Several readers and subscribers have asked me for my thoughts on short-term muni bond ETFs. There are several of these in the market, with the VanEck Short High Yield Muni ETF (BATS:SHYD) looking like a particularly strong choice, with a higher yield than most of its peers.

SHYD offers investors a tax-advantaged 3.8% SEC yield, below-average interest rate risk, low credit risk, and few significant negatives. Although there does not seem to be anything inherently wrong with the fund, I find its overall value proposition to be compelling, and to compare unfavorably to most other bond sub-asset classes. As such, I would not be investing in SHYD at the present time.

SHYD – Basics

- Investment Manager: VanEck

- Underlying Index: ICE 1-12 Year Broad High Yield Crossover Municipal Index

- Expense Ratio: 0.35%

- SEC Yield: 3.80%

SHYD – Quick Overview

SHYD is a simple, diversified short-term high yield municipal bond index ETF. It tracks the ICE 1-12 Year Broad High Yield Crossover Municipal Index, an index of these same securities.

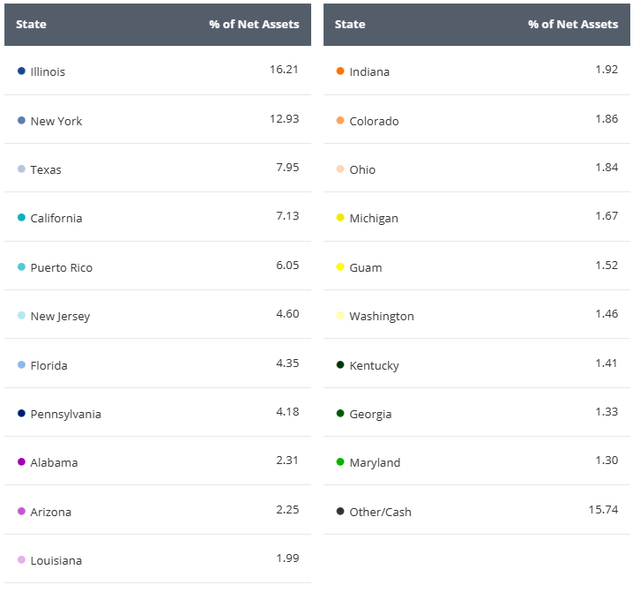

SHYD is quite diversified, for a niche bond sub-asset class fund, with investments in over 600 securities from dozens of states, and several sectors. SHYD remains a niche, targetted fund, however.

SHYD SHYD

SHYD – Benefits

Tax-Advantaged Yield

SHYD’s most important benefit, and key differentiator, is the fund’s tax-exempt dividends. Most dividends are taxable, SHYD’s dividends are not, a significant benefit for investors. On a more negative note, the fund’s dividends themselves are quite low, with the fund sporting a 2.8% TTM dividend yield, and a 3.8% SEC yield. SEC yields are a more recent, up to date metric, and more informative than TTM yields when interest rates are in flux, as they are right now.

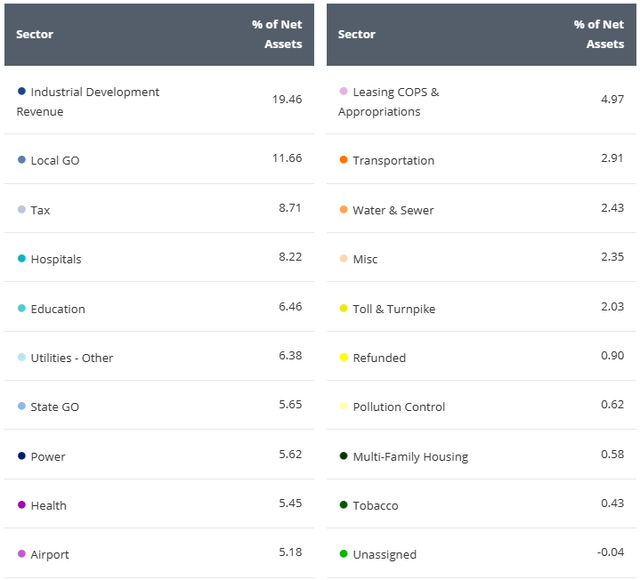

SHYD’s yield is quite low, so the fund’s tax advantages have little, albeit still positive, impact. Investors in higher tax brackets might be better off investing in SHYD over similar taxable bond funds, but the situation does not seem that clear-cut, to me at least. VanEck provides a simple table of taxable-equivalent yields for SHYD for the different tax brackets, which might be of use to readers and investors.

