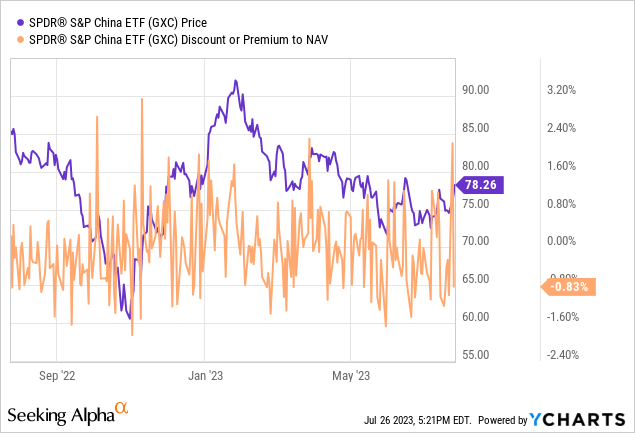

This week’s meeting of the Politburo, the Chinese ruling party’s top decision-making body, has come and gone with no major policy stimulus announcement. Yet, the meeting takeaways were well-received by the market, likely on hopes of support for the much-troubled property sector, as well as a renewed commitment to private sector ‘development.’ I would be cautious about the optimism – some stimulus is likely in the pipeline, but the scale could disappoint, particularly in light of the deleveraging required to fix China’s massive balance sheet issues. And given how uneven the post-reopening recovery has been so far, I favor a more selective approach to China plays. As I outlined previously, the consumer/tech-heavy SPDR S&P China ETF (NYSEARCA:GXC) portfolio is, for the most part, exposed to the right areas; at ~10x fwd earnings, the portfolio still seems very reasonably priced.

Fund Overview – Gain Diversified Exposure to China via the H-Shares

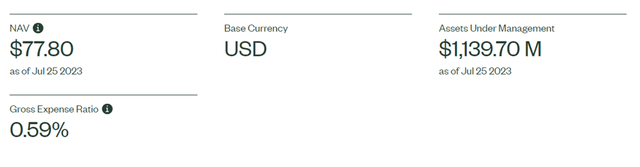

The SPDR S&P China ETF, managed by State Street (STT), tracks, on a pre-expenses basis, the performance of the market cap-weighted S&P China BMI Index, a group of listed Chinese stocks available to foreign investors. As GXC primarily gains its China exposure via Hong Kong-listed shares, the fund is a useful alternative to investors averse to the regulatory risks associated with US-listed Chinese depositary receipts (‘ADRs’). Unsurprisingly, the ETF has suffered a decline in its net asset base to $1.1bn over the last quarter (down from ~1.3bn previously) but maintains a competitive 0.6% expense ratio.

State Street

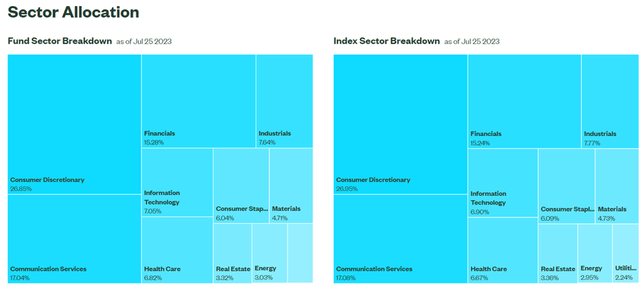

In line with prior reporting, the fund’s sector allocation remains skewed toward Consumer Discretionary at 26.9% (up from ~24% prior). The most notable change this quarter was the increased weighting of Communication Services at 17.0% (up from ~16% prior), replacing Financials (down to 15.3% from ~18% prior) as the second largest holding. The other notable change is Health Care (6.8%), swapping places with Information Technology (7.1%). Outside of Consumer Staples (6.0%), the remaining sector allocations are kept below the 5% threshold. With the top-five sectors contributing 73.9% of the overall portfolio, GXC is as concentrated as ever from a sector perspective.

State Street

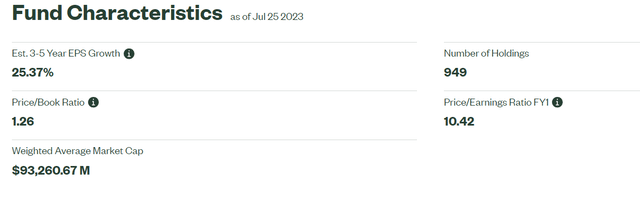

The fund’s single-stock composition also remains fairly similar, though the weightage of key consumer/tech holdings like Tencent (OTCPK:TCEHY), Alibaba Group (BABA), and Meituan has increased. The most notable shift is insurance conglomerate Ping An (OTCPK:PNGAY), dropping to 1.7% of the portfolio (down from 2.0% prior), while JD.com (JD) and PDD Holdings (PDD) have gained share by comparison. Given the size of GXC’s portfolio at 949 holdings (mainly Hong Kong listings), the portfolio is fairly well-diversified from a single-stock perspective, with no single name outside the top three holding more than a 2% weighting.

