Thesis

Veeva Systems (NYSE:VEEV) is an industry-leading provider of cloud solutions for the global life sciences industry. Being a first mover with a strategy to only focus on the needs of one industry, allows the company to understand its customers and become well-known in the sector. VEEV is led by its founder, who has a +8% stake in the company, a proven track record, and a tenure of sixteen years. The firm’s business model is durable, sticky, and has very little debt, which minimizes risk. I will explain my thesis’s key point in the sections that follow.

Company Overview & Outlook

Veeva Systems offers cloud software, data, and business consulting designed to meet customers’ unique needs. As of January 31, 2023, VEEV had 1,338 customers, up by 133 from last year. Its customers include big pharmaceutical names that I think everyone is familiar with, such as Eli Lilly, Merck, and Novartis. VEEV derives 80% of its revenue from subscriptions and 20% from Professional Services. 58% of revenue comes from North America, 28% from Europe, 11% from Asia Pacific, and 6% from the Middle East, Africa, and Latin America.

Created by the Author

The firm has two major solutions:

Veeva Development Cloud includes application solutions for the clinical, regulatory, quality, and safety functions of life sciences companies. Solutions include Veeva Vault Clinical, Veeva Vault RIM, Veeva Vault Safety, and Veeva Vault Quality.

Veeva Commercial Cloud consists of software and data solutions built particularly for life sciences companies sales, medical affairs, and marketing functions. It includes products such as Veeva CRM, Veeva Link, Veeva Compass, and more.

The firm has been in business for more than fifteen years. Focused on solely one industry, Life Solutions, this has allowed VEEV to understand their customers and provide them with the best products in the market. In 2022, the firm’s retention rate was 119%. This indicates the company’s products are of high quality and dependent on. After all, VEEV is a heavy R&D spender. Over the past five years, The company has spent an average of 20% of its revenue on R&D. This has helped it provide customers with innovative products rather than simple ones. I believe it is highly unlikely that VEEV’s customers will move on from its products, given the 15 years of experience, high retention rate, and dedication to one industry. This will allow the firm to stand out from competitors.

The company’s Total Addressable Market is $13 billion+. Considering the company’s revenue stood at $2.1 billion last fiscal year, there is still room for growth. VEEV is still expanding its reach by offering new products. It recently launched Compass Prescriber and Compass National, two applications that will provide prescription data. I believe these new product launches are important because the Life sciences sector is highly competitive with companies like Microsoft, Salesforce, and IQVIA.

Founder-led & Debt

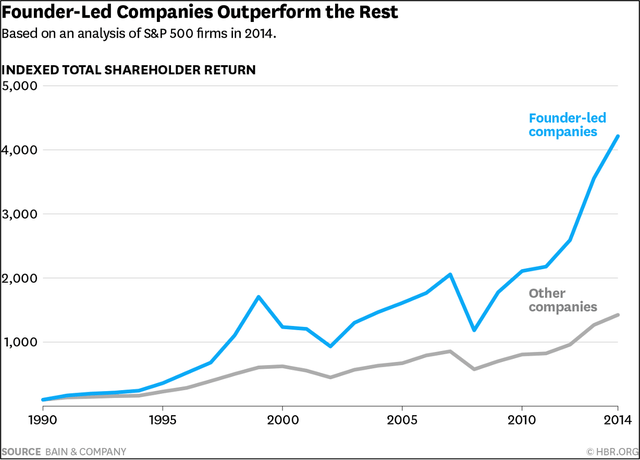

Peter Gassner, who is the founder and CEO of Veeva Systems, owns around 8.16% of the company. I believe founder-led companies tend to outperform non-founder-led companies for two reasons. First, A big chunk of the CEO’s wealth is usually tied to the company, which aligns his or her view with the shareholders. Second, founders tend to understand the business better than most people, focus on long-term growth, and have better instincts. Considering Peter has been with the company since 2007, I think it is safe to assume he knows what he is doing. Under Peter’s leadership, VEEV’s revenue has grown at a CAGR of 46% since 2011. Below is a graph that shows the performance of founder-led companies vs others. I know this graph is old, but the difference between the two is huge.

HBR

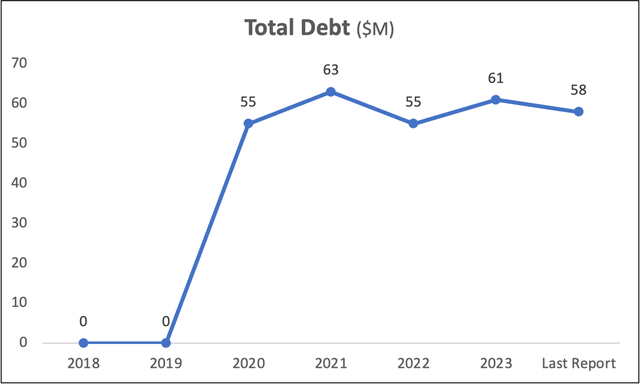

VEEV also has very little debt. As of the last quarter, the company had $58 million in total debt. That figure was $0 five years ago, but the debt increase was due to the funding needed for acquisitions the company had made. Plus, $58 million isn’t a huge amount considering the company generated $780 million in free cash flow last fiscal year and is expected to make $884 million this year.

