Elanco Animal Health (NYSE:ELAN) is an interesting case study – at least for me. And it is a stock that demonstrated how important it is to have a solid investment thesis based on fundamentals and rigorous analysis. In the following article I will look back at the stock performance in the last few years and we will also try to answer the question if Elanco Animal Health is a good investment today – after the stock lost about three fourth of its value.

Valuable Investing Lesson

In the past, I have published two articles about Elanco Animal Health and in both articles, I was rather bearish – mostly because the stock was overvalued in my opinion and the high stock price was not justified by fundamentals. I received Elanco shares as Aratana Therapeutics was acquired, but from the beginning I thought the stock was not a good investment. And in the summer of 2020, I sold my Elanco position and in an article published in September 2020 I explained my reasoning.

But after the article was published, it still took more than a year before it slowly became obvious that I was right about the stock (or before Mr. Market shared my view). In 2020 as well as 2021, Elanco’s stock price managed to stay at a rather high level, and it seemed like selling the stock was the wrong decision. Wall Street analysts were also bullish about the stock.

Wall Street Analyst Rating History for Elanco Animal Health (Seeking Alpha)

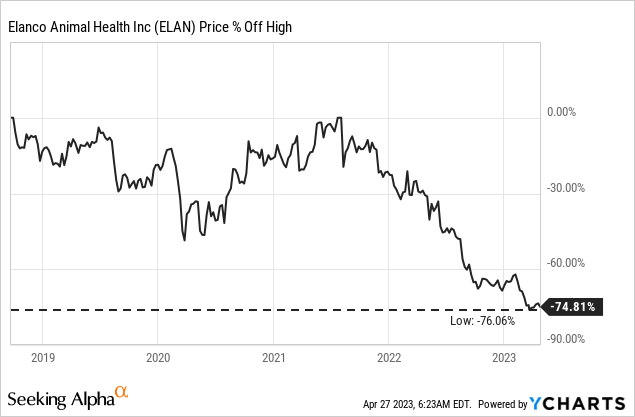

But after making its all-time high in summer 2021, the stock started to decline in the following quarters and is now trading 75% below its previous all-time high and the stock is now trading for much more reasonable valuation multiples.

Elanco Animal Health is a good example that it is important to stick to your guns. Even if it might take several years before the stock is returning to a reasonable price level or trading close to its intrinsic value again. And this process can sometimes be painful – especially when we are seeing irrational exuberance and a stock is continuing to increase in value although it seems completely unjustified. Elanco Animal Health just stayed at a high level making it easier to question the decision of selling Elanco Animal Health at that time.

Valuation

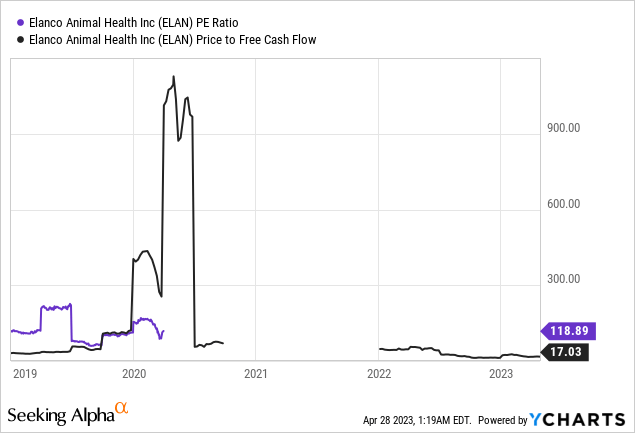

The biggest problem of Elanco Animal Health was the extremely high valuation level and the fact that the stock price did not match the fundamental performance of the business. When trying to determine an intrinsic value for a business or when trying to determine if a stock is fairly valued or not, we can start by looking at the price-earnings ratio to get a first feeling for the business. However, in case of Elanco Animal Health, we can’t calculate a price-earnings ratio since 2020 as the company constantly had to report a loss on a trailing twelve-month basis.

