With Union Pacific (NYSE:UNP) reporting Q2 results, it’s a good opportunity to measure up how the company’s year is progressing to management’s forecasts and also take a glimpse into the economy through analyzing the results of this transport industry leader.

Since I last wrote about Union Pacific in May 2023, the company has seen its share price increase by around 22% already, with the S&P 500 advancing 10.5%. As Q2 results show, the valuation of Union Pacific has become worse for investors as earnings are not meeting management’s forecasts and the price of the stock already has moved meaningfully higher.

This article will update investors on Union Pacific’s estimated long-term free cash flow yield in addition to management’s new guidance. With GICs from banks offering investors a low-risk +5% interest yield, the equity risk from cyclical names such as Union Pacific is getting harder to justify, even with adding long-term growth to a well-moated business such as Union Pacific.

Q2 Results Show A Tough Economy

Union Pacific’s recently released Q2 2023 results were cheered by the market, sending its share price up +10 on July 26, but they show a company adapting to a slowing economy. To start, the important car loads figure was down 2% continuing the trend of being down 1% in Q1 2023. Management had been originally guiding for carloads at the company to outperform industrial production, which was forecast to decrease 0.7% as of Q1. This forecast has now decreased to +0.1% for industrial production, but unfortunately, management is now expecting carloads to be below this level driven by decreases in consumer-related volumes being seen.

This pressure helped decrease EPS to $2.59 per share from $2.93 per share in the year-earlier period. Net income decreased to $1.6 billion from $1.8 billion. Operating income of $2.2 billion declined 12%, after a 3% decline in Q1 2023. With Industrial segment revenues roughly flat at $2,806 million, the decline was driven by Premium segment revenue dropping 11% to $1,726 million as shown in their Q2 earnings presentation.

Union Pacific continued returning cash to shareholders through dividends as well as buying back 600,000 shares for $120 million after repurchasing 2.9 million ($0.6 billion) in Q1. This represents around 3.5 million share repurchases year-to-date. However, the company stated in the Q2 release that there are no further buybacks planned for 2023.

In my opinion, management not planning any further share repurchases could signal they’re worried about revenues and the economy, or are just hesitant of the valuation themselves at the stock price level. Readers of my articles will know I often like to see share repurchases as part of the capital returns to shareholders, so management pulling back, even temporarily, is not a signal I like.

Great Cash Flow… But Low FCF Yield

Strong businesses with wide moats such as Union Pacific are able to generate cash beyond what is needed to fund sustainable operations. Updating my free cash flow analysis from my previous article for Union Pacific’s latest share price shows an obvious decrease in FCF yields to shareholders due mainly to the 22% price increase since my last article.

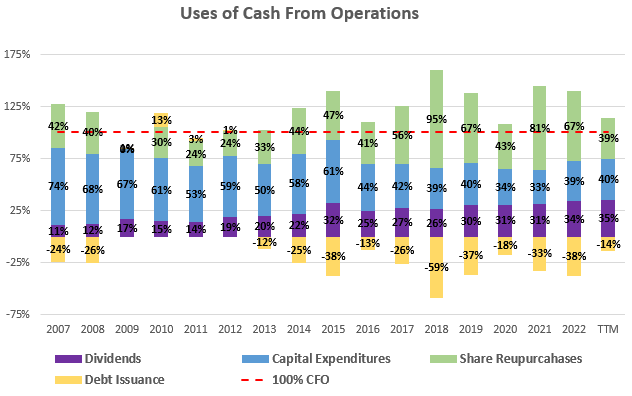

As can be seen in the graph below, capital expenditures have averaged only 51% of cash flow from operations since 2007. This is clearly a great business to be in and indicates Union Pacific has an economic moat that should continue to exist throughout economic cycles and be a good long-term hedge to inflation.