SHYD

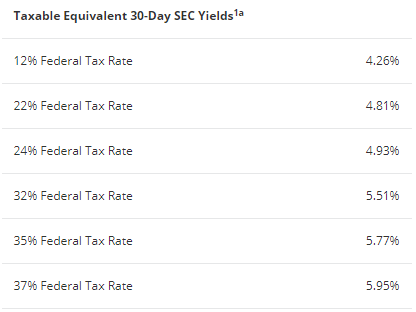

For reference, SEC yields for some large bond ETFs, mostly short-term funds.

Fund Filings – Chart by Author

As mentioned previously, SHYD’s dividend yield does not seem all that strong to me, even after accounting for its tax advantages. This is especially so considering SHYD’s credit and interest rate risk, which I’ll analyse in a moment. Other investors, especially those in higher tax brackets, might disagree.

Low Credit Risk

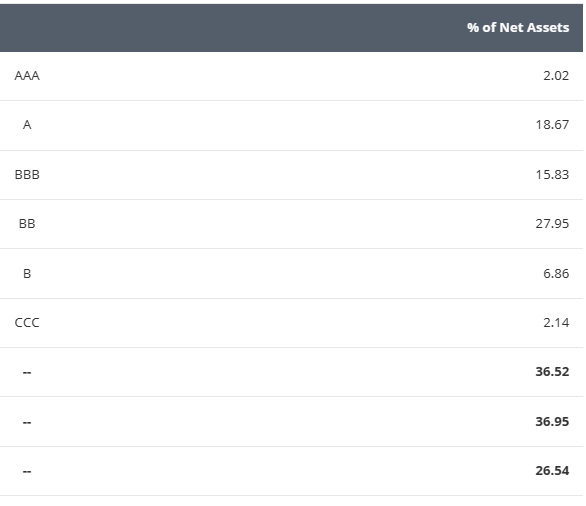

SHYD invests in both investment-grade and non-investment grade muni bonds, with a slight tilt towards non-investment grade. Credit quality seems to be below-average, although not excessively so.

SHYD

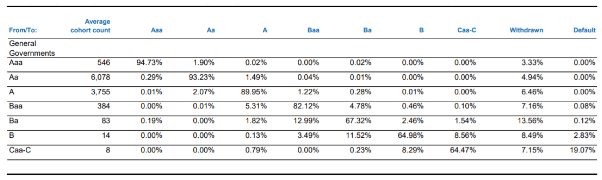

Although credit ratings are somewhat below-average, the actual credit quality of the fund’s portfolio is quite high, as muni bond default rates are incredibly low. As per Moody’s, default rates for non-investment grade bonds average around 0.10% per year, an extremely low, figure. For investment-grade bonds, default rates are effectively zero. Default rates do not significantly increase during recessions and downturns either, they remain consistently low.

Moody’s

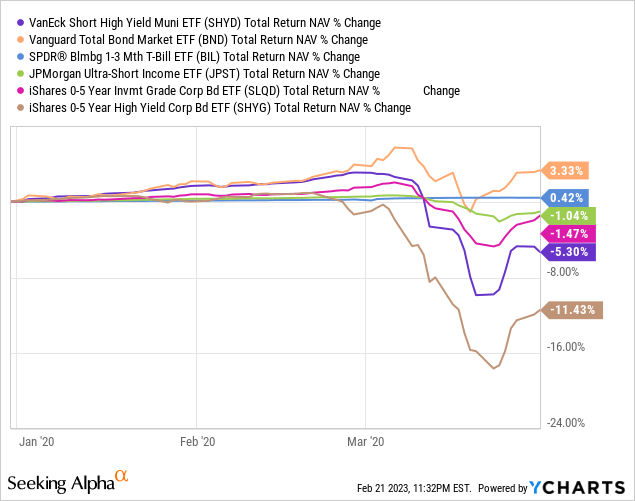

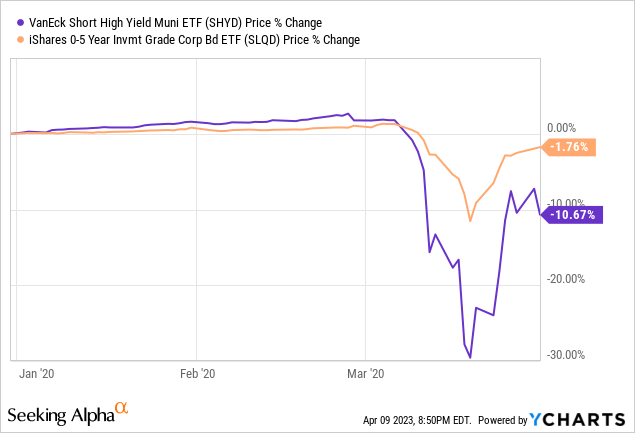

SHYD’s low credit risk should reduce losses during downturns and recessions. SHYD suffered losses of 5.3% during 1Q2020, the onset of the coronavirus pandemic and most recent recession, somewhat underperforming expectations.