Created by the Author

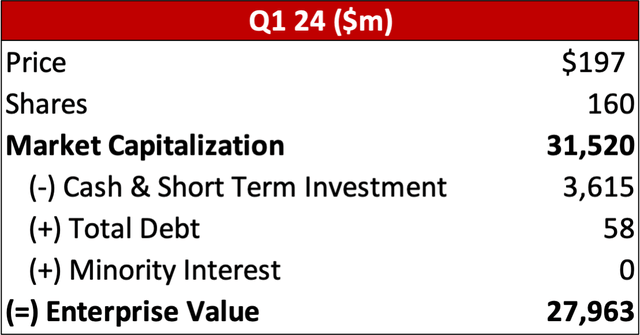

Valuation

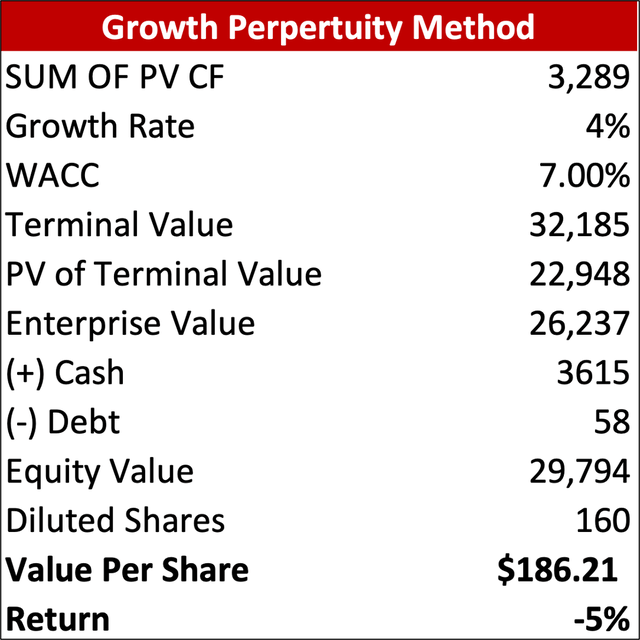

VEEV is currently trading at a FWD P/E and EV/EBITDA of 62.42x and 34.15x, respectively. I expect subscriptions to grow at an annual rate of 15% in the next five years, a faster rate when compared to professional services, which I expect to grow at a 12.8% CAGR from 2023 to 2027. Resulting in total revenue to grow by 15% annually over the next five years. The main drivers of revenue are new products, market penetration, and growth. The company guided for 2024 revenue to come in between $2.36 and $2.37 billion. VEEV has had a good reputation when it comes to guidance, It has exceeded its revenue guidance for the last five years.

Using a WACC of 7.0%, I discounted the future cash flow and terminal value. I arrived at an equity value of ~$30 billion. My fair value is $186, which equates to a 6% downside from the current price of $197. I assign a hold because my fair valuation is in line with the current stock price.

Created by the author

Risks

Given that VEEV has more than 1300 customers, Some of these are small businesses, and given the high-interest rates, they might undergo financial issues that can affect VEEV’s earning power.

Another risk is that Salesforce and VEEV have a partnership that expires on Sept 1, 2025, and VEEV’s CRM is built directly on the Salesforce 1 platform. VEEV’s management has said they will not renegotiate a deal with Salesforce but instead migrate customers from CRM on Salesforce’s platform to CRM on Veeva’s platform. This is where the company’s products will be put to the test. If customers value VEEV, they will migrate, but if they don’t, they can cause a blow to the firm. I think if the company is successful at migrating its customers, it will open more opportunities for the business. Lastly, Competition is also a risk to consider given that the company is competing with software giants such as Microsoft, Salesforce, and IQVIA.

The Bottom Line

The main takeaway from this analysis is that VEEV is a global leader with over a decade of experience. The company is founder-led, with an 8%+ stake in the company, which indicates to me that the CEO’s views are aligned with those of shareholders. VEEV has very little debt and is diversified in terms of customers. The firm still has more room for growth given its TAM. The company’s Quick ratio has also increased over the past few years, which indicates more cash flow generation. The business has great fundamentals, but I assign a hold because, according to my valuation, the company seems fairly valued at $197.

Read the full article here