State Street

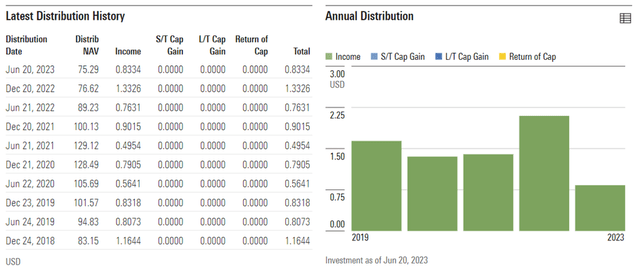

Fund Performance – Solid Income; YTD Losses Weigh on Track Record

As a result of its subpar Q2/Q3 performance, GXC’s returns have now turned negative for the year (-5.3% YTD in NAV terms). In tandem, the fund has seen its long-term track record decline to +4.0% per annum since its inception in 2007. But the GXC fund’s redeeming factor remains its distribution, which at 2.8% on a trailing twelve-month basis beats out most other US-listed China funds. And if the half-year distribution is anything to go by, the ETF is on track to exceed last year’s $2.10/share distribution as well (a record following the COVID-impacted 2020/2021).

Morningstar

Positive Policy Signals from the Politburo but Underlying Issues Remain

The July Politburo meeting offered some helpful insights into how policy stimulus might pan out over the coming months. Per the English statement, policymakers surprisingly acknowledged the ‘new difficulties and challenges’ facing the Chinese economy, pointing to ‘insufficient domestic demand, difficulties in the operation of some enterprises, risks and hidden dangers in key areas, as well as a grim and complex external environment.’ The more detailed Chinese statement expanded on this, also noting ‘it is necessary to actively expand domestic demand’ and to ‘expand consumption by increasing household income’ – a notable change in stance from policymakers.

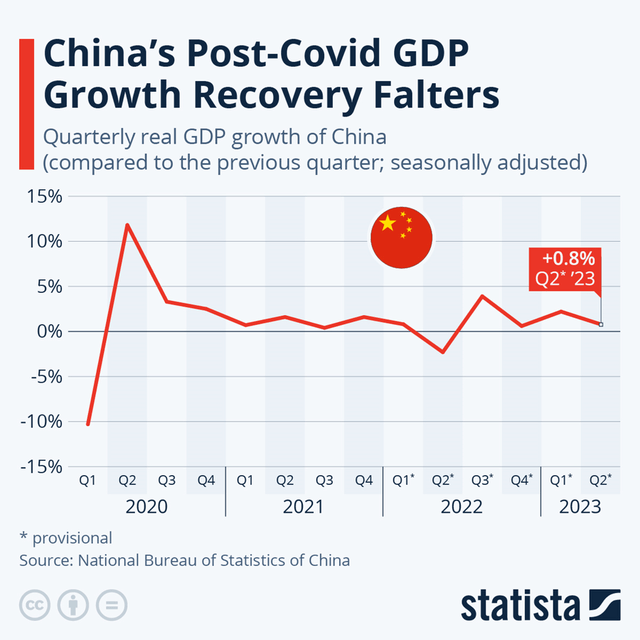

The market’s rise post-meeting indicates investors have underwritten a positive interpretation of the potential stimulus. But the statement also featured an important caveat – that ‘China’s economy has great development resilience and potential, and the long-term good fundamentals have not changed.’ Also concerning was the lack of concrete measures to address local government ‘hidden’ debt levels, leaving open the possibility of alternative options like asset swaps and increased distributions from state-owned enterprises to compensate. So while I do think some form of stimulus is in the pipeline, particularly on the consumption side, I wouldn’t bet on the sort of fiscal easing we’ve seen from China in the past. Given the extent of China’s Q2 GDP deterioration, with its sequential growth slowdown accompanied by a negative GDP deflator (i.e., inflation rate estimate), a lack of large-scale policy support likely entails more disappointments are likely on the horizon in H2.

Statista

Staying Selective on China Following the July Politburo Meeting

While the market has reacted positively to this week’s Politburo meeting, I wouldn’t be so quick to underwrite optimism across the board for Chinese stocks. As policymakers acknowledged in the post-meeting statement, the country faces some very serious structural economic challenges that will take time to fully address.

At the top of the list is the Chinese property sector, which continues to struggle under the weight of its debt load. The $10tn of hidden local government debt is another key issue, along with long-term demographic challenges and the rapidly fading post-reopening recovery. With the central government also holding back on the kind of massive stimulus we’ve seen in the past, I am concerned that this year’s GDP growth numbers could even fall short of the +5% target.

But even with the overall Chinese backdrop falling well short of expectations, the punishment that high-growth consumer and tech names have received this year seems unwarranted. Case in point – the tech/consumer-focused GXC fund, now on offer at a discounted ~10x fwd earnings despite the earnings growth potential of its underlying portfolio holdings. Alongside the well-covered ~3% yield, the risk/reward on GXC seems favorable here.

State Street

Read the full article here