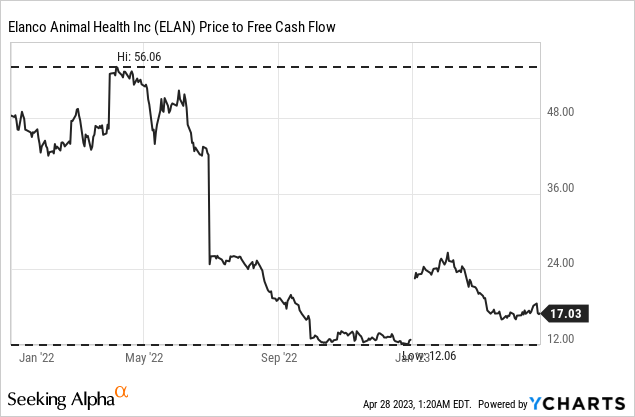

Instead of the P/E ratio, we can also look at the price-free-cash-flow ratio. Not only do I see the price-free-cash-flow ratio as the better metric, we actually have numbers we can calculate with. Between mid-2020 and the end of 2021, Elanco Animal Health reported a negative free cash flow, and it was not possible to calculate a meaningful P/FCF ratio. But since early 2022 the business is generating a positive free cash flow again and since then the P/FCF ratio declined from about 50 to 17 right now.

We will have to dig deeper in the following sections to be able to determine an intrinsic value for Elanco Animal Health, but a P/FCF ratio of 17 seems acceptable and it looks like the stock is not extremely overvalued anymore. But before we try to determine an intrinsic value for the stock, let’s take a look at the balance sheet, the reported annual results and the growth potential in the years to come.

Balance Sheet

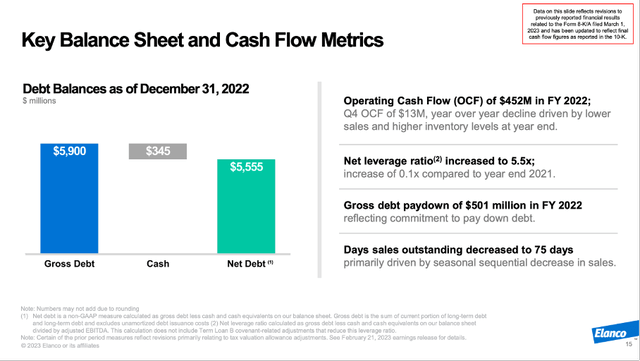

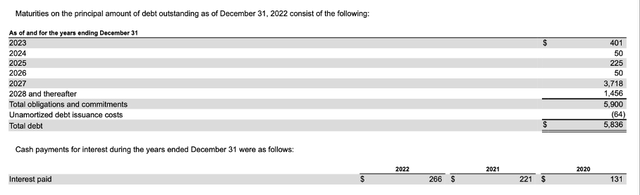

Aside from the extremely high valuation multiples Elanco was trading for, the second major problem was the high debt levels due to the acquisitions the company has made. On December 31, 2022, Elanco Animal Health still had $388 million in short-term debt as well as $5,448 million in long-term debt. When comparing to total debt to the total equity of $7,289 million, we get a debt-equity ratio of 0.80. And while that numbers seems acceptable, we have to take into account what kind of assets the company has on its balance sheet. Not only does Elanco Animal Health have $4,842 million in intangible assets, the company also has $5,993 million in goodwill – and these could be seen as worthless assets in my view.

To get a more accurate description of the financial health we should compare the total outstanding debt to the operating income – however operating income (or EBITDA) was also negative. We can only compare the total outstanding debt to the adjusted EBITDA, which was $1,017 million. When taking that number, it would take almost six years to repay the outstanding debt.