Cash Flow Analysis at Union Pacific (compiled by author from company financials)

With capital expenditures and acquisitions only taking up on average 51% of cash flow from operations over the past decade, this leaves approximately 49% to be returned to investors in the form of dividends and share repurchases. With an average cash flow from operations of $8.9 billion over the past five years, this 49% would imply free cash flow to shareholders of $4.4 billion for around a 3.0% free cash flow yield at the current $145.1 billion market capitalization.

While this free cash flow yield might not sound too enticing, remember that the other 51% of cash flows are being reinvested back into operations and the economic moat that has helped drive the 2.7% annualized revenue growth since 2007. While this revenue growth is not too impressive relative to inflation of 2%-3%, the economic moat of Union Pacific has achieved EPS growth of 12.6% since 2007 through operational improvements and share buybacks.

The revenue stream of this essential transportation company is repeatable and a great long-term hedge to the current high inflation we’re seeing. The revenue growth being in line with inflation would be the low estimate for growth from Union Pacific. Without getting too aggressive and adding the full 12.6% EPS growth to the FCF yield, a more conservative estimate could be placed in the middle at 7.7%. Adding this average revenue/EPS growth rate on top of the current FCF yield of 3.0% would imply solid long-term shareholder returns of around 10.7%.

Price Ratios And Potential Returns

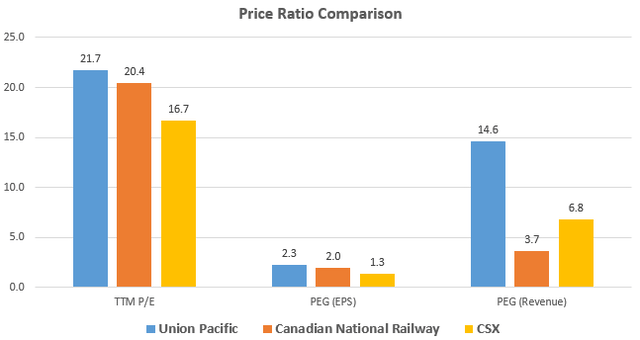

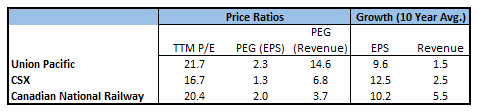

With Union Pacific’s P/E at 21.7x (4.6% earnings yield), it might be hard for some value investors to get their heads around being an owner at this price. When looking at steady growth companies such as Union Pacific, a good tool to use is legendary investor Peter Lynch’s PEG ratio. To get an idea of how Union Pacific’s market valuation compares to competitors CSX (CSX) and Canadian National Railway (CNI), I have placed them all side-by-side and used 10-year average growth rates to compare their valuations.

Railroad Company Valuation Comparison (compiled by author from Seeking Alpha data) Railroad Company Valuation Comparison (compiled by author from Seeking Alpha data)

As can be seen, Union Pacific’s ratios are more expensive than the pack and only the PEG EPS ratio is close to being within Peter Lynch’s rule of thumb of under 2x (a PEG ratio over 2 suggests that earnings growth is already built into the price). I’m a fan of the company and the railroad industry in general, but the recent run-up has made the company expensive, both in relative and absolute terms.

Part of the difference between the 10-year revenue and EPS growth rates are the share repurchases taken place over the past decade, in addition to operational efficiencies. Since 2012, Union Pacific has repurchased around 36% of their shares outstanding to lower the amount from 952 million to 610 million. These share repurchases may not be repeatable in a higher interest rate environment as seen over the past decade and as witnessed by management pulling back on repurchases in the recent Q2 announcements.

Takeaway For Investors

Union Pacific is a great company, but that doesn’t make it a great investment at any price. The company has run up significantly in recent months, outperforming the S&P, and both the conservative 3.0% long-term FCF yield and 4.6% TTM earning yield are getting squeezed. In an environment with declining earnings, investors choosing to hold would be focusing on long-term growth in a well-moated business such as Union Pacific to make the valuation work. With GICs from banks offering investors a low risk +5% interest yield, the equity risk from cyclical names such as Union Pacific is getting harder to justify.

Read the full article here