In my initial introductory article to Graphite One Inc. (OTCQX:GPHOF), I noted how it was still early days for the miner and that a lot yet needed to be done. The piece, which was published this past February, also noted that Graphite One, or G1 as management likes to refer to the company, had a rather vague timeline and would need to raise a lot more money if it hoped to bring its ambitious projects to fruition. And none of that has changed.

Nevertheless, G1’s been busy. News flow in the intervening period has been rather steady as the company made some materially meaningful announcements. In this article, we’ll review those developments and discuss what they may mean for G1’s long-term prospects

Resource Expansion

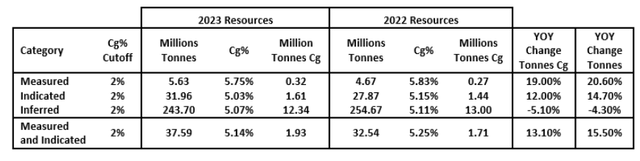

We’ll begin with the company’s March announcement of a Resource upgrade. Last year, the company funneled most of its cash into an infill drill program designed to true-up its Resource number. Twenty twenty-two saw G1 capitalize over $10 million in drilling and fieldwork expenses. The results of which were decent but not spectacular.

Sedar.com

As seen in the exhibit above, G1 was able to grow M&I by about 15% to just under 37M tonnes. That’s notable progress but it won’t be enough to move Graphite Creek to the top of global graphite charts. As a point of comparison, Syrah Resources Limited’s (OTCPK:SYAAF) Balama graphite mine in Mozambique has a Reserve of 107 Mt (Probable) and a Resource of 1.4 Bt (M&I&I).

However, G1’s revised figures are quite competitive when put up against those of cross-continent rival Nouveau Monde Graphite Inc. (NMG). NMG’s Matawinie Graphite property has a Resource of 130.3 Mt graded at 4.26% with a Reserve of 61.7 Mt at 4.23%. Granted, many other factors would need to be taken into consideration if we were to directly compare the two projects, but in terms of size, G1 isn’t looking too bad.

Another factor that most investors often take into account is jurisdiction. So, while G1’s Resource may not be the biggest, it does benefit from the United States’ stable legal and political environment as well as a federal government that’s currently spending big bucks on the energy transition.

DoD Grant

A couple weeks ago, G1 announced that it was going to be a beneficiary of that sweet, sweet government deficit spending. The company stated that it had been selected by the Department of Defense to receive a $37.5 million grant to further work on its Definitive Feasibility Study; a PFS was released last year and was discussed in my previous article on the company.

The terms of the grant require the government and the company to each pony up $37.5 million and the combined $75 million sum will be used to fund the accelerated completion of the Feasibility Study. G1, which only had a meager $1.2 million in cash on March 31, recently began raising some of those funds by entering into a $5 million loan agreement with privately-held Taiga Mining Company.

Management has not provided any detail as to how those funds are to be deployed but the following excerpt from the company’s March 31st MD&A hint at their use: “The planned 2023 Drilling Program will continue to delineate the scope and size of the resource, as the Graphite Creek deposit remains open to the West, East, and down dip. The budget for the 2023 field program is up to $37 million subject to funding availability.”

Unsurprisingly, and given that the company is working towards the preparation of its DFS, the company will spend some of those funds to better delineate the existing Reserve; however, there is still room for exploratory drilling which may lead to further Resource upgrades.

NSR Buyback

A factor that may give investors pause when considering G1’s stock is the issue of its outstanding Net Smelter Production Royalties that are currently attached to some of the company’s claims. However, there’s been movement on this front as well.

In June, the company announced that it had bought back a 1% NSR in exchange for company stock, reducing its active NSR commitments to only 2. However, those do consist of a 5% NSR on 4 Federal claims and a 2.5% NSR on 20 Federal claims, but G1 has the option of acquiring up to 2% of each for a total of $4 million and reducing those amounts to 3.0% and 0.5% respectively.

All else being equal, the market tends to favor projects with fewer of these types of encumbrances; therefore, G1’s purchase of the 1% NSR is welcome news and investors will probably be watching attentively to see if G1 exercises its other buyback options.

Takeaway

This stock is still rated as a Hold, but the steps taken in recent months secure its place on my watchlist. If management can continue this positive momentum in the months and quarters to come, this project may have some real potential in the long run.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here