Elanco Q4/22 Presentation

And although Elanco was able to reduce its debt levels during 2022 (gross debt paydown of $501 million), the company is still not in a great position. In fiscal 2022, the company also had to pay $266 million in interest and when taking the adjusted EBITDA, about one fourth had to be spent on interest payments.

Elanco Animal Health Annual Report 2022

When looking at the amounts that are due in the next few years, Elanco Animal Health should be able to repay the amounts in the years between 2023 and 2026 although $401 million in fiscal 2023 is more than the free cash flow the company could generate in fiscal 2022 ($315 million). But in combination with the cash on the balance sheet, it will be enough.

For fiscal 2023 however, I’d argue there is no way Elanco will manage to repay $3,718 million in debt. In my opinion, it would come close to a miracle if the company is becoming so profitable over the next few years to generate these amounts of free cash flow. The more likely scenario is for Elanco to restructure in some way and take on new debt – and while nobody has a crystal ball to know the interest rates in 2027, the risk of Elanco having to take on debt for worse conditions is rather high.

Annual Results

And while a net leverage ratio of 5.5 and requiring almost 6 times (adjusted!) operating income to repay outstanding debt is hardly acceptable for any business, it would not be so dramatic if Elanco was able grow at a high pace.

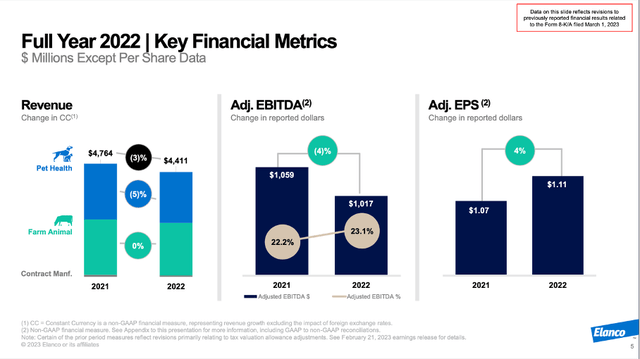

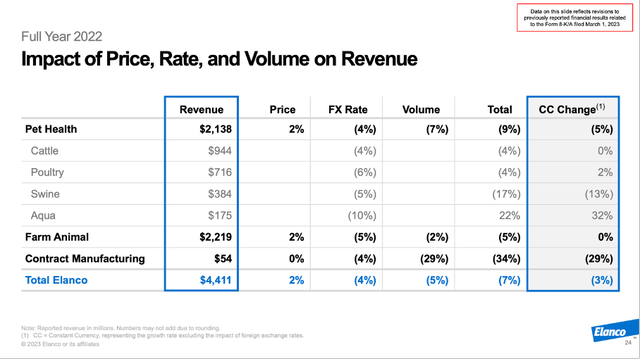

Fiscal 2022 results however demonstrated that Elanco Animal Health is once again struggling to be profitable and also struggling to grow. Revenue declined from $4,765 million in fiscal 2021 to $4,418 million in fiscal 2022 – resulting in a decline of 7.3% year-over-year. And while price still increased 2% (which is by the way terrible for a business in time of high-single digit or double-digit inflation), volume declined 5% and FX effects also had a negative impact of 4% on the top line.

When looking at the bottom half of the income statement, Elanco Animal Health had to report a loss before income taxes the third year in a row. Additionally, the company had to report a loss per share of $0.16 in fiscal 2022. And although the bottom line improved compared to fiscal 2021 (a loss of $0.99 per share) it is also not great when a business is not able to be profitable three years in a row.

Elanco Q4/22 Presentation

We can also look at the adjusted numbers for fiscal 2022 as these numbers are a little better than the numbers according to GAAP. Adjusted EBITDA declined slightly from $1,059 million in fiscal 2021 to $1,017 million in fiscal 2022 and adjusted EBITDA margin increased slightly from 22.2% in fiscal 2021 to 23.1% in fiscal 2023. Adjusted earnings per share also increased from $1.07 in fiscal 2021 to $1.11 in fiscal 2022.