Data by YCharts

SHYD’s low credit risk is a benefit for the fund and its shareholders, although said benefit has been a bit less impactful than expected in the past.

Below-Average Interest Rate risk

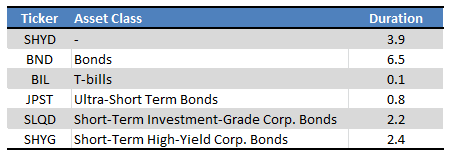

SHYD focuses on muni bonds with below-average maturities, which results in a fund with a below-average level of interest rate risk, with a duration of 4.1. SHYD’s interest rate risk is only moderately lower than average, and higher than that of many large, well-known short-term bond funds.

Fund Filings – Chart by author

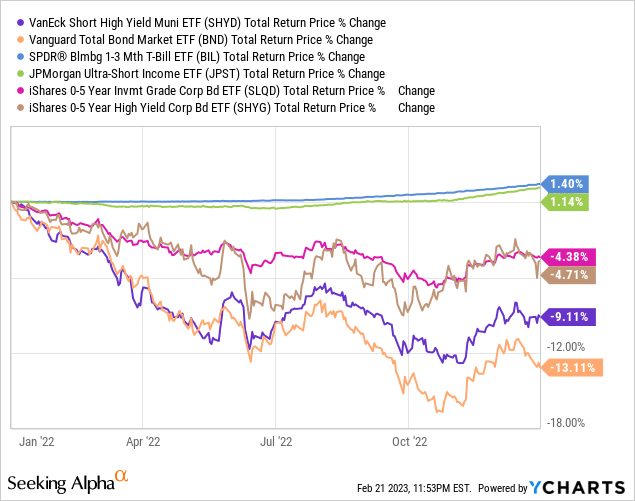

From the above, it seems clear that SHYD should see below-average losses during periods of rising interest rates, at least relative to broad-based, medium-term bond funds. Losses should be higher than those of most other short-term bond funds, however. Performance was as expected in 2022, a period of rapidly rising interest rates.

Data by YCharts

SHYD’s below-average interest rate risk is a benefit for the fund and its shareholders, but a small, uncompetitive one at that.

SHYD – Lackluster Value Proposition

Looking back at the fund’s benefits and overall value proposition, it seems quite weak. Tax-exempt dividends are obviously good, but the fund yields very little regardless. Credit risk is low, but the fund still suffered sizable losses during the most recent recession. Interest risk is below-average, but the fund has still suffered sizable losses during the current rate hike regime. Very lackluster results all around.

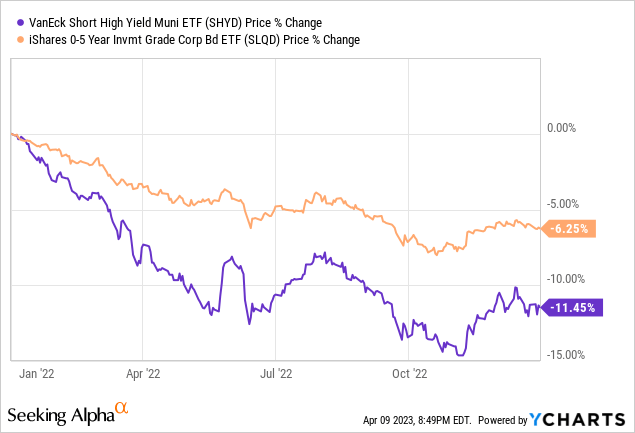

Comparing SHYD with the iShares 0-5 Years Investment Grade Corporate Bond ETF (SLQD) is, I think, clear evidence of the above. SLQD is the safer, more stable fund, as evidenced by the fund’s outperformance when rates rose in 2022.

Data by YCharts

And in 1Q2020, the last recession.

Data by YCharts

SLQD sports an SEC yield of 5.2%, compared to an SEC yield of 3.8% for SHYD. SHYD’s after-tax yield is higher for investors with a federal tax burden of at least 32%, assuming no tax savings or advantages of any kind. Investors in higher tax brackets might prefer SHYD over SLQD, due to the tax advantages of muni bonds, but the fund is quite a bit riskier too, so the overall risk-return profile is about the same. Choosing SHYD over SLQD simply means choosing a riskier, higher-yield fund (after tax), which is fine, but not an incredibly strong value proposition.

One reason for the above, is the simple fact that markets are mostly rational, and so SHYD’s tax advantages are generally canceled out by a comparatively low yield. As the tax advantages are dependent on an investor’s tax bracket, these are rarely completely canceled out for investors in the higher brackets.

Conclusion

SHYD offers investors a tax-advantaged 3.8% SEC yield, below-average interest rate risk, low credit risk, and few significant negatives. As the fund’s overall value proposition is quite weak, I would not be investing in the fund at the present time.

Read the full article here