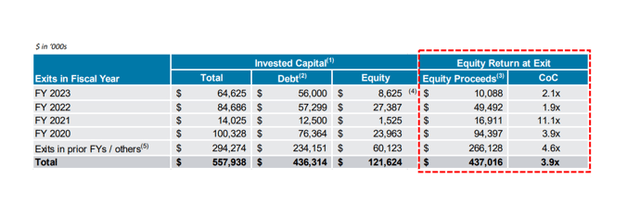

Gladstone Investment Corp has demonstrated that it can sell its Equity investment at lucrative multiples. Over the course of the BDC’s history, Equity investments were exited at 3.9x their original cost, resulting in $437.0 million of equity proceeds.

Equity Investments (Gladstone Investment Corp)

Growing Portfolio Value

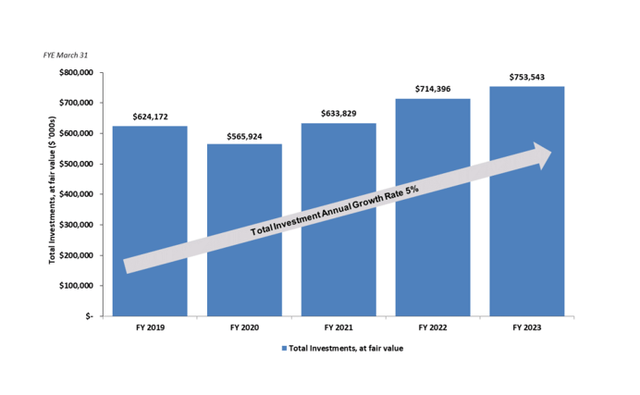

Gladstone Investment Corp saw a decline in its portfolio value in 2020 due to the Covid-19 pandemic, but the BDC has experienced three consecutive years of portfolio growth, primarily because of a rebound in loan originations after 2020. On average, Gladstone Investment Corp’s portfolio value grew at 10% in the last three financial years, mostly through new originations in the First Lien category.

Portfolio Growth (Gladstone Investment Corp)

Can The Dividend Be Sustained?

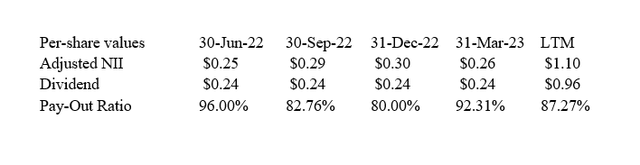

Gladstone Investment Corp’s portfolio produced $1.10 per share in adjusted net investment income in the last twelve months, which easily covered the BDC’s dividend of $0.96 per share. Gladstone Investment Corp pays a monthly dividend of $0.08 per share.

More importantly, passive income investors may ultimately see a much higher yield because the BDC distributes excess net investment income as special dividends which are paid on an irregular schedule. The next irregular dividend that was announced will be paid on September 15, 2023 and amounts to $0.12 per share. Successful Equity investments also directly improve Gladstone Investment Corp’s appeal as a bet on supplemental dividends going forward.

Dividend (Author Created Table Using Trust Information)

What Is Gladstone Investment Corp Worth?

Gladstone Investment Corp is not your average BDC, as I explained above, due to its heavy investments in Equity investments which also means that the BDC has higher risk, but also higher potential in an expanding economy.

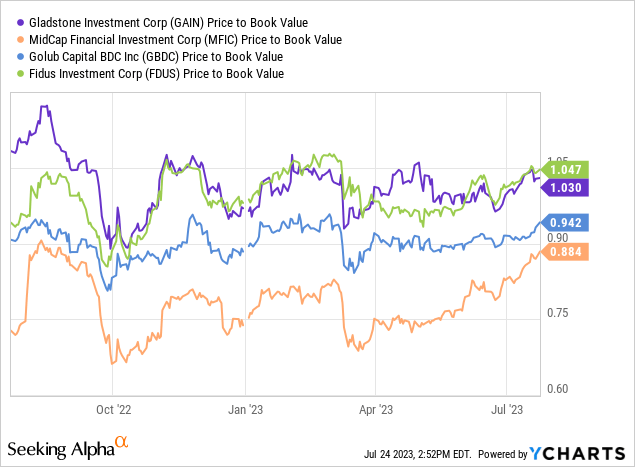

Gladstone Investment Corp is presently priced at a 3% premium to net asset value which undervalues the BDC’s potential, in my opinion. A year ago, Gladstone Investment Corp achieved a valuation of 1.15x NAV and I think that the multiple will eventually return to this level.

Other BDCs also trade around book value, some at small discounts, some at small premiums, but I think GAIN in particular has potential as long as the U.S. economy keeps plodding along.

What Could Go Wrong?

Gladstone Investment Corp, as I mentioned, is dependent on healthy primary and secondary markets in order to allow for Equity exits. If the transaction market slows and the BDC is not able to exit investments at lucrative multiples, no exits may happen at all and Gladstone Investment Corp may have to keep its investments on its balance sheet for longer than desirable.

However, GAIN has demonstrated over time that it can clear its Equity pipeline and sell investments at a profit.

My Conclusion

Gladstone Investment Corp is a BDC that I would recommend to passive income investors that have conviction in the strength of the U.S. economy, which I think is a prerequisite for Gladstone Investment Corp’s Equity-centric investment portfolio to do well.

Gladstone Investment Corp is also still selling at only a small net asset value premium, which I would expect over the long-term to expand.

Gladstone Investment Corp is looking back on a history of successful Equity exits and the BDC is a monthly dividend payer that distributes excess portfolio income in the form of supplemental dividends as well. With the stock paying a 7.1% yield (8.0% including the September supplemental dividend), GAIN is a buy.

Read the full article here