Elanco Q4/22 Presentation

When looking at the two major reporting segments, both had to report declining sales. While the Farm Animal segment generated $2,219 million in revenue (a decline of 5% year-over-year), the Pet Health segment declined 9% YoY to $2,138 million.

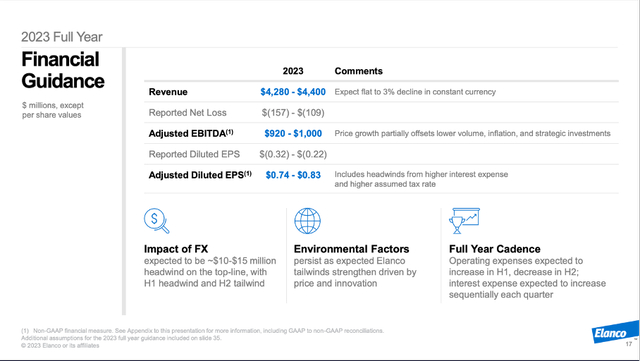

Pipeline and Growth

And not only were full year results for fiscal 2022 not great, the guidance for fiscal 2023 is also mediocre. Revenue is expected to be only between $4,280 million and $4,400 in the next year. Adjusted EBITDA will also be lower than in fiscal 2022 and only in a range between $920 million and $1,000 million. And finally, diluted earnings per share are expected to be in a range of $0.74 to $0.83. And we should not forget that these are adjusted numbers.

Elanco Q4/22 Presentation

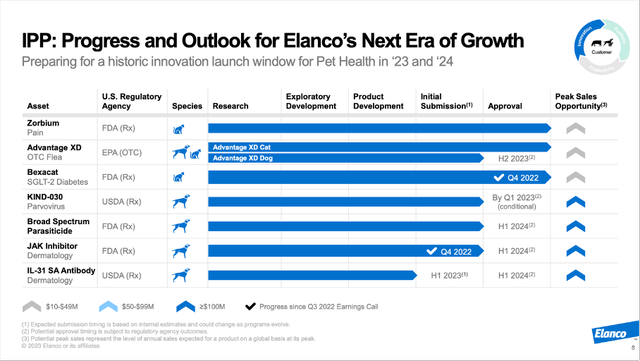

Like most other pharmaceutical companies, the success (and revenue growth) of Elanco Animal Health is depending mostly on the company’s pipeline and the new products it can launch. And 2022 was a productive year according to Elanco’s management – as CEO Jeff Simmons stated during the earnings call:

We had a productive year with 8 product approvals in major markets. This included differentiated fee line innovations like Zorbium, Advantage XD and Bexacat as well as important geographic expansions like Credelio for dogs in China. Additionally, the organization delivered valuable life cycle management, regional innovation and geographic expansions across the portfolio.

But management is not only looking back at 2022 but is also rather optimistic about the launches in the next two years. According to the company presentation, this will set the stage for Elanco’s next era of growth and the company is “preparing for a historic innovation launch window”.

Elanco Q4/22 Presentation

Management is aiming towards 6 new potential blockbusters being approved by the first half of 2024 (in animal health I would say a blockbuster is usually defined as generating at least $100 million in annual revenue). During the earnings call, management also made the following statement:

Also, our late-stage innovation is on track, and we continue to see a path towards U.S. approval of 5 potential blockbuster products by the first half of 2024. And today, very importantly, after close collaboration with the FDA, we are pleased to announce we now anticipate a first half 2024 U.S. approval and launch of Bovaer, a methane reducing product for cattle. This adds another potential blockbuster to our suite of late-stage innovation and adds to our confidence in 2024 and beyond.

And especially for Bovaer the expectations are high with sales being expected in excess of $200 million in the United States alone.

Elanco Q4/22 Presentation

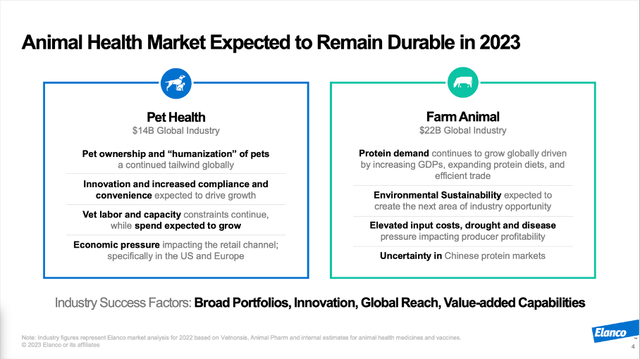

And with the pet health market being an $14 billion global industry and farm animal health being a $22 billion global industry, Elanco Animal Health has in theory the potential to grow by gaining market share. Additionally, the overall market is also expected to grow in the mid-single digits. Several studies expect growth rates somewhere between 4.9% CAGR until 2028 or when being more optimistic even a CAGR of 6.3% or a CAGR of 6.4% until 2028. But despite all the theoretical growth potential we should not ignore that Elanco Animal Health has been struggling for several years now and 2023 will likely not be better – and whether the new products can actually boost revenue growth in 2024 and beyond remains to be seen.

Intrinsic Value Calculation

And although the picture is still not convincing, it still changed since 2020. The stock losing more than two thirds of its value is changing the picture at least in some way and we must look differently at Elanco in 2023 than we were looking at it in 2020. The statement about the fundamental business might still be the same, but our statements about Elanco as an investment must reflect the new reality of a much lower stock price.

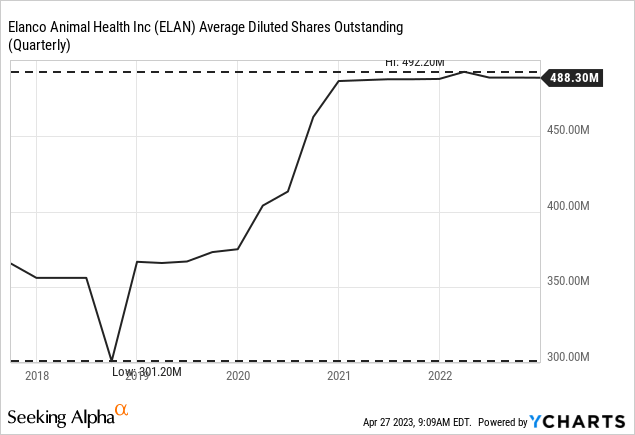

I already mentioned above that adjusted earnings per share were $1.11 and when using that amount the stock is trading only for 8 times earnings right now and seems like an extreme bargain. But as always, we should rather use a discount cash flow calculation to determine an intrinsic value as it is more accurate. As basis we can take the free cash flow of the last four quarters (which was $315 million) and when assuming 488 million outstanding shares and a 10% discount rate, Elanco Animal Health must grow about 3% annually to be fairly valued right now. Despite Elanco Animal Health clearly struggling right now, I think 3% annual growth could be realistic.

Of course, we should point out that Elanco Animal Health increased the number of outstanding shares in the last few years (due to acquisitions) but let’s be optimistic and assume the company won’t dilute further. And when being a little more optimistic and assume 5% to 6% growth in the years to come, we get an intrinsic value between $13 and $16, and Elanco could be a good investment.

Conclusion

Although Elanco could be undervalued, I don’t want to invest in the company and still don’t see it as a good investment. And it is highly speculative at which growth rates Elanco Animal Health could grow as the company has had to report a loss and a declining top line. Analysts are expecting earnings per share to grow with a CAGR in the high single digits in the next few years, but I remain a skeptic.

The stock could be fairly valued at this point, but I don’t see it as a good investment. While the valuation is more acceptable at this point, we still have a balance sheet that is overstretched, and Elanco still must demonstrate it is able to grow in my opinion.

Read the full article here